How to Improve Cash Flow: 10 Tips for Small Businesses

While profitability is the goal, being cash flow positive is what’s truly sustainable.

In a recent survey of businesses that failed in 2022, 44% cited running out of cash and 47% cited a lack of financing.

Both of these stem from businesses not having the money they need when they need it.

“When” is a key component of cash flow.

You might find yourself wishing that invoice was paid a week sooner because you’ve got a bill needing to be paid or payroll to run. What you’ve found yourself in is a cash flow problem.

Improving cash flow is more than generating more revenue.

Instead, it’s thinking about sustainable ways to have the money in your account when it’s time to send it out.

These 10 ways to improve cash flow will help you find creative new ways to optimize how money enters and exits your business.

10 Ways to Improve Cash Flow

1. Time Your Payments

A common mistake is thinking about cash flow like net income.

A basic definition of net income is your total revenue minus total expenses.

So how does cash flow differ?

Cash flow isn’t just what comes in and what goes out, but rather when these things happen.

If you have $1,500 coming in but $1,000 going out before you’re paid, your business is profitable but will have to find a way to bridge the time between earning the revenue and paying the bills.

It’s these kinds of cash flow problems that affect businesses of all levels of profitability. To avoid this, try to arrange payments and deposits to line up to your advantage.

Start by looking at your billing cycle. If your recurring invoices are coming after your payments, it’s time to reach out to your customers and suppliers to see what it will take to reconfigure.

By renegotiating billing and payout times, you can set up a smooth cycle of money coming in before it needs to go out, saving you the stress of figuring out how you’ll manage the time in between.

2. Review Your Recurring Expenses

Your recurring expenses are the constant costs of running your business.

As the most predictable part of your cash outflows and a main reason you might have negative cash flow, they’re a good place to look when thinking of cutting costs.

Reviewing your recurring expenses has three parts:

- Evaluate the necessity of each expense: Which costs are necessary versus simply nice to have? Any costs you can cut out completely are quick wins to improve cash flow.

- Look for savings on necessary costs: Maybe downsizing your office space or getting bulk discounts on common expenses helps keep more cash in your business.

- Optimize expenses with bundles: Try to find savings on software or equipment when bundled together. For example, specialized software for invoicing, accounts payable, and expense management could be more expensive than one option that does all three (hint 😉).

Comparing your budgeted spend to how much you actually spent (a.k.a. budget variance analysis) is a great way to understand what expenses may have impacted your cash flow performance.

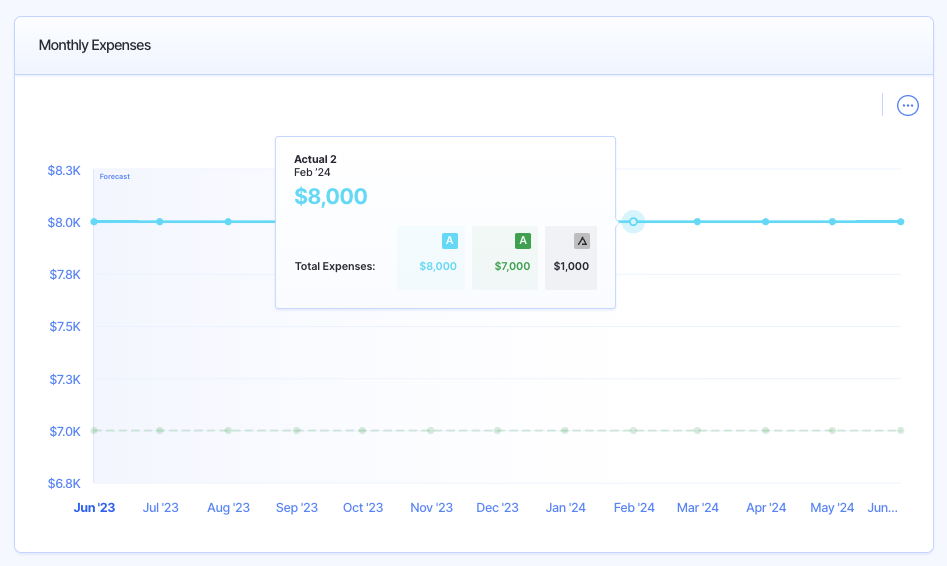

In the screenshot below (from Finmark) you can see this business budgeted $7,000 in expenses but spent $8,000, leaving a variance of $1,000. With that information, they can dig into the source of the variance and see if there’s room for improvement.

With your recurring expenses, a small savings might not seem like much immediately. But over the lifetime of your business, it can add up to achieving positive cash flow.

3. Take Stock Of Your Inventory

Managing inventory is deceptively tricky. You’re constantly having to stay on top of what you have, what you’re selling, and what’s sitting too long.

Optimizing your inventory is a recurring process of evaluating what you have and coming up with a process to move older stock.

Not only is this unrealized cash, but it’s unused space that can be used to house faster selling items.

Moving old inventory often comes with discounting or promotions that cut into your margins. It’s a tough pill to swallow.

However, if you compare it to the costs of credit, it might make sense and save you more money down the line.

4. Speed Up Your Accounts Receivables

Making sales but not seeing that money hit the bank account soon enough?

Consider some of the following strategies to get your money sooner:

- Discount early payments: Incentivize early payments by offering a percentage discount for payments made within the first 3 days.

- Offer different ways to pay: Make sure you’re accepting payments by credit card, check, or wire transfer so the process is more convenient for your customers.

- Send reminders: No one wants to be a nag, but following up on invoices increases your likelihood of being paid within a week, especially when it’s a combo of texts and email.

- Send invoices right away: Some businesses have regular payment schedules meaning if you’re late sending an invoice, you’ll have to wait until the next payment cycle.

5. Optimize Your Debt

Debt isn’t an inherently bad thing.

But if your debt is poorly structured, you risk racking up high interest costs that inflate your monthly payments.

Two popular options to reconfigure your debt include:

- Debt refinancing: A new lender pays a debt in full and offers new payment terms, ideally with a more manageable monthly payment or lower interest cost

- Debt consolidation: A lender you already work with combines multiple loans or debt into a single loan with new payment terms

With both options, you benefit by having payments that are easier to manage and potentially lower interest rates.

Keep in mind that refinancing and consolidation aren’t for everyone.

In some cases, there’ll be fees for paying off debt ahead of schedule and higher interest rates which end up costing you more money rather than saving you some.

6. Explore Alternative Credit

There are options for getting cash into your business quickly, but they come with costs.

Some businesses use lines of credit to get access to the capital they need when they need it without having to go through the hassle of applying for loans. Once approved, you can borrow what you need and pay interest on that amount.

Another option is turning unpaid invoices into cash now with invoice factoring.

Factoring companies pay you for unpaid invoices upfront then take over the collections process and keep the payment. Some have flat fees while others will base their take on a percentage of the outstanding amount.

Both options have their pros and cons worth weighing before committing.

Since they come with explicit monetary costs, consider these as last resorts that buy you time to figure out long-term solutions that improve your cash flow

7. Compare Leasing and Purchasing

Before making a big purchase, it’s worthwhile to weigh out the pros and cons of leasing first.

Purchasing a big asset can turn into a big payoff. It’s a one-time purchase that provides value over the lifetime of its use, often being cheaper than leasing long term.

From a cash flow perspective, the benefit of buying over leasing isn’t as much of a sure thing.

Purchasing a big piece of equipment is a massive disruption to your cash flow—not to mention any maintenance and upkeep costs that can come up unexpectedly.

With leasing, you get consistent costs that are only incurred when you’re using what you’re leasing. If you find yourself cash strapped, you can pause the lease without the stress of scrambling to sell a big piece of equipment.

8. Make the Most of Surplus Cash

When you have a month of positive cash flow, you can maximize the benefit by setting a plan on how to put it to use.

There are multiple small business savings accounts with no monthly fees that are a great place to store a rainy day fund or hold money in the interim. They can generate anywhere from 2.00% – 5.20% on whatever is being stored.

You can also consider putting extra funds towards upcoming debts. This helps you prevent any cash flow disruptions in the future where you might be scrambling to get the funds together.

When you have a surplus, don’t forget to make the most of any early payment discounts offered by suppliers. These are concrete savings that will improve both your cash flow and your bottom line.

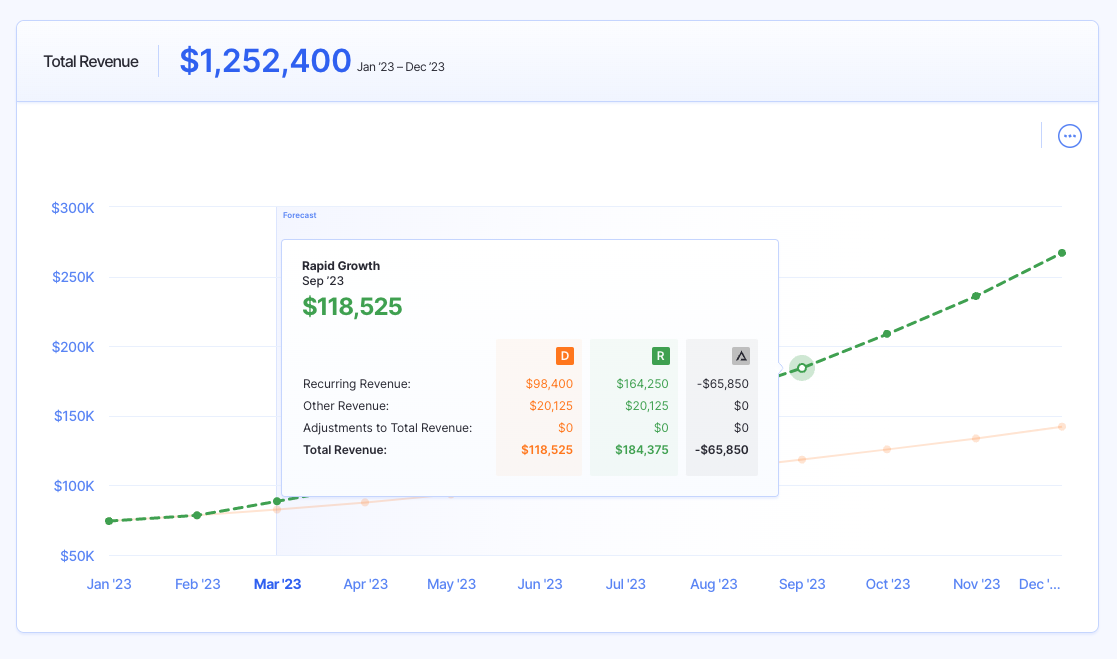

Pro tip: You can use Finmark to create revenue forecasts and compare the impact of different uses of your surplus cash. For instance, what happens if you stash money away in a small business savings account versus using it on a new ad campaign?

9. Find Upselling Opportunities

Not everyone has the time or money required to prospect new customers or clients.

So how do you add more revenue streams to your business and increase cash inflows?

Upsell!

Upselling gives you the opportunity to make the most of the customers you’ve already worked hard to acquire.

How it looks depends heavily on your business, but fortunately you have experts on what your customers might want—the customers themselves.

A quick survey helps you understand what customers want and the value they put on it. Follow customer survey best practices and provide a couple of options you’re considering offering.

When selling goods, reach out to your suppliers for potential upsell options they provide. By working with the same supplier, you can negotiate a deal where you save on bulk purchases and keep your cost of goods sold down.

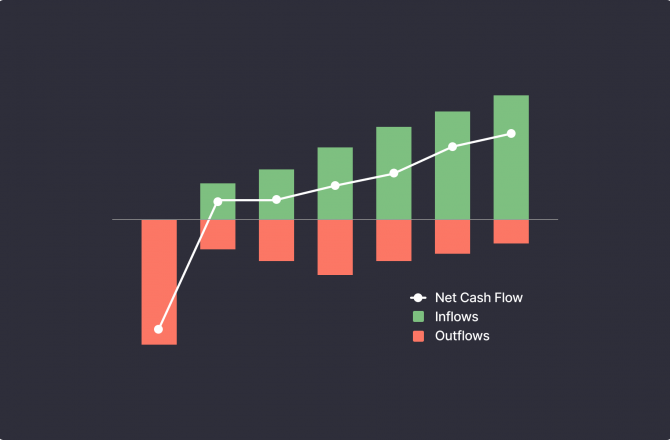

10. Monitor and Forecast Cash Flow

Simply put, the more you understand your cash flow in the future, the better you can manage and prepare today.

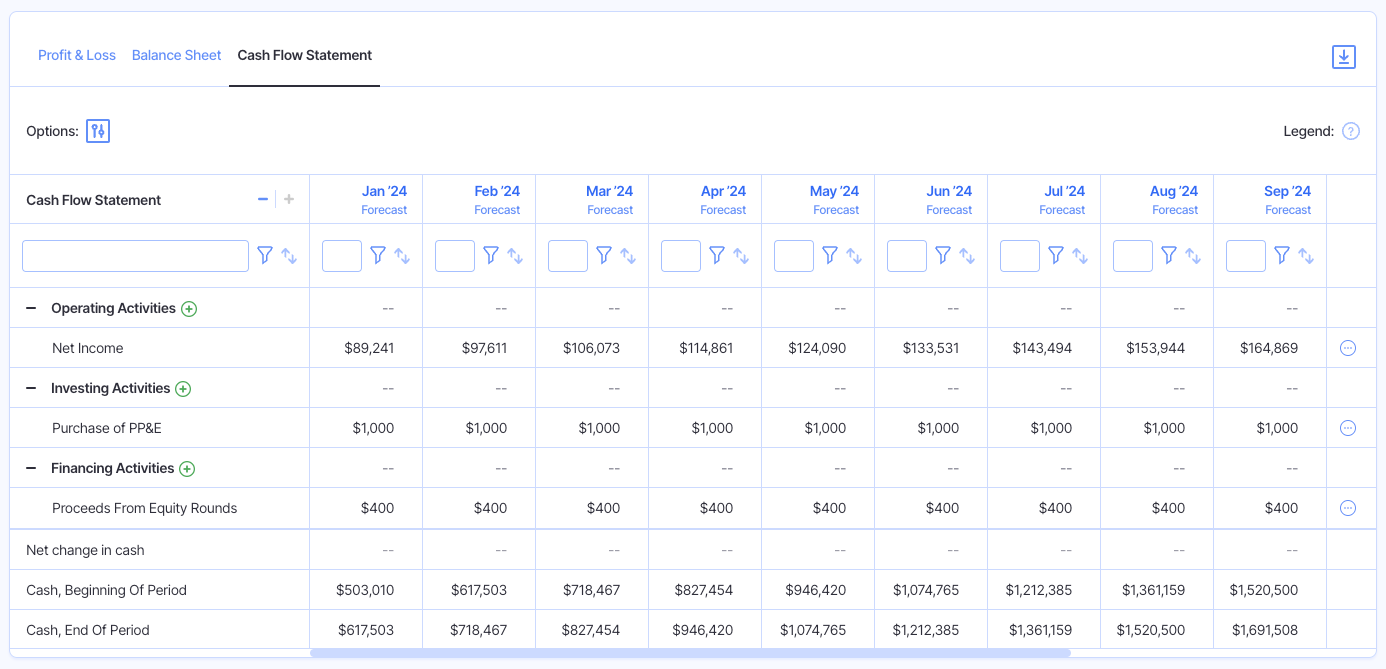

Having a regular cadence of checking past performance on a cash flow statement and forecasting your cash flow helps you identify when you might encounter problems. We happen to know a great tool you can use for this.

This opens up a whole new world of proactivity allowing you to plan and adapt on the fly.

Remember, cash flow problems aren’t a matter of more coming in and less going out, but when these activities happen.

Even the most profitable businesses can fall into cash flow problems if they aren’t monitoring it regularly.

As a general rule of thumb, review upcoming recurring expenses, project any down periods, and do a gut check on potential unexpected disruptors.

By putting a plan in place for any of these potential disruptors, you’re giving your business the best chance at long lasting success.

Improve Your Cash Flow With Finmark

When business owners aren’t trying to optimize their cash flow, they’re focusing on their other valuable resource: time.

If finding time is a barrier to understanding, analyzing, and improving your cash flow, you need reporting that updates with real-time data. This means less time creating the reports and more time learning from them.

With Finmark from BILL, you get an intuitive platform that allows you to customize your cash flow reporting with ease.

You choose the essential information and how it’s presented so it makes the most sense and can be understood at a glance. Integrations to QuickBooks, Xero, Wave, and more allows data to automatically import, saving you from entering information in multiple different platforms.

Get started with a free 30-day trial.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.