Financial Analytics: A Guide For Data-Driven Growth

From small businesses to full-fledged enterprises, there is one goal in the mind of business leaders:

Growth.

Revenue growth, user growth, headcount growth.

Successful businesses are intensely focused on finding opportunities to maximize growth, and the burden of identifying these opportunities is more and more falling on the shoulders of the financial leaders.

For ambitious CFOs looking to step up to the call of duty and provide their company with strategic direction for driving growth, financial analytics are a non-negotiable asset.

But it’s not enough to just “have” financial analytics—you need to know how to put the data to good use and pull out insights that keep your graphs headed up and to the right.

In this article, we’re going to discuss six strategies finance leaders can use to take advantage of financial analytics and deliver actionable advice for driving company growth.

What Are Financial Analytics?

Navigating the world of financial analytics can be a tricky task.

Finance platforms like to use industry jargon like “facilitate strategic cost reduction imperatives” and “eliminate redundancy and leverage integration” to make their thing sound more technical than it really is.

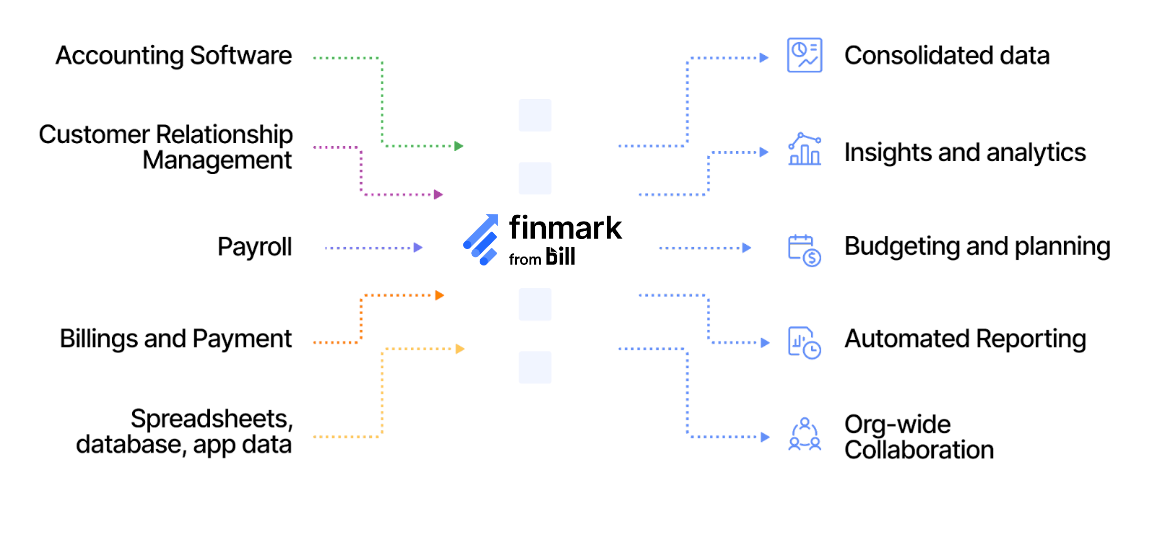

Financial analytics is about bringing all of your data together into one place, and allowing you to build reports, analyze trends, and compare scenarios.

You connect your financial analytics tool with all the other software you’re using to manage money (payroll, point of sale, accounting, etc.). Then you can look at all of your data in a centralized location and use it to make strategic financial decisions.

It’s about analyzing past performance and then using that analysis to plan for the future.

Financial analytics take into account everything from cash flow to margins, sales figures, accounts receivable and payable, and so on.

With a solid financial analytics tool on board, you can remove data siloes and stop having to switch between a ton of different tabs and reports when building budgets and financial strategies.

Why Financial Analytics Are Essential For Growth

The point of financial analytics is to give you insight into the current state of affairs.

You need to know what’s working well, what’s going okay, and what isn’t working at all. Only then can you make strategic decisions that fuel financial growth.

Let’s say, for example, that you’re investing in a bunch of different sales and marketing activities. You’re running social media ads, you’ve got a team of salespeople making cold calls, you’re publishing content with the goal of driving organic traffic, and so on.

It’s coming up to the start of the new financial year, and you’ve got a huge growth target on your shoulders. How are you going to make that happen?

One way would be to double down on the sales or marketing tactics that are working and cut spending on those that aren’t.

But you won’t know which is which without all of your spending, acquisition, and revenue data plumbed into a single place to analyze (the financial analytics platform).

In short, financial analytics help you make important decisions regarding financial strategy, by using complete and real-time data from various data sources.

6 Ways To Use Financial Analytics To Fuel Growth

1. Identify Your Growth Drivers

You can’t hit growth goals if you don’t know how to fuel growth.

Playing the guessing game is a recipe for failure—imagine trying to guess which fuel your new car takes…

Financial analytics can provide the insights you need to understand what your revenue drivers are.

Revenue drivers are exactly what they sound like, the things your business does that create more revenue.

Most revenue drivers fall into one of two categories:

- Sales

- Marketing

For instance, let’s say sales headcount is one of your growth drivers. The more salespeople you have, the more revenue you make, to the point where you can forecast how much revenue each new hire will generate.

Other revenue drivers might be podcast ads, organic social media engagement, or customer success manager hires.

Financial analytics allow you to identify what’s behind your revenue growth (so you can double down on it), and model scenarios of what might happen if you do invest in those drivers.

Speaking of…

2. Create And Analyze Multiple Scenarios

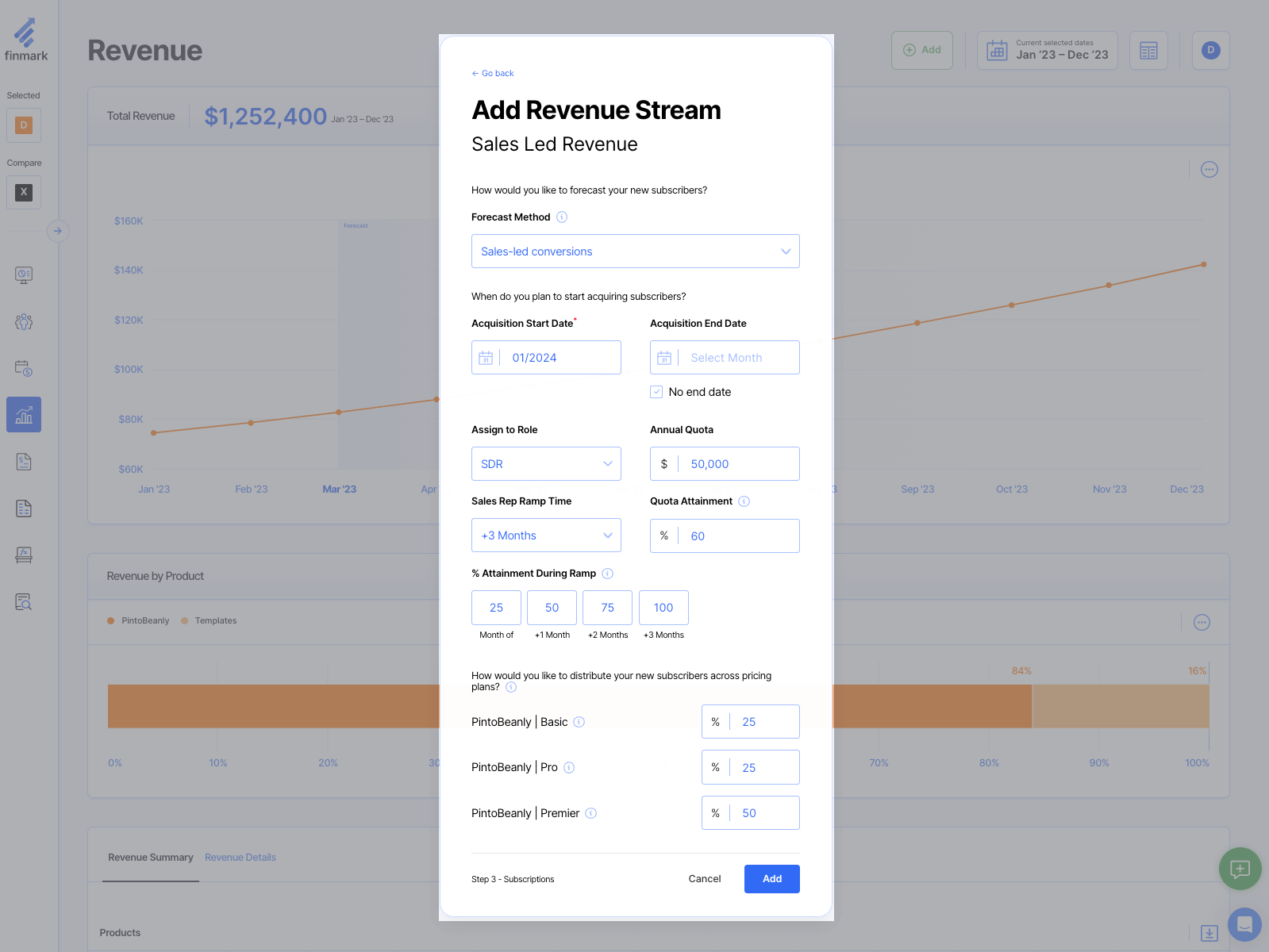

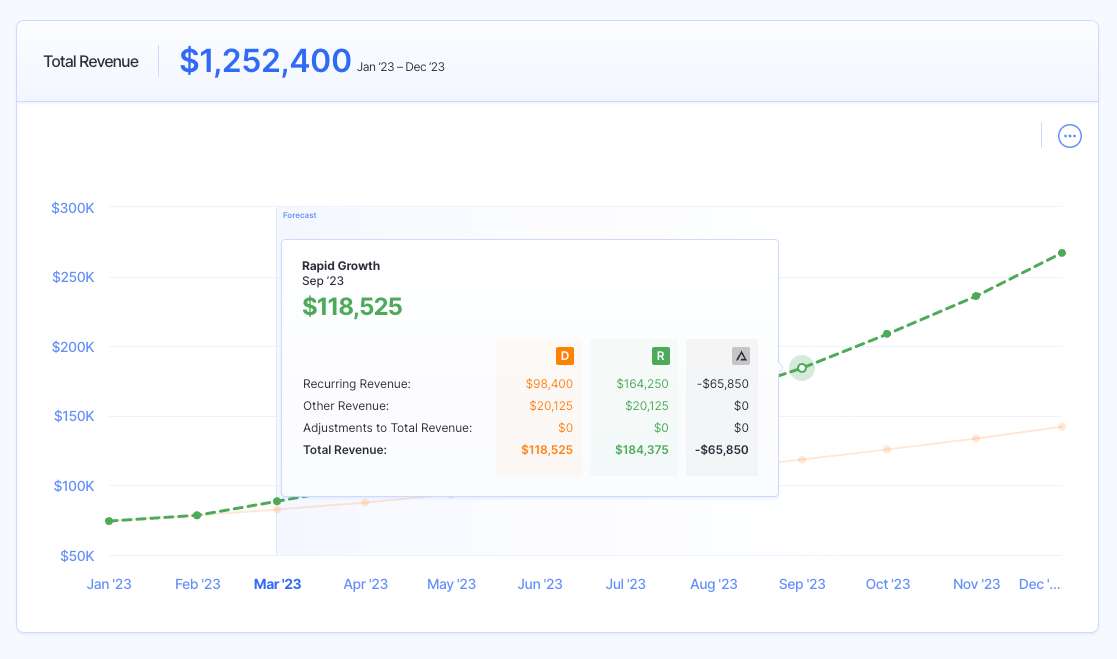

A great financial analytics platform allows finance teams to build and analyze multiple “what if” scenarios.

For example, let’s say you’ve just identified that one of your revenue drivers is podcast ads.

Now, you can build a scenario model that answers questions like, “What happens if we invest $10k more in podcast ads next quarter? What if we invest $20k?”

Your finance analytics tool will help you project what revenue will look like, so you can understand whether this investment is likely to create the revenue growth you need to hit your targets.

It can also tell you what this growth means for your customer base, so you can make hiring decisions (if you onboard more customers, you’re going to need a bigger team to service them).

This brings me to my second oh-so-convenient segue…

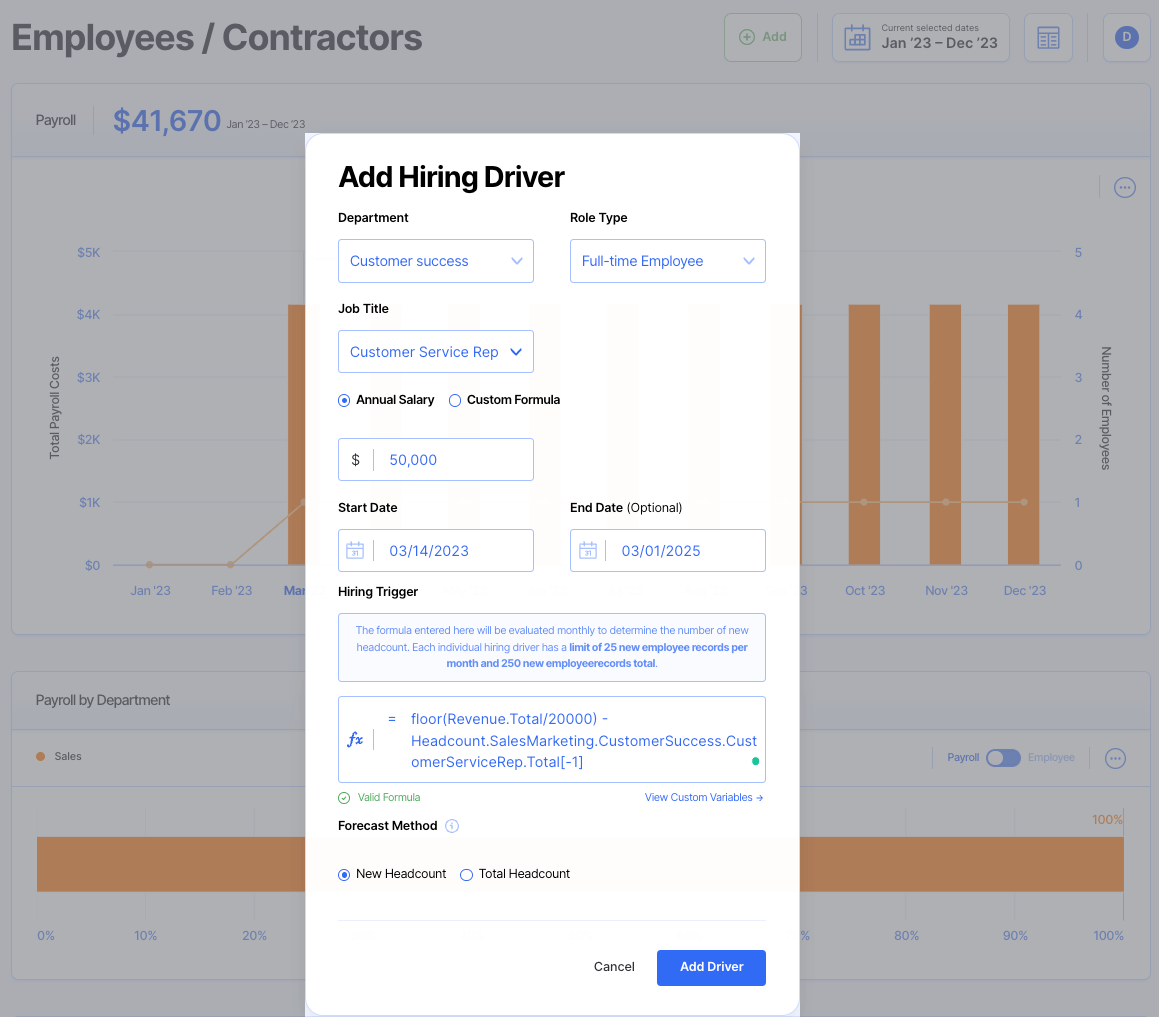

3. Design A Growth-Driven Hiring Strategy

Hiring doesn’t always need to be reactive.

Companies that only hire when they need to fill a gap are constantly chasing their tails and playing catch-up.

Let’s take the best-case scenario. Nobody hands in their resignation, and you double your customer base in a year.

You’re going to need twice as many customer support reps, twice as many customer success managers, and probably a larger development team to keep up with resolving bugs that all of those new customers find.

When the average hire takes 41 days (and some take much longer), it’ll be difficult to keep up with customer demand.

But if you have built a realistic growth model in your financial analytics platform, you can see exactly what revenue growth means for headcount, and plan out your hiring strategy accordingly.

You can use Finmark to build these hiring drivers into your financial analytics and forecast. Here’s an example of how we set a rule to automatically add a new customer service rep into our financial model for every additional $20K in revenue generated.

Click here to learn more about how to automate your hiring plan in Finmark.

4. Create More Realistic Department Budgets

In many organizations, there is a long-standing tension between finance leaders and department heads.

This often comes down to budgeting.

The traditional model is top-down, where the finance team creates budgets based on (often lofty) growth targets, and then hands them down to branch or department leaders.

The typical reaction is, “How am I supposed to make this happen?”, probably accompanied by one or two words we’ve tastefully omitted here.

That’s because department leaders weren’t consulted during the budgeting process.

The first step in fixing this problem is incorporating more of a bottom-up approach, where department VPs are consulted during the planning phase.

However, financial analytics have a hand to play in this game.

If finance teams have their analytics tools connected to the various software platforms that individual departments use, they can draw on this data when designing budgets.

For example, finance can look at the historical spending patterns of marketing and help them understand that while their budget only increased slightly this year, they can still hit more ambitious targets by shifting spending from one channel to another.

The best way to do this is with a financial analytics tool that allows your entire team to see what’s going on. For instance, in Finmark you can give department heads access to your dashboards and budget so they can ask and answer any questions directly in the platform.

It make financial analysis more collaborative, which can lead to more accurate budgeting.

5. Build Real-Time Cash Flow Projections

In the startup world, financial decisions need to be made rapidly.

Waiting until the end of the month to understand the current state of affairs as far as cash goes is insufficient; you need real-time data.

Financial analytics platforms give you access to just that.

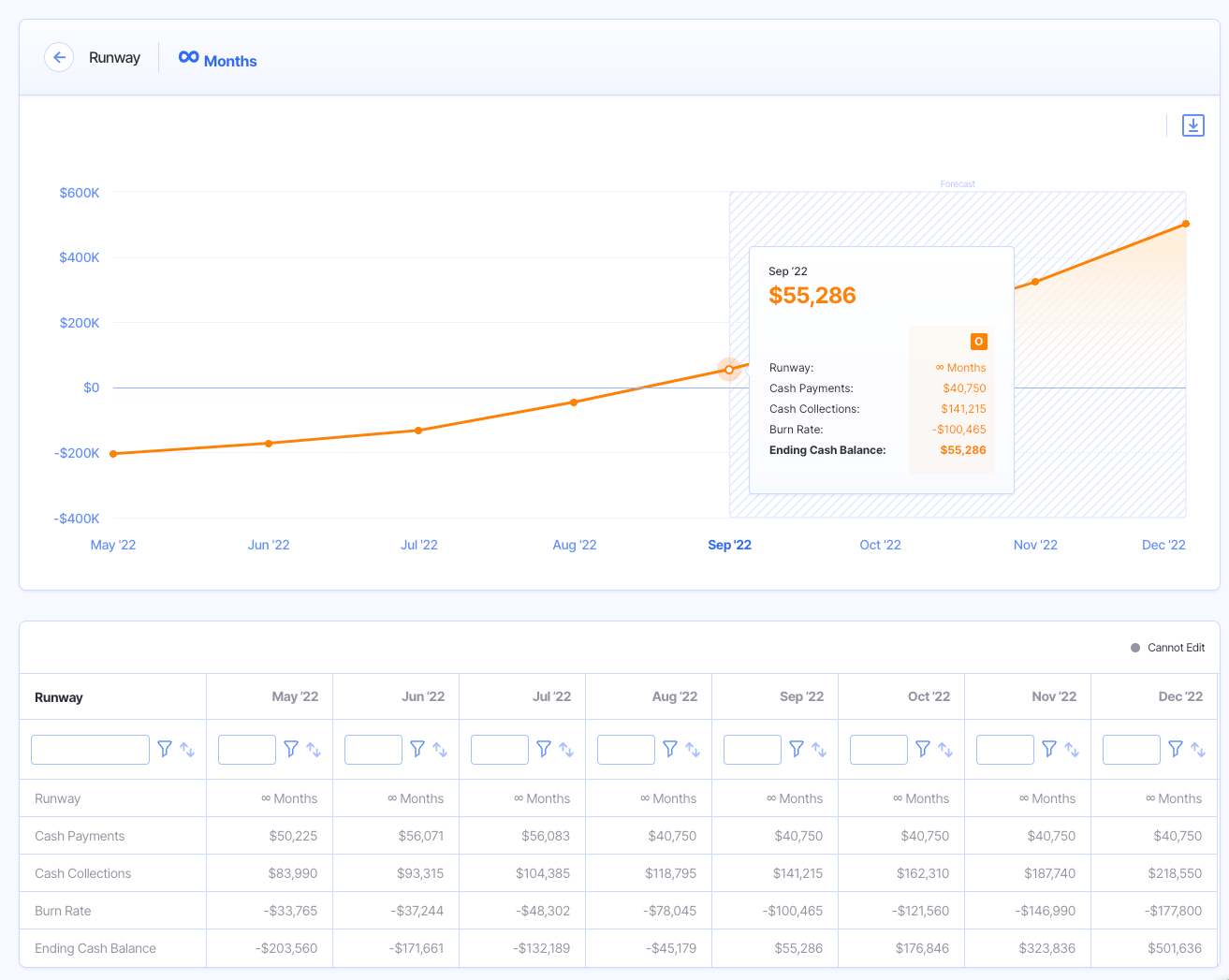

You can build reports like cash flow projections, connect your analytics tool with other revenue and expense management platforms, and see your report updating itself in real-time.

6. Build A Plan For Investor Fundraising

Fundraising is at the heart of many early-stage startups’ growth plans.

Without cash to invest in the activities that fuel growth, you’ve just got an idea. But investors don’t just go handing out money willy-nilly (well, sometimes). They need to see solid potential in the figures.

A good financial analytics platform can help you plan for fundraising by pulling together important financial data and providing insights into:

- Your current cash runway (so you know when and how much to raise)

- What happens under different fundraising scenarios (e.g., what you could do with $3 vs. $5m in funding)

- Cash burn rate (so you can see how long that new investment should last)

You’ll also be able to build reports that give investors the information they need to make a decision.

This includes financial statements like:

- Cash flow statement

- Profit and loss statement

- Balance sheet

- Revenue forecast

Financial Analytics Are The Key to Understanding Your Business

A solid financial analytics platform is critical to your ability to make strategic decisions that drive business growth and define success in your role as a finance leader.

There are a ton of options out there, meaning choosing a solid software tool requires just as much strategic thinking as using the thing to drive financial growth.

If you’re in the market for a financial analytics platform, we’ve got a guide to the best tools right here: Best Financial Modeling Tools & Software (2023).

Or, you know, you could skip all that extra reading and just jump straight into a 30-day free trial of Finmark by BILL, the financial modeling and planning platform for ambitious finance leaders.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.