Monthly Recurring Revenue (MRR)

Monthly recurring revenue (MRR) is one of the most important SaaS metrics you need to track and analyze. It’s also a building block for subscription-based businesses.

And while it’s a pretty simple and straightforward metric on the surface, if you make mistakes in tracking your MRR you open yourself up to a world of issues when it comes to forecasting growth, talking to investors, and measuring the overall performance of your business.

We want to help you avoid all those potential pitfalls.

In this guide, we’ll talk about how to calculate MRR, why it’s important, and everything else you need to know about monthly recurring revenue.

Let’s dive in.

What is MRR?

Monthly Recurring Revenue (MRR) is the amount of predictable revenue your business earns each month from customers.

In other words, MRR is the total amount of money you expect customers to pay you each month for their subscription to your product.

The “predictable” part comes in because your customers have subscribed to pay you “X” amount each month for their subscription. So barring some major event, MRR gives you a pretty accurate idea of how much revenue your business can expect to take in on a monthly basis.

How to Calculate MRR

The simplest way to calculate MRR is to multiply your average billed amount (or average revenue per customer) by your total number of active customers for that month.

MRR formula

Average revenue per customer (monthly) * total number of customers

Luckily, if you use a subscription billing tool like Stripe or Recurly, your MRR is calculated for you automatically. But it’s always a good idea to know where the number comes from, especially since not every tool calculates MRR the exact same way.

This can happen for a variety of reasons. For instance, some don’t account for coupons and discounts while others do.

If your numbers don’t match up across different tools, just ask for clarification on how they calculate MRR.

MRR Example

Here’s a quick example of how MRR works. Let’s say you’re a SaaS company and these are your customers:

| Customer | Monthly Subscription Amount |

| Martin | $10 |

| Gina | $10 |

| Tommy | $50 |

| Pam | $50 |

| Cole | $100 |

Your MRR would be:

44 (ARPU) * 5 (# of customers) = $220 MRR

Types of MRR

MRR isn’t only impacted by new customers signing up for your product. There are five types of MRR that all play a role in whether your monthly revenue increases or decreases:

New MRR

Monthly recurring revenue gained from new customers.

Example: Jim signs up for your Basic plan at $10/month.

+$10 in new MRR

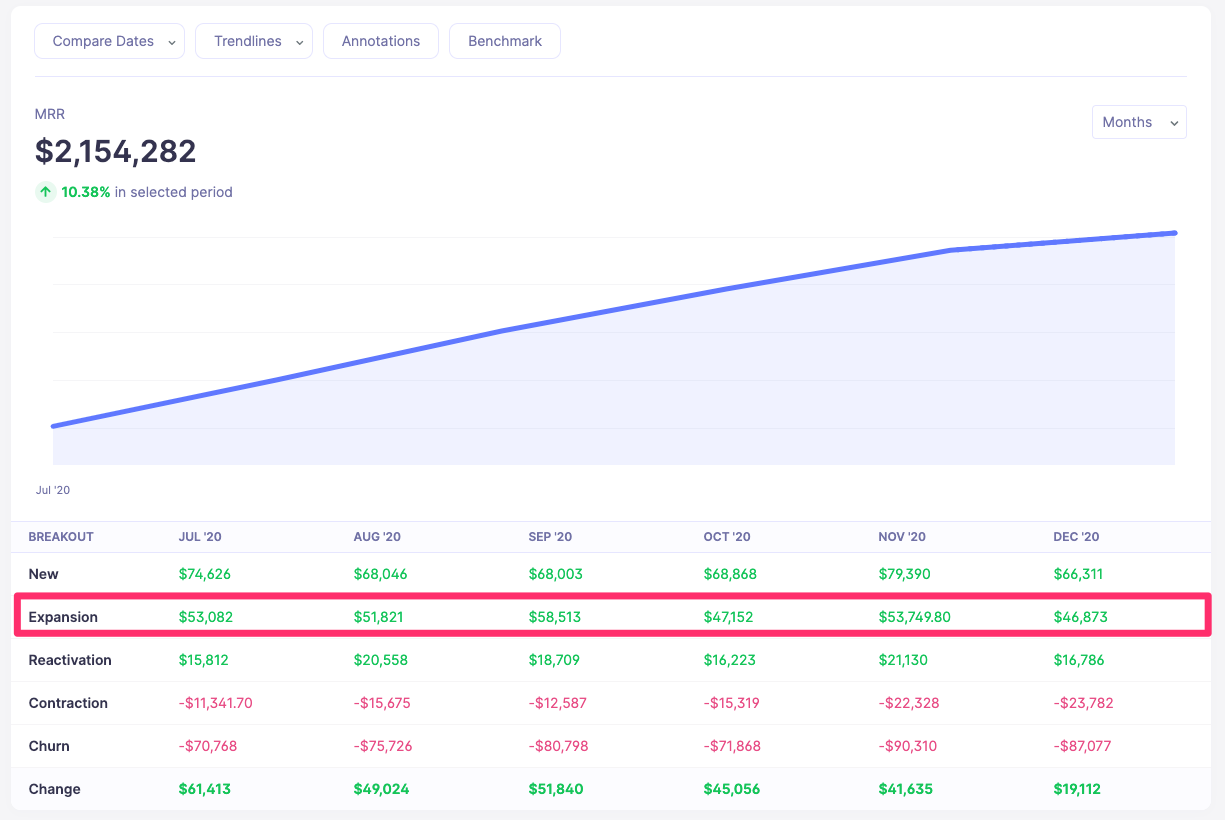

Expansion MRR

Monthly recurring revenue gained from existing customers through upgrades, add-ons, or cross-sells.

Example: Pam upgrades from your Basic plan ($10/month) to your Premium plan ($49/month).

+$39 in expansion MRR

Reactivation MRR

Monthly recurring revenue re-gained from churned customers.

Example: Michael canceled his $10 plan in January, but signs back up in June for the same $10 plan.

+$10 in reactivation MRR for June

Churned MRR

Monthly recurring revenue lost from customers who cancel/churn (Learn more about revenue churn).

Example: Phillis cancels her subscription to your $10 Basic plan.

-$10 in churned MRR

Contraction MRR

Monthly recurring revenue lost from existing customers through downgrades.

Example: Kevin downgrades from your $49 Premium plan to your $10 basic plan.

-$39 in contraction MRR.

This info will come in handy a little later, so keep them in mind.

Why MRR is Important

You probably already have a pretty good idea of why MRR is such a crucial metric to track: it gives you insights into your company’s cash flow.

Like we mentioned earlier, predictable cash flow is one of the biggest advantages the recurring revenue model has over something like retail where your revenue comes from one-time transactions.

But here are some other reasons why tracking and analyzing monthly recurring revenue is important:

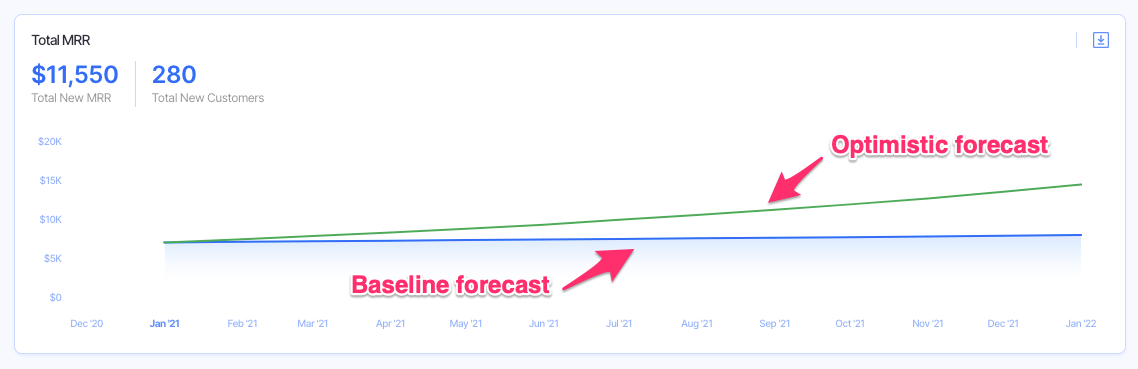

Building Financial Models

Since MRR tends to be pretty consistent barring any unforeseen incidents (like a huge economic downturn that causes tons of customers to churn at the same time), recurring revenue makes financial forecasting much easier.

For example, let’s say your current MRR is $100K and over the past 12 months you’ve been increasing MRR by ~5% per month.

With that data, you can start to build a financial model that forecasts how much revenue you’ll generate 3, 6, or even 12 months out from now at your current pace. Plus, you can create upside or downside scenarios to compare.

For instance, what if you want to know what your MRR will look like if you grow 10% monthly as opposed to 5%. You can build that into your forecast and see.

Whether you’re trying to fundraise, build a hiring plan or just plan for the future of your company, this data is invaluable.

And if you’re interested in building a financial model for your business, Finmark makes it easy. You can check it out here.

Track How Well You’re Doing (or Not Doing)

We alluded to it above, but MRR is a good indicator of your company’s growth.

If your MRR growth rate is positive month over month, that’s a great sign. It means more people are willing to pay you money and they’re sticking around.

If your MRR growth is relatively flat for an extended period of time, it could be a sign that you’ve hit a wall somewhere.

Maybe you need to build more awareness with marketing, roll out some product updates to attract new customers or it could mean you’re losing as many customers as you gain each month.

The worst-case scenario is when your MRR is on a decline. In all likelihood, that means your churn is outpacing customer acquisition which is a huge red flag that you need to get a hold on immediately!

As you can see, if you make money from subscriptions and aren’t tracking MRR, you’re missing out on some important data that could significantly impact your business.

Get into the habit of not only tracking your MRR, but analyzing the data as well.

MRR Benchmarks

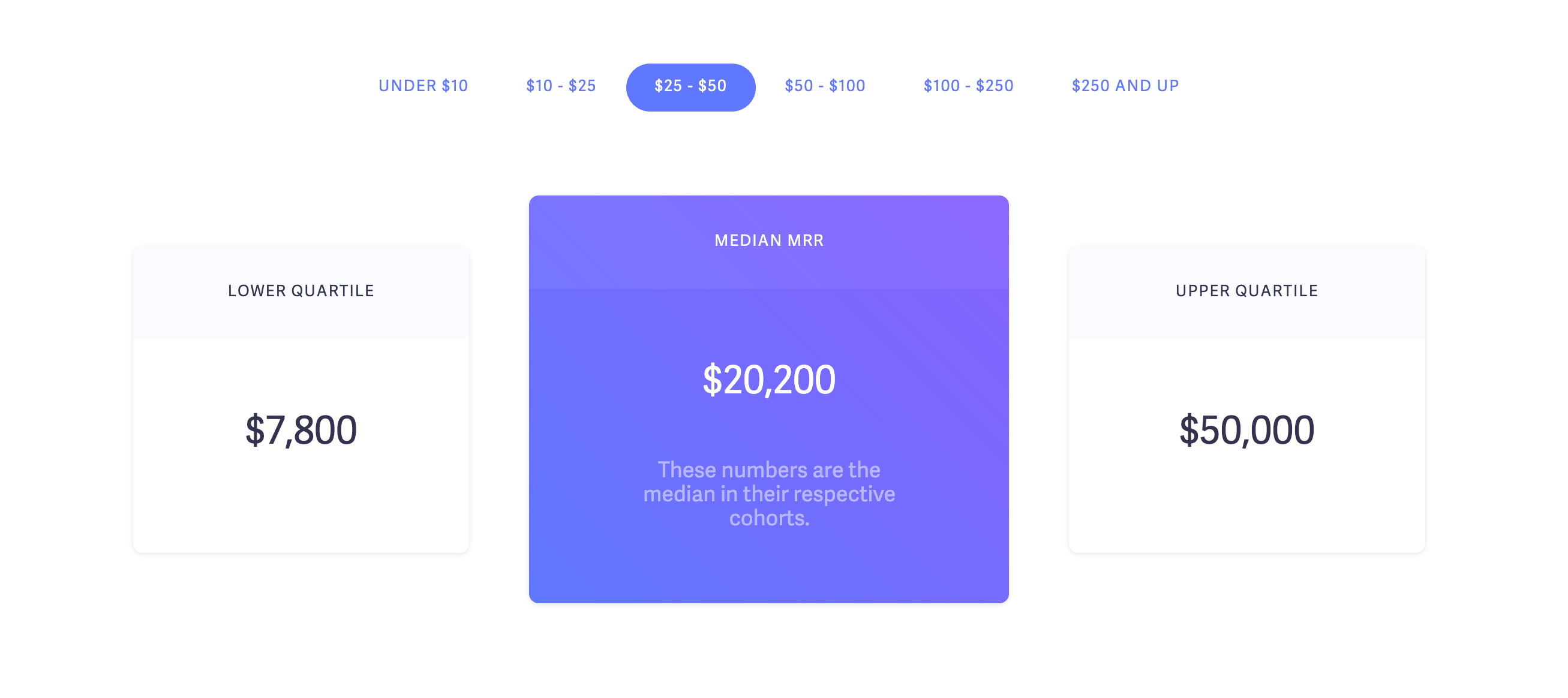

You might look at your MRR and think to yourself, “is $50K MRR good?”

Well, “good” is subjective. Depending on your industry, stage of your company, pricing, and other factors, $50K MRR could be good, bad, or just on-par with where you should be.

If you’re curious about where your MRR stands compared to other companies, you can do some benchmarking.

Luckily, there are quite a few Open Startups that share their numbers publicly. A good place to start is Baremetrics Open Benchmarks, which shows you MRR benchmarks based on average revenue per user (ARPU).

For instance, if your ARPU is $30, you can see the MRR benchmarks for similar companies.

But keep in mind that there are a ton of factors that go into a company’s MRR. Don’t get too wrapped up in how your MRR is doing compared to other companies.

How to increase MRR

You know what MRR is, how it’s calculated, and why it’s important. But the real question is how do you increase it?

Remember the five types of MRR we mentioned earlier? It’s time to put them to use.

By improving each type of MRR, you’ll be able to boost your overall MRR. Here’s how.

1. Get More Customers

Type of MRR you’re improving: New MRR

The most straightforward way to increase MRR is to just get more customers. I know, easier said than done.

But if you’re able to get new customers through marketing and sales, it’ll have a direct impact on your MRR.

If you’re a newer company, this needs to be your main focus for increasing MRR. Most of the other tactics on this list require you to have a good amount of existing customers in order to have a significant impact on your MRR.

But otherwise, customer acquisition is going to be your main path to increasing MRR.

Resources:

- How To Acquire B2B SaaS Customers

- How We Reached the Magical First 1,000 Customers

- 87 Must-try Saas Growth Hacking Strategies

2. Upsell Your Existing Customers

Type of MRR you’re improving: Expansion MRR

This is a very underrated way to increase MRR. And in some cases, it’s easier than getting new customers.

Instead of trying to win over new people who may have never heard of you and aren’t even sure if your product will help them, you can focus on customers who are already paying you and try to get them to pay you more (aka customer expansion).

There are tons of examples of successful SaaS companies that get a good chunk of their monthly revenue from customer expansion.

For example, ConvertKit is an email marketing tool that sets its prices based on how many email subscribers a customer has (aka metered billing). The more email subscribers a customer has, the more they pay.

As a result, over a third of their MRR comes from customer expansion in any given month.

Resources:

- How to Use Customer Expansion to Skyrocket Growth

- Upselling Prompts: 9 Excellent Examples From B2C, B2B, And Saas Companies

- Make More Money with Better Upgrade Emails

3. Win Back Cancelled Customers

Type of MRR you’re improving: Reactivation MRR

Just because a customer cancels their subscription doesn’t mean they’re gone for good. If you can win back customers after they’ve canceled, they can add to your MRR again.

In order to pull this off, you’ll likely need a great offboarding flow where you find out why customers churn and follow-up with them.

That, combined with a good win-back email series is a simple way to automate the process of getting reactivation MRR.

Resources:

- 5 Win-Back Email Campaign Examples That Will Get Customers Back

- The Anatomy of a Perfect Win-Back Campaign

4. Reduce Churn

Type of MRR you’re improving: Churned MRR

Churn is inevitable for SaaS companies. But when your churn rate gets out of control (like over 10%) it not only offsets the gains from new customers, but it also makes it extremely difficult to create sustainable growth.

All other things equal, if you’re able to lower your churn you should start to see some positive MRR growth month over month. No matter how many new customers you acquire per month, unless you’re able to get your churn under control it’s a recipe for disaster.

Aim to get your churn below 5% for more sustainable growth.

Resources:

5. Make Your Customers Successful

Type of MRR you’re improving: Contraction MRR

Last but not least, keeping customers on the same plan (or higher) is a good way to stop your MRR from decreasing.

A lot of times, customers downgrade their plans because they:

- Don’t feel they’re getting enough value from their current plan

- Are trying to cut expenses

In either case, your job is to make sure they’re getting enough value from their current subscription to justify the price. The best way to do this is by educating them on how to get the most out of your product.

Here are a few ideas to try:

- Improve your onboarding flow

- Create content that shows how to get more value from your product

- Proactively reach out to customers to see if they have questions

Whatever you can do to keep customers paying the same amount or more each month will have a big impact on your MRR.

Resources:

- 8 Proven Customer Marketing Strategies (+15 Examples!)

- 10 Great Examples of Customer Onboarding That You Can Learn From

Summing Up MRR

Knowing your MRR is table stakes for any SaaS or subscription-based business. It’s one of the quickest ways to get insight into how your business is doing.

Once you dive deeper your MRR can tell you (and investors) where your business is heading, and the steps you need to take to succeed. From building forecasts to creating a growth strategy and more, monthly recurring revenue is a key metric every founder should focus on.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.