Total Revenue

If you want to know how much money your business makes from all the products and services you sell, you need to track your total revenue.

Total revenue tells you exactly how much money your business generates before expenses. And since revenue is key for growth, it’s a metric that every startup needs to track and understand.

In this article, we’re going to break down everything you need to know about total revenue.

What is Total Revenue?

Total revenue, also known as gross revenue, is your total revenue from recurring (MRR) and non-recurring revenue streams.

In other words, it’s the total amount of income your company brings in from selling your products/services.

For instance, if you’re a SaaS startup that offers monthly packages plus ad-hoc services like consulting, your total revenue would be the sum of the money you earned from the monthly subscriptions plus the consulting services.

You’ll typically find total revenue at the top of an income statement before expenses have been taken out.

How to Calculate Total Revenue

To calculate total revenue, simply add up all your revenue sources.

Total Revenue Formula

MRR + Non-recurring revenue

Here’s an example.

Let’s say you run a SaaS company that sells accounting software. You have three revenue streams:

- Monthly subscriptions for your software

- Ad-hoc tax preparation services

- An educational course to teach businesses how to manage finances

Here’s what your revenue might look like over a four-month period when you factor in growth and churn:

In the screenshot above, you can see the three revenue streams, with the monthly revenue for each. The “Total” highlighted at the bottom is your total revenue for each month.

When you’re calculating total revenue, make sure you include all of your different revenue streams, even if they only make up a small part of your business.

Add-ons, one-time fees, monthly subscriptions, and any other source of revenue from your business needs to be accounted for. It’ll give you a full picture when it’s time to analyze your past revenue performance or forecast for the future.

Why Total Revenue is Important

Without tracking your total revenue, it’s impossible to know whether or not your business is growing.

Whether you’re creating a financial forecast, pitching investors, or analyzing your current revenue streams, total revenue is vital. Here are a few reasons every startup needs to track total revenue:

Find Out What’s Working (Or Not Working)

When you look at your total revenue by revenue stream, it’s a quick way to see where the bulk of your money is coming from.

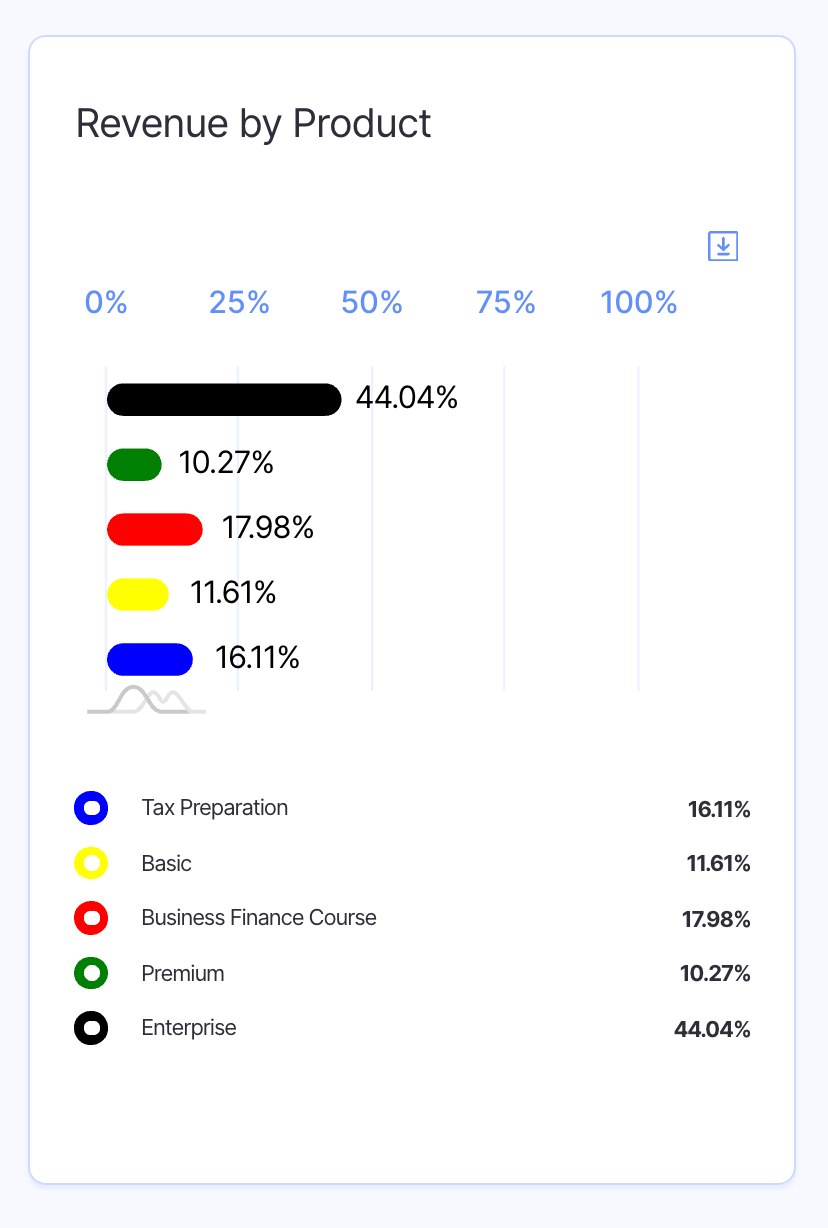

Let’s look at an example in Finmark. Sticking with our fictional accounting software company, our revenue comes from three sources:

- Monthly subscriptions

- Basic plan

- Premium plan

- Enterprise plan

- Course

- Tax preparation service

When we look at what percentage of our total revenue comes from each, we can start to understand a lot about the business.

Looking at this data, we can see:

- Our monthly Enterprise plan is where the bulk of our revenue comes from. If we were to add more enterprise sales reps, could we increase that even more?

- The business finance course and tax preparation service drives almost a third of our total revenue. If we were to increase our monthly growth by 5%, what would our runway look like in 12 months?

- Our premium and basic plans aren’t driving as much revenue as our other revenue streams. If we were to invest more in marketing, could we get those numbers up?

These are all questions you can answer by building a financial model and forecasting different scenarios. But it all starts with knowing your total revenue.

If you’re interested in doing this level of analysis for your business, you can give Finmark a try free for 30 days.

Calculate Your Runway

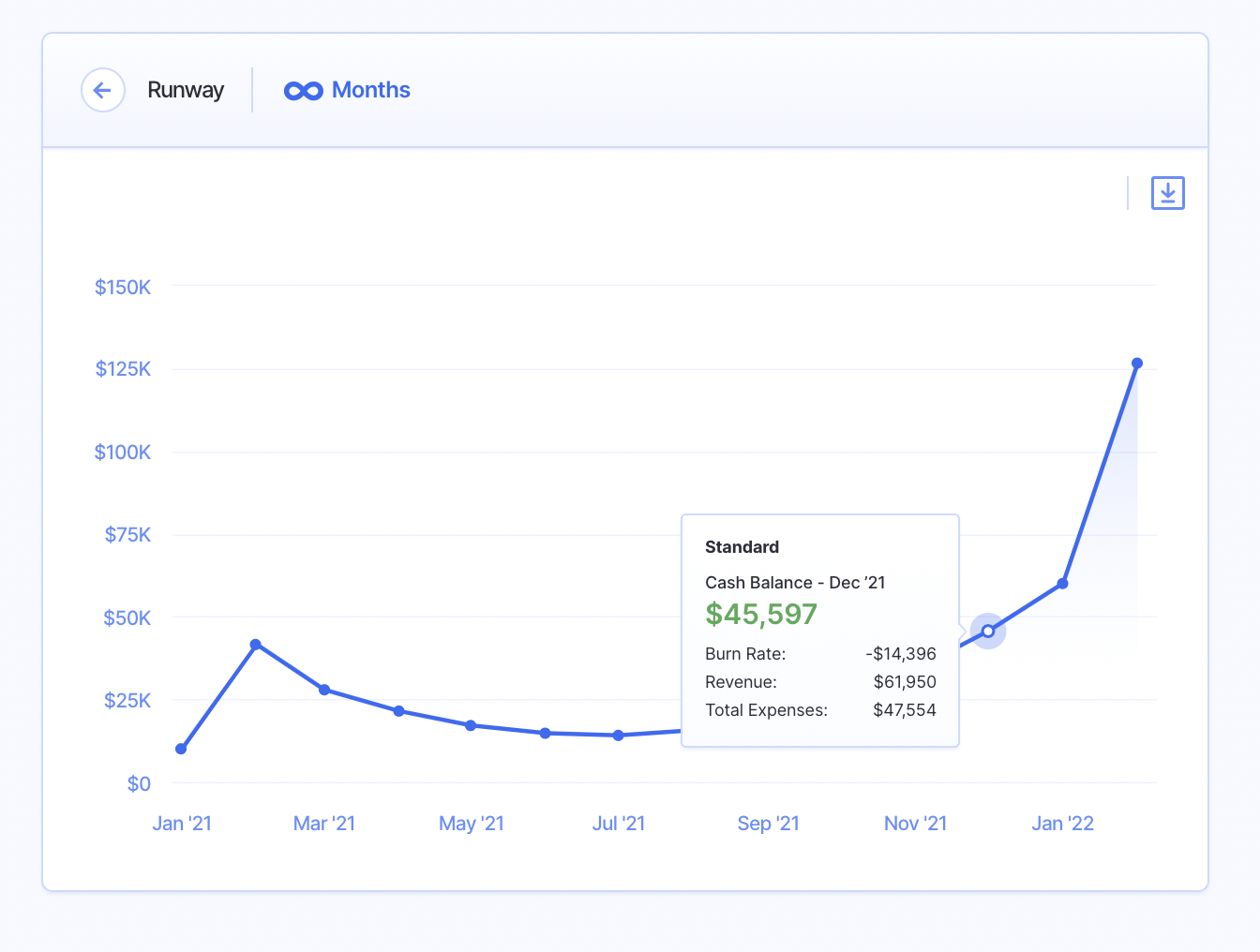

In order to see how much cash runway your business has, you need to know your revenue. You also need to be able to forecast based on your revenue and expected growth.

When you plug in all your data into a financial modeling tool, you can forecast your burn rate, runway, and growth trend over the next 6, 12, or however many months into the future you want to plan.

Forecast Your Runway With Finmark!

Budget for Expenses

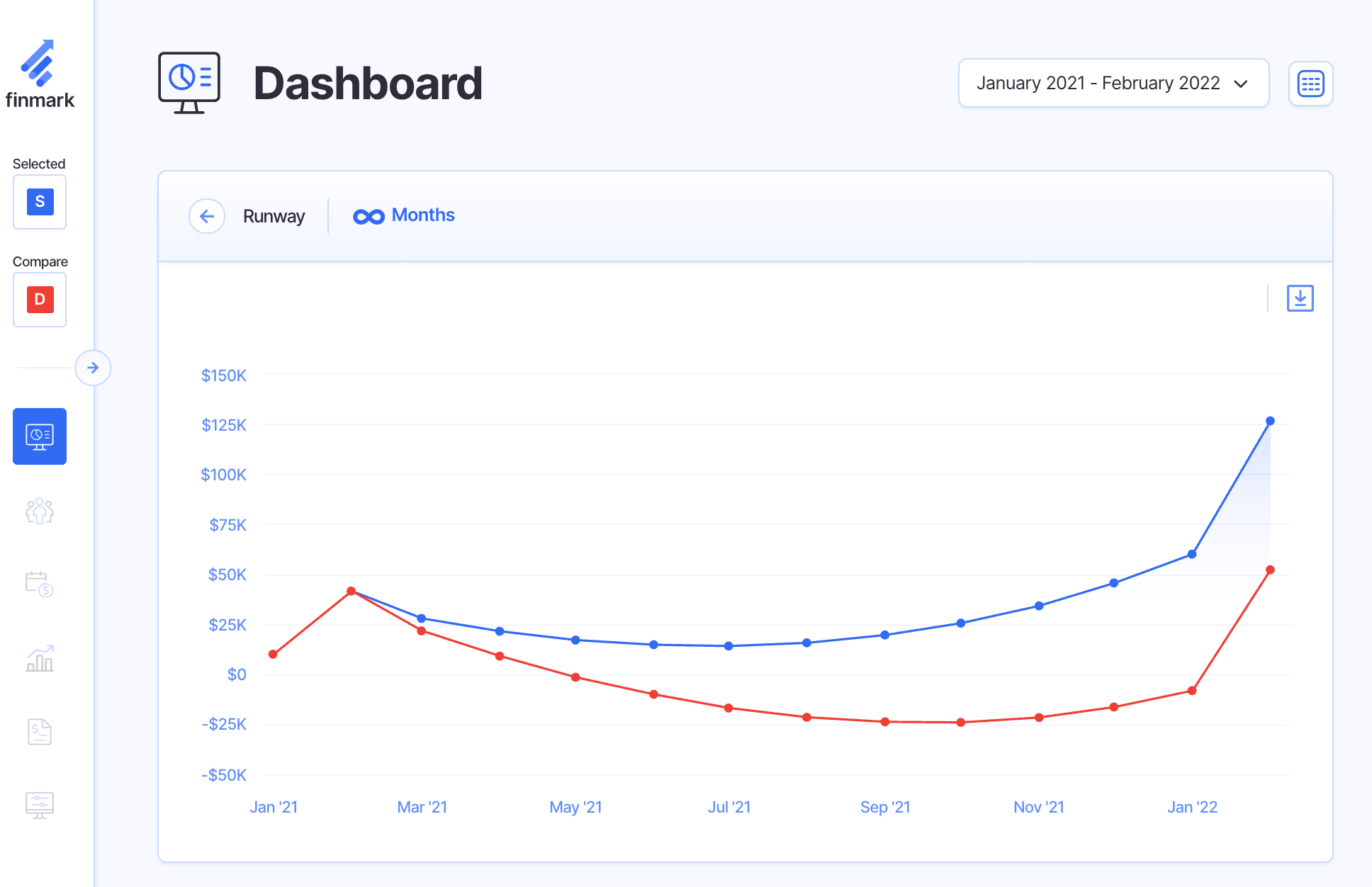

Speaking of runway, in order to grow efficiently, you need to balance your revenue with your expenses.

While it’s typical for startups to have more expenses than revenue in the early stages, eventually you’ll want (and need) to shift that ratio.

Your expenses can only outpace your total revenue for so long before you find yourself in a bad financial situation.

For instance, let’s say our accounting software company didn’t do such a great job of managing expenses. We can compare what the cash runway would look like in that scenario (red) vs. our baseline scenario (blue).

In the red scenario, we can either cut expenses or figure out a way to boost revenue in order to extend our cash runway.

Plan For Fundraising

Building a startup can be expensive. And sometimes, your revenue isn’t enough to fuel your growth goals.

When that happens, fundraising can be an option to extend your runway and continue to build your business without the fear of running out of cash.

Tracking your total revenue can help you figure out when to fundraise, and how much to raise.

How to Increase Total Revenue

Whether your revenue is trending upwards, downwards, or staying flat, there’s always room for improvement.

Here are some tips to increase your top line revenue:

Double Down on What’s Working

As tempting as it is to experiment with new growth strategies, sometimes the best course of action is to double down on what’s working.

Like we showed in our accounting startup example, if you can identify your biggest revenue drivers, you have a starting point for where to put your focus.

Once you take into account the amount of expenses needed to drive each revenue stream, it’ll be easier to make a data-informed decision on how to increase your total revenue.

Think Short and Long-Term

There are things you can do to increase your revenue in the short term like offering discounts and incentives to boost sales. While those tactics can give you a quick influx of cash, you also need to consider the long-game.

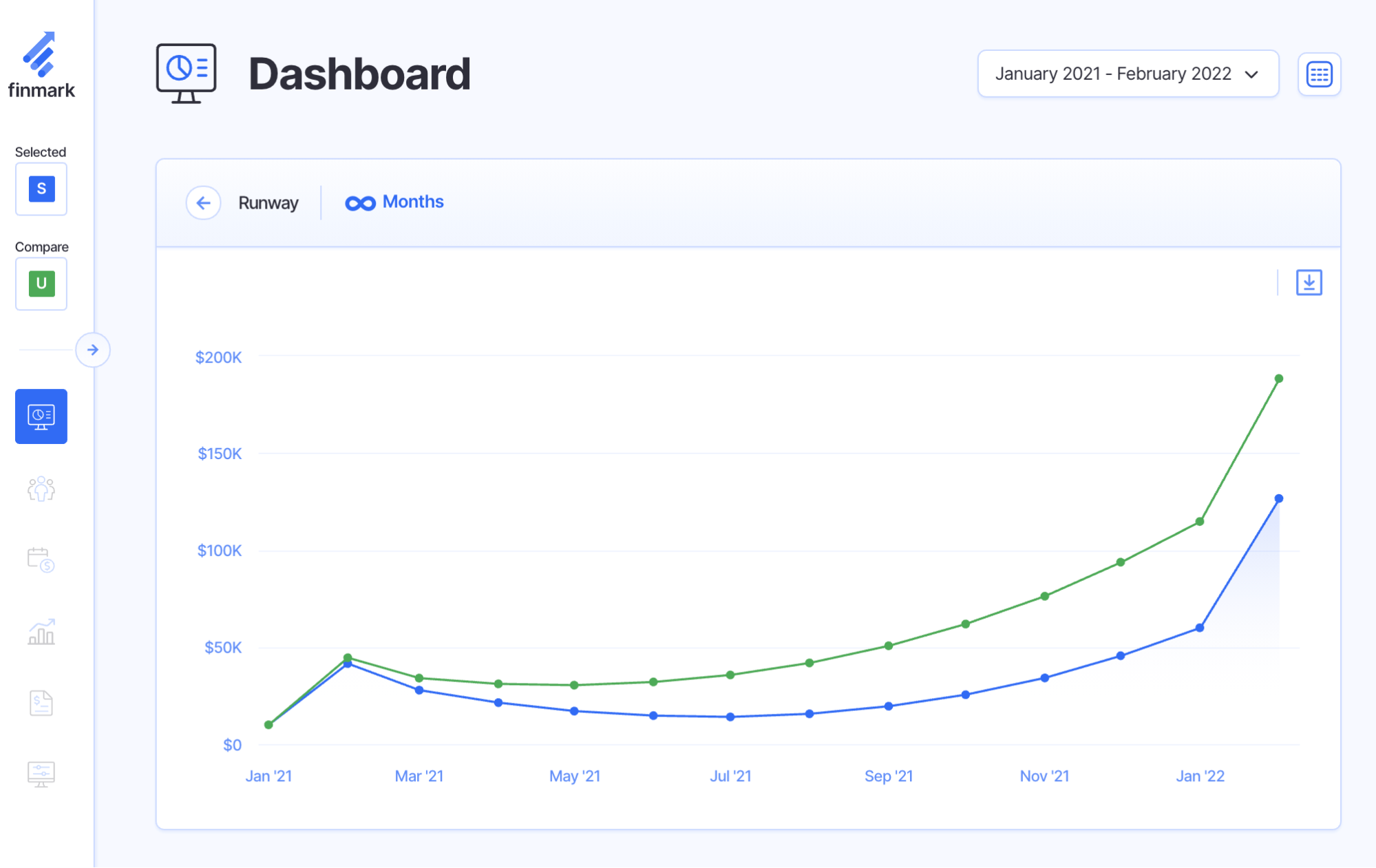

For instance, if you were to increase your pricing for all plans by 20%, what will your cash runway look like in 12 months?

Let’s create that scenario in Finmark and compare, using our accounting software startup example.

In the image below, the blue line represents what revenue looks like at regular pricing, and the green line shows what happens if we increase all the monthly pricing plans by 20%.

Mapping out various scenarios like this is a good way to forecast revenue based on any number of factors. From price to new revenue sources and more, you can see the impact that changes will have on your startup’s future.

Those are some big-picture approaches to increasing revenue. For more tactical strategies, check out these resources:

- How These 7 Companies Increased Revenue by an Average of 425%

- How to Grow Your Business: Lessons from Zero to $100k/month in 2 Years

- A Business Roadmap to Grow SaaS Startups From $0 to $50M ARR

The Bottom Line on Total Revenue

If your business was a car, then total revenue would be like the gasoline. Without revenue, your business isn’t going to be able to keep moving forward.

Want to know how much gas you have in the tank, or how far you can drive your “business” with your current revenue? Give Finmark a try today.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.