How to Get Seed Funding – Step-by-Step Guide for Startups

There’s a common problem many startup founders face:

They’ve got a strong idea with real potential, the beginnings of a great team, and a well-developed plan to bring their company to market.

But there’s one thing missing:

The funds to get off the ground.

Oh, and the know-how to obtain said funds. So I guess two things.

This guide is designed to help you with the second problem (how to get seed funding), so you can nail the first one (getting off the ground).

Note: If you’re more of a visual learner, check out this webinar about how to raise your first funding round, featuring our very own Rami Essaid!

What is Seed Funding?

Seed funding is the first official funding round for new business ventures.

In a seed round, funding is provided by an investor in exchange for convertible debt or equity in the company.

The best way to think about seed funding is like growing a tree (hence the name ‘seed’).

Investors provide the seed (the initial investment), which the business owners nurture into a healthy tree (the business).

In exchange, the startup owners must concede some form of return value to the investor, such as a percentage stake in the tree (company), or a share of the fruit it produces (profit).

Why Should You Raise Seed Capital?

The simple answer is that many startups can’t get to a point where their product is ready to sell without a decent chunk of capital.

Costs such as product development, employee salaries, and infrastructure expenses all add up pretty quickly, meaning you could easily be spending hundreds of thousands of dollars in capital before you even have something to sell.

Seed funding not only allows for crucial development steps such as these but also provides founders with a way to invest in initial marketing or public relations, key hires (such as bringing on a VP of Product or CTO early on), or building a successful sales team.

How is Seed Funding Different From Series A and Pre-Seed Funding?

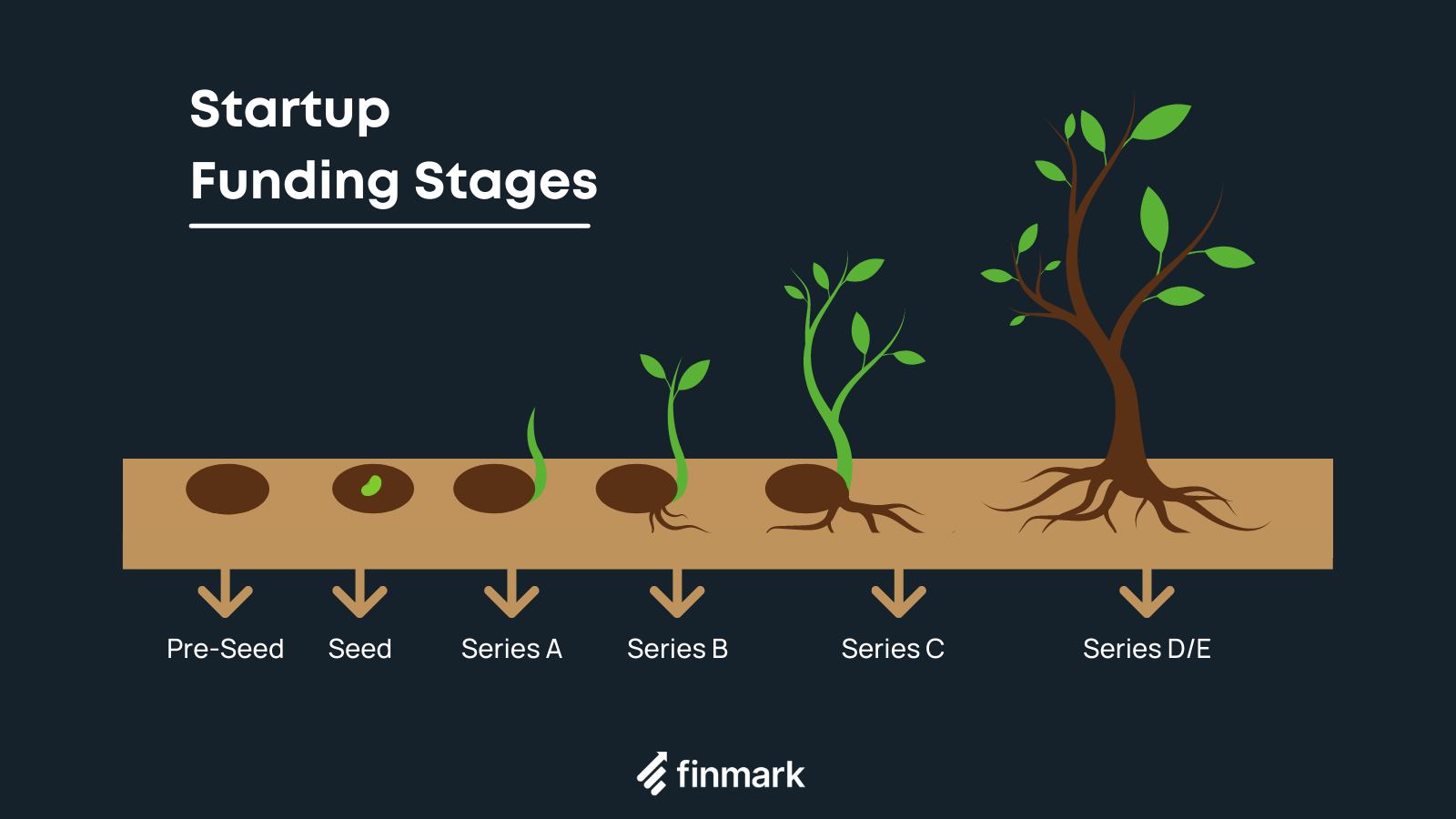

Rounds such as Series A, B, and C are quite obviously sequential, but where does seed funding fit in, and what about pre-seed funding?

Here’s how it works:

Seed funding comes before Series A funding and pre-seed funding before the seed investment.

So:

- Pre-seed

- Seed

- Series A

- Series B, and so on…

The difference between these funding rounds mostly comes down to investment amount, company valuation, and the stage of your venture.

| Pre-seed | Seed | Series A | |

| Typical funding amount | $50k – $250k | $500k – $2m | $2m – $15m |

| Company stage | MVP (minimum viable product) created, clear target market identified | Established product-market fit, started building a team | Established user base, consistent revenue growth, some market assumptions validated |

| Typical company valuation | $1m – $3m | $5m – $15m | More variation, with an average valuation of $24m |

| Most common investors | Friends, family, accelerators | Angels and some venture capitalists | VCs |

How Seed Funding Works For Startups and Investors

Your investors need to get something out of the deal too, that is, they need an ROI (return on investment).

There are a few ways this can be structured:

Equity Funding

With equity financing, the seed investor gives you funds in exchange for an equity share in your company, most commonly between 20% and 25%.

This means they own a percentage of your business.

Equity holders receive a share of dividends relative to their equity share, though the investor’s main incentive here is to hold shares while the company grows, and sell them off later for a large profit.

Convertible Debt (AKA Convertible Note)

This kind of funding typically occurs when an early-stage company is difficult to value. The investor gives you a loan, specifying a principal amount, interest rate, and maturity date.

The intention of the note is that it converts to equity when the company proceeds with an equity funding round.

However, the debt can be called by the investor at maturity, if they choose not to convert to equity and withdraw from financing the startup.

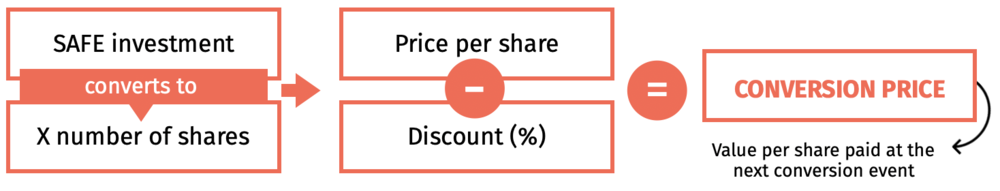

SAFE (Simple Agreement for Future Equity)

A SAFE is similar to convertible debt but doesn’t include interest or a maturity date. It was created by Y Combinator for startups looking for early-stage funding.

A SAFE is essentially a loan given in return for the right to purchase stock at a future date, usually at a discounted rate.

How to Get Seed Funding

To get seed funding you’ll need to decide what type of funding you need, determine how much to raise, create a pitch deck, meet with investors, and finalize a deal.

Let’s go into detail on each step involved.

1. Make Sure The Timing Is Right

Your first step in the funding journey is simply to determine whether the timing is right (or if you need seed funding at all).

This should be based on two factors:

- Whether you’re willing to give up a stake in your company

- Whether you can meet an investor’s criteria in convincing them you’re a good investment.

The first decision is entirely personal, it’s ultimately down to you to decide whether you’re comfortable giving up some equity in exchange for capital.

That said, there are many situations where this is the only way forward (some ventures simply need significant capital to get off the ground).

To persuade potential investors to strike a deal with you, you’ll need to provide evidence of:

- Product – You should have an MVP in place, and be able to demonstrate traction (some amount of initial customer adoption) and product growth.

- Market – You’ll need to be able to demonstrate significant market potential, and explain how your product services a strong need in the market.

- Team – Investors want to know that you have a capable team that can execute on bringing this product to market, and scaling the company. You’ll need to convince investors that you’ve got the right people for the job.

If you can satisfy these three criteria, the timing is right.

2. Choose Your Funding Source

There are a number of ways to access seed money; each has pros and cons.

Venture Capitalists

Venture Capitalists (VCs) are firms built specifically to provide funding to companies.

They’re the most conventional route of funding, especially as you move into Series A funding and onwards.

Many (but not all) VCs are open to seed funding, and you can expect these investors to be incredibly scrupulous, often requiring several meetings and involving many stakeholders.

Angel Investors

Angel investors are the second of the two most common investor types for seed funding.

Angels are wealthy individuals who invest in early-stage startups using their own money (as opposed to VCs who invest other people’s money).

Obtaining seed funding from angels can be a faster process involving less due diligence, though angels often expect a bigger equity cut in return.

If you’re interested in getting an angel investor, we wrote an entire guide on how to find one: How to Find The Perfect Angel Investor For Your Startup.

Friends and Family

Many early-stage companies get seed funding from friends or family members.

This gives you a little more flexibility as far as terms go (you can treat it as a loan rather than an equity trade) but carries with it the problem of mixing your business life with your personal life and can quickly become a recipe for disaster.

Crowdfunding

Crowdfunding has become a popular alternative, with sites like Kickstarter helping thousands of founders launch their startups.

This form of seed funding typically involves creating a crowdfunding campaign built on product pre-sales and then convincing hundreds or thousands of donors to invest in your product before it’s put to market.

If you raise enough capital, you’re able to build the product and fulfill the orders of each of the initial investors.

Accelerators and Incubators

Accelerators and Incubators like Y Combinator are enterprises built to assist founders through the process of launching and growing a company.

It’s not uncommon for these kinds of companies to ask for equity in exchange for their services, and in some cases may be able to provide seed funding for smaller companies.

Bootstrap

Remember that not all companies require outside funding to succeed.

Bootstrapping involves putting your own money up as investment, or simply relying on any business profits to reinvest in further growth.

Yes, successful bootstrapped startups are the exception, not the rule, but there are several great examples of bootstrapped companies (Facebook and Apple, to name two).

Based on the info above, choose the right type of investor for your needs.

3. Determine How Much Seed Money You Need

We’ve established already that the typical seed investment is between $500k and $2m, so we have a rough estimate.

But investors don’t want rough estimates, so you need to establish how much funding you’re asking for.

In the ideal world, you’ll receive enough funding to reach profitability.

This is achievable for many software-based startups, as the cost of product development is relatively low, and you can still grow market share and revenue with a ‘dumbed-down’ version of your ultimate product vision.

For companies producing physical products, it may not be reasonable to expect enough funding in a seed round to reach profitability (as production costs are higher).

In this case, your goal will be to generate enough funding to get you to the next fundable milestone, typically in the next 12-18 months.

A good way to calculate how much funding you need is to determine how many months of operation you need to fund.

Let’s say you need to fund your company for 12 months, with 6 engineers costing $15k per month. That means you need to raise $1,080,000 (roughly $1m).

Financial modeling software like Finmark can be extremely useful here, because you can project how much runway different investment amounts will give you and create a plan for how to use the capital. You can learn more here.

4. Get Prepared To Approach Investors

Investors need to see evidence of future success in order to feel comfortable putting their money into your startup.

Though part of their decision will be made subjectively (whether they feel you and your team are the right people to bring the vision to life), much of what investors want to see is tangible plans and financial forecasts.

That is, does it look good on paper?

You should be prepared with an executive summary and pitch deck covering:

- Your company name, logo, tagline

- Your long-term vision (why the company exists)

- The problem your product solves

- Your customer persona (what does your customer look like)

- The solution (what you’ve created, and why the timing is right)

- The total addressable market (size, as well as landscape such as macro trends, competition)

- Your traction (current results, extrapolations for future growth)

- Your business model (how customers translate to revenue)

- Financial projections (revenue, expenses, profit)

- A thorough breakdown of overhead (utility bills, salaries, rent, product development costs)

- Long-term planning for future product development as well as financials (beyond the runway this funding provides)

- Your team (who they are, what they bring to the table

- Fundraising (what you’ve already raised, what you’re looking for)

Want to make sure your deck is ready for investors? Check out guide to learn how to create a pitch deck investors want to see.

5. Build A List of Potential Investors

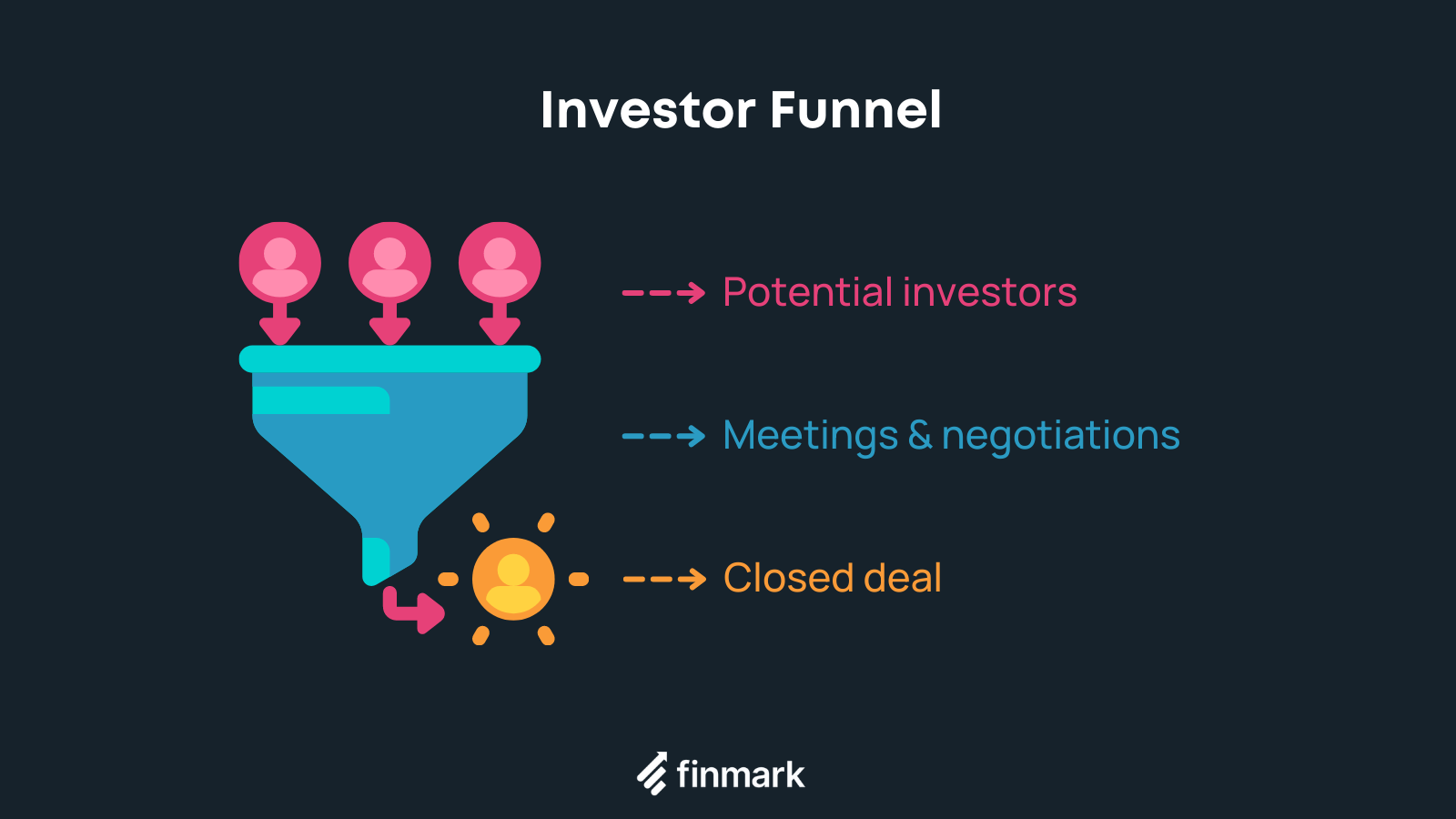

Obtaining seed funding can be a grueling process; you’ll need to speak to a lot of potential investors.

The best way to approach this is like a sales funnel.

In this case however, what you’re building is an investor pipeline. Each potential investor is a new lead, so you want to:

- Fill the top of your funnel with investors that meet your ideal investor persona

- Score and prioritize the most important leads (the investors most likely to fund you)

- Work each of those relationships right down the funnel until you close a deal

Use platforms like Visible Connect to search for active investors that meet your requirements. If you’re a Finmark user, you’ll also have access to our network of investors!

Also, here are some tips for networking with investors.

6. Meet With Interested Seed Investors

Meeting with investors is a skill you’ll refine over time.

The good news is, you’ll probably have to speak to a bunch of different investors before signing a deal, so you’ll gain that experience pretty quickly.

When meeting potential seed investors, there are a few important rules to follow:

- Make sure you know your audience (the investor, not your customer). Understand what they tend to invest in, and why.

- Simplify your pitch. Short and sweet is best, so focus on the important details (what we discussed in point four).

- Listen carefully to what they say, as a sign of respect, a way of learning, and of building mutual trust (they’ll like you more if you get them talking).

- Pitch your dream (go big), but make sure to back it up with facts and figures (go small).

- Find the balance between confidence and humility. You want to show that you believe in your idea and are a competent founder, but don’t want to come across as arrogant.

At this point, you’re nearing the finish line. You don’t want to fumble the ball by showing up to pitch meetings unprepared. That’s why we created this guide to help you out: How to Pitch Investors: 14 Tips to Get Your Startup Funded.

7. Negotiate The Final Deal

Negotiating can be tough for many founders.

You’re probably going to be on the back foot, as your VC or angel investor does this all day, so they’re way more experienced at it.

It’s best, then, not to negotiate in real-time.

It can be easy to want to jump straight in with the first offer you get, and though you certainly don’t want to waste any time (of yours or of your investors), it’s worth working where you can to negotiate on factors such as equity compensation.

1% of a $100m company is $1m, so carefully consider the future value you’re giving up.

But:Don’t lose the deal.

The number one priority is getting that cash in your account, so once you’re both in agreement, get the paperwork signed and close the deal.

Ready to Raise Your First Seed Round?

Of each of the seven steps we’ve discussed here, the biggest hurdle for most founders is preparing the right documentation to convince investors that your business concept is sound.

Many founders are able to communicate their product vision but struggle to provide tangible, convincing projections of revenue growth, burn rate, and operational expenses.

Finmark is designed to simplify this process for founders — it’s financial modeling made easy.

Check out how Finmark helps founders raise funding here.

Seed Funding FAQ

Here are some of the most frequently asked questions about getting seed funding.

What are the requirments for seed funding for startups?

There are no technical requirements for seed funding. Some businesses get funded with just an idea, while others have a working prototype of their product. A good place to start is to have a product MVP, an idea of your target market, and an initial team.

How much is seed funding?

The typical funding amount for a seed round is $500K-$2M, but this can vary depending on location, industry, the stage of your company, the track record of the startup founder, and other factors.

What is seed money used for?

Seed money is generally used to fund startups while they try to find product-market fit. The funding allows them to build or improve their product while getting feedback from early users and customers. However, some startups also use seed money to create their initial MVP.

How do seed investors make money?

Seed investors get a return on their investment when the companies they invest in have an exit (they get acquired or go public). Depending on the terms of the deal (term sheet), investors may also get dividends or other forms of payouts.

How do you value a startup for seed funding?

The easiest way to estimate the value for seed-stage startups is by looking at similar companies. However, for a more accurate valuation, think about how much money you need to raise and weigh it against how much equity you’re willing to give to investors.

We also have a handy startup valuation calculator that can help you.

How long does it take to raise a seed round?

It can take anywhere from a few weeks to months to raise a seed round. The timeline will depend on the market, your business, your pitch, and other factors.

What comes after seed funding?

Generally after your seed funding round, you’ll spend time finding product market fit and generating revenue. The next step is likely to raise a Series A round to continue growing your startup.

If you’re at a complete loss for what to do after raising your seed round, read this: You Got Funded, Now What?

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.