Projection vs. Forecasts: When & How to Use Each

To the uninitiated, projections and forecasts kind of sound like the same thing.

You’re looking into the future and asking, “What’s going to happen to our company financially?”

Indeed, even many senior finance professionals use the two terms interchangeably.

Financial forecasts and projections are not the same thing, however. I mean, you’ve probably already figured that out; it’s why you’re here.

But if they aren’t the same thing, what is the difference between a financial projection and a forecast?

And, perhaps most importantly, how do you use each one in the context of your business to report on successes and challenges, and to inform the strategic direction of your company.

This article will answer those exact questions.

What’s the Difference Between a Financial Forecast and Financial Projections?

As far as financial reports go, forecasts and projections are pretty similar.

Both consider the company’s current situation and financial trends, and predict what that means for future growth or decline.

But this is where they depart:

- Financial forecasts use current performance data to forecast future performance in the short term (up to a year).

- Financial projections use current performance data and assumptions about the impact of strategic changes to project future performance in the long term (typically one to five years).

The key to knowing the difference between financial projections and financial forecasts lies in understanding the question each seeks to answer.

Forecasts answer the question, “If things keep going the way they have been, what will the next year or quarter’s numbers look like?”

Projections, on the other hand, answer the question, “If we make X, Y, and Z changes, and our assumptions about the impact of those changes are correct, what will our financials look like in the coming years?”

3 Key Differences Between Projections And Forecasts

Before we dive into when and how to use each of these financial reports, let’s dive a little deeper into what distinguishes projections from forecasts.

By solidifying your understanding of each, you’ll be better prepared to choose which to employ in a given situation and to provide advice to others who aren’t clear on the distinctions.

1. Timeframes

The first major difference between financial forecasts and projections is the timeframe each uses.

Forecasts are generally shorter term. You might create a forecast for the next quarter, or for any period of time up to a year out.

Projections, on the other hand, tend to be longer. Because they take into account the strategic plans you have in place, they must recognize the period of time it will take for those changes to bear fruit.

For instance, if part of your strategic revenue growth plan is to double the headcount of your sales team, then you’ll need to take into account the time it will take to:

- Hire new reps

- Onboard and train them

- Get them ramped up to their full quota

As such, financial projections tend to be longer-term, for instance, projecting what the impact of this hiring strategy will be on the next three years of growth.

2. Assumptions And Data

Forecasts and projections both use current financial data to make estimates of future revenue and expenses.

However, forecasts stop there. They look at historical data and trends, and say, “If these things keep happening, here’s what our financials will look like.”

For instance, your analysis of current financial performance might tell you that you’ve been growing revenue by 10% quarter over quarter. You’ll use this trend to forecast future revenue growth.

Projections, on the other hand, include many more assumptions. They start with the same base level of data, drawing on historical financial information and growth trends to create the foundation of the projection.

From there, you’ll layer on your assumptions based on the growth initiatives you have in place for strategic change.

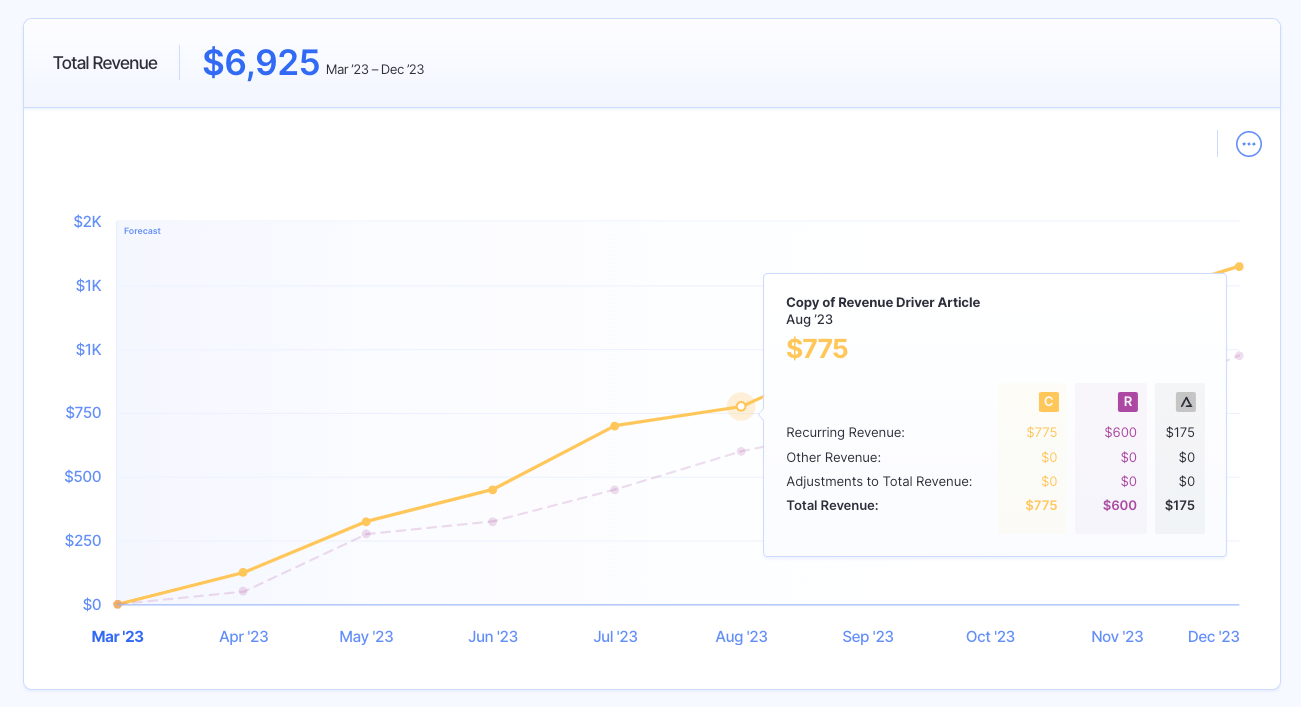

Say, for instance, that you’ve recently completed an analysis of your company’s most critical revenue drivers. You’ve learned that podcast advertising is a huge lead driver for your business, so you have put a strategic plan in place to increase investment in this channel.

You’ll build your projection by starting with current performance, then layering on your expectations regarding spending and revenue growth as a result of this increased investment in podcast ads.

When presenting projections to others, then, it’s incredibly important that you communicate the assumptions you’ve made and included in your report (e.g. you provide a breakdown of your analysis of the expected revenue you’ll drive from the additional advertising expenditure).

3. Applications

Given that projections and forecasts differ in the information they present and the inferences that can be drawn from them, the two reports have different applications.

Forecasts tend to be externally facing, created to let owners, shareholders, investors, and market analysts know how you’re tracking. That said, forecasts are also used internally to understand current performance.

Projections are generally internal facing only, as they are based on assumptions rather than solely on hard data. Financial projections are typically used to assess different options for strategic changes and to make important decisions.

For instance, you might create multiple projections to understand how investment in different initiatives will impact profitability.

As such, companies are likely to create several projections, whilst they’ll only create one forecast, based on their current and actual numbers.

Projections vs. Forecasts: When To Use Each

So, now you know the difference between financial projections and financial forecasts.

Let’s explore use cases for each so you can put this knowledge into play in your organization.

When To Use Financial Forecasts

Financial forecasts are best used when:

- You want to examine how current performance translates into future performance, assuming you make no additional strategic changes.

- You wish to communicate expected financial performance to stakeholders.

- Your company’s previous performance was below expectations, and you need to redesign budgets to accommodate.

When To Use Financial Projections

Financial projections are best used when:

- You want to compare different options for strategic changes

- You wish to understand how changes you’ve already made might impact expenses, revenue, and profitialbity

- You’re looking to understand the potential impact of external factors like economic or legal changes

Projections & Forecasts = A Full Picture of Your Financial Future

Whilst financial projections and financial forecasts are similar, there are some key differences that make each useful in their own scenarios.

Both start from a basis of historical data.

Financial forecasts look to the short term (one to four quarters) and answer the question, “If nothing changes, what will our financials look like?”

Financial projections build on this data with assumptions about the impact of your strategic initiatives, looking toward the longer term (one to five years) and asking, “If we implement this change, what will our financials look like?”

Both forecasts and projections are important for finance teams to use, and they’re created best when you have a robust financial modeling, analysis, and reporting tool on hand.

Finmark from BILL is the financial planning tool for startups and SMBs with robust tools that help teams:

- Model different scenarios

- Build automated hiring plans

- Prepare for fundraising

- Report on financial performance

And, of course, you can use Finmark to create financial forecasts and projections.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.