How to Make Accurate Financial Assumptions For Your Business

Forecasting is a crucial part of financial planning for any growing business. However, the accuracy of your forecasts hinges on the financial assumptions you make.

When you’re in the earlier stages, making financial assumptions can seem like an impossible task with limited historical data on hand. But, there are some key tips and considerations to keep in mind that will help you make more accurate assumptions to base the rest of your financial strategy on.

Throughout this guide, we’ll provide you with an overview of what financial assumptions are, and how to make them for your business.

What Are Financial Assumptions & Why Are They Important?

Financial assumptions are the expectations of how your business might perform in the coming periods. To create financial assumptions, you’ll rely on historical performance, operational strategy, market conditions, industry projections, and other considerations.

Financial assumptions are a key aspect of financial planning; they can provide your key decision-makers with reliable data to make financial forecasts and informed strategic business decisions that drive further growth.

Here are some examples of what financial assumptions might look like for your business:

- On average, customers will pay $50 for our product

- In April, we expect to acquire 250 new customers

With these assumptions, we can make a forecast for April revenue of around $12,500 (of course, you’d have to factor in other variables like churn and revenue expansion). However, your forecasts would quickly change if you only expect to acquire half that amount of new customers, which would result in a monthly revenue forecast of roughly $6,250.

Making financial assumptions can be particularly challenging for newer businesses since you don’t have a ton of historical data to analyze. However, over time as you have more performance data to work with, you can slowly refine your assumptions to build projections and forecasts that more accurately reflect the abilities of your business.

Thus, making accurate financial assumptions is the challenge here.

Inflated forecasts can make you look unreasonable to investors and leave you unprepared for a slowdown or increased competition.

On the other hand, estimates that are too conservative could make you overly cautious and keep you from taking advantage of growth opportunities.

Even still, in some cases, it’s better to err on the side of caution when making financial assumptions, as you’d rather be able to hit your conservative estimates instead of reporting performance that is much below your expectations.

How to Create Financial Assumptions

Above all, making accurate financial assumptions requires you to have a deep understanding of your business–like knowing its current financial health and strategic goals for the future.

Continue reading below as we walk you through the main steps to creating accurate financial assumptions for your business.

Keep in mind that each business will create its own process for making financial assumptions based on its own stage of development, niche, and other factors. However, the following steps are a good starting point to set you in the right direction.

1. Decide Which Financial Assumptions to Make

The first thing you’ll need to do is create a list of all the financial assumptions you’re going to make.

There are countless financial assumptions you can make for your business, though you will need to customize and tailor your assumptions to ensure it fits your business model, stakeholders’ interests, and strategic goals.

Here are some examples of financial assumptions that can aid the rest of your financial planning process.

Product/service-based:

- How many units you expect to sell every month

- The average price charged for each product or service

- Expected monthly sales growth rate

- How much it costs to produce each unit sold

- Expected growth in direct product costs each year

- The customer acquisition cost & LTV

Subscription/membership-based:

- The price charged for a membership

- Number of current members/subscribers

- Monthly/quarterly/yearly membership growth

- Projected customer churn each month/quarter/year

- Projected customer upgrades/downgrades each month/quarter/year

- Average monthly direct cost per membership

Cost-related:

- Monthly salaries for the team and the expected annual growth rate

- Monthly sales and marketing expenses and the expected annual growth rate

- Monthly rent and utilities expenses and the expected annual growth rate

- Monthly office supplies expense and expected annual growth rate

CapEx/tax/other:

- The amount needed for annual capital expenditures

- The amount of external funding required currently

- The expected corporate tax rate

- The current liabilities turnover rate

- The total amount of current assets, excluding cash

- Depreciation rate and amortization number of years

- When debt needs to be repaid

You can always make assumptions for additional items in future periods if they become more relevant to your business, or get rid of certain assumptions if they are not useful.

2. Choose Your Level of Granularity

One of the biggest challenges when making financial assumptions is to find the right balance between granularity and flexibility in a way that’s helpful to your financial planning efforts.

It’s easy to get caught up in the details given your level of understanding of the business as an internal member, though your financial assumptions need to be presented in a way that’s meaningful to all stakeholders and can easily be updated to reflect changes to the business or industry.

Making hyper-specific or complex assumptions can quickly make your financial planning efforts convoluted and inefficient as you scale up.

So, make a clear choice around how granular you’d like to make your assumptions, and stick with it–though try to veer on the more flexible side if possible to be more conducive to growth.

For instance, if you’re making assumptions about your sales growth early on and have a list of a dozen or so initial customers, you may be tempted to go through and estimate what they’ll each spend in coming periods based on what they’ve spent in the past.

However, this can quickly snowball out of control and become inefficient once you have hundreds or even thousands of customers, as you’ll no longer be able to make sales estimates for each customer.

Even if you believe this leads to the most accurate assumptions, you may want to prioritize values that are slightly less accurate though easier to calculate and update, like an assumption of overall sales growth instead.

3. Assess Current Performance

Now it’s time to analyze your current and historical financial performance for each of your assumptions.

For instance, if you want to make an assumption for monthly revenue growth, look at your performance year-to-date (YTD) to give you a baseline before you start making future assumptions. Even if you have limited data, be sure to utilize the info that you do have.

4. Gather Industry Data

Another important aspect to consider is the projection for the industry and your specific niche in the coming periods.

Your business does not operate in a vacuum, so you need to be aware of the macro trends that will impact your prospects, not just what you’re doing internally.

This can include a competitive analysis regarding your peers and what their market share is, all of which can give you a better understanding of where your business stands and what could impact your performance in the short term.

Here is a great resource where you can find additional information on how to perform an industry analysis.

5. Make Your Financial Assumptions

At this point, you can begin making your financial assumptions, keeping in mind the strategic goals of your business in addition to the aspects we’ve covered thus far.

For instance, say that your operating expenses have been fairly consistent over recent quarters, and you have no reason to believe this will be impacted by external factors. You can make the assumption that they’ll remain around the same level.

However, if you have an internal goal to cut down on operational costs to boost profitability, and you understand that supporting initiatives are underway, you can reasonably adjust your assumptions accordingly.

In Finmark from BILL, you can easily model these assumptions. You can create unlimited scenarios and simply change the assumptions in your forecast.

Financial Assumptions by Financial Statement

Another way to look at making your financial assumptions is to go through each financial statement to see how the assumptions all tie together.

Income Statement

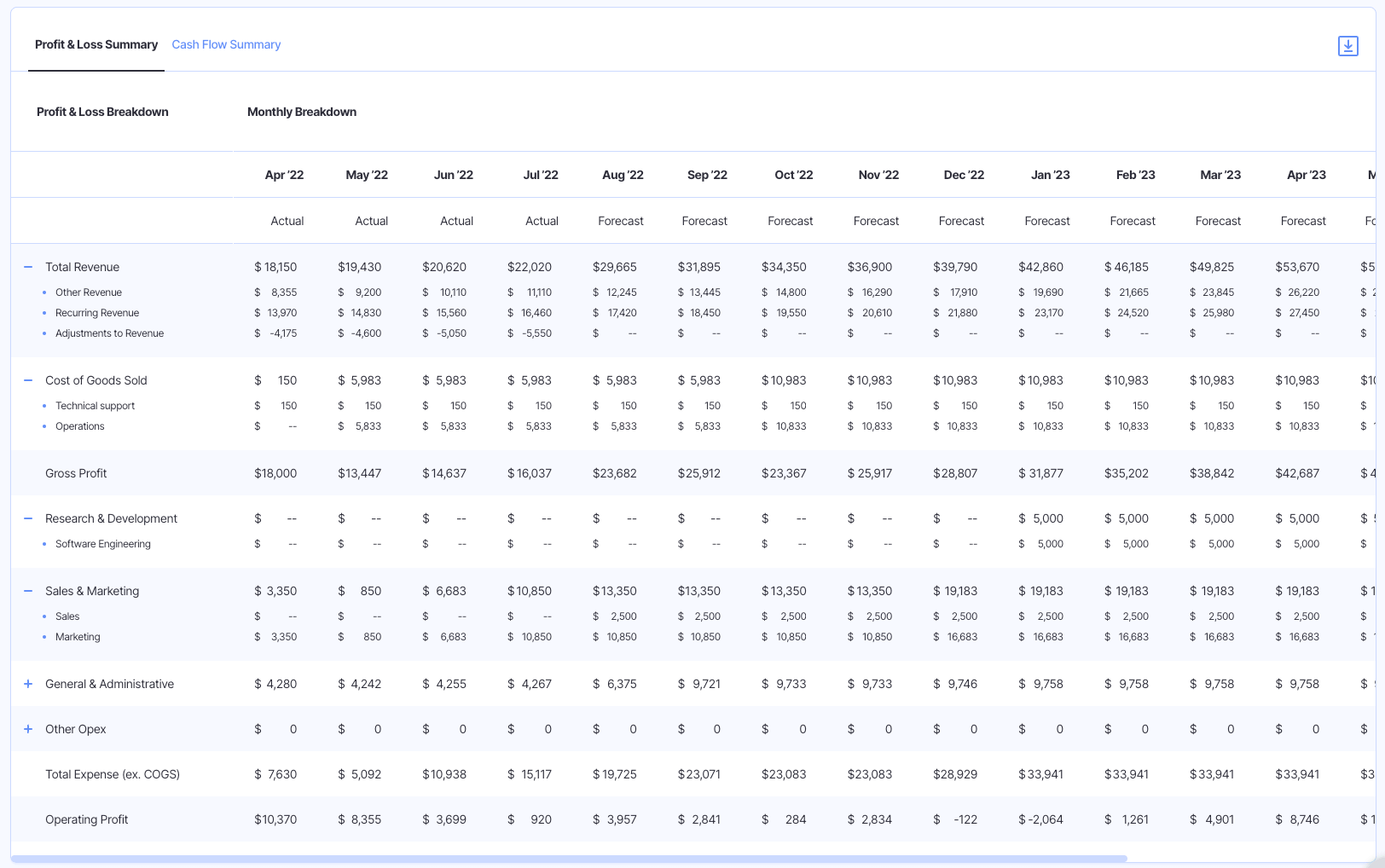

Financial assumptions for the income statement (a.k.a. profit and loss statement) include revenue or sales, cost of goods sold, operating expenses, and other items that affect this statement and the company’s overall profit, or net income.

Balance Sheet

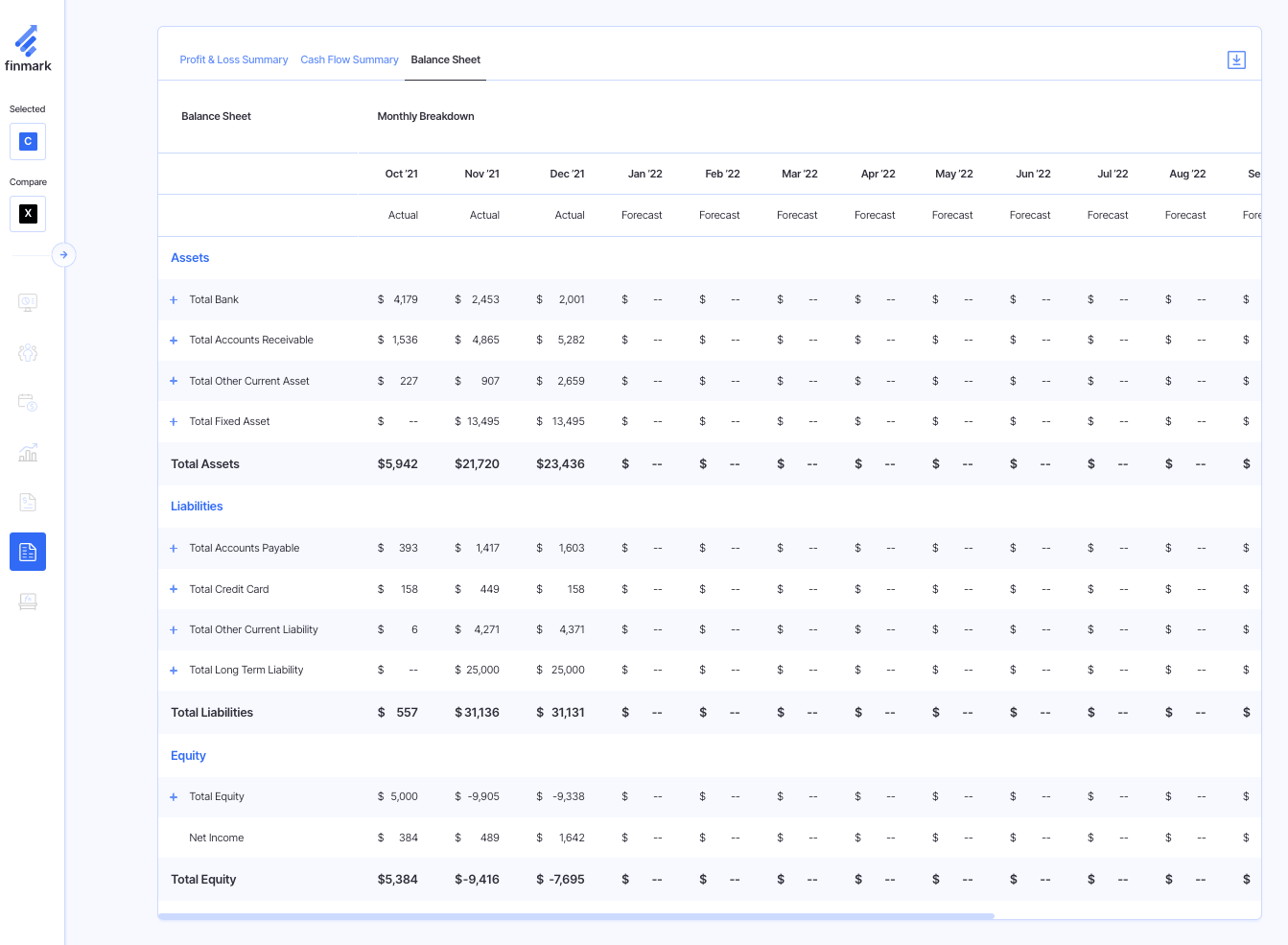

Assumptions for the balance sheet will relate to the assets and liabilities of the company, owner’s equity, and other pertinent factors to this statement.

The net income provided by the income statement ties into the balance sheet through the retained earnings line item, so you can see how assumptions made about the income statement can impact the balance sheet as well.

Cash Flow Statement

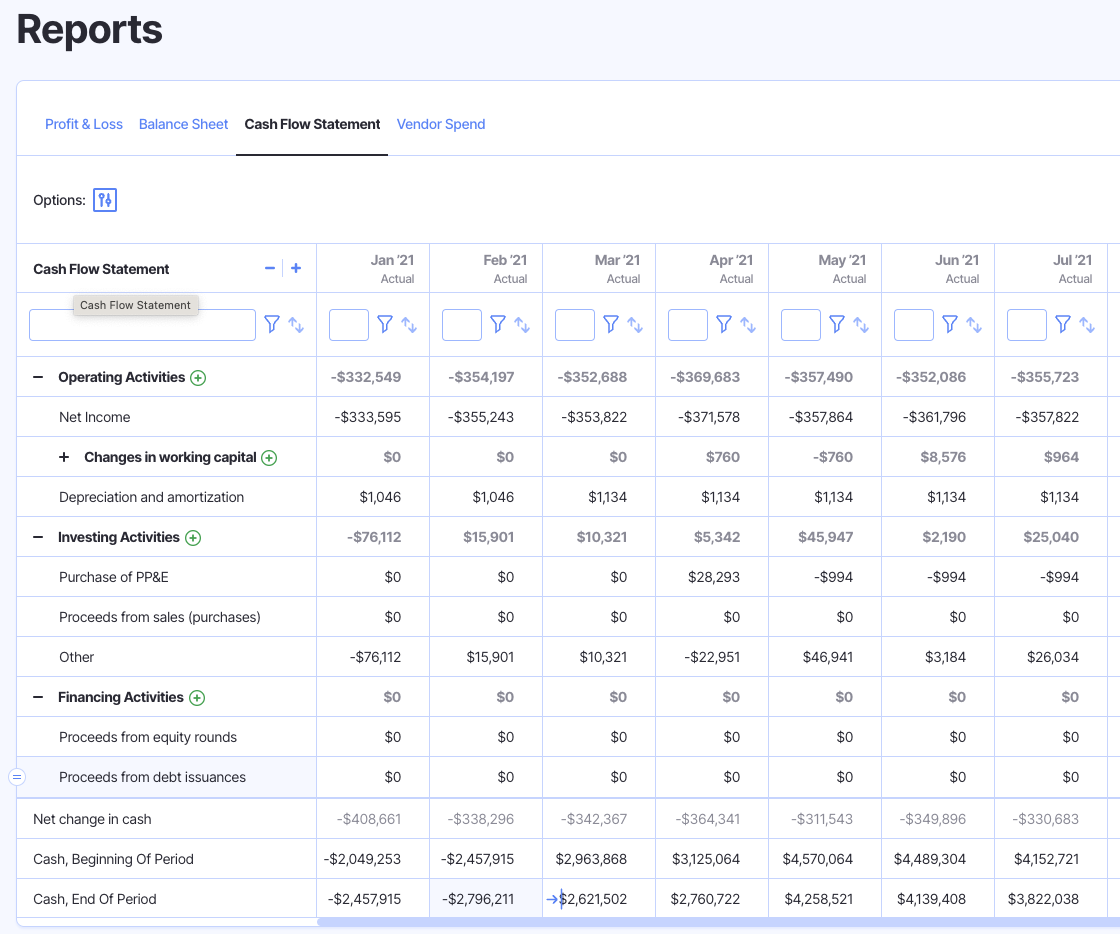

A business can make financial assumptions about cash flow, though they will not impact the other financial statements until the outflows or inflows actually occur.

However, the net income provided by the income statement is the starting point for building out the operating cash flow section.

A common assumption to make about cash flow is the annual cumulative cash flow that the business expects to generate for the year. This can help show how you’ll take advantage of cash inflows, and your ability to generate free cash flow.

Additional Tips on Making Financial Assumptions

With everything we’ve covered so far, you’ll be better prepared to create accurate financial assumptions for your business. But here are some additional tips to help you master this aspect of financial planning.

Measure Assumptions Against Actual Performance

One of the first keys to making better financial assumptions is to measure your actual performance against the assumptions you made for the period.

This will show you how accurate your assumptions were, which can help you make better assumptions for the future.

For instance, say you assumed your business would spend $4,000 a month on marketing expenses, but you ended up spending $9,000. You’ll want to assess why you were so off and dial in your assumptions for future budgets based on your findings.

Be Realistic

This tip may seem obvious, though it’s worth noting. While you can be optimistic about your expectations for the business, you don’t want to make lofty assumptions that you can’t back up with good reasoning.

In doing so, you’ll likely do more harm than good, and can even lose stakeholders’ trust when your actual results are far off from your assumptions.

Let’s say you’ve consistently seen 4% monthly sales growth for the past six months. It’s reasonable to assume something similar for the coming period, all things being equal. But, assuming that your sales growth will shoot up to 11% with nothing to back it up is not a wise move, even if you think it will make you look better to investors and stakeholders in the short term.

Stay Consistent

One mistake you can make with your financial assumptions is to not keep them consistent across all areas of your financial plan.

There are a lot of moving parts involved with forecasting and planning, so it’s not hard to imagine how this could happen. However, ensuring that you have consistent assumptions across your model will make them more reliable and accurate.

Plus, consistency in your assumptions can keep you from looking unprofessional and untrustworthy to stakeholders.

Final Thoughts on Making Financial Assumptions

Above all, it’s important to remember that the financial assumptions you make for your business are a working model that’s flexible and updatable.

As your business continues to grow and develop, you’ll be able to refine your financial assumptions and make them more accurate once you have more historical data to work from.

When working with an intuitive financial planning platform like Finmark, financial planning for your business can be a breeze. With our platform, you can build custom and data-driven forecasts, combining multiple data points to build a holistic model.

Try Finmark for free to see how we can transform your financial planning experience.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.