Rolling Budget 101: A Beginner’s Guide

One of the hardest parts about building a business is making enough educated guesses about your market, potential customers, and more.

More often than not, you have to plan for several factors seemingly out of your control. The thought of planning out the next 12-18 months may seem impossible.

How are you supposed to set a budget for an entire year?

Your runway and financial model are a good place to start, but that’s where dynamic budgets, like a rolling budget, really come in handy.

With a rolling budget, you’re constantly adding to your budget period.

So instead of static budget models that put you at zero at the beginning of the year, a rolling budget always looks out to the future so you’re never starting from scratch.

If you’re curious about what a rolling budget is and how it works, read on. Here’s everything you need to know about the rolling budget model.

What Is a Rolling Budget?

With a rolling budget—also known as a continuous budget—you add a new budget period at the end of the most recent period.

As a result, your budget always looks 12 months out (or however long of a horizon you set).

With this approach, you never have to start building a budget from the ground up.

So for example, if you just wrapped up Q1, then your budget would extend to Q1 of next year, based on assumptions you made from Q1 of this year (sales, revenue, campaign performance, and more).

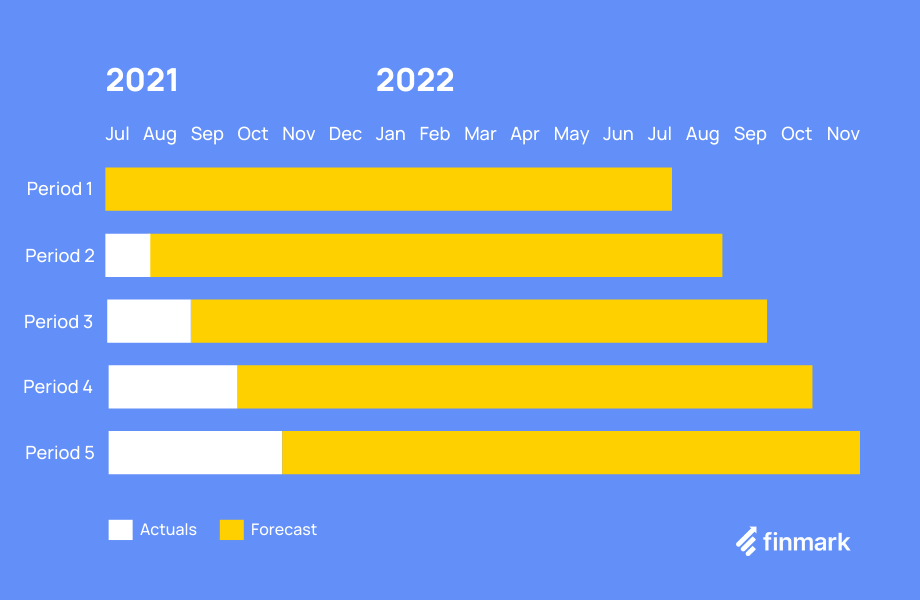

How does a rolling budget work?

The benefit of a rolling budget is that it takes into account your most recent actuals to forecast your future budget.

Here’s a graphic to illustrate how a rolling budget works.

The end result is a budget that’s more accurate since it’s based on recent actuals.

The flexibility of this budget model allows you to plan in increments versus plan for the year all at once. It also leverages real-time data to make decisions for both now and in the future, taking into account market conditions, performance, and more.

For example, if someone created a budget in January 2020, it was likely thrown out the window by the time March rolled around. A rolling budget and forecast allow you to be far more agile than a static budget.

When Is a Rolling Budget Useful?

Dynamic budgeting models like rolling budgets are a great option for early-stage startups.

Instead of being tied to a budget model that may not be realistic based on factors outside of your control, a rolling budget allows you to control the knobs and levers so you’re constantly making decisions based on your own data and performance.

Budgets and cash flow play a major role in decision-making at a startup. A rolling budget virtually ensures that you’ll never spend more than what you have in the bank.

On the flip side, rolling budgets also mean you can better account for unexpected expenses, or say, a global pandemic. This type of forward-looking approach means you have a better handle on overall company goals and projections for the foreseeable future.

If you’re going to use this model, the one thing you’ll need is patience. Rolling budgets take up far more time than a traditional budget model as you’re constantly updating your budget, instead of a “set it and forget it” type model.

That’s where tools like Finmark come in. Our financial modeling software automates a lot of the tedious parts of maintaining a rolling budget. Feel free to try it out for yourself today!

What Are the Pros and Cons of Rolling Budgets?

Rolling budgets sound like a no-brainer, right?

Here at Finmark, we’re big fans of rolling budgets, as it means you’ll be constantly looking at financial projections and figures, ensuring that both your budget and your financial models are in a good place. (No one wants an old, outdated financial model!)

But just in case you’re on the fence, check out the list of pros and cons below to make the decision for yourself.

Rolling Budget Pros:

- Your budget is based on recent data rather than just speculation.

- It gives you more flexibility and control over your budget.

- Since you’re regularly reviewing the data, you’ll pay more attention to your numbers and understand why you’re over or under budget.

- It makes investor meetings far easier, as you’re more familiar with the data.

Rolling Budget Cons:

- It requires more attention since you’re updating the budget more frequently. However, if you use a tool like Finmark, this is less of an issue.

Get Rolling With Finmark

Flexibility is king in the constantly-changing startup world.

Rolling budgets are just one way to find success. Having a sound financial model is another.

Finmark is financial modeling made easy. We take the stress and complexity out of building a financial model, so you can focus on what you do best – building your business.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.