Revenue vs. Profit: What’s The Difference?

Revenue and profit are two of the most important numbers on an income statement. Together they help tell the story of how much money your business makes.

However, sometimes the two terms are used interchangeably or incorrectly. While the two are similar, revenue and profit are not the same and it’s crucial to understand the difference.

Whether you want to understand how much money your business makes or you’re pitching investors, confusing revenue and profit could paint an entirely different picture of your company’s finances.

Not to worry though. We’re going to break down everything you need to know about revenue and profit including what they are, why both are important, and how they work together.

What is Revenue?

Revenue is the money you earn from selling your products or services.

You calculate revenue by multiplying the price of your product by the number of units sold.

For instance, if you sell widgets for $50/each and you sell 1,000 of them, you’ve generated $50,000 in revenue ($50×1,000).

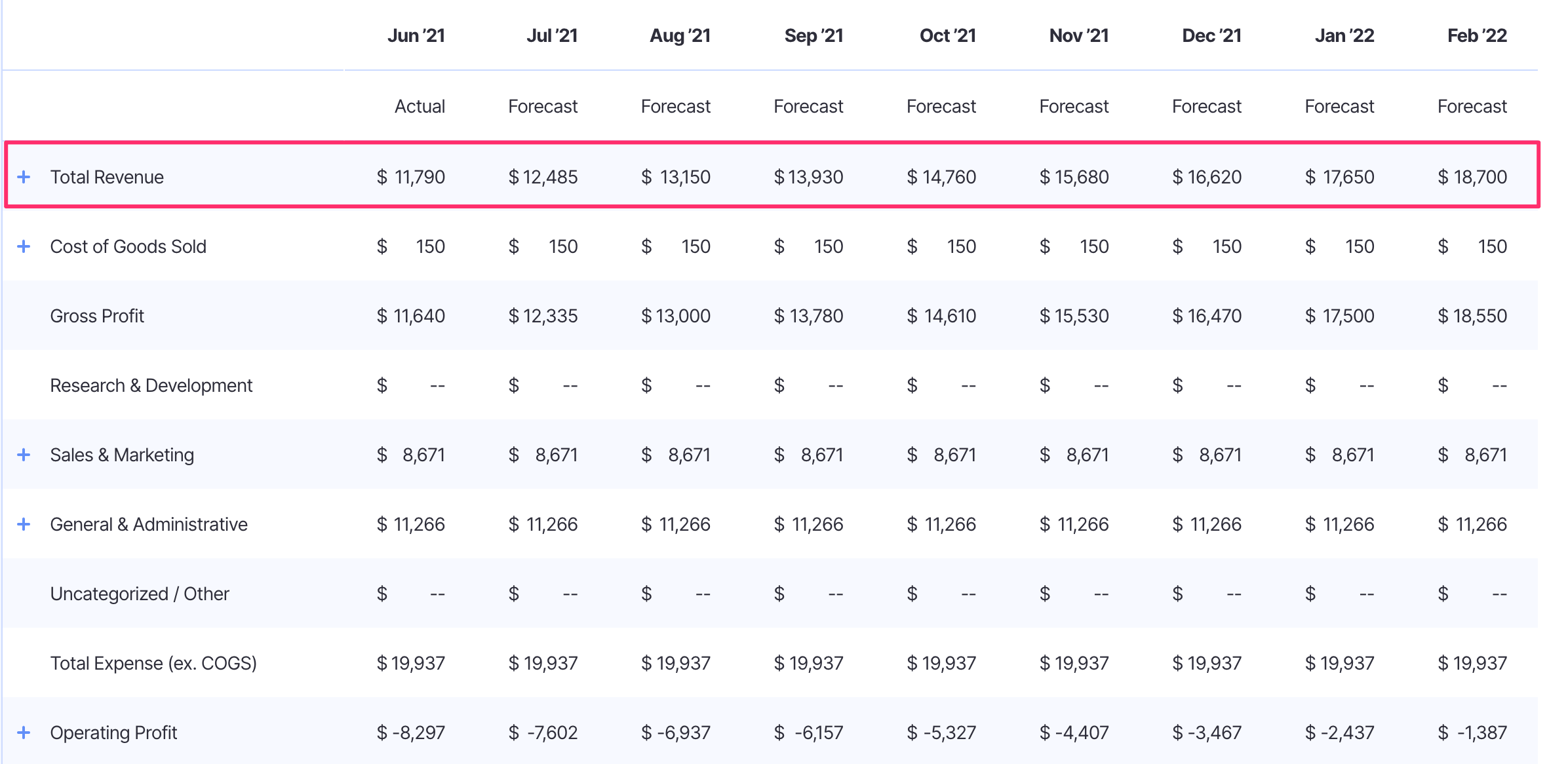

Revenue is referred to as the top line because it shows up at the top of your income statement.

The more you sell, the more revenue you generate. However, generating more revenue doesn’t necessarily mean your business is doing well. That’s where profit comes into play.

What is Profit?

Profit is the amount of income left after deducting expenses from your revenue.

To calculate profit, subtract your expenses from revenue.

If you generate $10,000 in revenue, but you had $5,000 in expenses, your profit would be $5,000.

Typically, when you hear people talk about profit, they’re referring to net profit.

Net profit is the profit left after you deduct all of your expenses from revenue. This is also considered your bottom line because it appears at the bottom of your income statement.

However, there are two other types of profit as well:

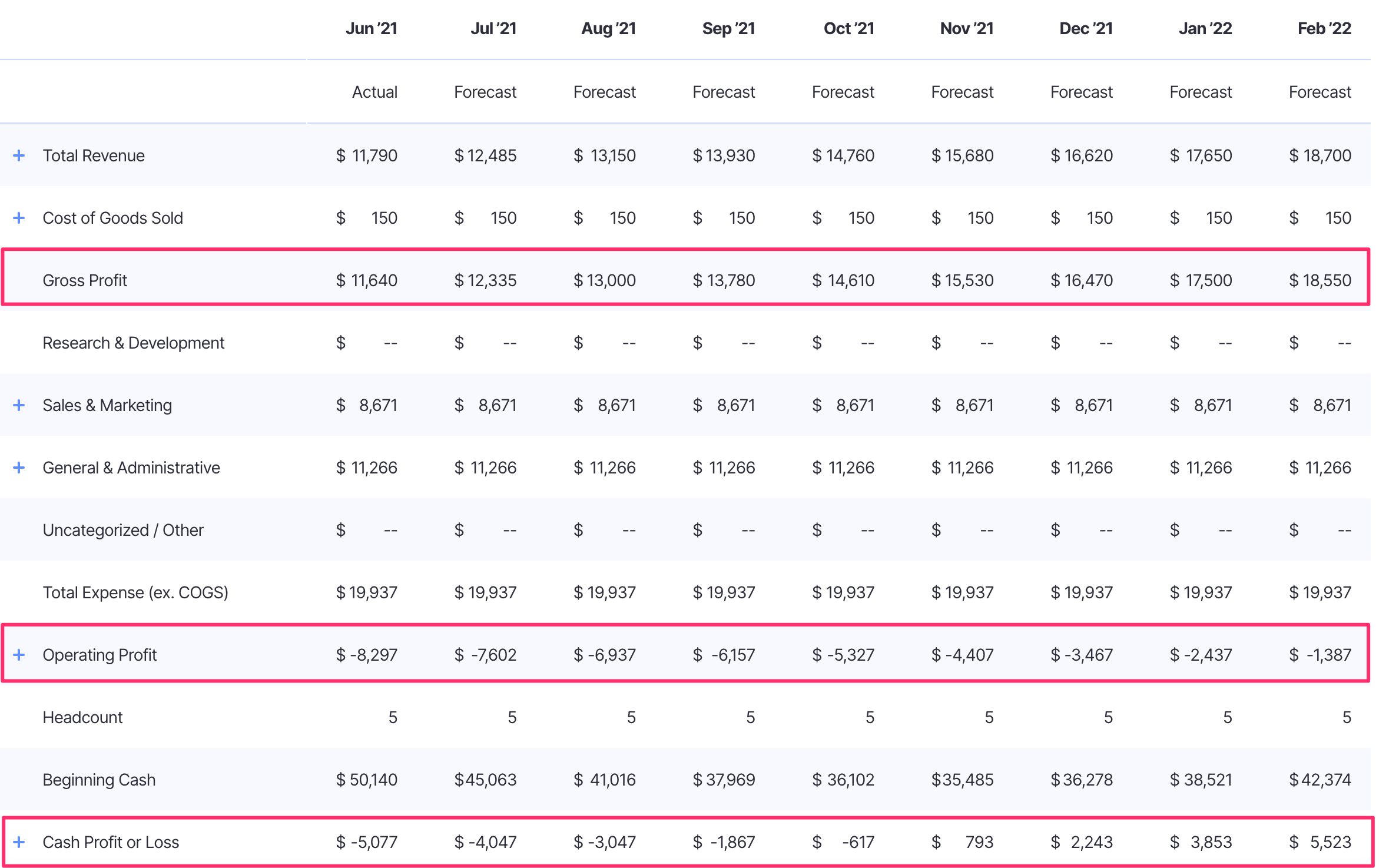

- Gross profit: Your income after deducting the cost of goods sold (COGS). COGS include all the expenses involved with producing your product or service like manufacturing costs, inventory, or hosting costs (for software companies).

- Operating profit: Your income after deducting operating expenses. Operating expenses include things like payroll, marketing expenses, software, office costs, and other expenses involved in operating and growing your company.

Separating gross, operating, and net profit is helpful because it allows you to spot your biggest opportunities to grow profit.

If you have high gross profit margins but low operating profit margins, that means you’re producing your product for a good price, but you might be spending too much on marketing, salaries, and other operating expenses.

If your gross and operating profit margins are low, take a look at everything from top to bottom because it’s hard to sustain growth long term if you’re consistently taking a loss.

What is The Difference Between Revenue and Profit?

Let’s go back to our $50 widget example. You generated $50,000 in revenue from selling your widgets. This is amazing;however, you need to account for your expenses so that you can see how much money you actually made.

Your expenses are:

- $10,000 for cost of goods sold

- $10,000 for marketing

- $5,000 for part-time employees

- $2,000 for rent

Your total expenses are $27,000. As a result, while you generated $50,000 in revenue, your net profit is only $23,000.

In short, revenue is how much money your business generates and profit is the portion of your revenue that you get to keep or reinvest.

How Revenue Affects Profit

The higher your revenue, the more potential that you have for profit.

For instance, a company that generates $100K can have a profit of $100K at the most. However, that’s unrealistic because it assumes you have no expenses.

On the other hand, a company that generates $500,000 in revenue has the potential to create even more profit depending on what their expenses are.

Also, companies with higher revenue have more money to spend on growth. When you’re generating $500K in revenue, you can afford to hire more employees, spend more on marketing, and other expenses to help you grow than a company that’s generating $50K in revenue.

Why Revenue & Profit Are Both Important

Depending on your business goals, the relationship between revenue and profit is extremely important.

For instance, many early stage startups with funding operate with the understanding that they won’t generate a profit for quite some time. This is because their goal is to get their business off the ground and start generating revenue to prove that people want what you’re selling. As a result, they might operate at a loss for months or even years.

If your end goal is to exit by being acquired years down the line, generating a profit early on may not be as important so long as you have money in the bank to continue operating.

On the other hand, some companies have a goal to become profitable as soon as possible. For instance, indie founders or bootstrapped startups might aim to generate higher profit margins quickly if the business is their primary source of income.

Revenue and profit are also important when you’re reporting your company’s numbers (for a sale, to investors, or just measuring growth internally). Say you’re looking at two companies:

- Company A generates $500K in monthly revenue with $700K in monthly expenses

- Company B generates $150K in monthly revenue with $50K in expenses

Company A generates more revenue, but Company B is profitable. However, this doesn’t mean that Company B is “better” than Company A. If company A can figure out a way to lower its expenses, they have the potential to generate greater profit than Company B.

Generally speaking, companies with higher profit margins tend to be more favorable if you’re looking to sell your company. High revenue with a net loss (meaning your expenses are more than your revenue) can be a red flag because it’s a sign the company is expensive to operate and may have a rough path to profitability.

What to Do When You’re Generating Revenue But Not Profit

If your company isn’t profitable, here are a couple of options to turn things around.

Increase Your Margins

Start by focusing on your gross profit. If you can lower your COGS or make more money per sale, you’ll open the door for higher profits.

For example, if you sell your widgets for $50 and your current COGS is $40, you have a gross profit of $10 per widget you sell. Let’s take a look at what happens if you decrease your COGS.

| Scenario | Sale Price | COGS | Gross Profit Per Widget |

| Original | $50 | $40 | $10 |

| Lower COGS | $50 | $30 | $20 |

If you sell 1,000 widgets per month, lowering your COGS by just $10 would double your gross profit:

| Scenario | Revenue | COGS | Gross Profit |

| Original | $50,000 | $40,000 | $10,000 |

| Lower COGS | $50,000 | $30,000 | $20,000 |

If you can’t lower your COGS, consider increasing your price. If you increase the price of your widgets from $50 to $60, with the same $40 COGS, here’s the difference in your gross profit per widget.

| Scenario | Sale Price | COGS | Gross Profit Per Widget |

| Original | $50 | $40 | $10 |

| Higher sale price | $60 | $40 | $20 |

Let’s see what this looks like in total gross profit assuming you sell 1,000 widgets.

| Scenario | Revenue | COGS | Gross Profit |

| Original | $50,000 | $40,000 | $10,000 |

| Higher Sale Price | $60,000 | $40,000 | $20,000 |

As you can see, both scenarios result in the same increase in gross profit. This is a good way to increase your profit by optimizing your gross margins.

Note: If you want to experiment and plan different scenarios like this, Finmark makes it easy. Learn more here.

Operate More Efficiently

Another way to increase your profit is to optimize your operating profit. Remember, your operating profit is the income left after you deduct operating expenses like payroll, rent, and marketing.

If you can lower some of these expenses, it can have a big impact on your bottom line. Here are a few examples:

- Payroll: Payroll is typically the largest expense for early stage startups. The way you decrease this expense depends largely on your company’s position. Layoffs and pay cuts should be a last resort if possible. Some other options are doing a hiring freeze, or reducing certain benefits.

- Marketing: Look for opportunities to either cut underperforming marketing channels or lower your customer acquisition cost for the better performing channels.

- Office expenses: Since the pandemic, more companies have gone remote which has eliminated certain expenses like rent and amenities like free lunch. Take a look at our article on how to extend your runway for more tips.

A good way to start the process of reducing operational expenses is to create a budget. Shameless plug—Finmark makes the process easier.

What Should You Do With Your Profit?

Generating profit is great, but taking that money out of your company could stunt your growth. If your company is profitable, consider reinvesting the money back into your business to fuel growth.

You can use your profit to hire new employees, spend more on marketing, or invest back into your employees. For instance, Convertkit has a profit sharing perk where they distribute their profits to employees. While there might not be a measurable ROI, profit sharing gives your team an added incentive to help grow the company.

Think of ways you can reinvest your profit to grow your revenue. That will in turn give you an opportunity to generate even more profit down the line.

The Bottom Line on Revenue vs. Profit

The more you understand about what your revenue and profit are, the easier it’ll be to plan a path for growth. If you’re at a point where your revenue is growing but you still aren’t generating a profit, take a look at your expenses and see what changes you can make.

If you’re generating a profit, look for ways to re-invest the money to fuel growth or do more of what’s working.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.