Cash Flow vs Net Income: What’s the Difference?

It’s generally a good sign if your business is generating a profit. But does a high net income always mean a positive net cash flow, and vice versa?

Understanding the differences between cash flow and net income may not be too obvious from the outside.

But, diving deeper into these two metrics reveals the different insights each metric can provide for your business, and how you’re able to make smart financial decisions for the future when analyzing them together.

Net Income Definition and Example

Net income (or net profit) is a profitability measure that tells you how much money your business made during the period after accounting for your expenses.

You may also hear net income referred to as the bottom-line profit, as it’s presented at the bottom line of the income statement (a.k.a profit and loss statement).

Net income is a key figure for investors and stakeholders to monitor and evaluate the business with. In general, the higher the net income, the better the profit and the more efficient your business is operating.

You can calculate net income using the following basic formula:

Net Income = Revenue – Expenses

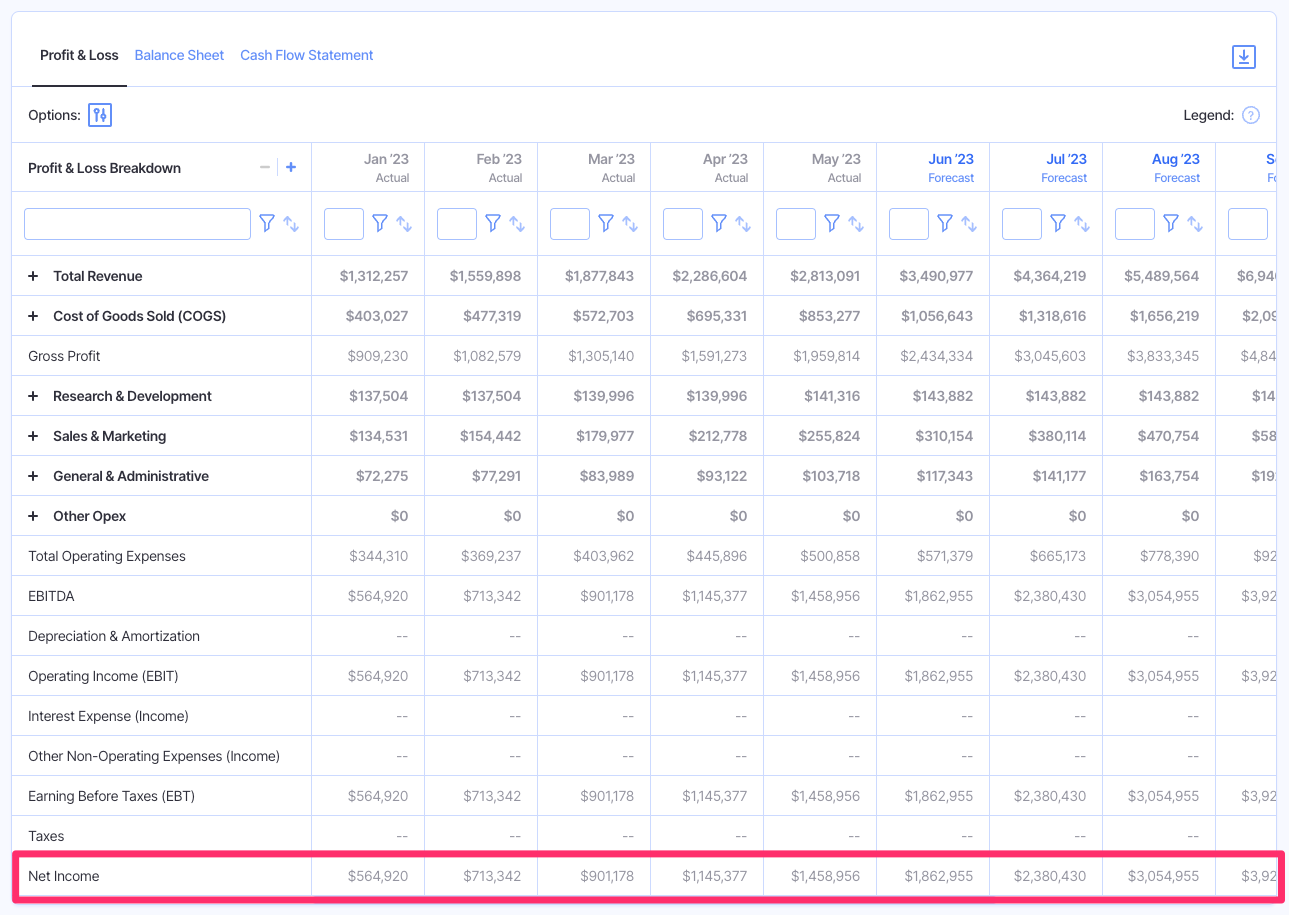

When using Finmark from BILL, you can quickly assess your net income in real-time using your current financial data.

Keep in mind that this formula can include non-cash expenses like amortization and depreciation, which are excluded in the cash flow statement, as you’ll see below.

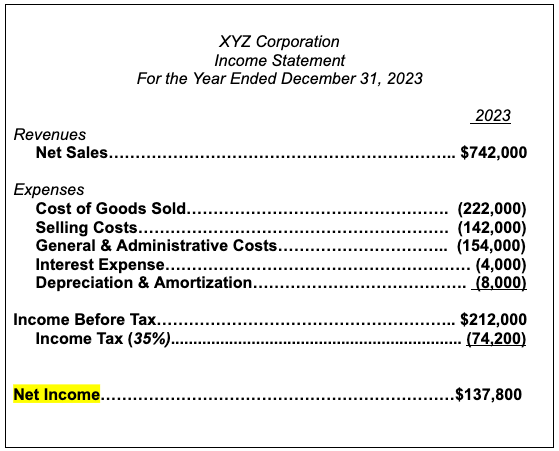

Here is an example of how you’ll find the company’s net income as reported on the income statement.

From this example, we can see that the company started with revenues of $742,000, but after accounting for all operating and other expenses, in addition to their tax liability, they’re left with a net income of $137,000 for the year.

Cash Flow Definition and Example

Cash flow is a measure of the cash that your business generates (or uses, in the case of negative cash flow) during a given period.

This metric can tell you whether your business ended with more or less cash on hand than it started with.

As it relates to the discussion of cash flow vs net income, we’re talking specifically about cash flow from operating activities, not investing or financing activities.

Cash inflows from operating activities tend to be cash receipts from the sale of goods. Cash outflows include any use of cash during the period like payments to suppliers, employees, utilities, and more.

Netting the cash inflows and outflows will provide you with your net cash from operating activities.

This figure can tell you how well your business’s core operations are funding your short-term obligations like supplier payments and other current liabilities.

Here is a general formula for calculating operating cash flow using the indirect method:

As you can see, to calculate your cash flow with this method, you’ll need to start with your net income figure first.

However, the operating cash flow formula makes adjustments to non-cash items that you’ll find on the income statement, which could artificially inflate or weigh on the financial position of your company.

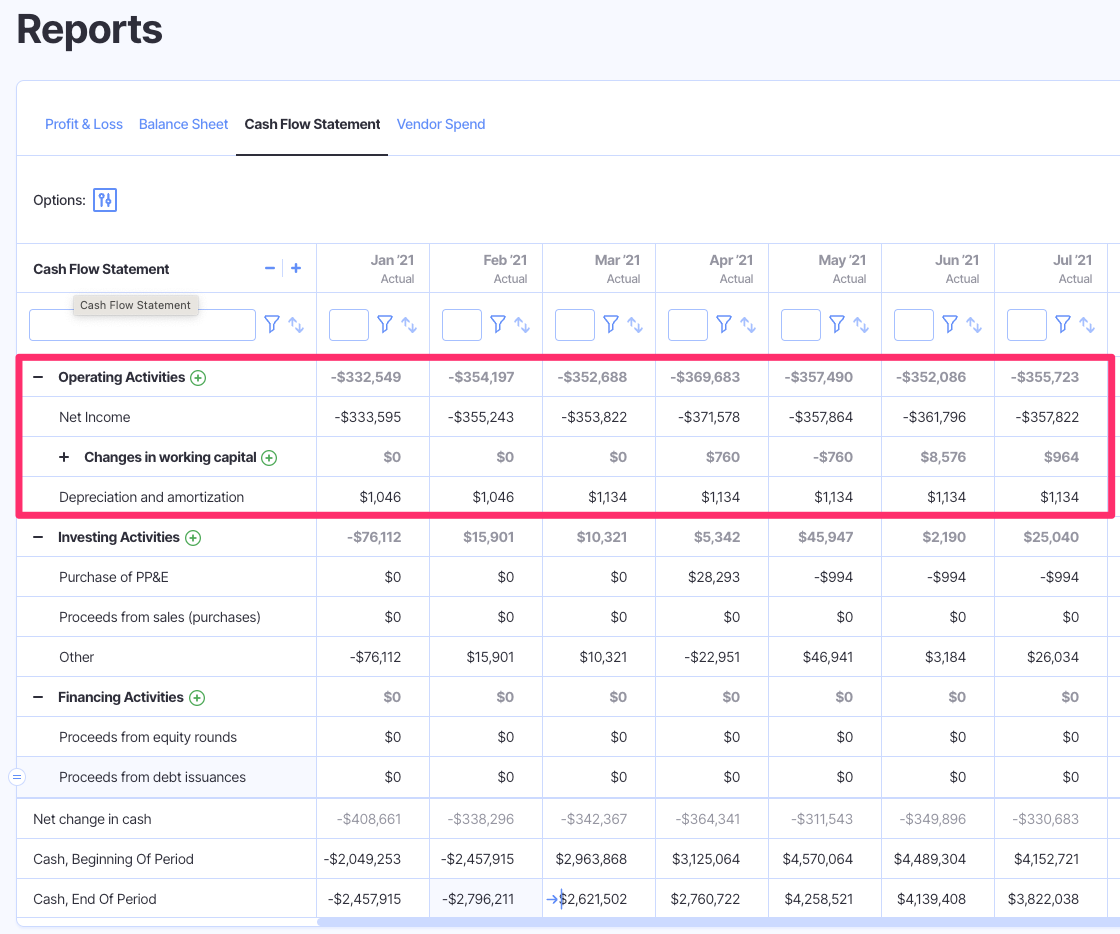

Just like with your net income, you can use Finmark to easily track your operating cash flow throughout the period and see how it compares to your net income and other key figures from a custom dashboard.

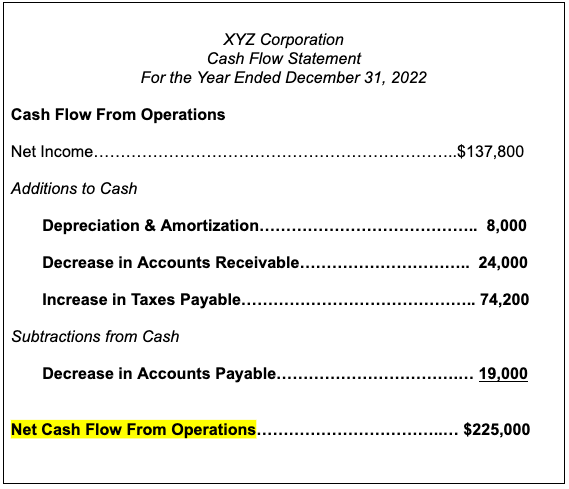

Using the same figures as above, here is what the sample company’s operating cash flow statement could look like for the same period.

You’ll notice this calculation also takes into account changes from other items like accounts receivable and accounts payable from the balance sheet. Such changes would impact the company’s cash balance, though may not be fully reflected in the income statement.

So, this calculation is meant to show the actual amount of cash that was paid or received over a period of time–not just what was incurred and reported on the income statement.

The company adds back:

- The depreciation and amortization expense

- The amount of accounts receivable that was collected over the period

- The amount of taxes that were incurred, but not yet paid

Then, the amount of accounts payable that the company paid off over the period is subtracted from the calculation, resulting in a net cash flow from operations of $225,000–quite a bit higher than the reported net income for the period.

The two metrics are highly related, though they can provide two unique sets of insights that are important for the financial health of your business.

Which Is More Important–Cash Flow or Net Income?

Though the two metrics are uniquely important for you to monitor, one is not necessarily better–nor are they a perfect replacement for one another.

Again, the calculated net income from the income statement is the starting point for calculating your net cash flows. So, the two formulas are very intertwined and correlated.

But, each figure has limitations that make them more meaningful to business leaders when analyzed together.

Potential Limitations of Net Income and Cash Flow

The main differences–and thus the possible limitation–between these two figures is mainly due to how non-cash items are treated on each of the statements. This difference leads you to two separate figures related to your operational efficiency and profitability.

In many cases, net cash flows are seen as the more objective measure of a business’s financial state. But, net income is the headline profitability number that investors and business leaders often focus on.

Management can have some influence on how revenue and expenses are recognized and how depreciation and amortization are treated from an accounting standpoint. This could impact the net income figure and misrepresent the actual financial position of the business.

As you can see from the above example, relying solely on the net income figure or the net cash flow from operations value would tell two very different stories about the business’s finances. In fact, the net cash flow was over 1.5x higher than the company’s reported net income for the same period.

In some instances, a company reports a positive net income, signifying profitability. But, they generated a negative net cash flow for the period, technically paying out more cash than they received.

Thus, you must monitor and assess both metrics simultaneously to make better and more sustainable decisions about the future of your business.

How to Use Cash Flow and Net Income Analysis for Better Decision-Making

Both metrics are widely monitored by stakeholders, investors, and internal management to gain a better understanding of your financial health.

When analyzed together, both your cash flow and net income figures can paint a comprehensive picture of your overall financial health. In turn, you can take these insights to inform your financial decision-making in important tasks like budgeting, forecasting, and investing.

Namely, your net income represents the profitability of your business, while the cash flow will reveal how much cash you actually have on hand at a given time.

So, you can track your net income over time to see how your profitability is improving and see where you can optimize your costs for a higher net income while still driving revenue growth.

If profitability is faltering, you may want to look deeper into your expenses to see where you can find cost savings to retain your profitability going forward.

On the other hand, analyzing your net cash flow will show how effectively you’re collecting cash payments, your ability to meet your short-term liabilities, and how you’re managing your working capital to stay self-sufficient.

When cash flows are negative, you can further investigate your changes in working capital accounts and see if you can collect customer payments quicker, negotiate for better payment terms with suppliers, and more.

Using Finmark to Track Net Income and Cash Flow

You can use both the net income and net cash flow figures to tell you how your company is doing financially.

But, relying on just one of these figures can be misleading about the actual financial health of the business.

Given the differences in accounting practices, the timing of payments, and other tedious details, your net income and cash flow from operating activities are almost always going to be different.

So, by optimizing for both metrics rather than focusing on one over the other, you can gain a more comprehensive view of your finances and retain a strong position for your business by all measures.

With Finmark, you can easily track both of these metrics in real-time right from your dashboard. With easy customization features, countless out-of-the-box metrics to utilize, and a user-friendly interface, Finmark helps you stay on top of your finances and plan ahead for the future.

Start your 30-day free trial with Finmark today to level up your financial planning.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.