Budgeting vs. Forecasting: What’s the Difference? (And Why Both Are Important for Startups)

Do you know the difference between budgeting and forecasting?

A budget and a forecast are two of the most important tools for startups when it comes to financial modeling. They work together to help you steer your startup in the right direction, but they shouldn’t be confused for each other.

Both serve their own unique purpose and are crucial to building the financial model for your business.

Let’s explore the difference between both and why they are each important in their own right!

What is the Difference Between Budgeting and Forecasting?

Both budgeting and forecasting are typically used together, but they don’t have the same purpose.

What is a Budget?

Budgeting will help you plan out the metrics—whether that’s revenue, expenses, cash flow, cash runway, or more—your company expects to hit throughout the year. Your budget essentially represents your startup’s target numbers.

With a budget, you can create an action plan for your startup, including:

- Estimated revenue and expenses

- Your goal for cash flow

- How much money you need

Your budget will help you determine how feasible your plan is while also providing you with a baseline for your performance throughout the year.

Budgets are short-term and typically outline your plan for less than a year. You can also adjust your budget as the year passes depending on your startup’s needs.

You should regularly reevaluate your budget and make adjustments based on your startup’s current financial position.

What is a Financial Forecast?

Forecasting, on the other hand, is a projection of numbers your startup will hit based on your current performance. It shows you where your business is headed as it currently stands.

Your financial forecast will let you know whether or not you’re currently on track to hit your budget numbers. You’ll be able to anticipate what numbers you’ll hit so that your startup can take the appropriate actions to change the course if necessary.

Because forecasts are typically based on historical data, they can inform budget allocations and help you develop the right strategies to hit your target numbers.

You can use forecasting for the short-term and for the long-term. While you can have a forecast for the entire year or even several years, companies typically have a revenue forecast for the quarter or six months out. The challenge with long-term forecasts is that so much can change in your business over the course of a year, that 2, 3, 4+ year forecasts tend to become less accurate over time.

The shorter timeframe of a forecast will help your business act fast and make decisions quickly rather than wait an entire year to see whether or not you’re headed back in the right direction.

In short, budgeting is a business plan that establishes target numbers, and forecasting is an estimation of those numbers based on historical data, not a plan.

Your budget represents what you want to achieve, whereas a forecast estimates what you’re on track to achieve.

What Comes First – Budget or Forecast?

Because budgeting and forecasting don’t work on the same timeframes, there isn’t technically one that comes before the other.

For instance, you may have a financial forecast for the next two years ready, but your budget will never exceed a year. So in that sense, you could say your forecast comes first if you have a long-term forecast.

On the other hand, since the forecast is used to see whether or not you are on track to hit your budget numbers, you could say the budget comes first.

Why Are Budgeting and Forecasting Both Important?

When running a business at any stage, startup or otherwise, you need to use both budgeting and forecasting as tools for your financial model.

Without a budget, you’re running your startup without any concrete goals to hit. And without goals, it’s difficult to take the right strategic action at the right time, since you won’t know where you’re headed.

When you have a clear budget, you can always refer back to it when you make an important strategic decision while asking: Is this action going to take us closer to our budgeting numbers?

Forecasting works in tandem with budgeting. Without a financial forecast, you won’t be able to accurately judge whether or not you’re currently on track to reach the numbers established by your budget.

So even if you have a plan, you won’t know when you’re veering off-road until it’s too late unless you use financial forecasting.

With a financial forecast built on real historical data, you’ll be able to measure whether or not you’re on track, but also what you can expect your future growth to look like based on your current performance.

When you use budgeting and forecasting together, you know where you want to go and whether or not you’re going to make it to your destination if current trends continue.

How to Compare Your Budget and Forecast

In order to evaluate whether or not you’re on track to hit your target numbers established in your budget, you’ll periodically need to compare your budget and your forecast to see if they are trending in the same direction.

If you check your forecast against your budget and notice that you’re currently off track from your budget numbers, you’ll be able to course correct before it’s too late. This data will help you decide what action to take next.

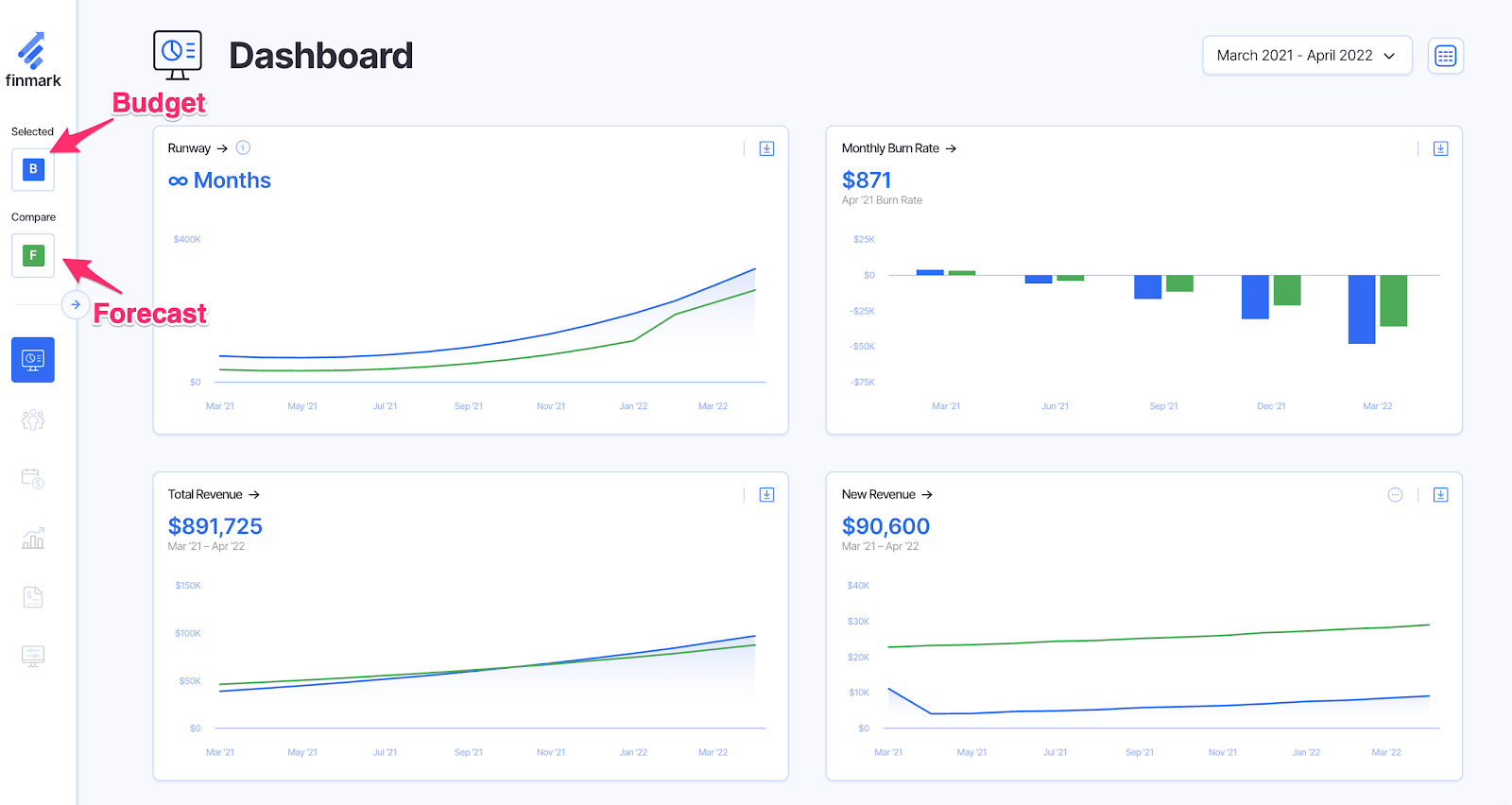

You can easily compare your budget and forecast in Finmark. Below is an example dashboard representing both the budget and the forecast:

This dashboard displays four data points:

- Cash runway

- Monthly burn rate

- Total revenue

- New revenue

The blue lines on the graphs represent the budget, whereas the green line represents the forecast.

For the total revenue, you can see that the forecast is trending in the same direction as the budget, but the numbers aren’t quite as high.

The forecast seems to indicate a growing disparity between the budget and the forecast, which could indicate that this startup needs to take action to course correct.

However, new revenue is forecasted to be much higher than what was budgeted. That’s a red flag that something is off somewhere. Either their budget was way off, or something significantly impacted the amount of new revenue they’re bringing in.

This is exactly why it pays to regularly check and compare your budget and forecast numbers.

What Causes Your Budget and Forecast to Be Different?

In the example shown above, the budget and forecast differ somewhat, but they aren’t drastically different.

So what could cause your budget and forecast to look completely different from one another when you compare them? Here are a few common reasons.

Customer Acquisition

Let’s say you created your budget with the assumption that you would acquire a specific number of new customers each month.

Now, for some reason—lack of quality leads, an issue with your conversion rates, or something else—your customer acquisition isn’t as high as you’d expected, and you aren’t hitting your monthly goals.

In this case, your forecast, which is based on your actual numbers (that aren’t hitting the target currently), will show revenue numbers that are lower than your budgeted numbers.

In order to get back on track, you would need to take strategic action to get more new customers.

The opposite can happen as well—if you’re surpassing your customer acquisition goals, your forecasted revenue will be higher than your budget.

Churn

Even if your current customer acquisition is on target, you can still see a difference between your budget and your forecast if your customer churn is different.

If your churn is higher than expected and you’re losing more customers each month, your customer base won’t grow as quickly as you planned, which will lower your forecast numbers.

When this happens, you’ll need to find a way to reduce churn if you want to hit your targets. Maybe this means you need to create a better onboarding process to help your customers get value from your product, or maybe you need to invest in better customer service.

Of course, if your churn is lower than expected, you’ll be above target and won’t need to make any changes in that regard if you want to meet your budgeting numbers.

Revenue

In some cases, your runway will look different than what was expected. Here’s an example of why this could happen.

Let’s say you set your budget for the year and estimate that you’ll add $50k in revenue per month. This is based on your estimated customer acquisition. With this much new revenue each month, your startup will have a runway of 10 months.

However, when you’re four months into the year, you realize you’re only averaging $20k-$30k in new revenue each month. While your budget will give you a runway of 10 months, your forecast will show you a shorter runway.

If your runway forecast keeps getting shorter as each month passes, you’ll know you need to take action right away, otherwise, you could end up one bad month away from crashing and burning!

Start Implementing Budgeting and Forecasting to Stay On Top of Your Startup

Budgeting and forecasting serve different functions, but don’t consider them mutually exclusive! When you have the right tools necessary to make an effective financial forecast, you can create and monitor a realistic budget for your startup.

If doing all of this sounds challenging, don’t worry! With Finmark, you can eliminate the need for spreadsheets when budgeting and forecasting and easily compare both data points to take the pulse of your startup as needed. Click here to build your forecast for free!

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.