Driver-Based Budgeting: How to Level Up Your Financial Plan

Building, refining, and executing budgets is a key part of any successful CFO’s role.

The problem is, many of us aren’t designing budgets that are rooted in facts, data, or any tangible explanation of how the money we plan to spend will impact revenue and profitability.

Driver-based budgeting is the answer to this issue.

It essentially takes stock of the key levers you can pull to create more revenue (which we call drivers), and then analyzes how spending needs to be distributed to influence those drivers and meet revenue goals.

This article is your guide to driver-based budgeting. We’ll start by clearly defining what driver-based budgeting is, and why it’s so important for strategically-minded finance professionals to master.

Then, we’ll get into the details with a six-step approach to applying driver-based budgeting in your own organization.

What Is Driver-Based Budgeting?

Driver-based budgeting is an approach to company budgeting that focuses heavily on identifying the key revenue drivers your business can use to generate more revenue.

Let’s break that down a bit by defining all of those key terms:

- Budgets – An estimate of incoming revenue and outgoing expenditure over a given period of time, with department and sometimes category allocations.

- Revenue – The money your company receives for the goods or services it provides.

- Drivers – The things that lead to revenue growth (if you do more of X, revenue grows by Y).

These drivers most regularly fall into one of two categories: sales and marketing.

For example, investment in Google Ads might be an important marketing revenue driver, and sales team headcount growth may be one example on the sales side.

What’s The Point Of Driver-Based Budgeting?

This one’s pretty plain and simple:

Driver-based budgeting helps you design more accurate and effective budgets.

Rather than guessing how much to spend to reach your revenue goals, you can confidently say, “If we do X, we’ll earn Y,” and then develop a spending plan that allows you to invest in the things that move the needle (your revenue drivers).

How Does Driver-Based Budgeting Work?

Driver-based budgeting involves using those key revenue drivers (the levers you can pull to create more revenue) to make more informed estimates of income and expenses (your budget).

To illustrate with an example, let’s say you’re designing the company budget for the next quarter. Company revenue for last quarter came in at $1.2m. Next quarter, you need to reach $1.6m

To understand where money needs to be spent most effectively (so you can hit that goal), and to accurately estimate earnings, you look to your revenue drivers. Let’s say one of your drivers is podcast advertising.

You know (because you’ve built and tested your financial model) that for every $100 you spend on podcast ads, you can grow revenue by $400.

So, to grow revenue by $400k (which is the requirement), you’ll need to spend $100k on podcast ads.

Now, you can use this revenue driver information to inform both sides of the budget: expenditure (the cost of podcast ads), and income forecasts (the revenue you expect to see from that investment).

How To Apply Driver-Based Budgeting: 6 Steps

Ready to start using a driver-based approach to create a more accurate and effective budget? Apply these six steps.

1. Revisit Your Most Important Business Goals

A good driver-based budget is built entirely around the core organizational and financial goals your company has for the period for which you’re developing the budget.

Revenue growth is probably going to be an important goal for most businesses, but this isn’t specific enough to be helpful in a budgeting scenario.

Translate these objectives into cold hard numbers, with dollar amounts and dates attached (S.M.A.R.T goals). For example:

- Goal 1: Grow expansion revenue by $1.3m in the upcoming financial year

- Goal 2: Grow revenue from new accounts by $2.3m in the upcoming financial year

These are examples of specific goals we can work toward with a driver-based budget. We know how much we need to grow revenue, so now we just need to figure out how.

2. Gain Clarity on Revenue Drivers

Driver-based budgeting is based on revenue drivers, so this is a crucial next step.

To identify your organization’s key revenue drivers, analyze historical financial performance.

Look for growth trends in your data to spot times when revenue has grown significantly. Then, analyze what your company’s sales and marketing activity looked like just before that, and how it might have changed.

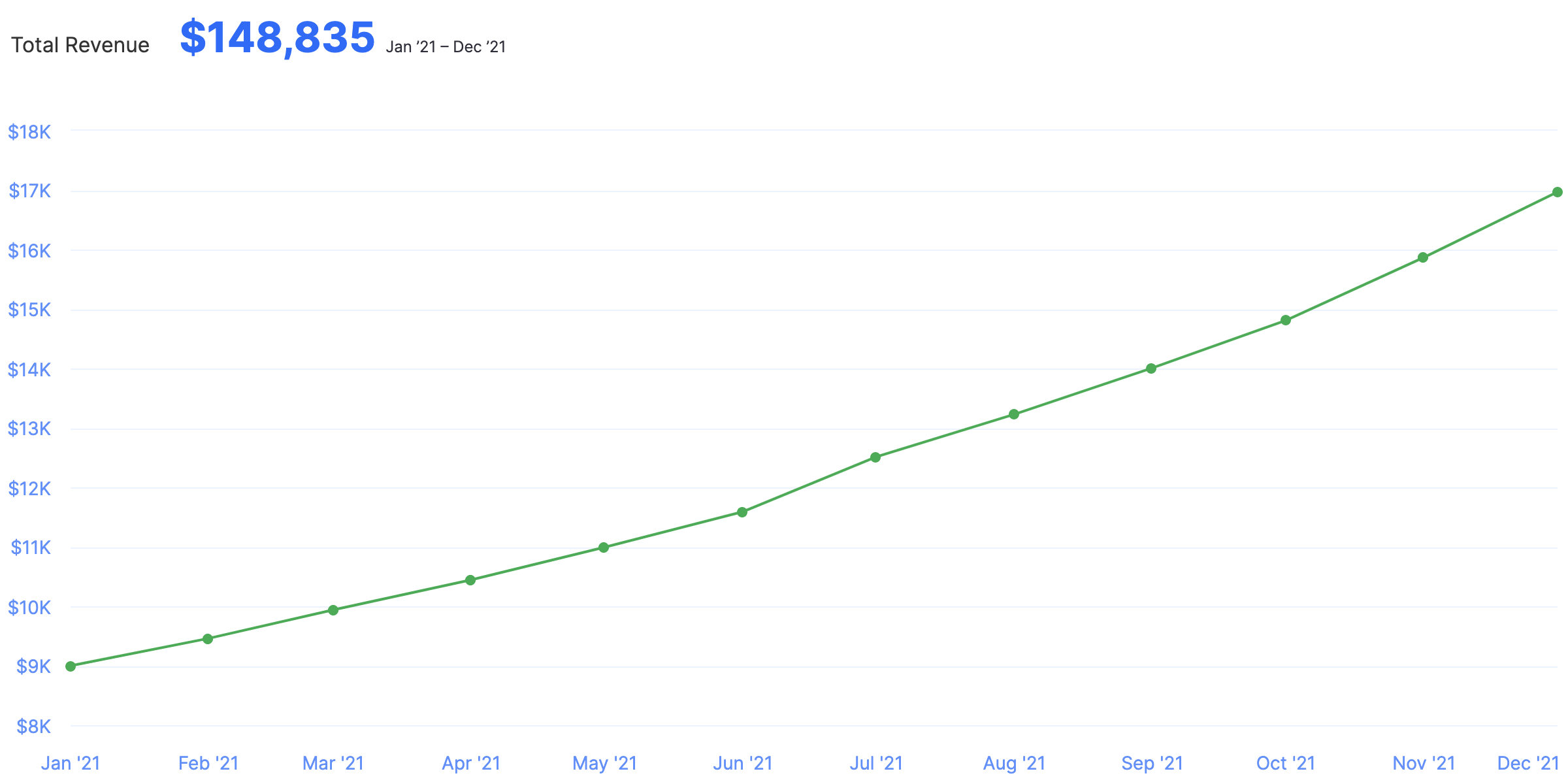

Say, for example, in the Q3 of last year, you noticed a $100k increase in revenue from new accounts.

Digging deeper into your financial planning platform, you see that in Q2 you increased your spending on Facebook ads by $20k.

This is a sign that Facebook ads are an important marketing-based revenue driver for your company.

It’s helpful to add more weight to this identification by looking at other times when Facebook ad spending has changed, and analyzing differences in revenue.

However, we’re going to put these assumptions to the test in the next step, so don’t stress too much if you don’t have a lot of historical data to go on.

3. Build and Test Driver Models

Building a budget off of assumptions is a recipe for disaster (or at least disappointment).

The whole point of driver-based budgeting is to avoid this pitfall. However, designing a budget based on models you haven’t put to the test isn’t really solving the problem.

So, take the chance here to build driver models and then run tests to establish their validity.

A driver model is basically an equation that says, “When we do X, Y happens.”

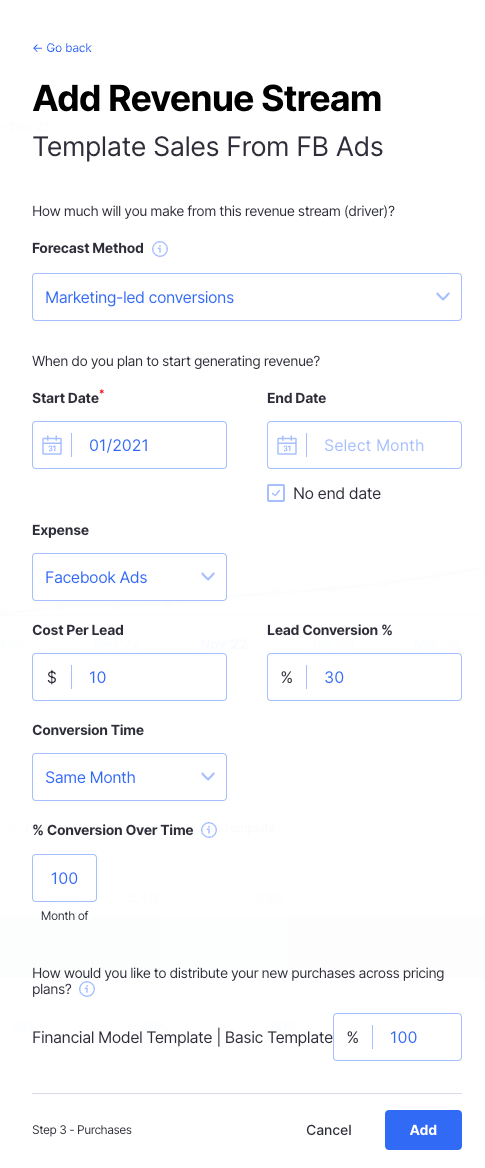

For example, say we sell financial modeling templates for $100 each. We use Facebook Ads to get leads that eventually convert to customers.

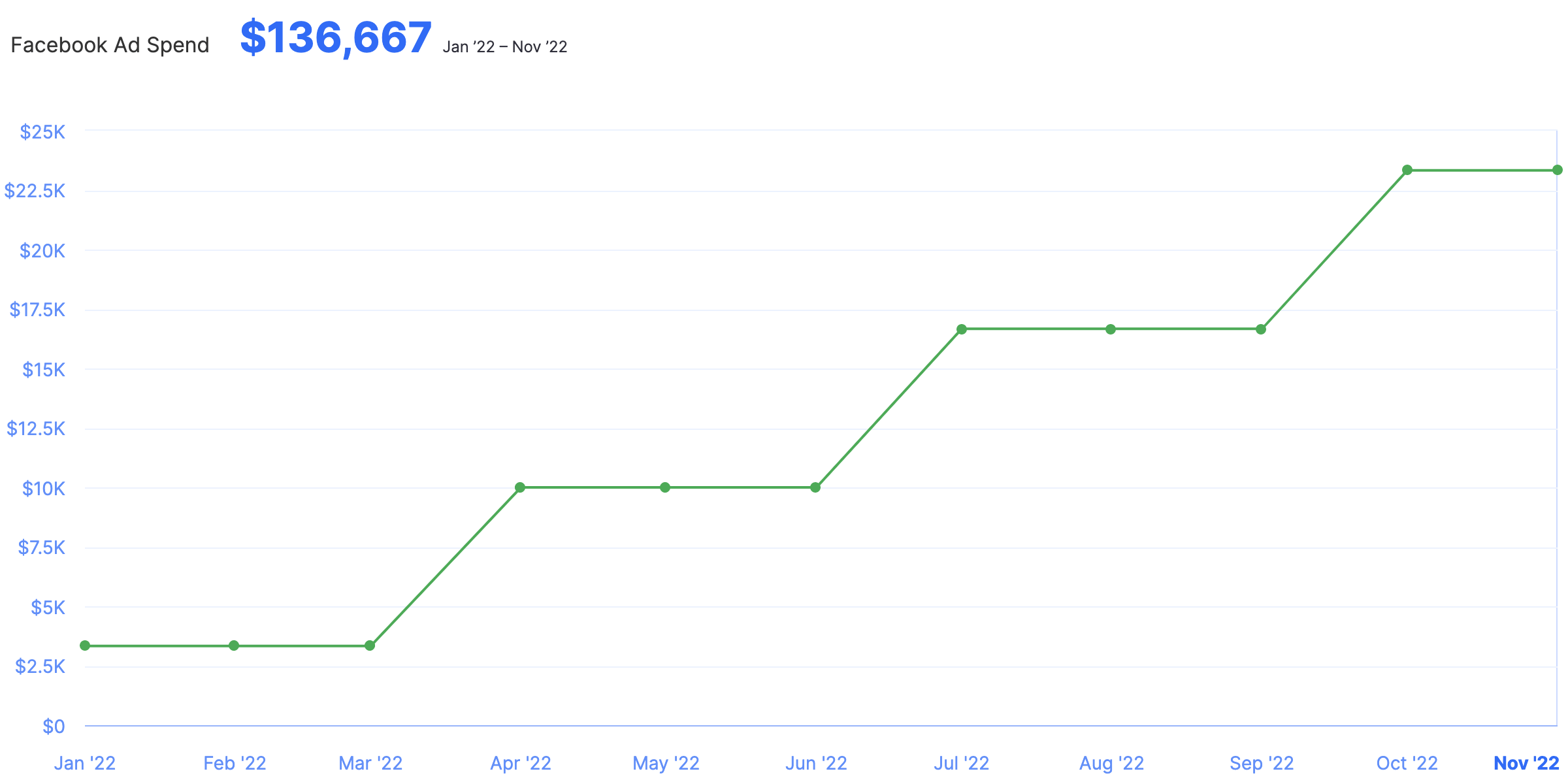

Based on historical performance, we know we invest $5,000 per month into Facebook ads with an average cost per lead (CPL) of $10, and 30% of our leads convert into paying customers.

We can plug that data into our financial model to forecast how much revenue we’ll drive based on different budgets.

However, keep in mind that just because we’ve converted 30% of our leads in the past, that doesn’t mean it’ll stay that way. So we need to put this to the test.

The experiment in this case will be pretty simple: invest $5,000 for a few months, and see if our conversion rate and CPL hold steady. If that’s what happens, you’ve validated the revenue driver model, and it is safe for use in our driver-based budget.

It’s important to recognize the possibility of diminishing returns here.

That is, there may be a ceiling to the amount of revenue you can drive from Facebook ads. The first $20k in ads might create $80k in revenue, but a $100k investment might only yield $150k due to diminishing returns.

Bear this possibility in mind as you move through the following stages (so, maybe make your revenue estimates a little more conservative if you’re investing an amount higher than what you’ve tested and validated).

4. Map Drivers to Goals and Analyze Scenarios

Now’s the part where we bring in the goals, and map those driver models over to them.

Let’s head back to our examples:

- Goal 1: Grow expansion revenue by $1.3m in the upcoming financial year

- Goal 2: Grow revenue from new accounts by $2.3m in the upcoming financial year

- Driver 1: Facebook Ads: $100k in spending drives $500k in revenue from new accounts

- Driver 2: Podcast Ads: $100k in ads creates $400k in revenue from new accounts

On the surface, Facebook Ads seem like the better deal for driving that $2.3m revenue growth goal.

However, because we’ve established that Facebook advertising does see some diminishing returns (we max out at about $1.5m in new revenue growth), we can run a bit of scenario analysis to understand the best mix between investments.

5. Determining Spending Based on Driver Needs

Here’s what our scenario analysis tells us the best approach is:

- Invest $300k in Facebook ads to drive $1.5m in revenue

- Invest $200k in Podcast ads to drive $800k in revenue

Now we can create the driver-based budget, where we invest an additional $500k in advertising to hit that $2.3m revenue growth goal.

Bear in mind, of course, that this is a simplified example. Your budget will probably involve many more revenue drivers, requiring a more in-depth scenario analysis and determination of your investment mix. The guiding principles remain the same, however.

6. Seek Feedback and Adjust as Required

Before you roll that driver-based budget out to the team, it’s always a good idea to seek feedback from those whom it concerns.

That is, have your department leaders take a look over your plan, and point out any potential flaws or pitfalls.

Say, for example, that one of your revenue drivers for the expansion revenue goal is increasing the headcount on your customer success team. As such, you’ve planned to add three new Customer Success Managers.

However, when you run the budget past your VP of Sales, you come to learn that you’ve underestimated the ramp time (the amount of time it takes a sales rep to start reaching their quote regularly) each new hire will require.

As a result, your plan won’t help you meet your revenue goal in time, and you actually need to add four new CSMs (so you can hit the revenue goal later in the year once they’re all ramped).

Use this kind of feedback to inform changes to your budget, then roll it out and action those new growth initiatives!

What Drives Your Budget?

Driver-based budgeting is an important and powerful approach to designing company budget, allocating spending, and creating a more strategic plan for reaching your business revenue and growth goals.

To maximize your effectiveness in this domain, you’ll need a powerful financial reporting and modeling tool. Try Finmark from BILL for free today and kickstart your driver-based budgeting process.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.