What Are The Best Financial Modeling Tools in 2023?

Trying to grow a successful business without a financial model is like driving across the country without a map—it’s going to be extremely difficult to reach your destination.

With your financial model, you can plan what route you’re going to take and course correct whenever you veer off track.

Before you head out on your journey, you need to choose the right navigation tool (your financial modeling tool) to guide you along the trip. And that’s what we’re going to help you with today.

In this article, we’ll walk you through:

- How financial modeling tools work

- The old-school financial modeling tool that way too many business owners still use

- A smarter alternative to old-school tools

- The best financial modeling tool on the market

What are Financial Modeling Tools?

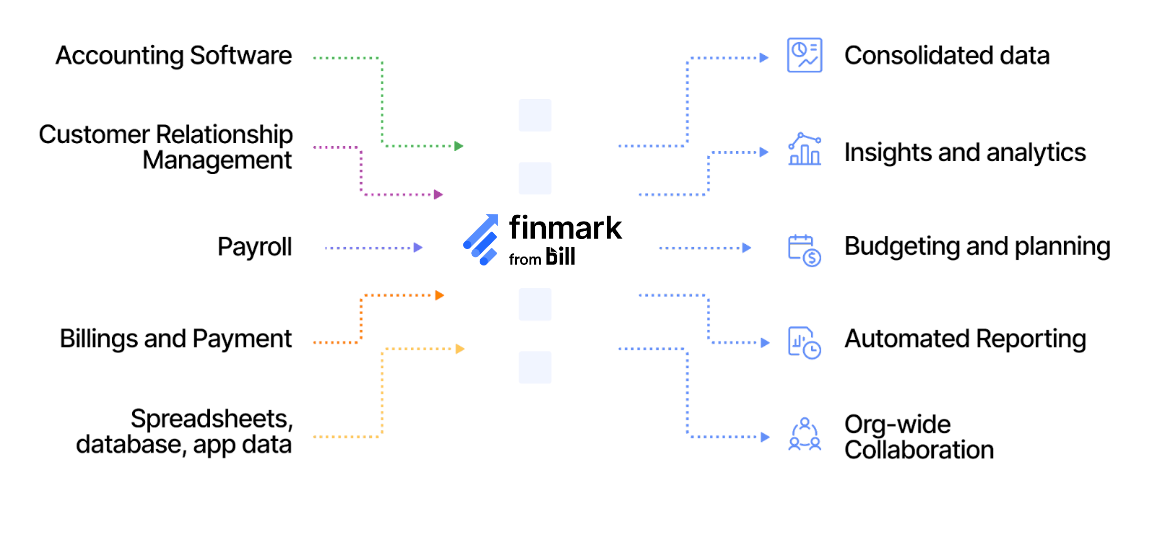

Building a financial model requires data about your revenue, expenses, and payroll.

All this data comes from separate sources. You might have revenue data stored in Stripe, expenses in Quickbooks, and use Gusto to manage payroll.

Think of your financial modeling tool as the “hub” where all these data sources get combined and speak to each other, allowing you to create a financial model for your business.

For example, look at a metric like burn rate. In order to calculate and forecast what your burn rate will be for the next 6-12 months, you need to know your revenue and expenses.

If that data is stored in two different tools, you need a place to combine them so you can calculate your burn rate. You would use your financial modeling tool to do that.

Speaking of calculating, the other reason financial modeling tools are important is that building a financial model involves a lot of math. From calculating metrics to forecasting what those metrics will look like years down the road, you need dozens of calculations to pull it all together.

Unless you plan to do all that math manually and know the right formulas off the top of your head, a financial modeling tool is going to save you hours of work.

Right now, there are two main types of financial modeling tools:

- Template-based tools built with Excel

- Dedicated financial modeling software

Which do you think is the most common?

Using Spreadsheets For Financial Modeling

Many businesses currently rely on spreadsheets as their financial modeling tool.

We wrote an entire article about how financial modeling templates are hurting your business, so our stance on Excel-built models is pretty clear.

But here’s how financial modeling spreadsheets work.

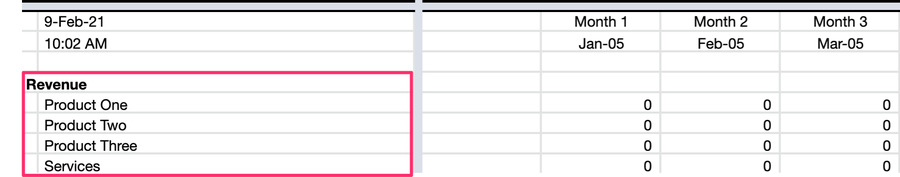

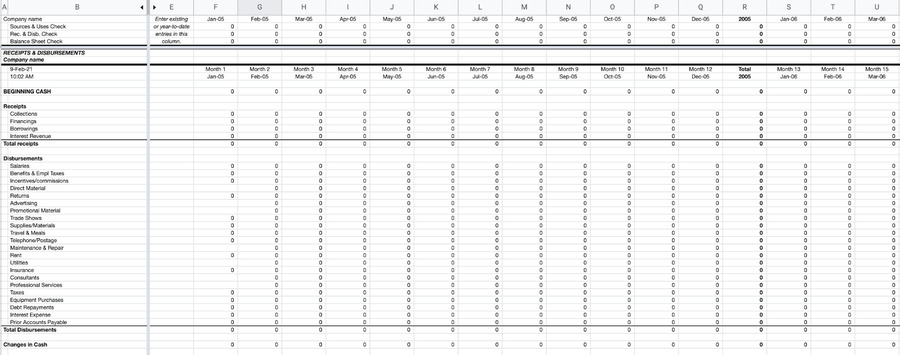

Generally, you’ll start with a template. That template will have several tabs and placeholders, like this.

To build your model, you’ll export data from your data sources (accounting, revenue, payroll, etc.), and manually input all of your historicals/actuals. It’s a very time-consuming and tedious process.

The one upside is the formulas and calculations should already be built into the template, so you won’t have to do as much math.

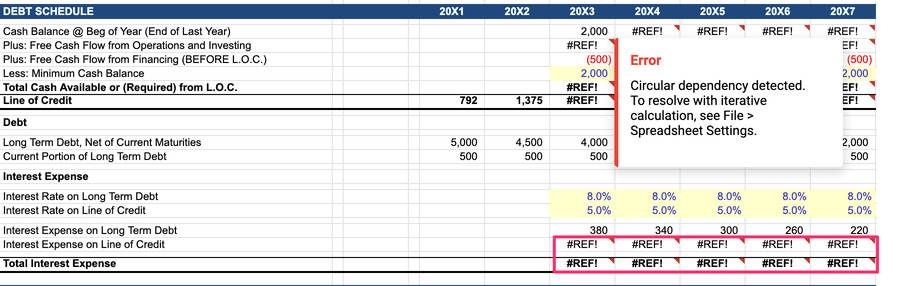

The downside is that since you’re working in a spreadsheet, some of those formulas can break, or not even be relevant to your business.

Spreadsheets were the best (or pretty much only) option for decades, particularly for small and midsize businesses (SMBs) because:

- Most founders are already used to working in spreadsheets

- Templates are generally free or very low-cost

- Dedicated financial modeling software has primarily been built for large enterprises in the past

However, things are changing. This brings me to my next point!

Why Financial Modeling Software is Better That Spreadsheets

Let’s go back to our analogy of driving across the country.

Using spreadsheets as financial modeling tools is the equivalent of printing out Mapquest directions to navigate your way to your destination.

You have your directions planned out for you, but if you go off the set path or need to make a detour, you’ll either need to figure out how to get back on track yourself or print new directions. And in some cases, you won’t even realize you went off track until it’s too late.

On the other end of the spectrum, we have GPS apps like Google Maps. You plug in your destination, and as you drive you can update your route in real-time.

If you take a wrong turn, the app re-routes you. If you want to figure out an alternate route to avoid traffic or tolls, you can adjust your settings. If your plans change along the way and you need to add new stops to your trip, you can do it in real-time.

In this analogy, dedicated financial modeling software is like a GPS app.

Here are a few quick reasons to go with a dedicated financial modeling tool over spreadsheets.

Built-In Automation

Many financial modeling tools have direct integrations with data sources you need to build your model.

With financial modeling software, you can connect data sources like Quickbooks, Gusto, or others, and automatically feed in your inputs like historical revenue and expenses.

You can easily update your model and plan and analyze different scenarios without doing a bunch of copying/pasting and creating new formulas.

All of the math and calculations happen on the backend, so you don’t have to stress over whether or not you’re using the right formulas or if inputting a number in one place “breaks” something somewhere else.

Not only does this save you time, but it helps reduce errors from manual data entry (we’ve all done it).

Single Source of Truth

If you feed your data from your accounting, payroll, and other sources directly into your financial modeling tool, it can become your single source of truth for financial reporting.

Easier Collaboration

Trying to collaborate on a financial model with spreadsheets can be a nightmare. Oftentimes the only person who truly understands how the model works is the person who built it.

Custom formulas that reference multiple cells, and multiple sheets without clear definitions create a steep learning curve for anyone outside of the finance team to understand how the model is built.

Then there’s the issue of sharing the spreadsheet with other parties. Since you can’t restrict access to certain parts of your spreadsheet for specific users, you end up making multiple versions of your model to share with different people. Or worse, you take screenshots and just send those.

With dedicated financial modeling tools, you generally have more control over who can access what data and collaboration can happen directly in the app as opposed to emails.

Easier to Navigate

While finance is a more analytical than “creative” field, that doesn’t mean your financial model shouldn’t look nice.

The UI of modern financial modeling software is much more user-friendly than financial modeling tools built in complex spreadsheets.

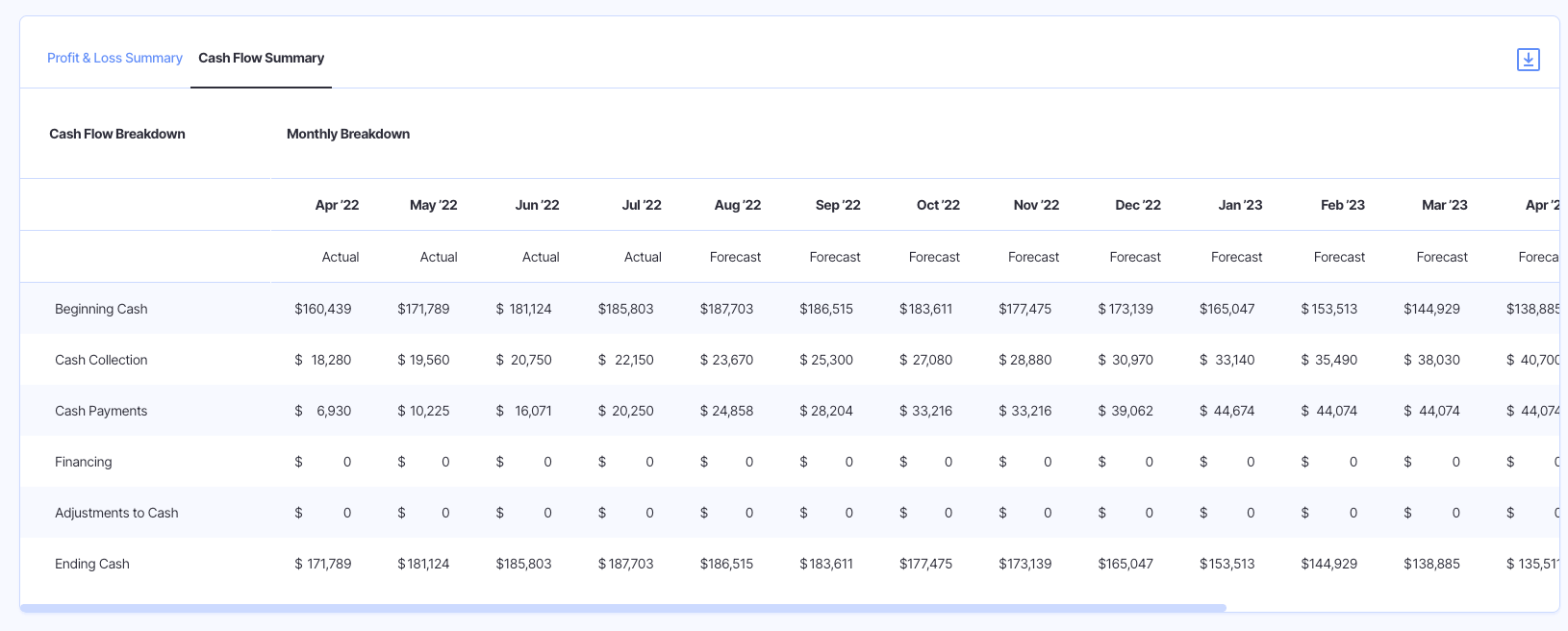

I mean, which one would you rather look at?

This.

Or this?

As I mentioned earlier, spreadsheets have been the go-to financial modeling tool for a long time.

But the same reason we stopped using paper maps and Mapquest print-outs is the same reason more businesses are starting to break away from using spreadsheets as financial modeling tools—something better came along.

However, there is one challenge that came along with the shift towards purpose-built financial modeling tools.

You have more financial modeling tools than ever to choose from, which can make it difficult to choose a tool that’ll fit your specific needs.

The Best Financial Modeling Software

Ok, we might be a little biased, but we’d be doing you a disservice if we didn’t recommend our own financial modeling tool.

Finmark is a financial modeling tool we built after experiencing the frustrations of using Excel-based models first-hand.

Our goal was to create financial modeling software that’s powerful enough for seasoned CFOs, analysts, and other finance pros to do their job easier (without spreadsheets), yet intuitive enough for small business owners to use and understand.

Whether you’re switching from a model you made in a spreadsheet or starting from scratch, we make it easier to build an accurate financial model that you can use to project growth, pitch investors, and share financial plans with your team.

I won’t dive deep into all of our features, but some of the key advantages to using Finmark over other financial modeling tools are:

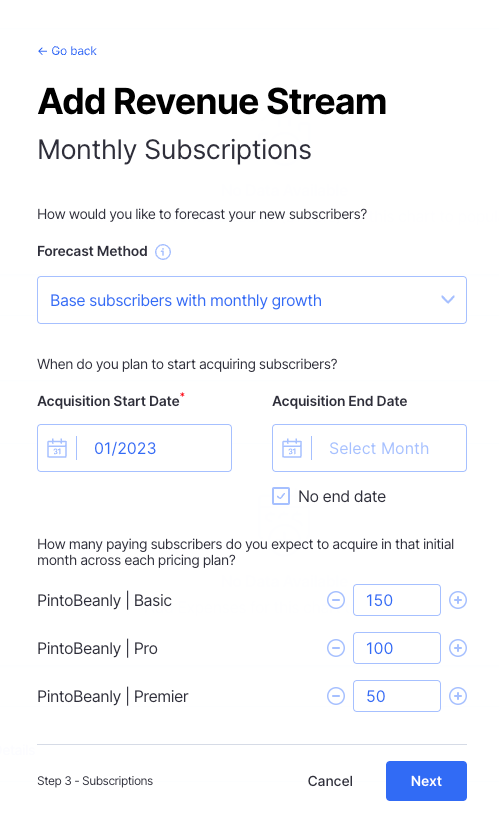

- Easy to use: Our intuitive UI makes it easy to get started. If you’re already familiar with the process of building and updating a model in spreadsheets, you’ll feel right at home in Finmark. If Finmark is your first financial modeling tool, getting setup is a breeze.

- Flexible: No two businesses are exactly alike, so their financial models shouldn’t be either. With Finmark, we don’t force you into a confined box. Whether you’re an early-stage SaaS company, agency, rental company or something else entirely, you can build a model that reflects your business.

- Collaboration: Financial models shouldn’t be built in isolation. Getting input from the executive team, department heads, investors, and other stakeholders allows you to account for different assumptions and get insights you might’ve otherwise missed. You can easily share and collaborate on your financial plans with a couple of clicks in Finmark.

- Reporting: Export financial statements (cash flow statement, P&L / income statement, and balance sheet), add graphs to presentations, and showcase all of your metrics with our customizable dashboards.

Again, I don’t want to hard-sell you on everything you can do with Finmark. But if you’re looking for a financial modeling tool, I highly suggest giving Finmark a try. You can start a free 30-day trial today (no credit-card required!).

Other Financial Modeling Tools

While we recommend our financial modeling platform for most businesses, here are some other options to consider as well:

- Finmark

- IBM Cognos

- Quantrix

- Oracle

- Prophix

- Anaplan

Again, Finmark is our top choice, and our users seem to agree.

Financial Modeling Tool FAQ

What is the Best Free Financial Modeling Tool?

It’s hard to eat Excel as a free financial modeling tool. Although it may not have the features of a dedicated financial modeling platform, it’s what many financial professionals start with.

On top of that, there are templates and a large community of accountants, analysts, and others to help answer questions. However, as your business grows, we’d highly recommend upgrading to a tool like Finmark to build and maintain your financial model.

How Much Do Financial Modeling Tools Cost?

The cost of financial modeling tools varies substantially. While you have free options like Excel, paid tools are sometimes priced as low as $10/month.

Most financial modeling tools either charge a flat fee or have some type of usage-based pricing where your cost varies based on revenue or other variables.

The cost of financial modeling tools also depends on the target market of the company. Software aimed at large enterprise companies can cost thousands of dollars per month, whereas software built for SMBs tends to be more affordable (like Finmark!).

Can I use Google Sheets as a Financial Modeling Tool?

When most people think of building financial models in spreadsheets, they automatically think of Microsoft Excel. However, you can use Google Sheets as a financial modeling tool as well.

Not only is Google Sheets free, but it has many of the same features as Excel. Google Sheets tend to be a bit easier to share and collaborate with than Excel, and some payroll and accounting platforms have Google Sheets integrations which makes connecting data easier.

Finmark has a Google Sheets integration as well, which you can check out with a free trial.

Is Excel The Best Financial Modeling Tool?

While Excel is great at many things, it is not a purpose-built financial modeling tool—it’s a tool that can be used for financial modeling.

Tools like Finmark on the other hand, are built for the purpose of Financial modeling. Our product is set up to be used to model revenue, expenses, payroll, and other parts of your financial plan. You don’t need to download a template from a marketplace or format a blank spreadsheet to turn it into a financial modeling tool.

Choose the Best Financial Modeling Tool for Your Business

A financial model is a necessity for businesses of all sizes (startups, SMBs, enterprise). Being able to reflect and analyze past performance, see where you stand today, and forecast the future makes it easier to plan for growth, get funding, or achieve any of your other goals.

In order to get the most accurate data though, you need to choose the right financial modeling tool. Whether you go with a spreadsheet or financial modeling software, make sure you’re choosing a tool that not only works for your business today, but something you’ll be able to use long term.

If you’re interested in giving Finmark a try or want to see it in action,start with a free 30-day trial.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.