Financial Reporting vs. Management Reporting: An In-Depth Comparison

Creating reports on your business’s operational metrics and financial performance can hold a lot of important information both for internal and external stakeholders.

But, while financial reporting and management reporting often pull from the same data sources, how they are presented can vary quite a bit depending on who the audience is and the insights they’re looking to gain.

This means that the general financial reports that get sent to your investors and banks will likely differ from the performance and management reports that your internal leadership team uses to make decisions.

Thus, understanding the key differences between these two types of reporting, and what to include in each, is something you need to be aware of.

Continue reading below as we discuss the purpose of each type of reporting, what’s included in each, and when they should be used.

What is Financial Reporting?

Financial reporting is the process of compiling and formally presenting financial data and the performance of a company during a given period–typically quarterly, annually, or both.

The resulting financial statements can be used for internal purposes, but are often presented to external parties outside of the company.

External stakeholders rely on financial reporting to monitor the business’s cash flow and assess their performance against forecasts, while also seeing that the company is adhering to proper accounting standards.

The goal of financial reporting management, then, is to show an accurate portrayal of the company’s financial performance and health during a specific time frame.

Depending on the state and country where your company operates, financial reporting is likely required for your business, especially as it relates to your tax obligations.

For publicly-traded companies, financial reporting management is a legal requirement, and their financial statements must be audited by a third party to be independently verified for accuracy.

Financial Reporting Use Cases

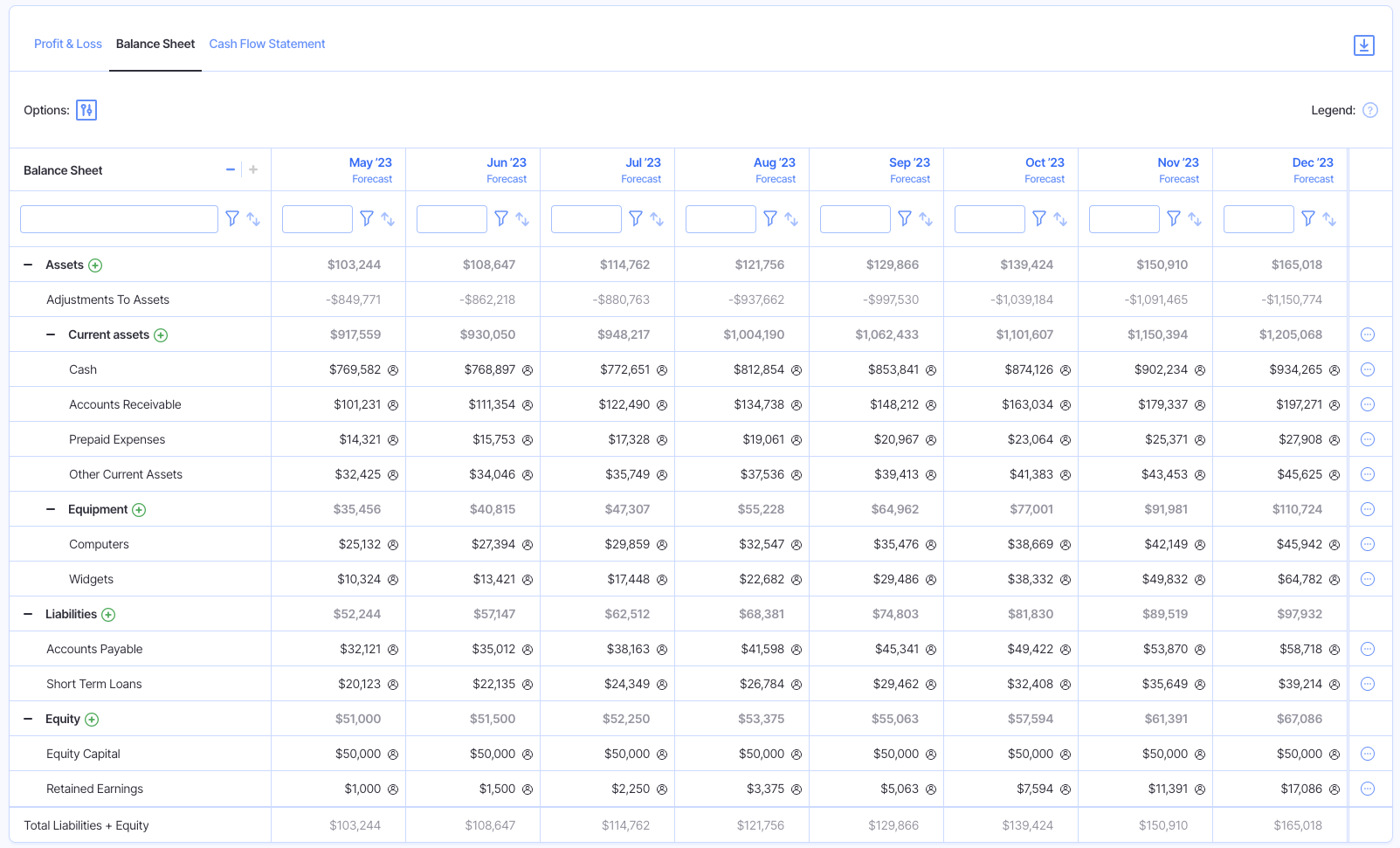

The three main financial statements that are created for financial reporting management are the income statement, the balance sheet, and the cash flow statement.

Example of a balance sheet

External parties like investors, banks, and industry officials are interested in the metrics that are reported in these financial statements, like revenue and gross profit. Such metrics can provide a clear and objective way to assess the financial health and performance of a company against their historical data and their competitors.

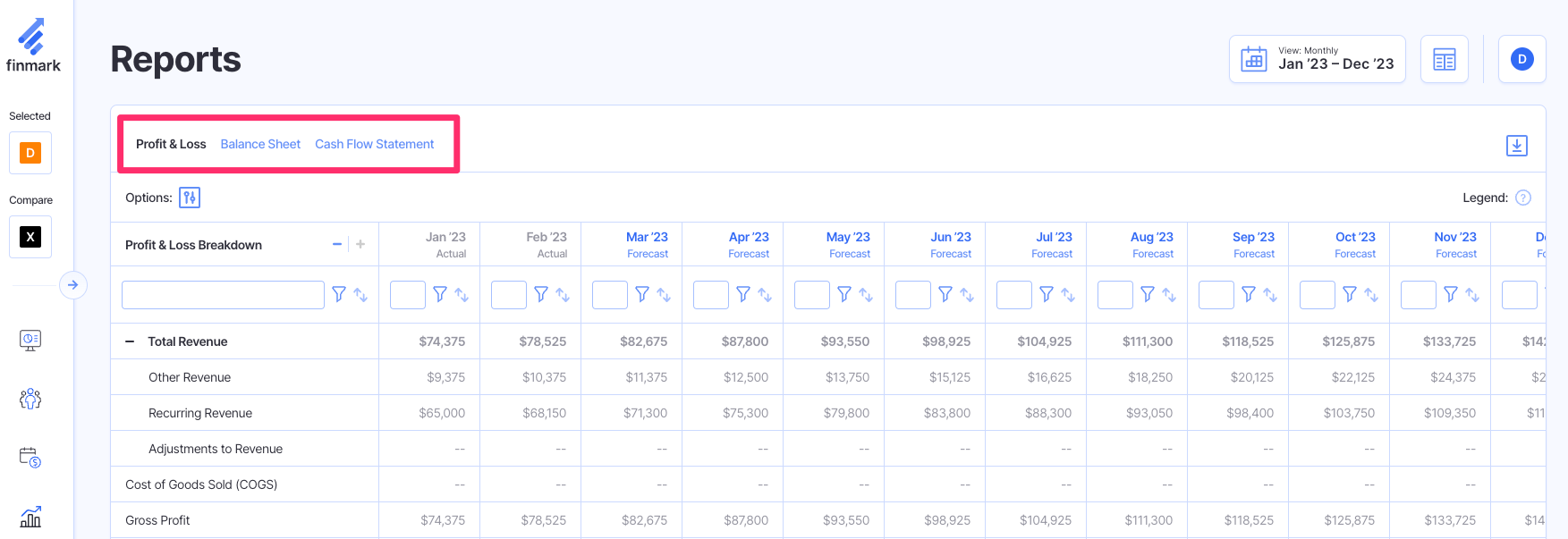

In Finmark from BILL, financial reporting management is simple. You can access all three major financial statements for your business in just a few clicks, as seen below.

See all three financial statements in Finmark

All in all, these financial reports can offer a good look into the financial standing of your business at a given time, but they don’t necessarily provide specific details or information about the inner workings, initiatives, or future goals of your company.

What is Management Reporting?

On the other hand, management reporting is used for internal purposes only and isn’t required by law.

As such, there are no specific guidelines or presentation standards for how to create these reports as with financial reporting management.

Management reporting tends to focus on individual business segments, offering specific information and insights for the segment’s leadership team and key decision-makers.

This makes it easier to see which aspects of your operations drive performance and can help segment leaders look for ways to make improvements or set goals for the future.

For instance, your CMO likely doesn’t need to stay up to date with the inner workings of the finance department, but they’re probably interested in the trends and underlying data within the Sales & Marketing segment, which is where management reporting offers deep value.

With a more narrow focus and flexible guidelines, business leaders can track and monitor the individual metrics and levers that make the most sense for their department, business, and industry.

Management Reporting Use Cases

Given the flexible nature of management reporting, it’s important that you create reports that provide actionable data and insights that can be used to make business decisions and improvements for the future.

You should avoid just compiling data for the sake of it, which could be a waste of time and resources.

Conversely, since it’s not technically required, bootstrapped teams may be tempted to omit management reporting altogether as a way to save time (or costs).

However, management reporting can provide you with the information you need to make data-driven decisions, recognize your strengths, and pinpoint certain areas for improvement.

For instance, you can gain a lot of value from maintaining the following internal reports:

- Sales reports

- Inventory reports

- Marketing reports

- Utilization reports

- Departmental P&L statements

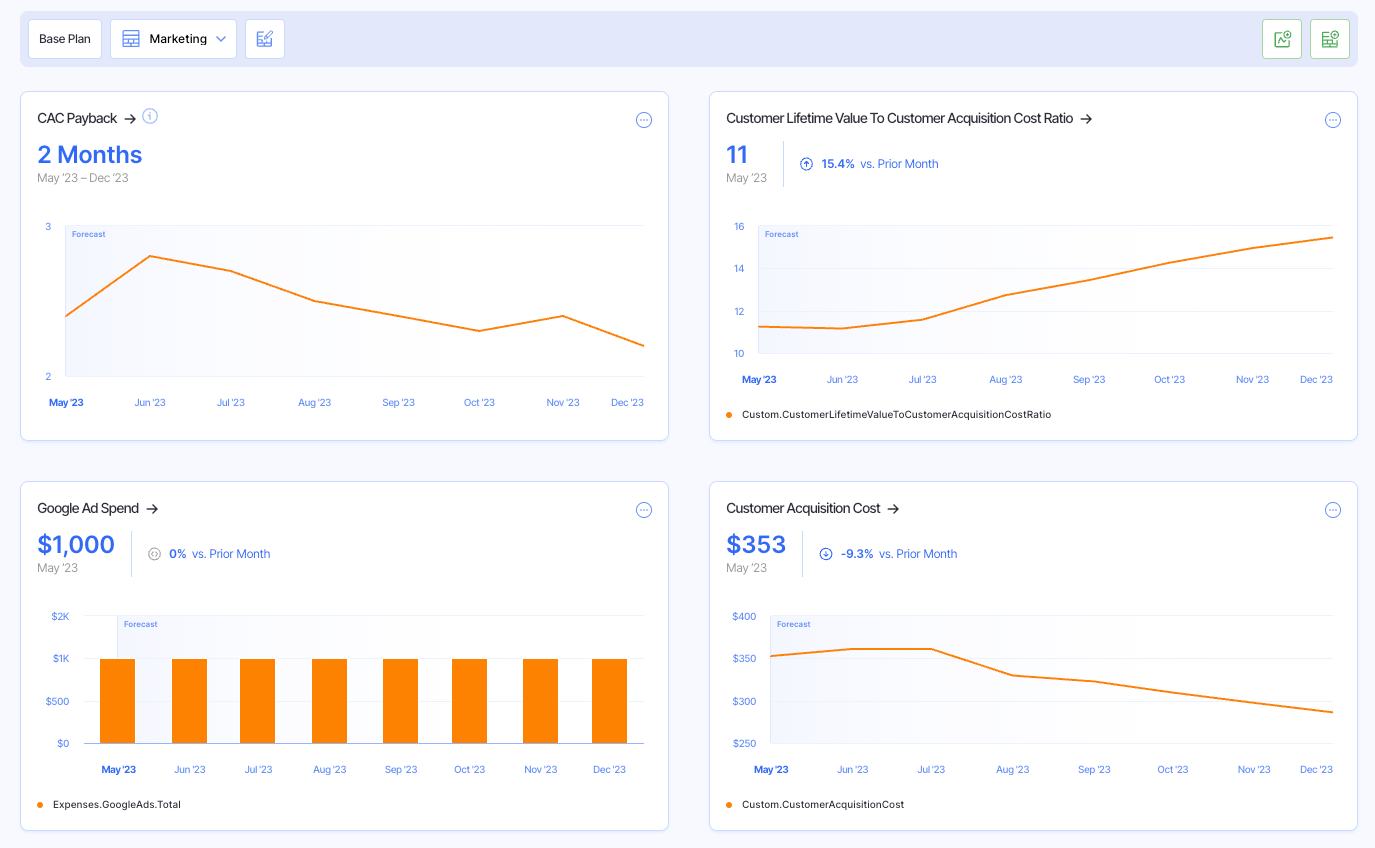

Example of a marketing report

Such reports can contain highly useful metrics like revenue per employee, customer acquisition cost (CAC), and return on ad spend (ROAS) on the sales report, and department-specific expenses and payroll on departmental P&L statements.

Consider the case where revenue has declined for your company over the past year. Aside from the top-level decrease in revenue that’s apparent to all stakeholders from the income statement, you need a way to dive deeper into your operations and find the source of this decline to come up with a solution.

If you are tracking revenue per employee on the sales report, you can take a look at the individual sales levels of each salesperson, seeing who the top performers were and who could use more resources or assistance.

Thus, management reporting gives you the data you need to plan and create goals or initiatives for the future that can drive improvements to top-line revenue.

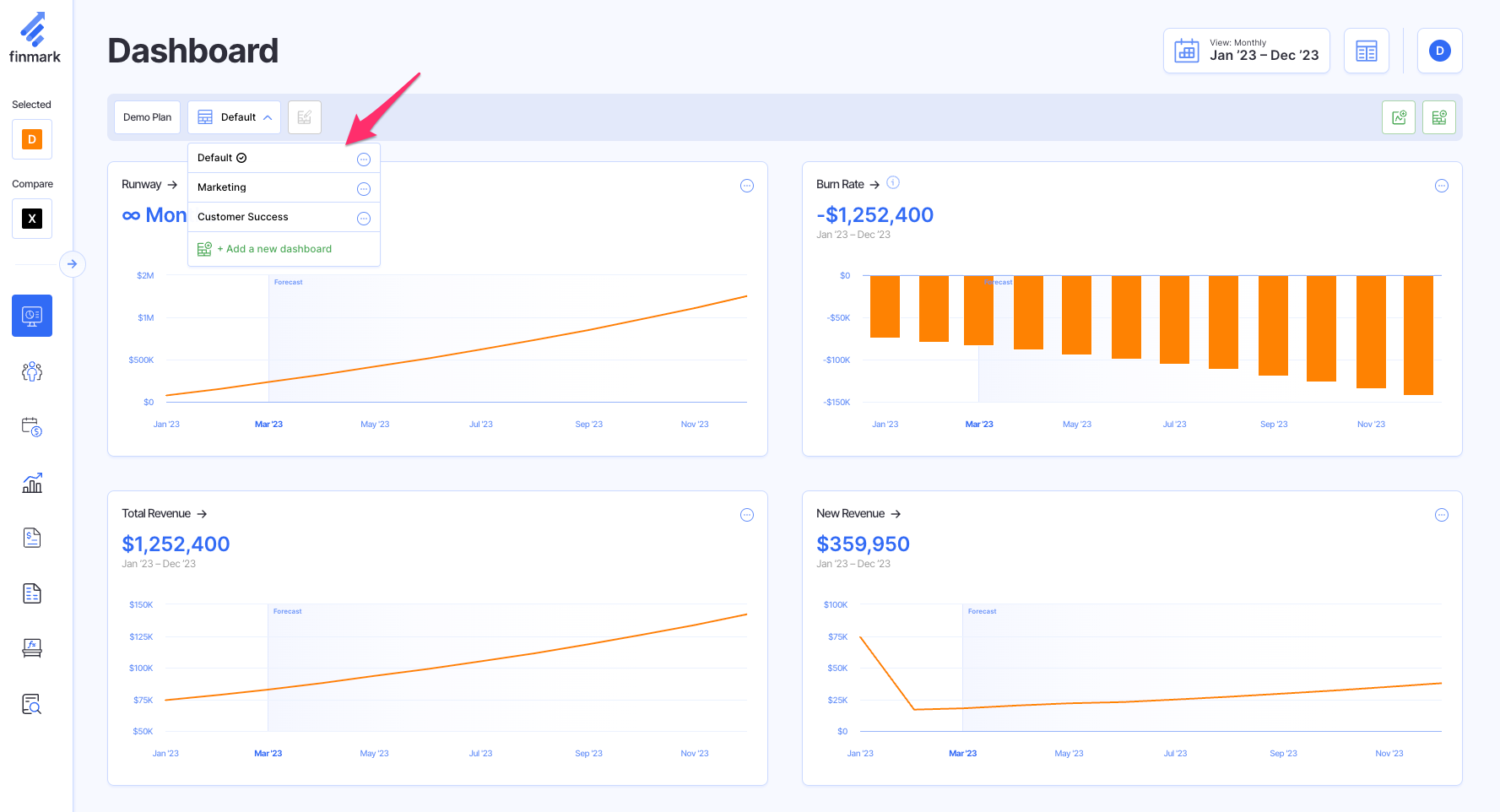

The custom dashboards in Finmark make it easy to create management reports with metrics that your internal team will gravitate toward, as demonstrated below.

Easily create and switch between custom dashboards in Finmark

Within Finmark, you can even create dashboards for specific business segments, like for your sales, marketing, or customer success departments.

This way, each team will see the financial data that’s most important to them in a streamlined presentation without having to sift through data that isn’t relevant to their processes.

The Differences Between Financial Reporting vs. Management Reporting

As you can see, both financial reporting and management reporting involve the analysis and presentation of numerical data.

Plus, both types of reporting can be used by your leadership team to make informed decisions about the business. Aside from these similar aspects, the two types of reporting are very distinct from one another.

Below, we dive deeper into some of the main differences between financial and management reporting.

Audience

Financial and management reporting tend to serve two different audiences.

While financial reporting can be useful for internal and external parties, its purpose is largely for outsiders to get a high-level overview of the financial health of a business.

In contrast, management reporting is solely for internal use, providing you with the clear and actionable data you need to manage the business and make informed decisions for the future.

Scope

Similarly, the scope of the two types of reporting is quite different given the distinct audiences they serve.

Financial reporting tends to have a broad or general scope to provide an overview of the business’s financial standing at a given time.

With this in mind, financial reporting provides you with a view into the company’s financial health at the time of reporting but doesn’t offer up any specific insights.

In comparison, management reporting tends to have a much narrower lens, focusing on an individual business segment or department.

This allows management reporting to get much more granular as needed to provide further insights for your team that might not necessarily be interesting to external stakeholders.

Requirements

Each business must complete some form of financial reporting to meet their tax obligations and have a way to present their financials in a formal manner to investors or financial institutions.

And as we briefly mentioned above, the SEC has additional financial reporting requirements for public companies.

Management reporting, on the other hand, is not required by law since it is done solely for internal purposes. The C-suite and individual department heads within your company can choose which reports and metrics they want to track depending on your business’s unique needs.

Get Reliable Financial & Management Reporting

Financial reporting and management reporting can both offer valuable insights into the financial health and operations of a company, though they are not to be confounded with one another.

Understanding the key differences between the two will help you get the most out of the data and information you track and stay compliant with any reporting requirements that you are subject to.

Companies that rely on a powerful and intuitive financial planning platform like Finmark can easily access the major financial statements they need for financial reporting management, and create custom dashboards and reports for internal management reporting in just a few clicks.

Try Finmark for free to seamlessly manage both financial and management reporting from one location.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.