Budget Allocation: A Step-by-Step Guide

Most of us are fairly familiar with putting together a monthly budget for personal expenses.

We put aside X for rent, Y for bills and groceries, and Z for entertainment. But when approaching budget allocation for your startup, things look a whole lot different.

To start with, you’ve got more than a few extra zeroes on the end of each line item, and you’ve got various departments to consider:

- How much should you spend on marketing?

- What about human resources?

- How do you determine what your labor cost is going to be before you’ve hired a full team?

Some of these questions are ultimately answered in time (you’ll have to be content with your most well-calculated guestimates for now), but many of them are solved with a bit of good old-fashioned budget allocation.

In this article, we’ll give you a rundown on what budget allocation is, how it works for startups, and guide you through a four-step process for determining how to spread your budget across various departments to get the most bang for your buck.

What is Budget Allocation?

Budget allocation is a pretty simple concept:

It refers to the amount of spending allocated to each expenditure line, which in layman’s terms basically means the amount of money you spend on each thing your company spends money on.

In a budget allocation, you don’t go right down to the nitty-gritty. Generally, it’s kept to the department level.

So, for example, you’re not going to list out how much you intend to spend on paper clips this year. Rather, you’ll allocate a certain percentage of your budget to the admin department.

They’ll take care of the paper clip budget.

Budget allocation is a process that happens at organizations of all sizes, not just startups.

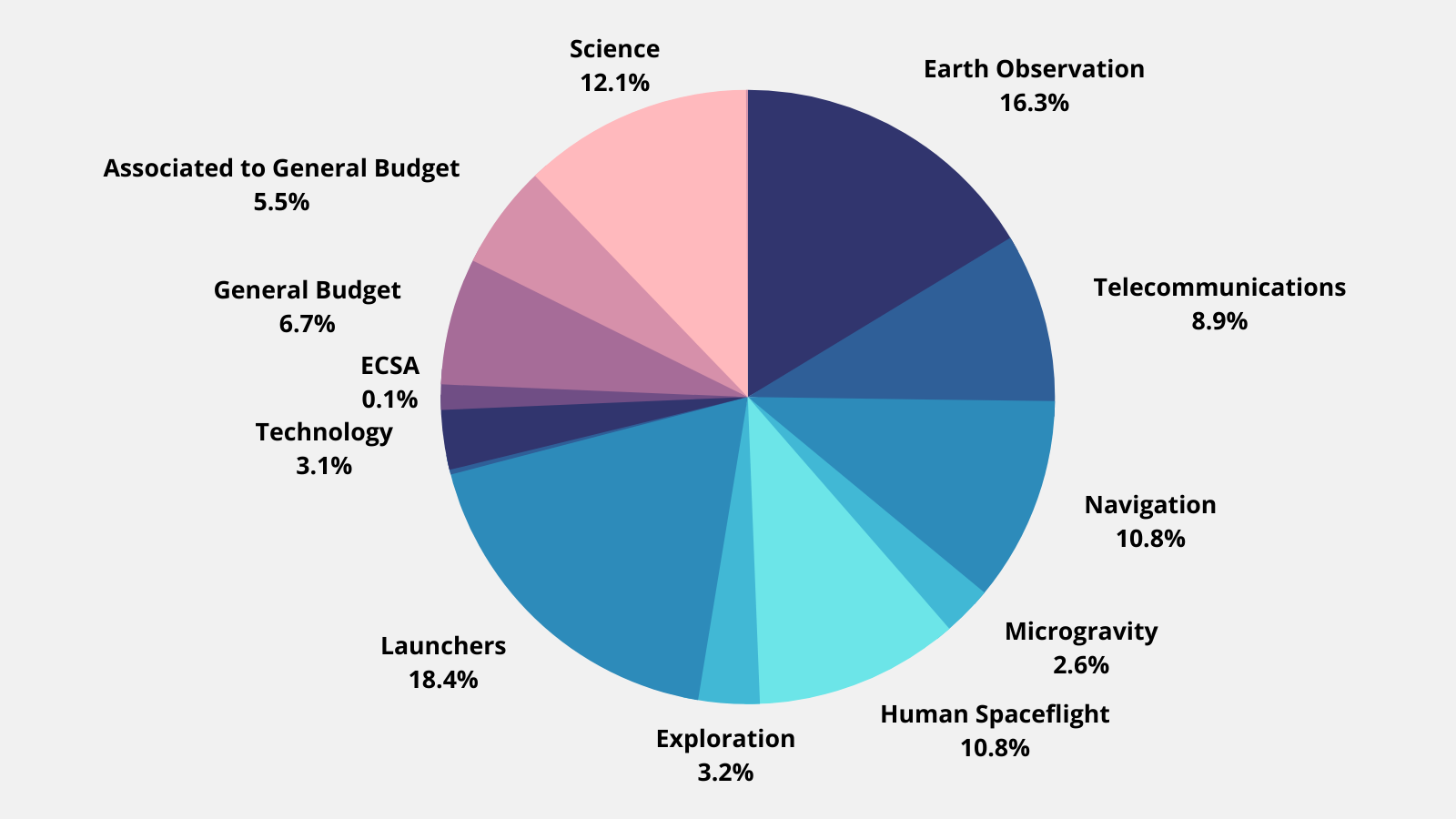

Take a look at this old European Space Agency’s budget allocation, for example.

The budget allocation tells employees (generally department heads) the maximum amount of money they can spend during the fiscal period, without having to seek approval from someone above them.

How to Allocate Budget Across Departments

Budget allocation as a concept is fairly straightforward, sure. But how do you actually go about it?

Let’s explore.

1. Determine Your Total Spending Requirements

Budgetary decisions should be based as much as possible on actual facts and figures, be it previous spending or informed estimates.

This is easier for companies that have already been in the game for a couple of years, as they have a much clearer understanding of the various costs they’ll incur.

For startups, there’s a lot of estimation and forecasting involved.

Note that this doesn’t mean throwing your hands up in the air and shouting “Who knows!? 20% to each department and let’s be done with it!”

Rather, you’ll need to sit down and detail the various costs you plan to incur.

A financial planning platform like Finmark will help you significantly here (not so subtle plug).

There are three kinds of costs you need to calculate:

- Startup costs

- Fixed costs

- Variable costs

Startup costs

Startup costs are the expenses you incur before launch. Depending on where you are in the startup journey, you may have already moved past this stage.

If you’re just getting going, though, then you’ll have to calculate necessary startup costs such as:

- Computers

- Furniture

- Property

- Inventory

- Security deposits

- Equipment

Fixed costs

Fixed costs, also known as overheads, are expenses you incur at the same rate, each month, regardless of how your company performs.

The classic example of a fixed cost is your rent. It doesn’t matter if your company sells two million dollars or two dollars in product that month, your rent remains the same.

Fixed costs are the easiest to calculate because of this factor.

Other examples of fixed costs include:

- Wages

- Utilities (some, others are variable)

- Website hosting

- Insurance

- Financial repayment obligations

Variable costs

Variable costs are those expenses that fluctuate each month, typically in response to sales and revenue performance.

The most obvious example of a variable expense is the cost of raw materials. If you’re producing a physical product, then the more you produce, the more raw materials you’ll need to purchase, so your variable costs increase for that period.

Other examples include:

- Advertising and marketing spend

- Sales commission

- Some utilities

- Business income taxes

- Transport

- Freelance services

Because variable costs are more difficult to forecast accurately, it’s best to build in some buffer to this aspect of your budget. For example, round up a $473 estimate to $500 to give you some leeway for unexpected increases.

Building in a buffer

Now that you’ve got an idea of your total required spend, it’s a good idea to build in a small buffer (perhaps 5-10%) to give your team leaders a bit of extra room in the event that costs increase.

Expenses rarely go down (don’t we know it?), and it’s much more common to underestimate than to overestimate, so for the sake of agility in spending, build a small safety net into your budget allocation.

2. Identify Funding Methods

So far, we’ve calculated the expenses we expect to accrue, but we need to ensure this aligns with the funding we have available.

There are two main sources of funding for startups.

The first is to receive an investment from a venture capitalist or angel investor. If you’re yet to get funded, check out our guide on the whole process: How to Get Seed Funding – A Step by Step Guide for Founders.

The second source of funding to fuel your budget is your company revenue model.

Part of the budget allocation process is to provide a breakdown of where the funds are coming from.

For example, your funding source might look something like this:

- 70% from seed investment

- 20% from existing revenue

- 10% from expected growth from a new revenue stream

Assuming you can match your funding amounts with the expected costs, then you’re good to move forward.

If not, you may need to reassess your expenses to identify areas to cut back, or seek further funding.

3. Allocate Budget by Department

Now, you’ll use the total costs you’ve calculated to allocate your overall budget by department.

The makeup of your budget allocation will ultimately differ by the industry you’re in, the size and stage of your company, and the departments you currently have operating.

That said, most startups can be easily divided into 6 core departments:

- Marketing

- Sales

- Engineering

- Customer Success/Support

- Operations/Administration

- HR

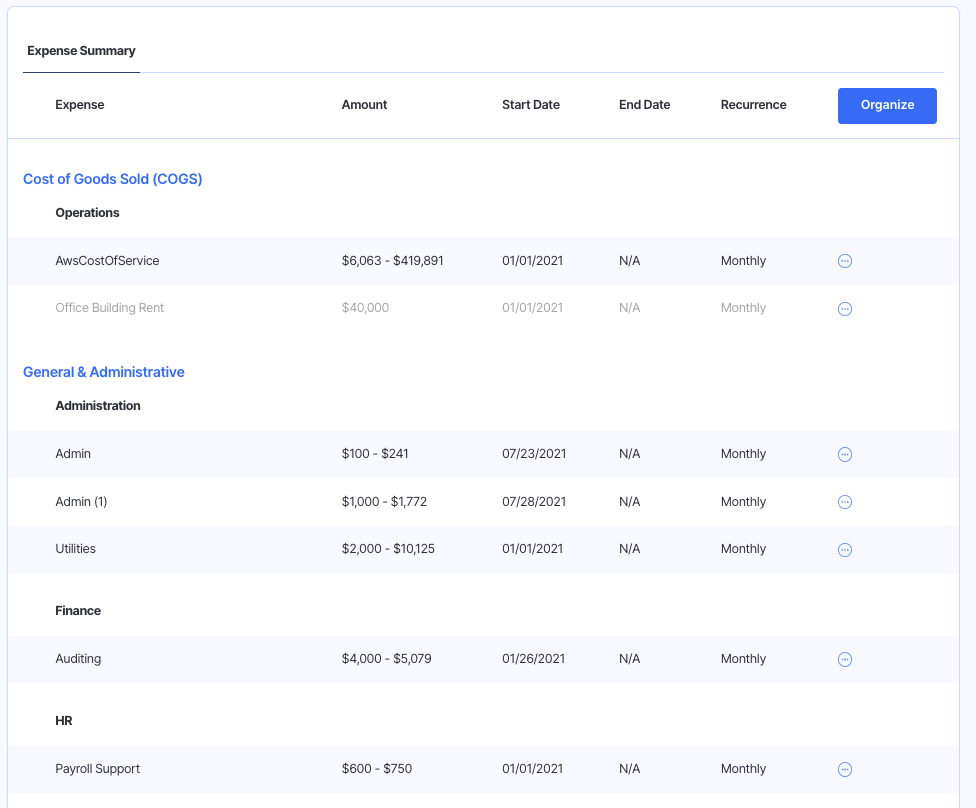

You’ve already got a breakdown of the various startup, fixed, and variable costs you expect to accrue (whether you’ve used a helpful tool like Finmark or gone old-school with a spreadsheet), so the next step is to go through each expense and assign it to a given department, like this:

Now you’ve got figures for:

- Your total budget for the year

- Budget allocation based on department

Budget allocations are often displayed as both spend by department and percentage of total budget by department, so you can use the following calculation to determine percentages:

[department spend] / [total budget] * 100 = [department spend as a percentage of total budget]

For example, if your total budget is $2,000,000, and your marketing budget is $450,000, then your calculation would be:

$450,000 / $2,000,000 * 100 = 22.5%

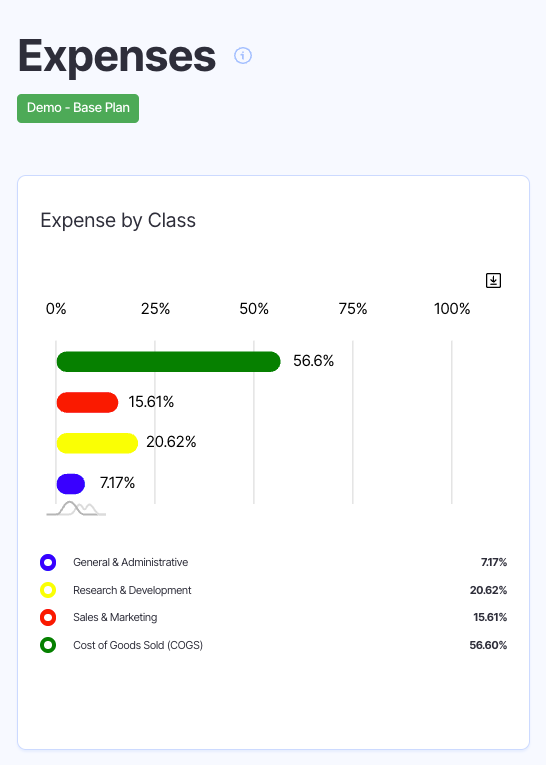

Then, if you like, you can display your budget allocation visually, like this:

4. Design a System For Monitoring Spend

The actual allocation of your annual budget is only the first half of the process.

Now, you’re going to execute on the allocated spend, and you’re going to need a way to track your actual expenses against your budget and to be able to report on what’s available to spend at any point.

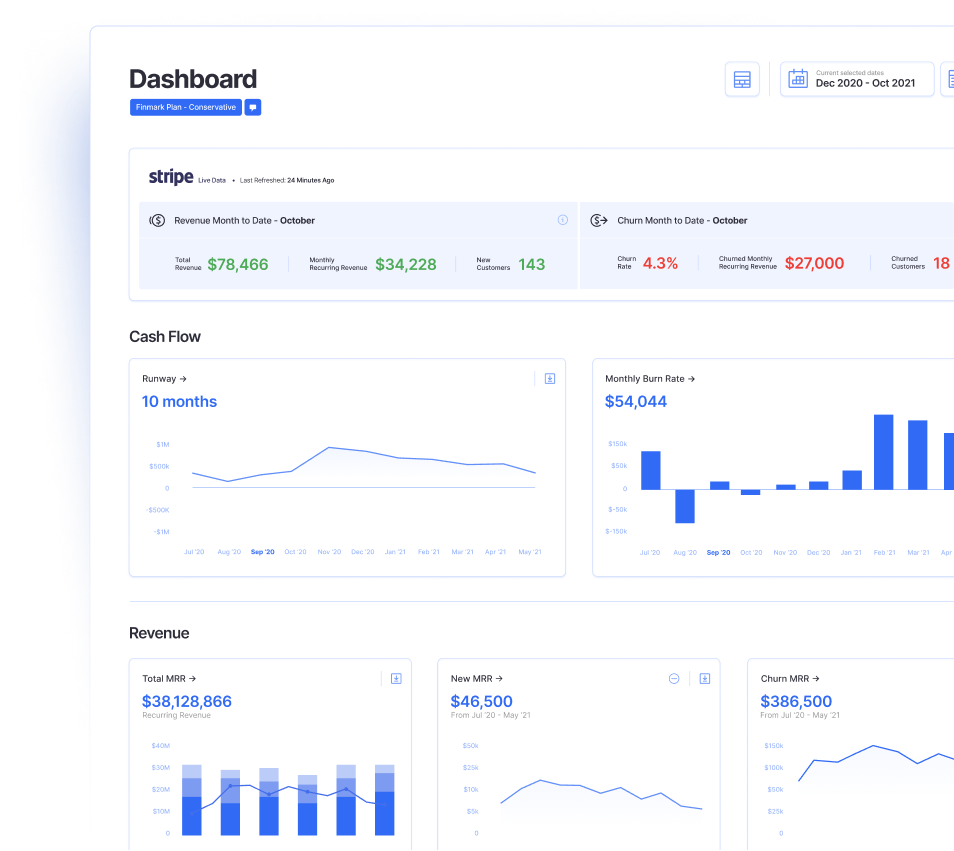

Using a financial modeling platform like Finmark, founders can easily forecast cash burn rate, and build projections for runway, budgetary spend, and revenue growth.

Tracking metrics such as these allows you to be agile with budgetary adjustments, to identify areas to reallocate budget, and to catch runaway costs before they become unmanageable.

Speaking of making adjustments to your budget allocation…

Budget Reallocation: Making Adjustments

Throughout the year, it’s likely that you’ll come to find that certain cost estimates were over or underestimated.

As a startup founder, you need to be agile with spending, which means being prepared to reallocate budget as needs arise.

We’d recommend a quarterly cadence for reassessing and adjusting budget allocation.

There are a few situations that may cause you to reallocate your company’s budget:

- One department is spending more than expected

- One department is spending less than expected

- Your company as a whole is spending more or less than anticipated

In the event of an under or overestimate in a particular department, you’ll need to make the decision either to filter more budget to that department (at the expense of another), or cut department spending going forward (depending on your budget model).

These calculations should be based on your actual expenses, but you should also bear in mind that particular expenses may not be accrued throughout the entirety of the year.

For example, let’s say you’ve identified at the end of the first quarter that your marketing department is 2% over budget, and the sales department is 2% under.

Seems like a nice easy reallocation.

But upon looking further, you might identify that your plan for sales growth includes onboarding three new reps in the third quarter, which will increase your commission expense, meaning reallocating that sales budget wouldn’t be a wise idea after all.

Allocate Your Budget More Efficiently

Allocating a budget is often a task that sends new startup founders into a spiral, wondering how to calculate expenses and where to siphon their money.

As you can see, though, it’s not such a terrifying process, especially if you’ve got a capable financial modeling platform on your side.

Book a demo with the Finmark team today, and let us show you how we can supercharge your budget allocation process!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.