How to Do Budget Analysis in 4 Easy Steps

Whether you’re a founder, CFO, or work in the finance department of a company, understanding cash flow is vital for the long-term success of your company.

You need a firm grasp of how much cash is coming in and out of your business today, as well as a forecast of what those numbers will look like in the future.

That’s where budget analysis comes in handy.

Tracking your cash is one thing. But taking a step back to analyze your expenses and revenue will help you make smarter financial decisions, ensure growth, and keep you from running out of money.

In this guide, we’re going to break down how to do budget analysis, why it’s important, and give you plenty of tips along the way.

What is Budget Analysis?

Budget analysis is the process of examining cash flowing in and out of your business and comparing that cash flow to your budget to determine whether or not you’re on track. It allows you to check if you’re over, under, or within your budget and make any adjustments to stay on track.

Benefits of Budget Analysis

Way too many startups end up going out of business because they don’t realize their business is running out of money until it’s too late.

By routinely analyzing your budget and cash flow, you’ll always know where your company stands and whether or not you’re trending in the right direction.

Below are three of the most important benefits afforded by regular budget analysis.

More Accurate Budget Creation

While budget variance (differences between your forecasts and actuals) is normal, it’s not exactly something you want.

In an ideal world, you’d create budgets that are as accurate as possible, and reflect the actual income and expenses for the period for which they are created.

Good budget analysis helps you achieve that goal.

By regularly analyzing where revenue and expenditure differ from projected figures, you gain a better understanding of how your business financials really work. You can then use this information to plan future budgets.

Improved Financial Agility

Budget analysis also helps you stay flexible in the moment, and make changes throughout the financial period to remain on track.

Say, for example, that you perform a budget analysis at the end of the first quarter, and find that your advertising expense was 12% higher than you had budgeted for.

Now, you have the ability to make relevant changes.

This change might be to actively reduce expenditure on this line item, though it may be that you decide to keep it as is and adjust your budget if you can demonstrate that the additional expenditure created significant revenue growth.

More on that in Best Practices For Budget Analysis.

Greater Control Over Spending

By consistently reviewing how your actual cash flow stacks up against expectations, you gain a better hold on company spending and improve your spend visibility (your ability to track where, how, and why cash wash spent in daily business operations).

Each time you run a budget analysis, you dive into spending by department and then category, to understand where every dollar is going.

Then, you can put the appropriate actions into place.

For instance, if out-of-contract software spending is higher than anticipated, you might look at your software procurement protocols and make some changes to internal policies to tighten up spending.

How to Do Budget Analysis in 4 Steps

There’s no need to get overly complicated with your budget analysis. The process we’re going to outline is simple and easy to follow, even if you’re not a financial analyst.

All you need to get started is:

- An accounting tool: You need a tool to track all your expenses. We recommend Xero, Quickbooks, Wave, or Zoho so that you can integrate directly with Finmark from BILL.

- A financial planning tool: You need a way to create a budget, build a forecast, and compare both to your actuals. Obviously, we recommend Finmark.

If you’re old school, you can also use spreadsheets, but you’ll save a lot of time by using the tools above. Now let’s walk through how to do your budget analysis.

1. Decide on a Frequency

First, you need to determine how often you want to analyze your budget. Monthly? Quarterly? Bi-annually?

For early-stage startups or companies that are growing quickly, we suggest sticking to a monthly or quarterly schedule.

Since you’re likely testing new marketing and sales strategies, hiring, and things are changing daily, your revenue and expenses aren’t as predictable. As a result, your budget needs to be analyzed and adjusted more frequently.

On the other hand, if your company is more established and you tend to stay within your budgeted numbers, you might not need to do budget analysis as frequently.

2. Look for Variances

After you decide on a frequency, the next step is to start analyzing the numbers. We’re going to do that in two ways:

Analyzing how you did (comparing your budget to actuals)

- Analyzing where you’re heading (comparing your actuals to your forecast)

In this step, let’s talk about the first one—analyzing how you did.

We’re going to compare your planned budget to how you actually performed by looking for budget variances.

A budget variance is just a difference between a budgeted figure and an actual figure. For instance, if you budgeted $10,000 for Facebook Ads for the quarter but only spent $7,000, you have a budget variance of $3,000.

👉 Learn more: A Simple Guide to Budget Variance

During your budget analysis, you need to look for any variances in both expenses and revenue.

While we’re mainly focused on expenses here, it’s important to look at revenue variance as well because if you generated more or less revenue than expected, it can impact how much money you spend going forward.

If you use a tool like Finmark for financial planning, spotting variances is simple. You can create multiple scenarios—one for your budget and one for your actual spend. Then you can compare the two during your budget analysis process.

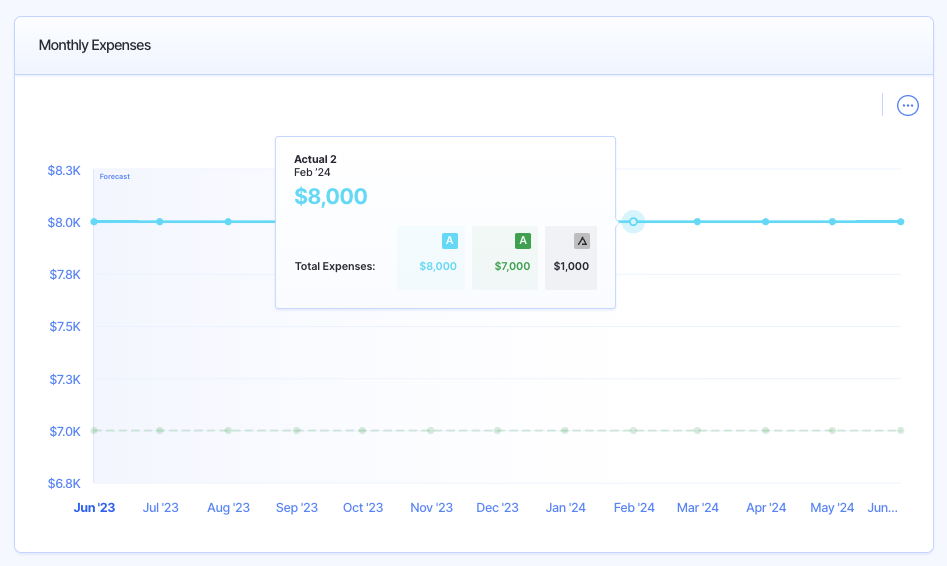

In the screenshot below, you can see there’s a $1,000 variance in monthly expenses for February.

From here, you’d just compare the expenses to see where the variance is coming from. We’ll talk about what to do once you spot a variance in step #4.

3. Check Your Budget Against the Forecast

After you’ve compared your past performance, it’s time to compare your budget against the forecast.

This is particularly important if you use a dynamic budget model like a rolling budget or flexible budget.

👉 Learn more: 5 Types of Budget Models (And How to Choose the Right One)

Unlike static budget models that stay the same throughout an entire budgeting cycle, dynamic budgets leave room to make adjustments. That means if your actuals are consistently over or under budget, your forecast is probably inaccurate.

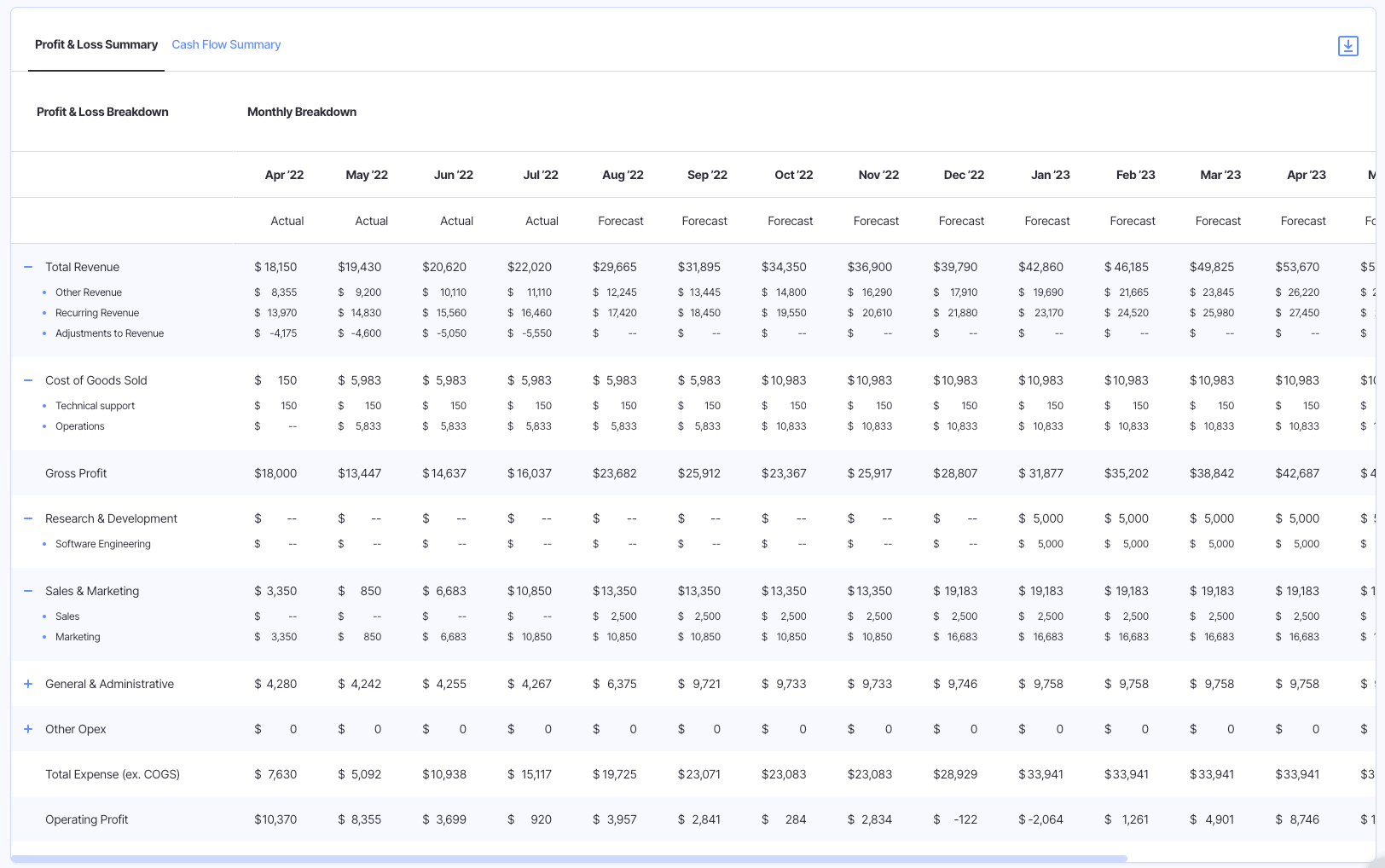

So in this step of the budget analysis process, you need to check your actuals against your forecast. You can get this data in Finmark as well. Here’s an example that shows the actual vs. forecasted P&L for an imaginary budget.

The expenses are broken down by department, so it’s easier to see where your forecast is off-track or on-track. You can even click into each department for a breakdown of individual line items.

There are two main questions you want to answer in this step:

- Is my revenue forecast realistic? Compare your actual revenue over the past 3-6 months against the forecasted revenue. Is your growth trajectory realistic?

- Are my expenses steady? If your expenses don’t have a ton of variance or are flat, then you’re good to go. But if your expenses vary month-to-month, you need to pay attention to how they’re growing or shrinking. This is particularly important for expenses that are tied directly to revenue, like cost of goods sold (COGS).

Once you do that, it’s time to move on to the next step.

4. Make Changes If Needed

Analysis without action is pointless. That’s why the final step of your budget analysis is to make any necessary adjustments based on what you found.

It’s important to note though, that not every variance warrants a change to your budget. For instance, if you budgeted $2,000 a month for freelance writers, and you spent $2,050 one month because you needed some extra work, it’s not a reason to overhaul your budget.

However, if you budgeted $500 a month for software, and over the past three months you spent $550, $650, and $700 because you’ve had to upgrade your plan each month, then you should update your budget accordingly.

Best Practices For Budget Analysis

Expect Variance

Variance (a difference between your budgeted and actual figures) always exists.

The simple truth is that it’s kind of impossible to predict everything. Small market fluctuations are super common, and larger ones can pop up without notice.

Your goal shouldn’t be to eliminate variance altogether, as it’s a goal you’re simply not going to achieve unless you have a magical crystal ball.

Instead, start with the mindset that variance will exist, and that your goal is to use budget analysis to produce more accurate budgets in the future that minimize variance.

Consider Expenses In The Context Of Revenue

Part of your budget analysis will be to dive into your business expenses and compare them with your projections.

Don’t make the mistake of thinking that any increase in expenses is necessarily a bad thing. Instead, consider business expenditure in the context of revenue generated for the same period.

For example, let’s say you perform a quarterly budget analysis and see that your cloud expense was higher than expected.

Before you jump to sourcing a new supplier or otherwise looking to cut costs, look at your revenue. Did you close more customers (and therefore increase revenue, and your need for cloud hosting) in the period than expected?

If so, then the increase in that particular expense may be completely justifiable, and even expected.

Make Budget Analysis Collaborative

One of the best ways to get the most out of your budget analysis is to involve non-finance team leaders in the process. They can provide insights into spending or revenue generation that might otherwise not be visible.

For instance, in the above example, your CIO would be able to give you the low-down on the increased cloud expenditure, why it occurred, and what can be done about it. None of that information is apparent simply by reviewing the numbers.

Check Regularly For Variances

While it is a best practice to perform a formal budget analysis on a regular basis (monthly or quarterly, depending on your business needs), any cadence naturally brings with it the consequences of delay.

That’s why it’s a good idea to check in regularly with your financing planning and forecasting platform to see immediately if your actual spending differs significantly from budgeted projections.

All this takes is to open up your finance tool every morning (or every Monday morning), and quickly scan for any variances.

Want to Make Budget Analysis Easier?

Budgeting isn’t an exact science, so be ready to make changes over time. Doing a budget analysis gives you the opportunity to go over the cash flowing in and out of your business so you don’t wait until it’s too late to make changes.

If you want to do a budget analysis for your company, Finmark makes the process a lot easier. Not only can you compare your actuals, budget, and forecast, but you can build a financial plan for your business—without spreadsheets.

Try it free here, you won’t regret it!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.