How to Increase Revenue: 8 Strategies For Rapid Growth

Revenue is the fuel that keeps your business going.

But here’s the thing:

Consistent, growing revenue is harder to generate than you might think.

Sure, you’ve got a great product, researched your target market, and built a solid marketing plan. Sometimes, though, even the best-laid plans don’t pan out.

And so you’re left wondering: what will I do to drive more cash into my business?

In this article, we’ll show you eight strategic ways to increase revenue right now, so you can keep the bottom line in the black and get through to your next funding round!

1. Double Down On Your Most Lucrative Revenue Streams

This tactic seems obvious, but in reality, many startups fail to consider it.

Instead, they try various tactics and channels, hoping to find a silver bullet.

Rather than throwing it all at the wall and seeing what sticks, double down on what you already know is working.

Use hard data to inform this decision.

Say you’re using a financial modeling platform (ahem, Finmark) to manage all of your revenue and expense forecasting. You’ve got the data there; you just need to ask the right questions.

Analyze each revenue stream, and ask:

- Which avenues are delivering the most revenue right now?

- What is the ROI for each revenue stream? Which gives us the best value for our spend?

- Which streams have the highest trajectory for growth? You want revenue growth to be sustainable.

Now, double down on the channel (or channels) that prove the most lucrative.

If your budget is limited, consider redirecting budget from streams that aren’t performing as well.

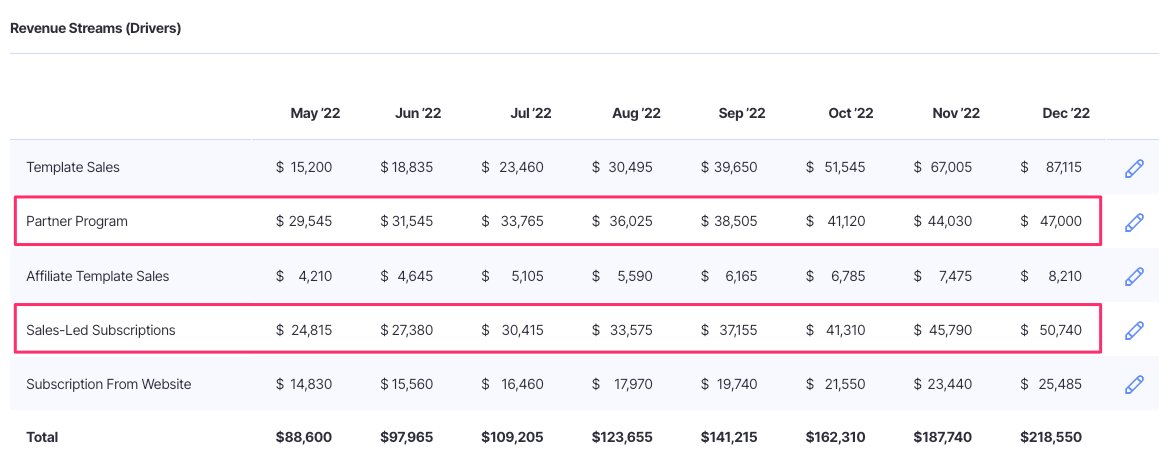

For instance, in the example below (made in Finmark!), we can see this business generates most of its revenue from sales-led subscriptions and the partner program.

It may make sense for them to invest more into those avenues as opposed to affiliate template sales, for instance.

2. Pre-Sell Products You Have In Development

Pre-selling is a great tactic for generating revenue quickly, even if you don’t have something to deliver right away.

Here’s how it works:

Say you have a core product right now. But you’ve got some impressive features in the pipeline that you know you can sell.

You’re in a bit of a bind, though: you can’t finish developing those features without generating revenue (so you can pay your team).

So, you approach your existing customers and pitch them:

“Hey, we’ve got this thing coming, and it’s going to change your life. It’s going to cost X, but if you buy now, we’ll give it to you for 30% less and give you early access to our beta.”

If both the feature and the offering are compelling, you’ll win.

3. Use Scenario Modeling To Understand How Marketing Spend Impacts Revenue

You know that one general assumption is true:

If you increase your marketing budget, you’ll generate more leads and drive more revenue. Assuming your marketing efforts are effective, of course.

But here’s what you don’t know:

Which marketing tactics will generate the most revenue?

What happens if you invest $10,000 in PPC? What about if you put that same chunk of cash on social media ads? Does your revenue growth look the same?

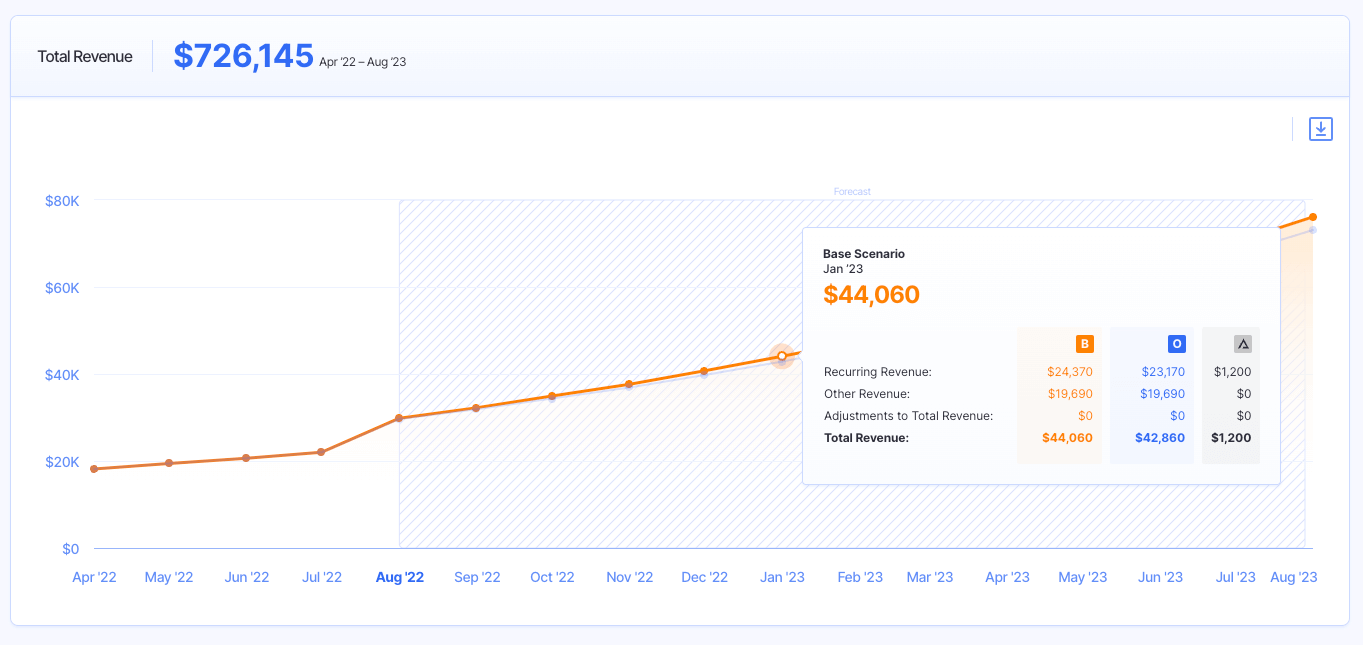

The process of uncovering this information is known as scenario analysis, and you’re going to use it to determine which marketing tactics are your biggest revenue drivers.

Using your financial modeling and scenario analysis platform (you have one, right?), analyze the impact of marketing spend in each tactic on revenue.

For example, let’s say you run a scenario that looks at what happens when you invest $10,000 in Google Ads, and the answer is you can expect to generate $30,000 in revenue.

Then, you run a second scenario for investing that same amount in social media ads, and your expected revenue is $25,000.

In this instance, Google Ads looks like the better proposition.

4. Run Growth Experiments To Optimize Pricing

One area where many startups fail to maximize revenue is their pricing.

Often, pricing is initially set without a lot of strategy involved. You look at what your competitors are charging, review their features, and make your best guess as to what customers would be willing to pay.

Growth marketers go a step further, running experiments to optimize each step of the customer acquisition process, including pricing.

A simple test would be running an experiment on your price point.

For example, would you convert the same number of customers if you charged $55 per month instead of $45 per month? If so, you’ve got an easy win.

You can also experiment with how you present pricing.

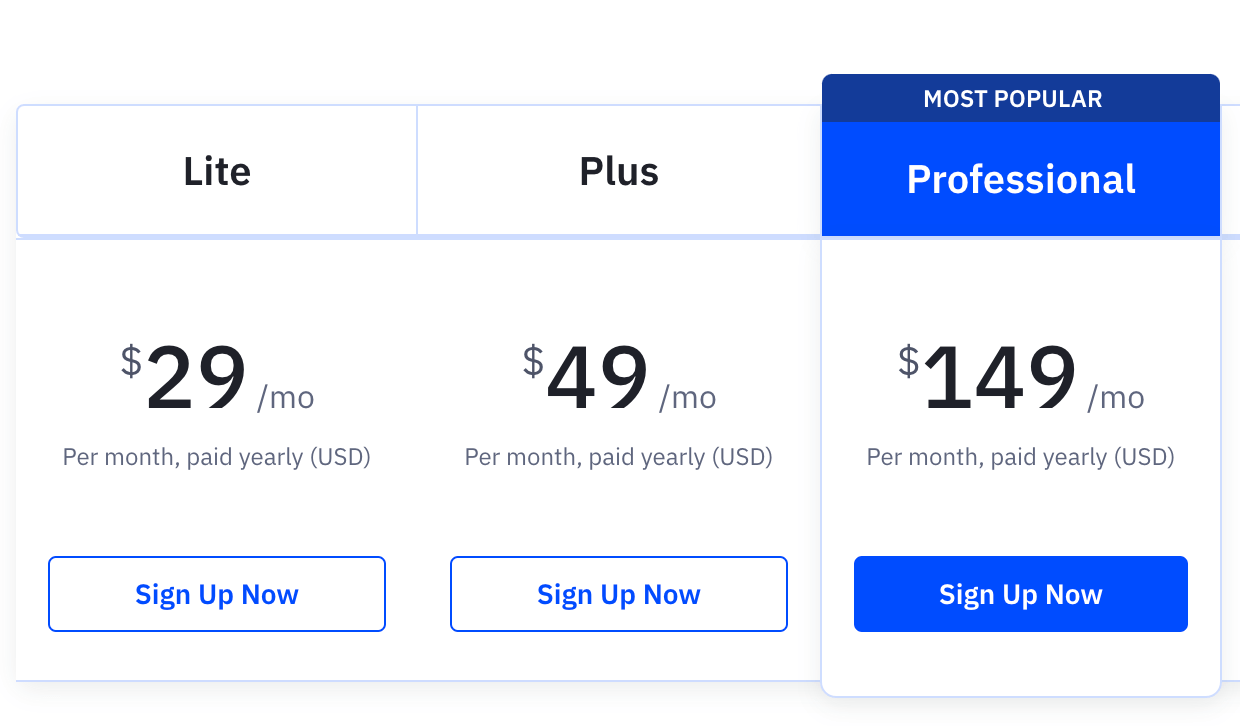

Take ActiveCampaign, which offers three pricing tiers.

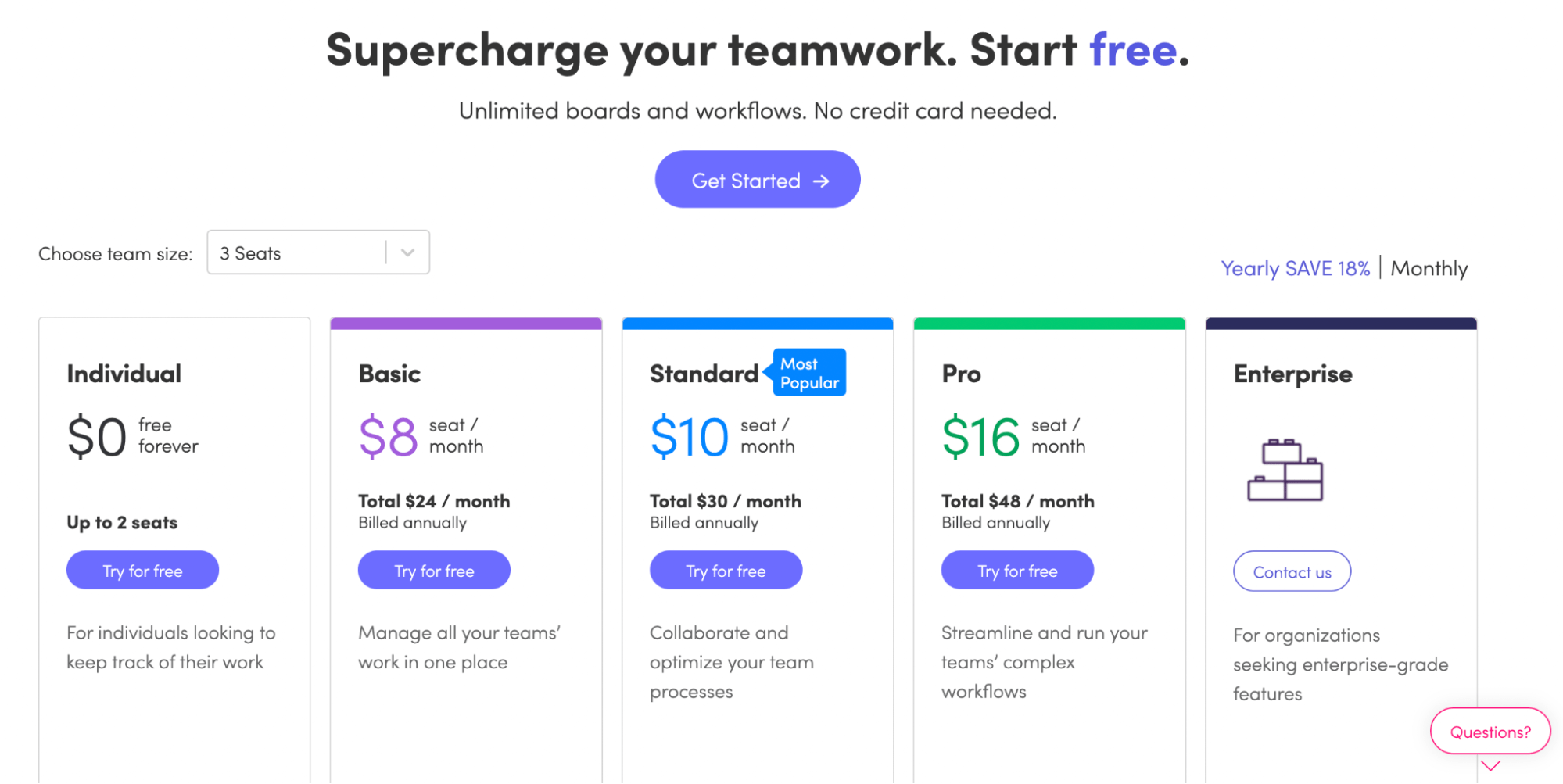

ActiveCampaign could experiment to see if a five-tier pricing model (like monday.com’s) converts more readily than a three-tier one.

5. Look For Cross-Sell Opportunities

Let’s say you sell a CRM platform (because who doesn’t these days?)

Like most CRMs, you charge per user. But what happens when you close a new customer who needs to migrate over from another CRM?

Do you let them handle data migration or offer to do it for free?

Consider a third option: one-time implementation fees.

You can capture some extra revenue upfront by including an additional charge to get set up and migrate their data.

6. Use Customer Analysis To Identify Your Most Important Segments

We’ve already looked at identifying our biggest revenue drivers from a marketing channel perspective, but another way to quickly turn up your income stream is to focus only on the customer segments that prove most lucrative.

Let’s say, for instance, you’re Ringy, a sales CRM.

You have a few customer segments, including insurance agents, lawyers, and recruitment agencies. You’re probably targeting all these customers right now because you want to capture as many customers as possible.

What if, however, the typical insurance agent only buys one seat, and the typical recruitment agency signs up for seven?

If the cost of acquiring either customer type is the same, you will have a 7x better ROI by adjusting your marketing spend to target only recruiters.

Review your financial analytics to understand which customer segment offers the best customer lifetime value (LTV), and double down on the audience that delivers more revenue.

7. Analyze The Impact Of Offering A Lifetime Deal (LTD)

If you’re selling software, there’s a strong probability that you’re selling on a subscription model.

This has several benefits (consistent, predictable revenue, for example), but it does have a huge drawback:

If you close a customer now, you’re not going to see all the revenue from them right away, assuming they’re paying monthly.

But there’s a quick workaround for this: the lifetime deal.

Lifetime deals (aka LTDs) are a nice blend between the subscription and traditional perpetual license models.

If a customer purchases an LTD license from you, they have access to your platform (and generally any upgrades and additional features) in perpetuity.

Yes, you’ll get less revenue over the course of a customer’s lifetime (because you’ll need to provide a compelling offer), but you’ll generate that revenue upfront, which can be a smart way to get you through to the next funding round or extend your runway.

8. Be Careful Not To Neglect Existing Customers

One of the biggest traps founders fall into when looking to increase revenue is failing to continue to nurture existing relationships.

This is important for a few reasons: brand loyalty and the impact of referrals and word of mouth.

But it also impacts revenue:

If you’re pulling in an additional $20k in revenue each month, but you’re losing $5k in customer churn, then a quarter of your work is just filling that leaky bucket.

Don’t forget, as well, that existing customers can be opportunities for revenue generation.

For instance, you might release a new set of features only available in a newly created pricing tier. Now, you can initiate conversations with all of your existing customers and upsell to a few of them to boost your recurring revenue stream.

Ready to Increase Your Revenue?

There are several ways you can increase revenue and bolster growth.

However, all of the best strategies for this are built on a foundation of solid data, looking into your current financials to determine which segments, tactics, and drivers are best to invest in.

For that, you’ll need a powerful financial modeling platform.

Sign up for a free trial of Finmark today, and learn how we can help fuel your revenue engine.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.