Accounting vs. FP&A: What’s The Difference?

For many founders, one of the most challenging and confusing aspects of starting a business is wrapping your head around the myriad financial aspects of entrepreneurship.

Balance sheets, financial forecasts, cash flow reports, budget allocation. The list is far from short.

And though understanding certain financial concepts (like the difference between revenue and profit) might be fairly straightforward, others are less so.

For example, many founders aren’t super clear on the difference between FP&A and accounting in a startup, and how each contributes to revenue growth, expense management, and overall financial success.

So, in this article, we’re going to break down both of those terms, explain what they mean in the context of a startup, and provide a recommendation as to how to approach financial hires in your business.

Accounting vs. FP&A: Differences At A Glance

Let’s start nice and simple.

Accounting is about recording financial transactions, ensuring data is accurate and correctly filed, and preparing financial reports on behalf of a business. It’s about the “what”. As in “what happened this financial year?”

FP&A (which stands for financial planning and analysis, by the way), is more about the “why”.

It looks at the information accounting gathers and prepares, and asks, “why did this happen?” FP&A provides answers to those questions, analyzing financial information for holes and opportunities.

Then, it provides recommendations to senior leaders to make decisions.

In practice, it’s not really a matter of one or the other, and the “FP&A vs. Accounting” debate is kind of a moot point, because you need both.

Look at it like this:

At the end of the financial year, accounting pulls together a variety of reports, such as your profit and loss statement (P&L). That’s the “what”.

Then, FP&A takes that statement and identifies that while you’ve hit your revenue goal for the year, profit wasn’t as high as expected. That means there’s a hole (read: opportunity) somewhere. We need to find out why.

FP&A analyzes your company’s financial data, and determines that the cause was a mid-year increase in your utility bill. Then, it provides a recommendation as to what you can do about it going forward.

What is Accounting?

Accounting covers a wide variety of responsibilities, including:

- Recording financial transactions

- Auditing financial records to ensure accuracy

- Preparing financial reports

- Sharing reports with stakeholders

- Preparing tax returns and other legal financial reports

In larger organizations, accounting often breaks down into three different arms.

Financial accounting

Financial creates annual and interim financial statements (such as balance sheets, income statements, and cash flow statements). For most companies, these statements are then audited by a professional CPA (Certified Public Accountant) firm.

Managerial Accounting

Managerial accounting is similar to financial accounting (in that it utilizes much of the same data), but its purpose is to prepare monthly or quarterly reports to allow the company’s management team to make important financial decisions.

Cost Accounting

Cost accounting is like managerial accounting, but it’s all about expenses. Cost accountants consider and analyze all of the costs related to production, which can be used to determine the business’s pricing model.

How Accounting Departments Work in Startups

So, what does accounting look like for the average startup?

You’ve got two options here. You can either hire in-house, or outsource your accounting needs to an external firm.

Many startups opt for the second approach early on, as it’s an easier way to get started, ensuring you’re staying compliant while still being fairly lean and keeping costs low.

Plus, when you work with an accountancy firm, you may have the option of seeking financial advice, and it’s always helpful to have another expert on your team!

It’s worth bearing in mind here the difference between bookkeeping and accounting. Simply put, bookkeeping is about recording and organizing your financial data. Accounting is about preparing financial reports based on that data.

Many startups handle the bookkeeping aspects in-house and outsource only the creation of financial reports and tax returns.

Alternatively, there are bookkeeping firms (like Bench) that can work directly with your CPA, meaning you can outsource both aspects of the accounting process.

If you do decide to outsource accounting duties, be careful not to become too far removed from the financial picture. If you’re looking to raise funding, for example, then potential investors will be looking to your understanding of the company’s financials as a sign of strong leadership.

What is FP&A?

As we’ve already discussed, FP&A (financial planning and analysis) is about the “why” behind your company’s financial situation.

It seeks to understand the causes behind your financial performance (good or bad), and then make recommendations for senior leaders to make important decisions (like reducing expenses, doubling down on marketing, or altering the pricing model).

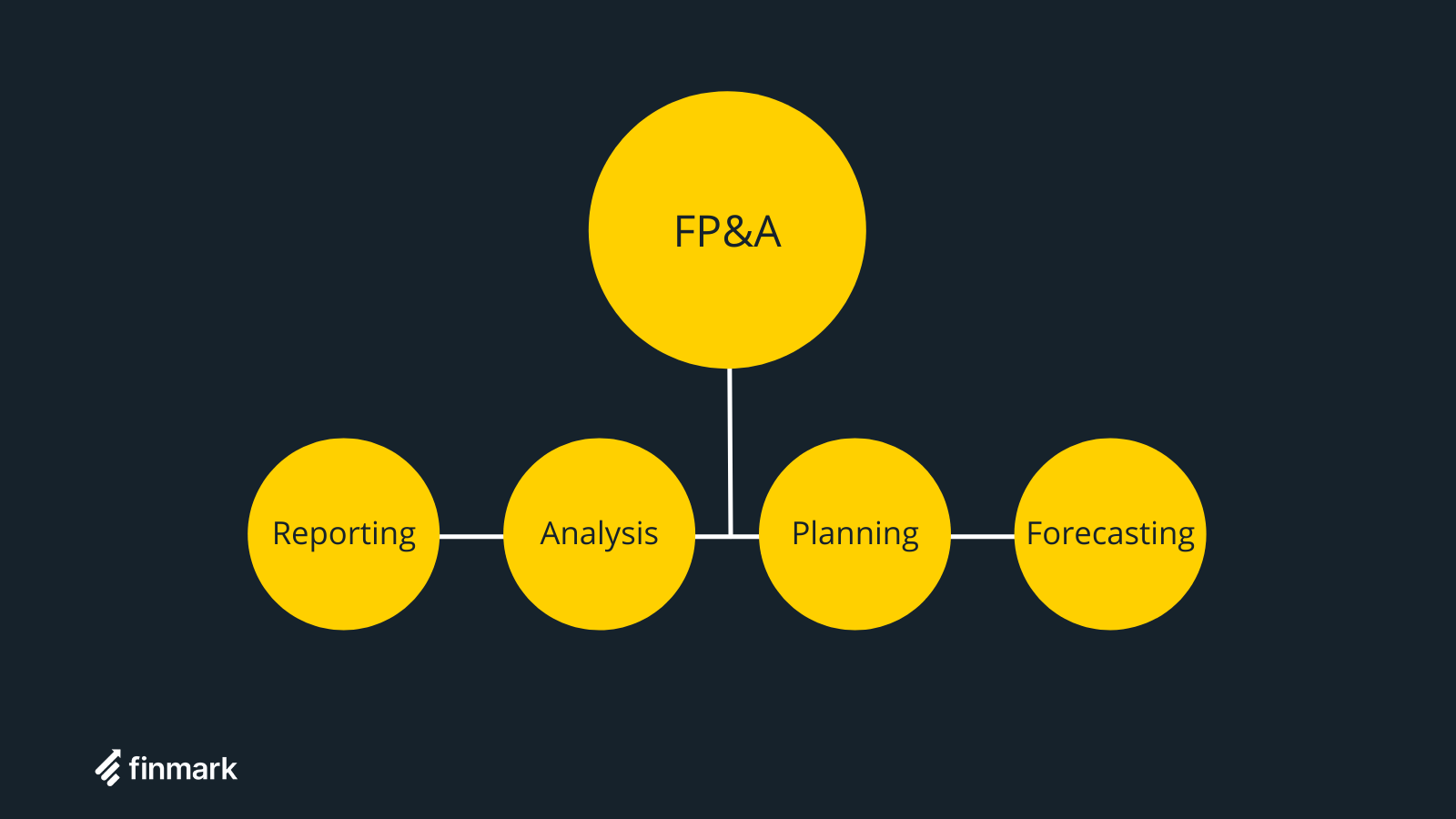

FP&A consists of four key components: reporting, analysis, planning, and forecasting.

More and more, FP&A is taking a forward-looking approach (leaning more heavily into the forecasting aspect), leveraging financial planning tools (like Finmark!) to create insight predictions and analyses.

FP&A analysts and directors tend to have a background in accounting (often they are accountants), but their skillset needs to be broader, as they’ll also be analyzing information from sales, marketing, operations, and human resources.

FP&A responsibilities include:

- Putting together profit and loss statements with key insights

- Analyzing financial statements to determine which product lines have the most profit potential

- Scenario planning

- Identifying new investment opportunities

- Creating the company budget

- Other ad-hoc reporting as requested by leadership

How FP&A Works in Startups

As a startup founder, you’ll likely rely heavily on FP&A to provide valuable insights that allow you to make good, informed financial decisions.

Your FP&A director or analyst can, for example, help you to determine how best to allocate investor funding, understand which of your product lines are proving most valuable, and identify areas to reduce expenses to increase profitability.

For that reason, FP&A can be a good early hire, and is often seen as a viable lean alternative to hiring a CFO.

How Founders Should Approach FP&A and Accounting

So, as a startup founder, how should you approach FP&A and accounting? Who should you hire, and when?

Accounting can either be a hire, or you can outsource. This often comes down to a matter of preference, though we’d say in the case of most early-stage companies, outsourcing is the better option.

It still provides you with the opportunity to seek advice, and of course, ensures all of your financial reports are compliant and filed on time. But by outsourcing to an accountancy firm, you’re able to access much more scalability and stay lean as long as possible.

FP&A, on the other hand, should be a hire (if you don’t already have that expertise on your leadership team). FP&A is the department that’s going to dig deep into the financial statements your accountant prepares, and provide valuable answers to the burning questions you have.

They’ll be able to identify ways to increase your revenue and profit, reduce expenses, and take advantage of new investment opportunities.

FP&A + Accounting = The Best of Both Worlds

Of course, it’s worth bearing in mind that there are a number of powerful tools out there that can help you with financial reporting and analysis, and so you may be content to manage FP&A duties in-house.

Yes, this is a not-so-subtle self-plug 😉

Check out Finmark, the financial modeling and planning platform that will level up your company’s finances, today!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.