Cash Flow vs. Revenue: What’s The Difference?

Do you keep seeing the words “cash flow” and “revenue” being used together in conversations about business, yet have no idea what they really mean?

Understanding the difference between cash flow and revenue can be confusing—even for experienced business owners.

Both are important. So let’s dive into the difference between cash flow vs revenue so you’ll be better equipped to manage your business finances.

Cash Flow vs Revenue: What’s the Difference?

Cash flow is the amount of money that comes into and flows out of your business during a certain period, such as a week, month, quarter, or year.

If you have more cash coming in than going out, your business has positive cash flow. Conversely, if more cash goes out than comes in, you have negative cash flow.

Cash flow is an important indicator of your company’s financial health because it determines whether you have enough cash to pay bills, make debt payments, return a profit to the business owner(s) or investors, and save for future goals.

Revenue, on the other hand, is the total amount of money your company earns over a certain period. It reflects how much money you bring in before deducting any expenses, such as costs of goods sold, salaries, rent, taxes, etc.

For most businesses, revenue comes from the sale of products and services. But you might have other sources of revenue, such as rental income or dividends and interests from loans or other investments.

Revenue is an important indicator of business success and growth potential, as it reflects the demand for your products and services.

| Cash Flow | Revenue | |

| What It Is | The money coming in and out of your business | The amount you earn from sales of your products or services |

| Drivers | Revenue, expenses, investing, financing | Activities, products, services, and markets that generate income for your business |

| Where to Find it | Statement of Cash Flows | Income Statement |

Does Strong Revenue Equal Positive Cash Flow?

It’s possible to have healthy sales revenue but negative cash flow. This can happen for a couple of reasons, such as:

Spending is Outpacing Revenue

Revenue is different from net profit, which is what’s left over after you pay all your business expenses. For example, if you invest heavily in research and development, purchase new equipment, or hire more employees, you might spend more money than the business takes in for a while.

Although these investments may lead to higher revenues over time, you may still have negative cash flow in the short term.

Revenue is Tied Up in Receivables

You might have negative cash flow when revenue is tied up in accounts receivable.

Accounts receivable is money owed by customers for goods and services they’ve received but not yet paid for.

If you use the accrual accounting method and sell on credit, you experience a delay between when you generate revenue and when you receive cash because customers might take 30, 60, 90, or more days to pay for their purchases.

Having processes in place to budget for expenses, track receivables, and collect outstanding balances can help you maintain positive cash flow.

Where Are Cash Flow and Revenue In the Financial Statements?

You can find both revenue and cash flow in your financial statements—namely, in the Cash Flow Statement and Profit and Loss Statement.

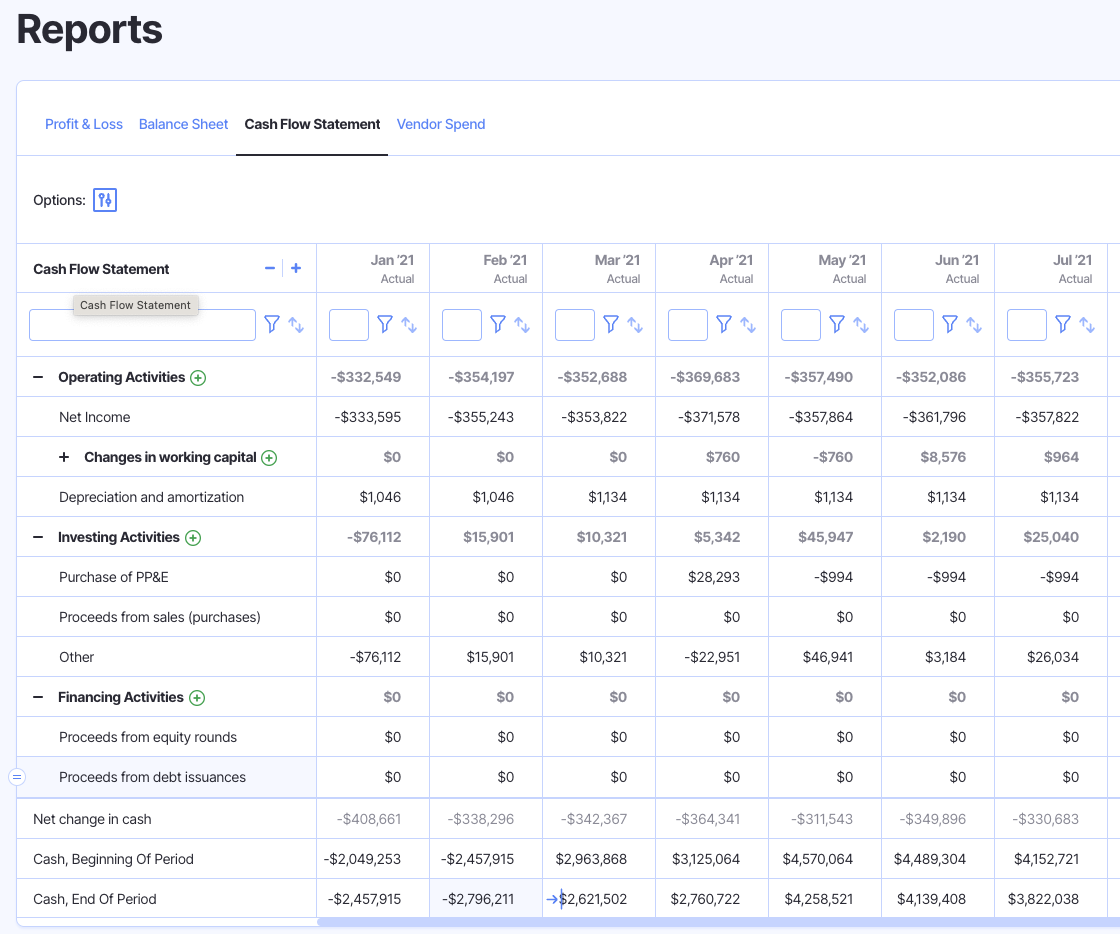

Cash Flow Statement

A Cash Flow Statement, also known as a Statement of Cash Flows, is a financial report that summarizes the cash generated by and used by the business over a given period—typically a month, quarter, or year.

The cash flow statement usually begins with your cash balances at the beginning of the period, then shows cash inflows and outflows broken down into three categories:

Cash Flows From Operating Activities

Operating cash flow is cash earned or spent performing your company’s primary operations.

This section adds your net income figure to your beginning cash balance, then makes adjustments for any non-cash items reflected in net income, such as depreciation or changes to accounts payable, accounts receivable, and inventory.

Cash Flow From Investing Activities

Investing cash flow is cash earned or spent from investments you make in the business, such as purchasing or selling equipment.

Cash Flow From Financing Activities

Financing cash flow is money earned or spent in the course of financing your business operations, such as making dividend payments to shareholders, taking out loans, and interest payments on those loans or lines of credit.

All of the cash generated by or used in operating, investing, and financing activities is your company’s cash flow for the period.

When you add that number to your beginning cash balance, the result should be the cash balance in your bank account at the end of the period.

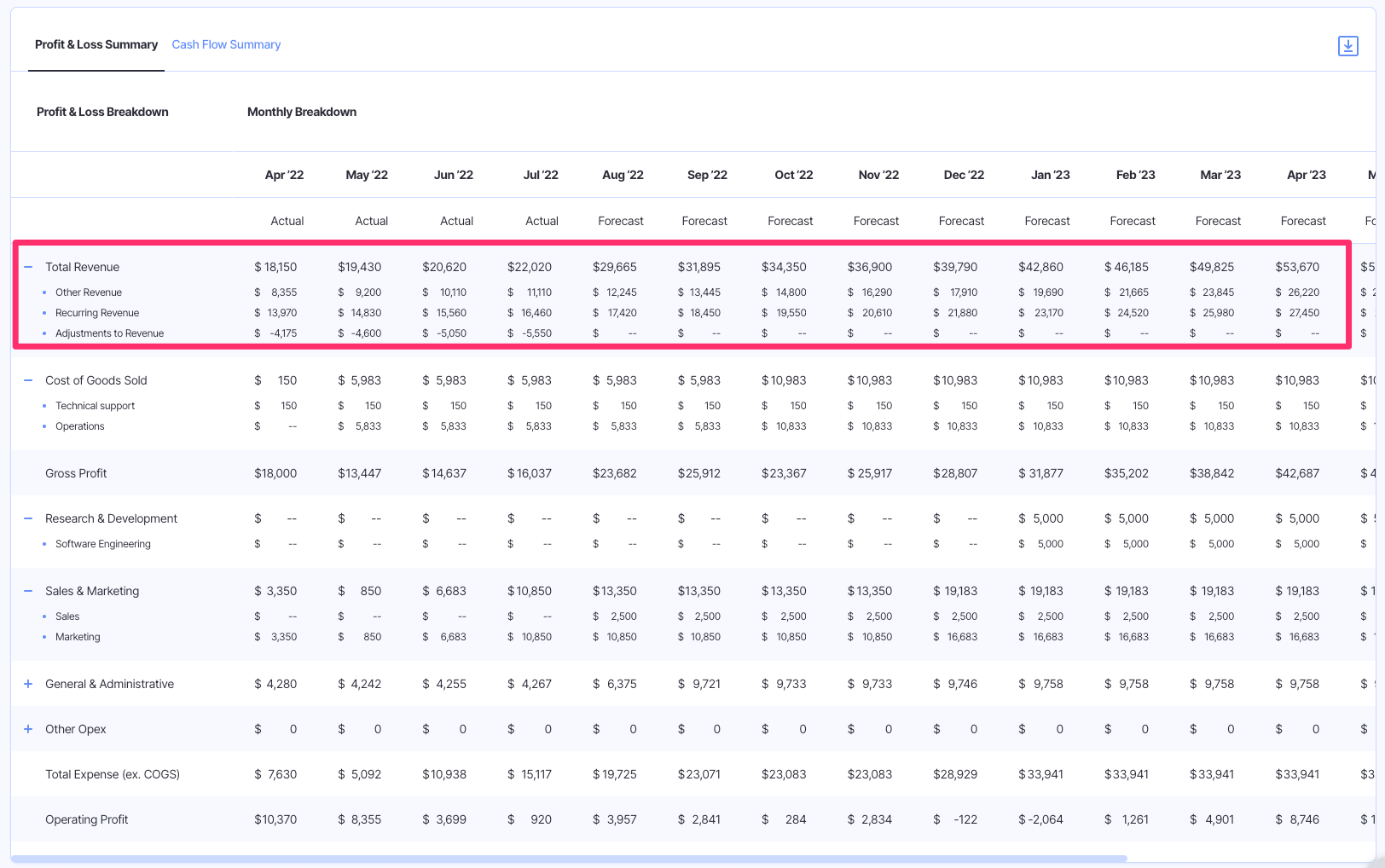

Profit and Loss Statement

A Profit and Loss (P&L) statement, also known as an Income Statement, is a financial report that summarizes your revenue, expenses, and profits over a given period.

You can find your total revenue at the top of the income statement.

Other financial data that appears on the income statement includes:

- Cost of goods sold (COGS). On the income statement, you’ll often see cost of goods sold subtracted from revenue. COGS includes direct labor, materials, and other components necessary to make the products a business sells.

- Gross profit. Gross profit is revenue minus COGS.

- Operating expenses. Operating expenses are things you spend money on to generate revenue. They can include management and administrative salaries, rent, advertising expenses, office supplies, property taxes, etc.

- Operating income. Operating income is gross profit after subtracting operating expenses.

- Other income and expenses. This section of the P&L statement includes income and expenses that aren’t related to the business’s core operations. For example, it might include interest income earned from a business savings account, the profit from the sale of a piece of equipment, and income taxes paid to the federal, state, and local tax authorities.

- Net income. Net income, also known as “the bottom line,” is the profit left over after accounting for all revenues and expenses.

What’s More Important: Revenue or Cash Flow?

Now that you know what cash flow and revenue are and where to find them on your financial statement, you might wonder which is more important: revenue or cash flow?

The short answer is that both are important, as they each provide necessary insight into the financial health of your business.

Think of revenue as your top-line number. It gives you an indication of how well you’re doing at generating sales.

Cash flow, on the other hand, shows you how much of that revenue you have available to run and grow your business.

If you have strong revenue but a weak cash position, you’ll have trouble paying your employees, keeping the lights on, and handling your other financial obligations.

On the other hand, if you have poor revenues and plenty of cash on hand, you’re likely not using that cash effectively. You should consider putting some of that cash to work by investing in equipment, advertising, or other revenue-driving activities.

Use Finmark to Track and Forecast Revenue and Cash Flow

You can look at your cash flow statement and income statement to find your cash flow and revenue.

But the problem with financial statements is they’re historical records. They show you the revenues and cash generated for the last month, quarter or year—not what’s happening right now or in the near future.

Finmark from BILL helps business owners easily track and forecast their revenue and cash flow.

Being able to forecast these financial metrics is crucial because it can help you make more informed business decisions, identify potential problems that may arise, and plan for the future.

For example, if your cash flow forecast predicts cash will be tight next quarter because you’re making some business acquisitions, you might want to talk to your bank about a line of credit.

This short-term cash inflow can help ensure you’re able to continue paying employees and other operating expenses.

Likewise, if your revenue forecast shows revenue dropping in the future because you lost a big customer, you might want to invest in more marketing and business development and try to replace that revenue before it impacts the company’s ability to stay in the black.

Ready to Start Better Managing Your Revenue and Cash Flow?

As you can see, monitoring your business’ revenue and cash flow is incredibly important.

It can help you identify potential risks early, aid in budgeting for future projects, and assist with decisions around applying for financing or making investments.

If you need help forecasting revenues and cash flow, give Finmark a try. With easy forecasting for multiple scenarios and other financial planning tools, it can give you the peace of mind that comes from knowing where you stand financially.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.