Flexible Budget Variance Analysis: Beginner’s Guide

Do you find that when it comes to preparing financial statements at the end of the year, quarter, or even month, your actual figures don’t quite stack up with what was budgeted for?

If you answered yes, the first thing you need to know is that this is, at least to an extent, completely normal.

However, if you’re looking to improve the accuracy of your budgets and financial forecasts, then you’ll want to engage in a practice known as budget variance analysis.

Variance analysis is essentially digging into the causes behind differences between budgets and actual spending.

Sounds good, but what if you’re running a flexible budget? Is variance analysis still a viable practice?

The answer is yes, which is why we’ve written this guide all about flexible budget variance analysis.

What Is Flexible Budget Variance Analysis?

To understand what flexible budget variance analysis is, we’ve first got to answer a more basic question:

What exactly is flexible budgeting?

The flexible budget is one of five popular budget models and is kind of a hybrid approach to financial planning.

It begins with a static framework, which you build using costs that aren’t likely to change throughout the year (like your office rent).

Then, on top of that, you layer a flexible budget system that allows for variable costs, which are likely to fluctuate based on sales performance (sales team commission, for instance).

The flexible elements use a percentage of your projected revenue rather than hard and fast figures, such that they can be easily adjusted up and down based on your current performance and projected expectations.

Want to learn more about the flexible budget? We’ve got a dedicated guide just for that. Check it out here: Flexible Budgeting 101: What Is It & How Does It Work?

Okay, so we know what flexible budgeting is; now for the other piece of the puzzle:

What the heck is budget variance analysis?

Variance analysis is the practice of reviewing any differences (known in finance speak as variance) between your actual figures and your projected numbers.

Here’s a simple example:

Say you projected $2,000 for your email marketing spend for the quarter, but you actually ended up spending $2,400.

You want to look into the reasons behind that $400 difference.Perhaps you find that your email list grew much faster than anticipated (probably a good thing), and thus you sent more emails than projected, driving up your email marketing expense.

That’s variance analysis: spotting the differences between budgets and actuals, then figuring out what happened (and making a relevant plan for moving forward).

Flexible budget variance analysis, then, is the application of the variance analysis process to a flexible budget.

You’ve already allowed for fluctuations in the budget due to changes in projected revenue growth—which is what makes flexible budgeting a great approach—now you want to dive into the reasons behind those changes.

When And Why To Use Flexible Budget Variance Analysis

If you’re using a traditional static budget, then the need for performing a variance analysis is obvious:

Your actuals didn’t stack up against the projected figures, and you need to know why and what to do about it.

But a flexible budget already accounts for normal movements in revenue growth, so is variance analysis still necessary?

Well, it depends on your answer to this question:

Do you want to know why the dynamic items in your flexible budget changed?

The flexible budget itself allows for such changes, but the practice of analyzing variances (especially in those expenses you expected to be completely fixed) is what gives you the opportunity to dig into the root causes.

Let’s explore this idea with an example.

Imagine that you budgeted $20,000 annually for cloud hosting services.

Halfway through the fiscal year, when performing your flexible budget variance analysis, you see that you’ve already spent $13,000, which means you’re pacing towards an annual cost of $26,000.

Now, because you’re using a flexible budget, this additional cost is already anticipated in the budget, so you’re good from that perspective. But you probably still want to know why the hosting cost went up and whether you need to make adujstments.

Let’s say your cloud hosting expense increased because several of your smaller customers grew exponentially and are now storing more data in your platform.

Pretty good thing (the assumption being that they’ve upgraded their subscription or added more users), so you’re probably fine with the larger expenses.

But what if the cloud hosting expense increased because of a price hike on the part of your vendor? Now you’re looking at a higher operational cost with no additional revenue benefit. Not so good.

This is why analyzing variance in a flexible budget is of critical importance.

It helps you identify the underlying causes behind variances (differences between projected and actual figures) and then create a reasonable plan of action.

Alright, enough of the who, what, when, and where. How exactly do you go about performing a flexible budget variance analysis?

How to Perform Flexible Budget Variance Analysis

1. Collect Data

Your first step is nice and easy. You’ve just got to pull together the financial data you need, like:

- Your previous budgets

- Financial statements

- Receipts

- Invoices

- Sales and production reports

But that’s easy, right, because you’ve got all of your data integrated into a financial planning and reporting platform like Finmark from BILL.

But what if you don’t?

Well, for now, you’ll need to sink a bit of time pulling all of that data. Then bookmark this guide and come back to it later: What Are The Best Financial Modeling Tools in 2023?

You’ll want to get all of your data in a single place to make performing flexible budget variance analyses on a regular basis a much simpler and less painful process.

2. Identify Variances

Now that you’ve got all of your statements in front of you, you’re going to look for any differences between budgeted figures and actual figures.

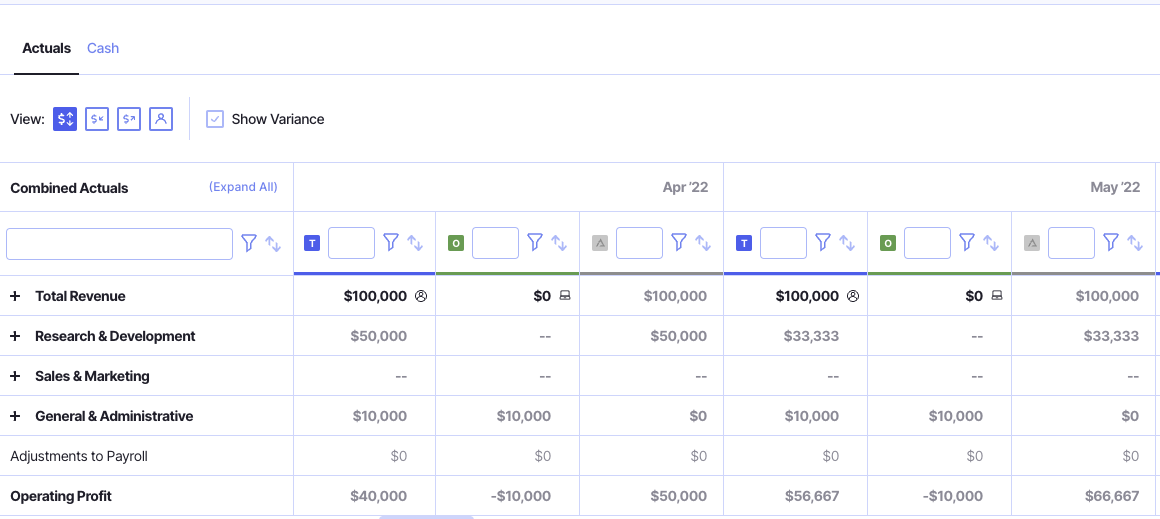

If you’re using a software platform like Finmark, you can create a budget versus actuals report and instantly see each line item where a variance is present.

Pro tip: Learn how to easily compare budget versus actuals in Finmark!

Remember, though, that you’re analyzing variance in a flexible budget. That means that you need to compare actuals not to your most recent version of the budget (which will have already updated itself to reflect actual projections) but to the original budget you created.

Scan through your data (or the variance report in the financial modeling tool of your choice) and identify the instances of variance you’d like to dig deeper into.

3. Review and Analyze the Variances

Here, you’re going to dig into the underlying causes and reasons behind variance.

Now, you don’t have to analyze every budget variance. Remember that variance is normal (nobody can predict the future with absolute precision, try as we might).

Many organizations decide on a threshold above which variance is considered “significant.” For instance, you might determine that any variance that is ±$1,000 or ±5% is significant.

There are no hard and fast rules here; set a significance threshold based on your company’s age, stage, and financial goals.

For the variances you wish to analyze, ask probing questions such as:

- Why did this happen?

- What factors contributed to this variance?

- How much control do/did we have over this variance?

- Is this variance related to growth or other external factors?

This step is all about looking for causes. Once you’ve identified the causes, you can start thinking about what needs to happen next.

4. Make a Plan For Action

Variance analysis without corrective action is simply the acquisition of knowledge without any actual impact on your business.

To make the most of your flexible budget variance analysis process, you want to put an action plan in place.

However, not all variances require action. Let’s go back to our example of cloud hosting.

If your analysis tells you that the cause of the cost increase was user growth, and this results in an increase in revenue, then you probably don’t need to do anything going forward.

But if, on the other hand, the increase was a result of a price hike, you might decide to look at alternative options or renegotiate your rates.

Use your analysis of underlying root causes to guide your change plans, put them into action, then monitor and review the impact of any changes.

Make Flexible Budget Variance Analysis Painless With Finmark

The longest and most time-consuming part of any budget variance analysis is the collection of the data you need to identify variances and then properly dive into their root causes.

But this is only the case if you don’t have your financial data integrated and easily visible in a central location.

That’s where Finmark comes in.

With Finmark, you can pull in all of your financial data by integrating it with the accounting software and other financial tools you’re already using.

Then, when it comes time to dive into variance analysis, you can pull up flexible variance reports that help you identify differences between actuals and budgeted figures.

Now all that’s left for you to do is identify root causes and create strategic plans for action!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.