How to Read a Cash Flow Statement: A Beginner’s Guide

As a small business owner or entrepreneur, you’re always looking for ways to better manage and understand your business. A key component of understanding your numbers is cash flow.

Cash flow is one of the most critical indicators of a business’s financial stability. In fact, according to a CB Insights analysis of over 110 startups, 38% of startups fail because they run out of cash.

So how can you get a better handle on your business’s cash? One crucial step is understanding your cash flow statement.

A cash flow statement provides an overview of the money entering and leaving your business, providing essential insight into operations and helping inform strategic decision-making.

Reading this financial statement may seem daunting, but with this beginner’s guide, we’ll take you through the fundamentals step by step.

What is a Cash Flow Statement?

A cash flow statement is one of the three basic financial reports—the other two being the balance sheet and income statement (or profit and loss statement).

It provides an overview of how much cash the business generates and where it’s being spent.

The cash flow statement differs from the profit and loss (P&L) statement. A P&L shows a business’s revenues and expenses over a certain period and whether it made or lost money.

But profit is different from cash flow.

A company can be profitable—i.e., show a net profit on its P&L—but have cash flow problems.

This can happen when a business’s revenue is tied up in accounts receivable, or it’s using a large portion of its cash to pay down debts or provide a return on investment to shareholders.

A cash flow statement differs from a P&L because it focuses solely on the actual money coming in and out of the business, regardless of when revenues are earned and expenses are incurred.

How Cash Flow Statements Are Prepared

Now that you know what a cash flow statement is, let’s go into the details of how this financial statement works.

There are two main methods for preparing a cash flow statement: direct and indirect.

Direct method

The direct method is relatively straightforward.

It involves totaling up all of the cash transactions in your business, such as cash received from customers, money paid to suppliers, debt payments, employee pay and salaries, paying income taxes, and more.

It ignores non-cash transactions, such as depreciation, accrued expenses, or unpaid invoices.

Indirect method

The indirect method of creating a cash flow statement involves starting with your business’s net income and adjusting for non-cash transactions such as depreciation, accounts receivable, and accounts payable.

Businesses can use either method to prepare their cash flow statements—both should result in the same figure for ending net cash flows.

However, most organizations use the indirect method because it uses readily available income statement and balance sheet data.

For that reason, we’ll focus on the indirect method in the rest of this article.

How to Read a Cash Flow Statement

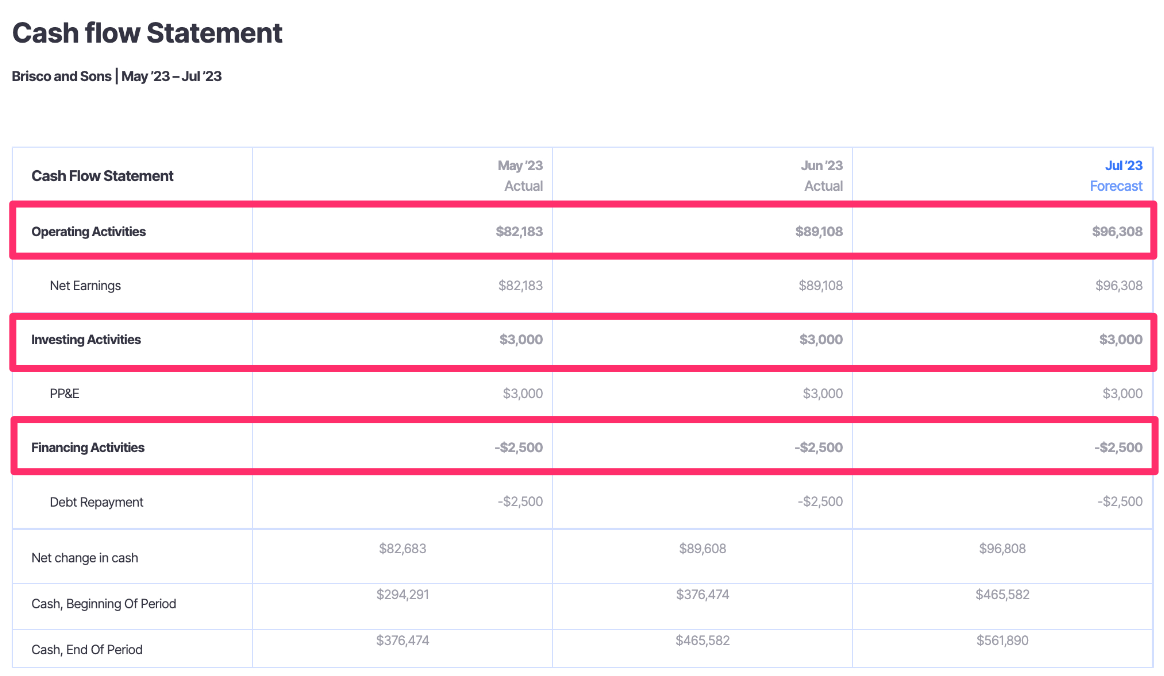

A typical cash flow statement divides cash inflows and outflows into three main categories:

- Cash Flow From Operating activities

- Cash Flow From Investing activities

- Cash Flow From Financing activities

Let’s look at each of these areas in more detail.

Cash Flows from Operating Activities

This section of the cash flow statement shows how much cash is coming in or going out from your core business operations.

This includes sales, operating expenses, inventory, receivables, and payables.

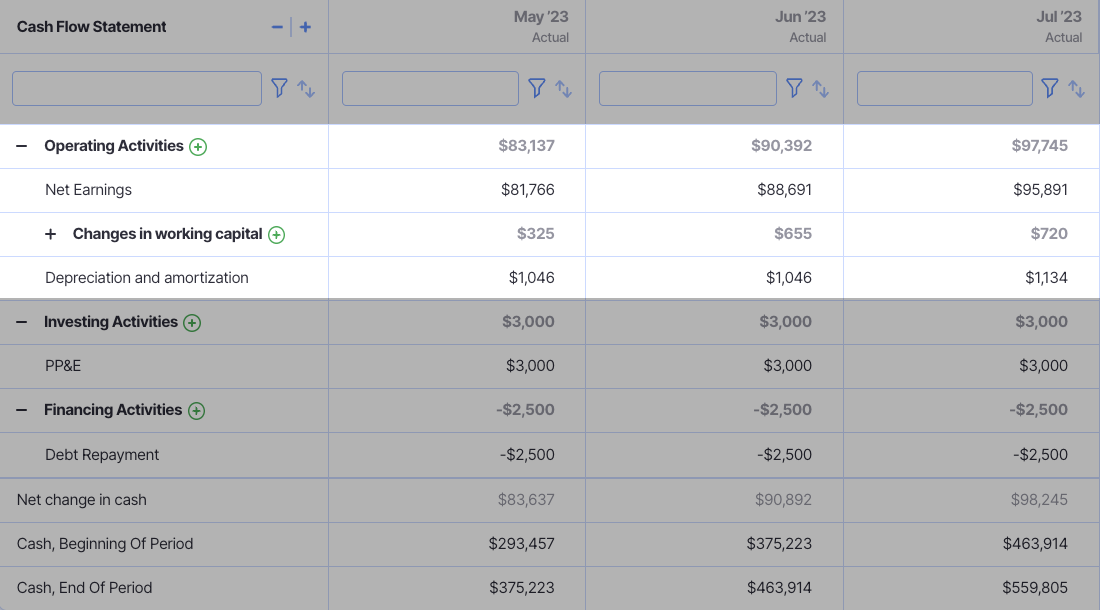

When you use the indirect method to prepare your cash flow statements, you start with your company’s net income, then make adjustments for any non-cash items reflected in that number.

First, you’ll see adjustments to reconcile your net income or loss to cash provided by (or used in) your operating activities. These are usually expenses that impact your company’s net income but don’t impact cash.

Some common items you might see in this section include:

- Depreciation and amortization

- Stock-based compensation paid to employees

Next, you’ll see adjustments for increases and decreases to current assets and current liabilities.

These adjustments are typically transactions that impact net income in the accounting period represented in the financial statements but impact cash in another period.

For example, say your accounts receivable balance increased by $1,000 from December 31, 2023 to December 31, 2024. This means that $1,000 of revenue on the books for 2024 won’t be collected—i.e., turned into cash—until 2025.

To accurately reflect your net cash flow for 2024, you need to remove $1,000 from your net income.

Other increases and decreases to current assets and current liabilities you might find in the operating cash flow section include:

- Inventory

- Prepaid expenses

- Accounts payable

- Accrued expenses

- Unearned revenues

Once these adjustments have been made, you should see a subtotal: your net cash provided by (or used by) operating activities.

Cash Flows from Investing Activities

Investing activities involve buying and selling assets or investing in other businesses.

Some examples include purchasing real estate or other fixed assets, investing in stocks, receiving income from investments, or proceeds from selling fixed assets or investments.

For example, say you purchased a new piece of equipment for your business and paid $10,000 in cash. This section of your cash flow statement would show:

Purchase of property and equipment: ($10,000)

But remember: this section of your cash flow statement only shows cash transactions.

So, say you financed part of the purchase, paying $2,000 down and signing a promissory note for the remaining $8,000 balance.

In that case, your statement of cash flows would only reflect the $2,000 cash transaction and any principal payments you made on the loan that year.

Once all these adjustments have been made, you should see a subtotal for your net cash provided by (or used by) investing activities.

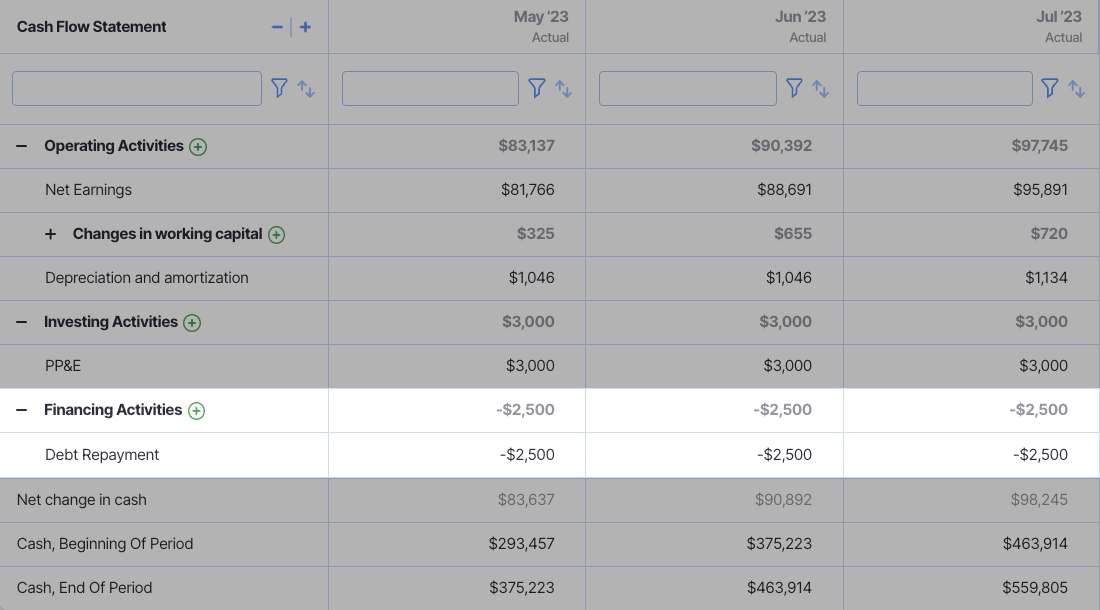

Cash Flows from Financing Activities

Financing activities involve financing the company’s operations through debt or equity.

For example, say you took out a $20,000 small business loan to provide the business with additional working capital. In that case, the financing activities section of your cash flow statement would show:

Proceeds from long-term debt: $20,000

Some other examples of items that might appear under financing activities include:

- Issuing shares of stock

- Payments on a loan or line of credit

- Borrowing money from banks or other lenders

- Repurchasing treasury stock

Once all these transactions have been accounted for, you’ll see a subtotal for your net cash provided by (or used by) financing activities.

The final few lines of the cash flow statement show your net increase or decrease in cash. This is the total net cash generated by (or used by) operating, investing, and financing activities.

When you add this figure to your beginning cash balance, the total should match the ending cash balance on your balance sheet. If it doesn’t, you’ve made an error somewhere.

Assuming the numbers reconcile, you’re ready to move on to evaluating your company’s financial health based on your cash flow statements.

Interpreting a Cash Flow Statement

To interpret your company’s cash flow statement, start by looking at the inflows and outflows of cash for each category: operating activities, investing activities, and financing activities. If all three areas show positive cash flow, your business is likely doing well (although there are exceptions).

If any of those areas show a negative cash flow, don’t panic. Dig into the numbers to see why you have negative net cash flow.

Let’s look at a few reasons you might have negative cash flow in each area.

Operating Activities

Having a negative operating cash flow can be a cause for concern.

This means you’re spending more cash in your business operations than you’re bringing in. If this trend continues, you could have difficulty paying employees or keeping the lights on.

However, there are some situations in which negative operating cash is expected. For example, if your business is in a startup or aggressive growth phase, you might spend heavily on marketing or product development.

In that case, you may have significant cash outflows now, but expect the company’s financial position to improve significantly in the future.

Investing activities

It’s also common for a company to have negative cash flow from investing activities when it’s investing heavily in growth.

For example, in capital-heavy industries, using cash to buy or improve buildings, machinery, or technology is a crucial part of growth.

When a business reports negative cash flows due to the purchase of fixed assets year after year, this can indicate that management believes it can generate a positive return on investment.

Financing activities

This is one area of the cash flow statement where positive cash flows aren’t always a good sign—you have to look a little closer to see where the cash is coming from.

For example, a large loan or drawing down from a line of credit can make this section of the cash flow statement look like the business generates cash when, in fact, it’s taking on more debt.

Negative cash flow in this section might mean the company is aggressively paying down debt or paying dividends to shareholders.

Get Greater Insight Into Your Cash Position

Knowing how to read and interpret your statement of cash flows can give you incredible insight into your company’s financial well-being because it paints a far more detailed picture than the profit and loss statement alone.

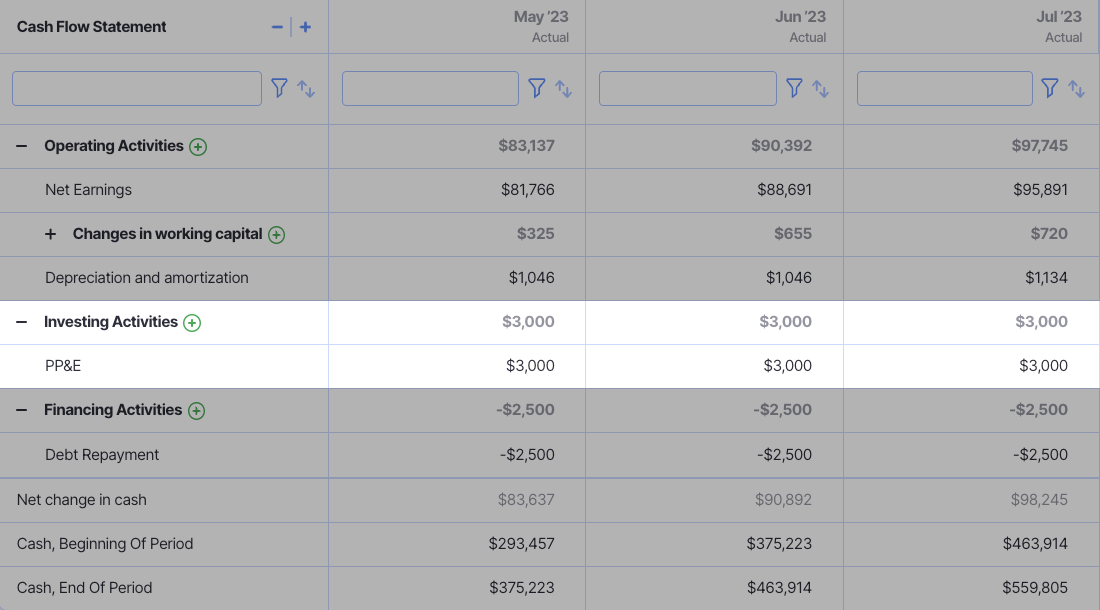

If you’re ready to manage your cash better, Finmark from BILL can help you manage, track, and forecast your cash flows.

Our platform integrates with your accounting software to create and update your statement of cash flows. And if you’re looking for a deeper view into where your money is going, you can customize your reports with subheadings and choose what to include so your financial reports provide the level of detail you need.

Get started with a free 30-day trial.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.