Indirect Method Cash Flow Statement: How & When to Use It

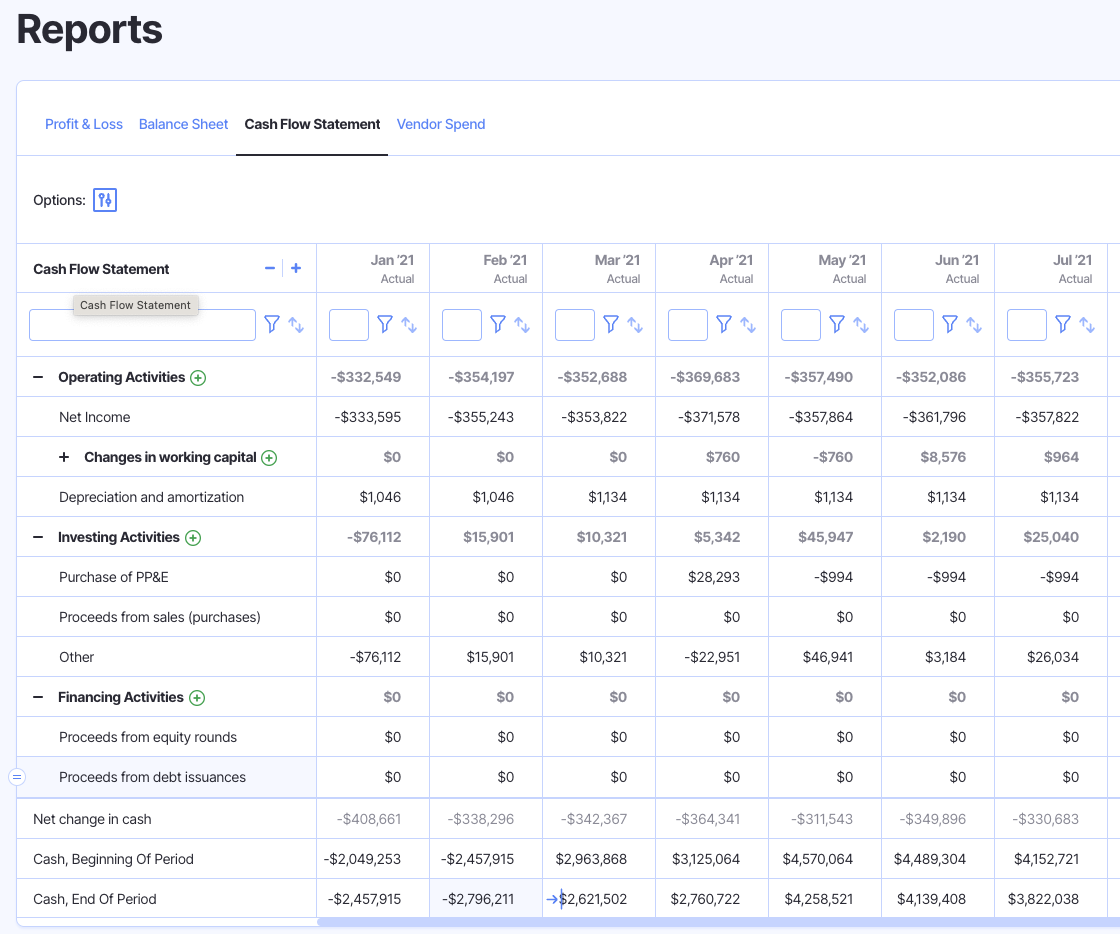

Of the three main financial statements, finance managers often turn to the cash flow statement for a real-time look into their current financial situation.

The insights provided by the cash flow statement can help them make short-term operational decisions, as well as long-term planning and investments.

While the other two financial statements–the income statement and the balance sheet–have a clear formula for creating them, the cash flow statement can be prepared in two different ways:

- Direct method

- Indirect method

The indirect method tends to be more popular given how much easier it is to create than the direct method, but there are some potential drawbacks to this approach that are important to keep in mind.

Continue reading to decide whether or not the indirect method cash flow statement is the right choice for your business.

What is the Indirect Method to Create a Cash Flow Statement?

The indirect method is one of the two treatments for creating cash flow statements.

It is used to reconcile the net income provided on the income statement under accrual-based accounting to the actual cash flows generated or used in operations during the period.

Investors, business leaders, and other stakeholders of the business are often interested in the operating section when doing a cash flow analysis.

It can help illustrate if the business can sustain itself on the cash it generates from operations, or if it requires external financing to stay afloat.

When preparing an indirect method cash flow statement, you’ll start with the net income reported on the income statement. Then, you’ll make adjustments for non-cash transactions that were made using the increases and decreases in balance sheet items over the period.

It’s important to note that the two methods for building cash flow statements are only applied to the operating section of the cash flow statement, not the investing or financing sections. Those two sections are calculated in the same way using either method.

When is the Indirect Method Used?

The most widely used method for building cash flow statements is the indirect method. This is because it is applicable to businesses that use accrual-based accounting, which most small businesses utilize.

Additionally, the accrual accounting method is , which public companies must adhere to for their financial reporting. So, the indirect method is most popular among these firms as well.

Plus, indirect method cash flow statements are also preferred by International Financial Reporting Standards (IFRS).

To meet the relevant regulations and reporting standards, companies of all sizes commonly utilize the indirect method for building cash flow statements.

If companies prefer to use the direct method for internal reporting, they’d still have to create indirect method cash flow statements for reporting purposes. Using the indirect method helps the finance department avoid doing double the work when generating cash flow statements.

How to Build an Indirect Method Cash Flow Statement

With a better understanding of why a company would choose to use the indirect method for cash flow statements, we can now break down the steps for putting it into practice.

Here is the basic formula for building an indirect method cash flow statement:

Net Income

+ Non-Cash Expenses

+/– Adjustments to Short-Term Assets & Liabilities

+/– Adjustments to Long-Term Assets & Liabilities

= Net Cash from Operating Activities

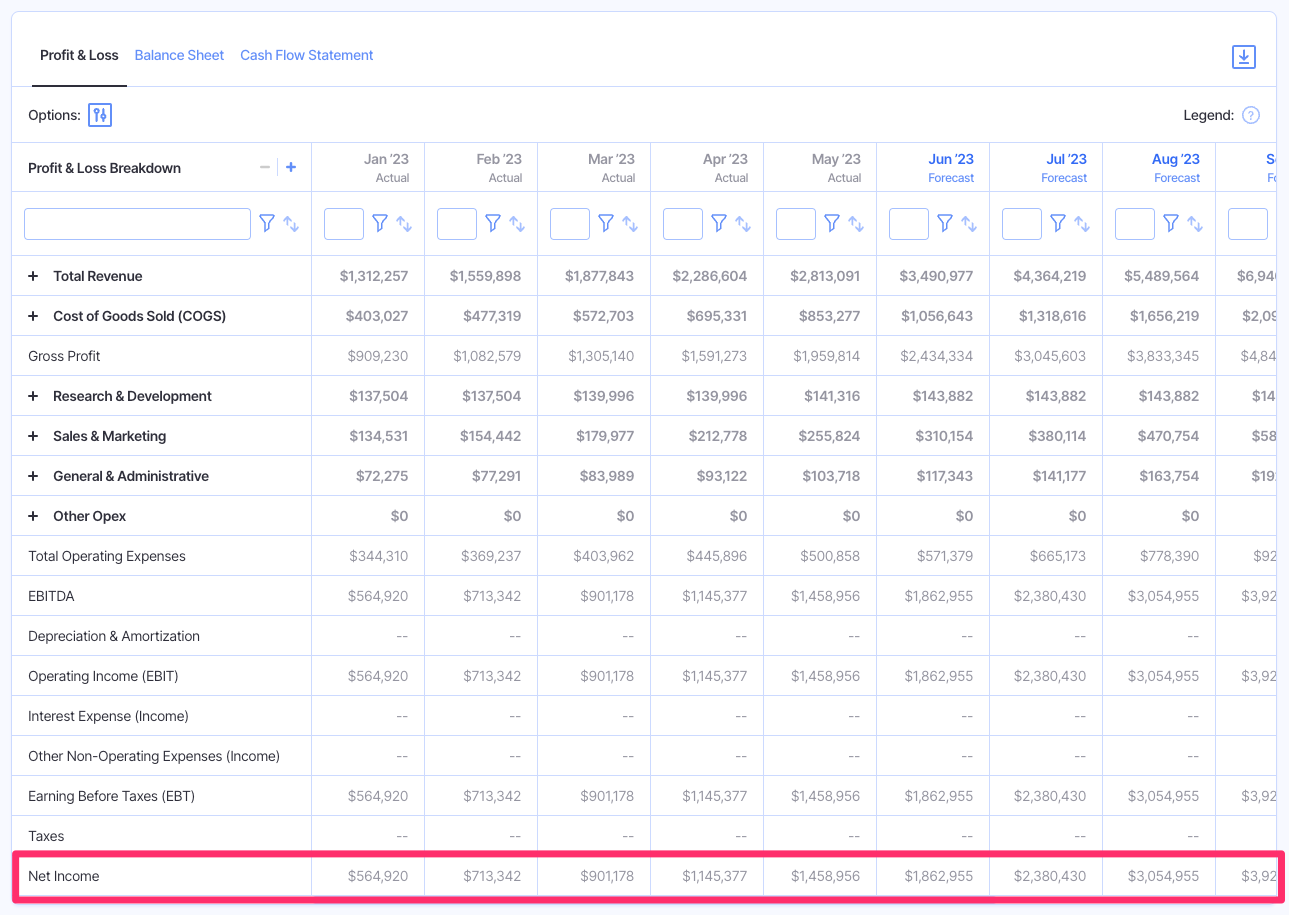

When using an intuitive financial planning tool like Finmark from BILL, you can build an indirect method cash flow statement and customize it to fit your business.

But, if you’re building it manually, the components of the indirect method come directly from items reported on the other financial statements. So, you don’t need to seek out additional information in order to prepare the operating section of the income statement with this method.

There can be some nuances and complexities that arise when deciding which items to add back and which to subtract when you complete this process by hand. So, let’s break this process down step-by-step to provide some more guidance for completing the indirect method.

Step 1: Calculate Net Income

The indirect method starts by taking the net income provided in the income statement.

You’ll likely already have this financial statement completed, so simply refer back to the figure that you’ve already calculated. If not, that will need to be done first before you can finish the cash flow statement using the indirect method.

Step 2: Add Back Any Non-Cash Expenses

Since net income includes non-cash expenses under accrual-based accounting, you’ll need to add back any expenses that were reported but didn’t require an actual cash outflow during the period.

Total up your non-cash expenses for the period and add them back to your net income. These expenses may include depreciation and amortization.

Step 3: Account for Changes in Current Assets and Liabilities

The next step is to adjust for any changes to your current liabilities and assets that involved non-cash transactions. This will typically involve your accounts payable and accounts receivable.

This step can be a bit confusing, so it’s important to get it right in order to create an accurate cash flow statement for your business. You will need to add back decreases to your current assets and subtract any increases.

Think of a current asset like your accounts receivable. If the account went up over the period, this means you earned the income, which would be accounted for in accrual-based accounting.

But, you didn’t actually receive the payment for this sale yet. As a result, you’ll need to subtract the amount that this account increased from your cash flow calculation.

If the account went down over the period, that means you got paid for a sale, and you can add that amount back.

On the other hand, you should add any increase in your current liability accounts and subtract any decreases.

Applying the same logic, a decrease in a current liability account like your accounts payable means you paid off a bill you owed, so you’d need to subtract this amount from your cash flow calculation.

If the accounts payable goes up, that means there hasn’t been a cash outflow yet, even if the expense was incurred according to accrual standards and reported on the income statement. So, you can add this amount to your cash flows for the period.

Step 4: Adjust for Changes in Long-Term Assets and Liabilities

You will also make adjustments to changes in long-term assets and liabilities.

If you had a sale of any property or equipment, you can add back any proceeds from the transaction. If you paid for any capital expenditures over the period, make sure to subtract them.

Utilize the same reasoning for adjustments to your long-term liabilities.

Step 5: Calculate the Operating Cash Flow

With all the above steps complete, you can now calculate your operating cash flow. The ending figure will tell you how much cash your operations generated or used during the given period.

You can then use this figure alongside your net cash flow from investing activities and net cash flow from financial activities to get your total net cash flow for the period.

Advantages of the Indirect Method Cash Flow

The indirect method comes with a number of advantages, which makes sense given its popularity. Here are some of the main benefits of this method.

Simpler to Create

The biggest advantage of indirect method cash flow statements is that the process to create them is much more practical and streamlined.

The formula relies on line items and financial data that have already been reported in the other two financial statements.

Thus, people preparing cash flow statements with the indirect method do not need to search for any information outside what is already readily available on the balance sheet and income statement.

Industry Standard

As we discussed above, the indirect method is the standard under IFRS and GAAP guidelines. So, finance professionals are likely already familiar with this method, and are more accustomed to the process of creating and interpreting its results.

Additionally, since the indirect method is more common, it makes it easier for business leaders to compare against industry benchmarks and peers.

Disadvantages of the Indirect Method Cash Flow

Despite the simplicity and historical preference for the indirect method among finance professionals, there are some drawbacks to this method.

Lacks Deep Insights

The indirect method for building cash flow statements lacks some of the granularity that business leaders may be looking for.

This method doesn’t show the individual transactions that are driving cash inflows or outflows. So, it can be difficult for finance managers to pinpoint exactly what’s dragging down their operating cash flow, or conversely, what’s supporting it.

Less Accurate

Since the indirect method is based on accrual accounting and the income statement, there may be some inconsistencies and inaccuracies when it comes to the timing of actual cash inflows or outflows.

The cash flow statement is meant to show the cash-based transactions that occurred during the period. But, there can be some limitations given you’re reconciling the net income statement to the operating cash flows, not calculating it directly from transactions made during the period.

Wrapping up Our Discussion on Indirect Method Cash Flow Statements

The indirect method for cash flow statements may have its limitations, but it’s still the popular choice among finance professionals.

It’s easier to calculate using information from the other financial statements, and can better show the relationship between your net income and the cash flow generated during the period.

With Finmark, you can make better business decisions by building out accurate cash flow statements, customizing your dashboards to track the metrics that are most relevant to your operations, and much more.

See why hundreds of businesses rely on Finmark for financial decision-making and start your 30-day free trial today!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.