Driver-Based Planning: How Experts Build Forecasts

Building simple financial forecasts is pretty straightforward.

You look at past performance (say, what you were doing last year), and project this forward for the coming financial period.

The problem is, simple forecasts aren’t always that accurate, and they don’t take into account any new growth initiatives you have in play.

For many finance leaders, all of that stuff is really guesswork, informed by what their department heads tell them is going to happen.

But there’s another way. A better way. And it’s called driver-based planning.

What Is Driver-Based Planning?

Driver-based planning is a form of financial planning that uses revenue drivers to understand how strategic initiatives might impact revenue growth.

Let’s back up, then, and explain what revenue drivers are.

Revenue drivers are the activities and investments you have influence over that can literally drive more revenue.

Most commonly, they fall into either the marketing or sales camp.

For instance, upping your sales team headcount might be a key revenue driver for your company, as might Google Ads.

Other examples of drivers could be sales channels (e.g., partners, affiliates, FB ads, etc.), customer success reps, or capacity (think # of seats in a stadium or airplane). These drivers are all adjustable and tie directly to potential revenue.

One real-life example of the benefit of driver-based planning is airlines. They continuously add more seats (driver) to planes to increase their capacity. They also adjust things like carry-on limits (driver) to create new opportunities for revenue.

When they’re building a forecast, they have to account for the maximum seat capacity of different planes as well as luggage capacity. When they’re planning for ways to increase revenue, they can consider adding more seats, changing carry-on requirements, or other adjustments to their drivers.

The point here, however, is that the drivers are verifiable. That is, they are things you’re doing that drive revenue, and if you up your spend or capacity in that driver, you’ll create more revenue (so, they aren’t assumptions).

Driver-based planning, then, uses your understanding of these drivers to make more accurate financial plans. It’s a more holistic approach to forecasting where you account for all the different factors that drive business, not just the end result.

What’s The Purpose Of Driver-Based Planning?

The primary reason for adopting a driver-based planning approach is that it makes it easier for your to build accurate forecasts.

Once you know what your key drivers are and how they impact revenue, you can design a model and then adjust the drivers to get a more realistic idea of how much revenue your business can generate.

From here, you can engage in driver-based budgeting to build realistic spending budgets that drive growth initiatives.

Also read: Driver-Based Budgeting: How to Level Up Your Financial Plan

How To Implement Driver-Based Planning: 7 Steps

Follow these seven steps and start using driver-based planning to create more realistic forecasts, budgets, and growth plans.

1. Get Clear On Organizational Goals

Good financial decision-making is strategic, and it’s impossible to be strategic about any decisions without a clear understanding of where you’re aiming to steer the company.

To be clear, this step is not exactly about setting organizational goals; you should already have those.

Rather, it’s about reestablishing clarity around what those goals are, and what they mean from the perspective of the finance team.

You’ll also want to make sure they’re detailed enough to work with effectively. “Grow revenue” is nice, but insufficient to formulate a decent financial plan.

“Increase revenue by 50% in the next three quarters” is better, and something you can actually measure.

On that note, now is a great time to ensure you have some solid financial metrics in place. Metrics help to quantify progress, so that the impact of any changes you pursue can be objectively measured.

Common metrics that financial leaders track to measure success include:

- ARR (annual recurring revenue) and MRR (monthly recurring revenue)

- CAC (customer acquisition cost)

- LTV (customer lifetime value)

- Customer churn rate

- MAU (monthly active users)

Lock in these objectives, then keep them in the forefront of your mind as you move through the remaining six stages of the driver-based planning process.

2. Identify Your Most Important Revenue Drivers

This step is arguably the most crucial; identifying the actual levers you can pull to drive revenue.

Use your historical revenue data to ascertain which tactics, actions, and activities have delivered the biggest changes in revenue.

Whenever you’ve experienced a period of revenue growth, dig deeper. Ask, “What changes did we make or occurred prior to this revenue growth?”

Some common examples of revenue drivers (to give you an idea of where to look) include:

- Advertising (social media, digital banners, Google Ads)

- Content (SEO, blogs, webinars, ebooks)

- Promotions

- Headcount (new sales reps)

- Product developments and new feature rollouts

Figuring out what your revenue drivers actually are can be a tricky process. Sometimes things that occur before revenue growth aren’t the reason for that growth (correlation doesn’t always equal causation).

Don’t stress too much about this at this stage. In the latter steps of our driver-based planning process, we’re going to validate these models.

3. Create Relevant Models

With your revenue drivers discovered, it’s time to build some models for financial success.

At the simplest level, driver-based models assert that, “If we do X, Y will happen to revenue.”

Let’s say, for instance, that one of your revenue drivers is headcount in the SDR (Sales Development Rep) team.

You know that for every SDR you onboard, you can book an additional 30 meetings a month. Each AE (account executive) can handle 6 meetings a day, so roughly 120 per month, from which they’ll close 10 new customers.

So, by increasing your headcount (driver) by 4 SDRs and 1 AE, you can add 10 new customers a month.

Assuming the revenue you drive from those new customers is higher than the cost of hiring, onboarding, training, and paying those sales reps, then you have a profitable model.

This stage is just about creating the models. We’ll validate them shortly.

4. Obtain Feedback From Team Leaders

Before you start pouring money into those drivers and validating the models you’ve created, it’s a good idea to run your plans by your department leaders (it’s part of being a good finance business partner). There’s a fair chance they’ll have some valuable insights for you.

Let’s take the above example.

If that model works, it’s reasonable to assume that you can just hire a ton of new sales reps to meet your revenue growth goals this quarter.

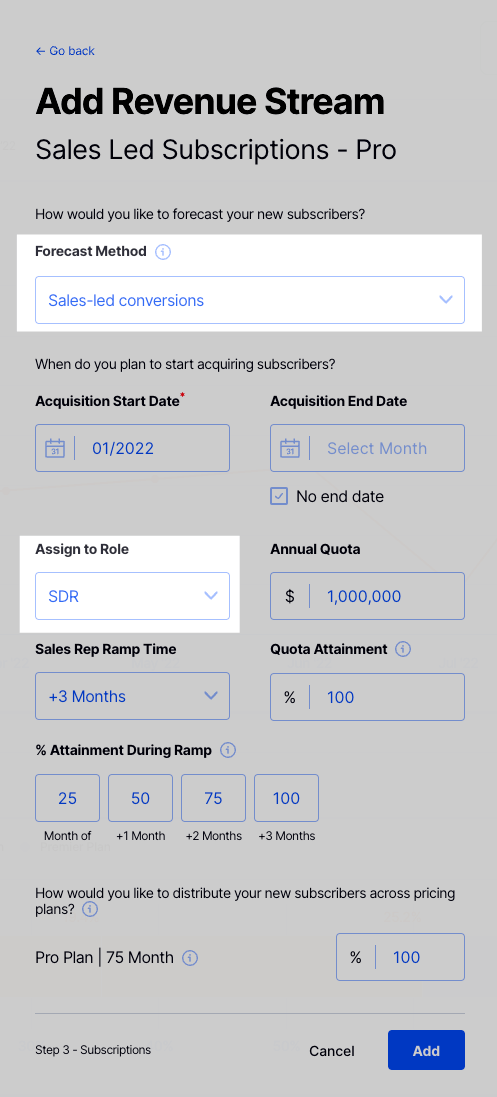

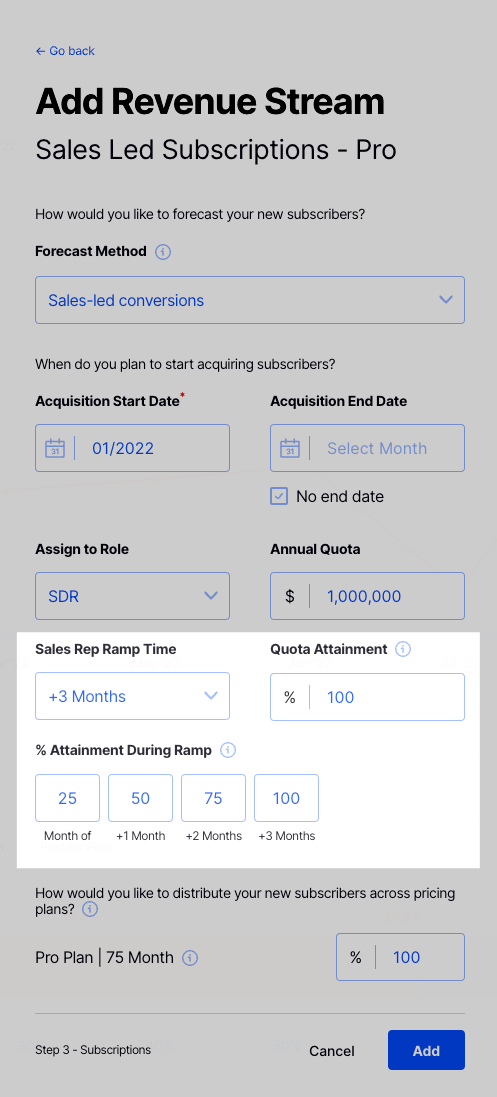

But by having your VP of Sales review your model, you come to learn that you need to account for ramp time (the amount of time that it takes for a sales rep to reach quota attainment).

As such, you’ll need to adjust your model to suit, and increase the total costs and timeline until those new reps are actually driving revenue.

Ask your department head for any feedback they might have on your driver-based models, and then move forward.

5. Validate Assumptions and Models

Now it’s time to put those models to the test.

You’ve designed a model, which is based on certain assumptions about activities that drive revenue. This is your hypothesis.

Now, it’s time to design the experiment.

Let’s say you’ve identified that advertising on a given podcast network is a key revenue driver. You’ve determined that for every $10,000 you spend on ads, you can drive an extra $30,000 in revenue.

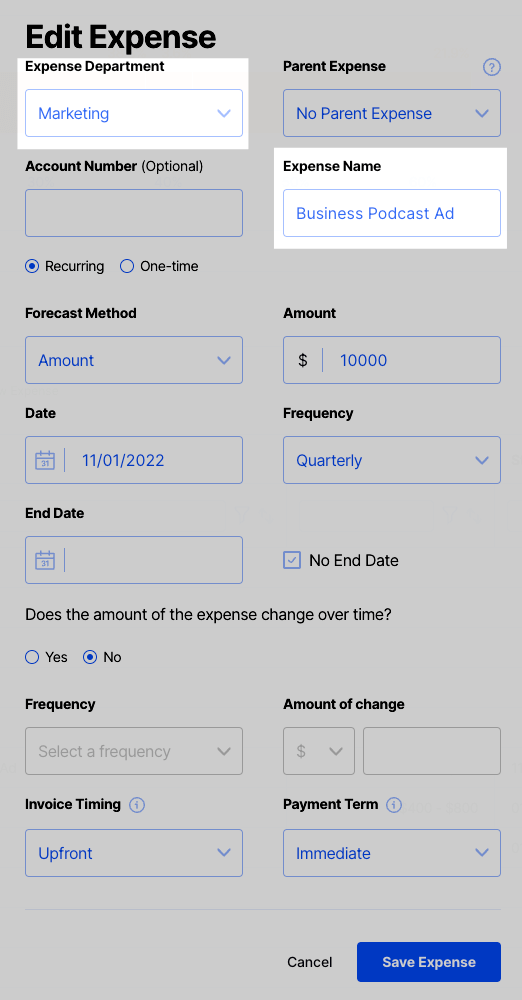

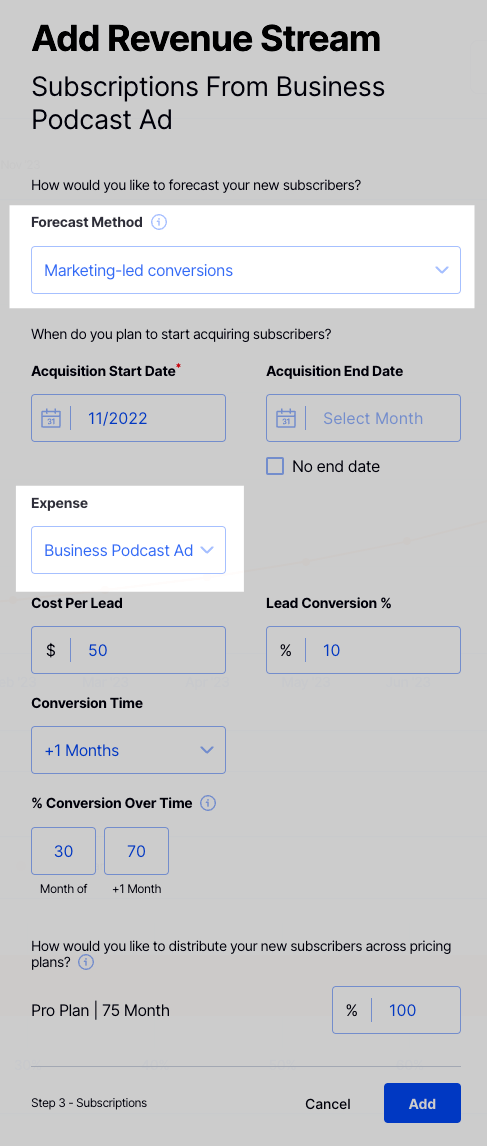

With Finmark, from BILL, you can easily forecast revenue based on marketing expenses. First, create a marketing expense, which in this case, is a podcast ad.

Then we’ll create a revenue driver based on this expense to forecast how much revenue we can expect to generate from our podcast ads over time.

The process here is pretty simple then. Invest $10,000 in ads, and monitor revenue growth following that investment.

Be careful to watch for diminishing returns here. You might find, for instance, that the first $5,000 investment drives $18,000 in revenue, and that the second only creates another $12,000.

Investing $30,000 in ads, then, might not give you the $90,000 in revenue you thought it would.

Once you’ve established valid, accurate revenue driver models, you can use them to inform the planning process.

6. Create And Implement Plans For Change

Remember how we made a big fuss of getting clear on your organizational goals back at step one?

Well, here’s where you’re gonna need them.

Driver-based planning is, as you can probably guess from the name, an approach to making financial plans, and these plans are in pursuit of organizational goals.

It’s not all that different from any other kind of goal-based planning, except that you have a really clear understanding of what levers you can pull to help you achieve those goals.

Let’s say that you have a goal of onboarding 300 new customers in the next financial year.

You’ve built your models, and you know that by investing in 10 new sales reps (7 SDRs and 3 AEs) you can close 100 new customers a quarter, or 400 a year, which is well in excess of your goal of 300 new customers.

However, you’ve run that model past your sales leader (because you’re an amazing finance leader), and you now know that it’s going to take a quarter just to hire, onboard, train, and ramp those reps.

So, if you start now, you’ll have 10 new salespeople by the start of quarter two, who’ll close your goal of 300 new customers by the end of the year.

Perfect

7. Test, Optimize, Repeat

No plan is perfect the first time around. Not even one built using a driver-based planning model.

As you learn more about your business, your revenue drivers, and the impact you can have on revenue growth and progress toward organizational goals, continue updating your models.

If, for example, you reach a point of diminishing returns with a given driver, update your model, and consider what other revenue drivers you might be able to leverage.

As the market, your business, and your customers develop, optimize and edit your models, and apply those changes to the driver-based plans you have in place.

Build a More Accurate Forecast With Driver-Based Planning

For ambitious and strategically-driven finance teams, driver-based planning is basically a non-negotiable.

It’s a solid model for understanding what activities and investments have the biggest impact on your profitability and ability to drive revenue growth, as well as for designing effective budgets that actually move the needle.

To implement driver-based planning effectively, you’ll need to be able to create and analyze multiple scenarios, design revenue forecasts, and automate headcount planning.

Get all of this and more done with Finmark, the financial modeling platform for strategic finance leaders.

Sign up for a free trial today to check it out!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.