Cash Flow Statement vs. Balance Sheet (Compared)

For a comprehensive assessment of a business’s financials, you need to understand how to analyze each of the main financial statements and how they are interconnected.

This includes the cash flow statement and balance sheet, which investors, business leaders, creditors, and others will often refer to as a way to gauge the business’s financial standing and health.

As you continue reading through this article, we will lay out the main differences between a cash flow statement vs balance sheet so you can see what they can each tell you about your business’s finances.

You’ll be able to see how the two statements are interconnected and why you’d want to analyze both together to derive deeper insights.

What Is a Cash Flow Statement?

The cash flow statement breaks down the sources for cash inflows and outflows during a specific period.

More specifically, the cash flow statement reflects where the company generates cash from, and what its main uses are.

This financial statement shows the sources and uses of cash in three distinct sections:

- Cash Flow From Operating Activities

- Cash Flow From Financing Activities

- Cash Flow From Investing Activities

The sources and uses of cash from each section are totaled to determine the net cash flow generated or used by the company over the period.

There are two main methods that can be used to build a cash flow statement, which are the indirect method and the direct method.

These methods only apply to the operating section, and will both result in the same net cash flow figure for the business.

Choosing which method to utilize is a decision that companies make internally based on the unique insights they want to gather about their business in addition to the preferences of their team.

Having an accurate view of your cash activities helps with future financial planning, allowing you to make data-informed decisions to ensure your business has enough cash on hand to meet short-term liquidity needs.

And Finmark from BILL can help here. You can easily create and analyze your cash flow statement and keep it up-to-date.

What’s the Purpose of a Cash Flow Statement?

The cash flow statement is based on cash-based accounting principles, meaning it focuses on the actual cash that flowed in or out of the business during a given period.

This means a transaction is only accounted for on the cash flow statement when the cash has actually exchanged hands, not just when it’s incurred or reported under accrual-based accounting practices.

Thus, the cash flow statement is necessary to reconcile the non-cash items that were reported on the income statement–like depreciation expense or the incurred income tax liability.

It is meant to give businesses an objective assessment of how much cash they have on hand, and whether their cash balance went up or down over the period.

Once the statement has been prepared, the business can perform a cash flow analysis to dive deeper into the items on the statement and make informed decisions about how to optimize their activities for better net cash flow.

In other words, the cash flow statement helps show business leaders whether they’ll have enough cash on hand to meet their short-term obligations, or if they’ll need to secure external financing to remain solvent.

What Is a Balance Sheet?

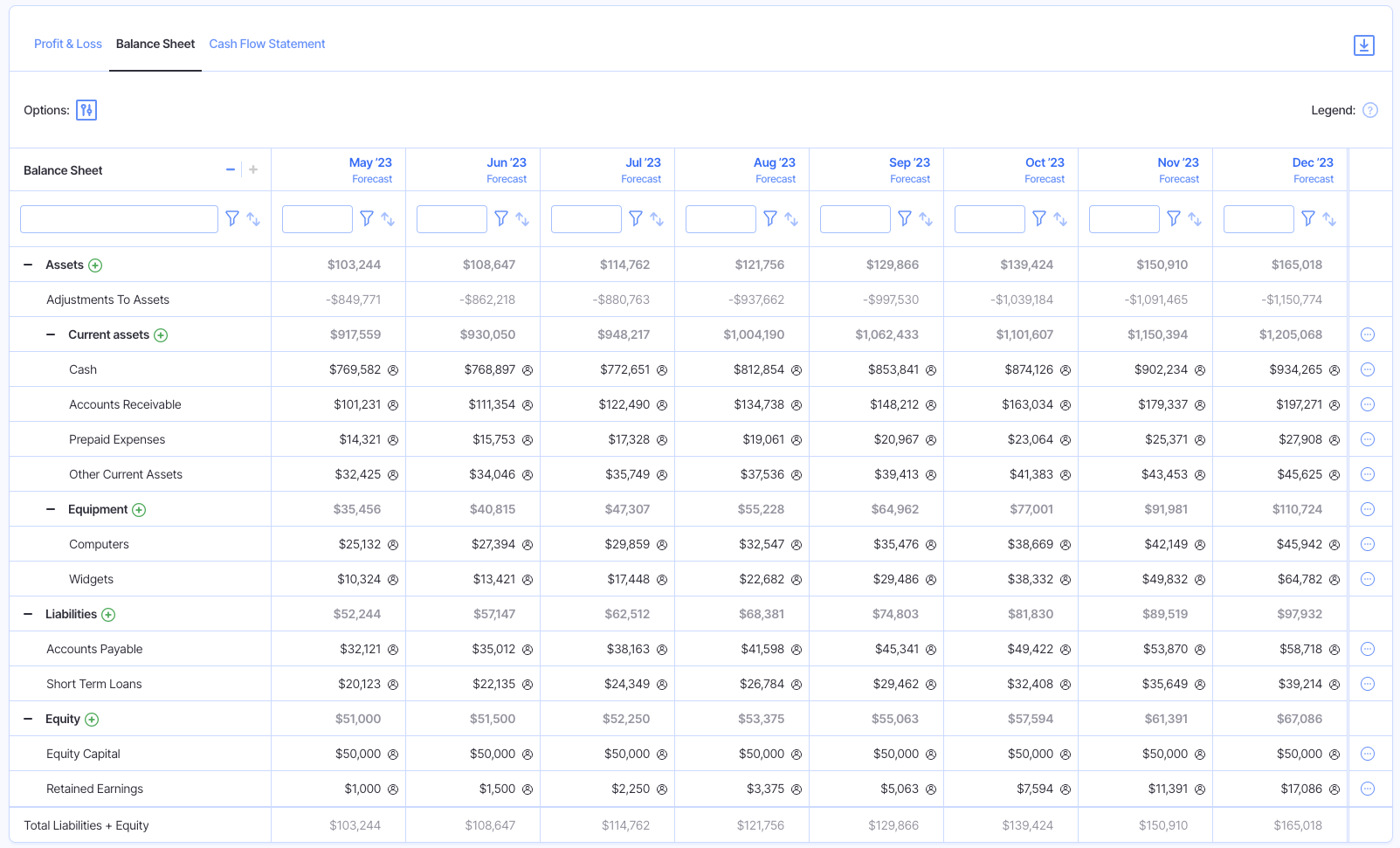

A balance sheet gives companies a snapshot of what they own and what they owe, represented by assets, liabilities, and shareholder’s equity.

The basic formula for the balance sheet is as follows:

| Assets = Liabilities + Shareholder’s EquityOR

Shareholder’s Equity = Assets – Liabilities |

On the balance sheet, the assets section refers to everything the business owns, the liabilities reflect what they owe, and the shareholder’s equity section shows how much money has been invested in the business by shareholders.

Here are some examples of asset accounts that you would find on a balance sheet:

- Cash and cash equivalents

- Accounts receivable

- Inventory

These are some of the liability accounts that are typically shown on a balance sheet:

- Debts

- Accounts payable

- Wages payable

- Income tax payable

Like with cash flow statements, you can use Finmark to build your balance sheet using up-to-date financial data from multiple sources.

This gives you an accurate picture of where your asset and liability accounts stand at a given time, which can aid in future financial planning.

What’s the Purpose of a Balance Sheet?

The balance sheet offers an overview of the company’s financial position at a given point in time.

As the name might suggest, the formula for this financial statement is designed to always remain balanced, with both sides of the equation equalling each other at all times–even when a transaction occurs.

For instance, if the company uses cash to pay down its debt liability, the cash asset account and debt liability account would be reduced by the same amount to keep the equation balanced.

In addition, the shareholder’s equity section of the balance sheet reflects the company’s book value.

It represents the amount of money that would be returned to shareholders in the event that all the business’s liabilities were liquidated and all outstanding debts were paid off.

This section also includes retained earnings, or the amount of net income that was not paid out to shareholders as dividends, and was retained by the company to fuel future investments or pay down debt.

Comparing Cash Flow Statement vs Balance Sheet: How They’re Connected

It’s evident that the cash flow statement and balance sheet offer two very different purposes as it relates to financial reporting.

But, both can be used to assess the company’s financial health and help with future planning.

As a reminder, the balance sheet provides a snapshot of the company’s liabilities and assets at a given time.

On the other hand, the cash flow statement shows the activities that occurred during the period that contributed to any changes in account balances.

Let’s compare the cash flow statement vs balance sheet for a company to further understand where the two differ and how they’re related.

|

|

From this example, we can see how the company’s account balances ended for the period using the balance sheet.

But, without any supplementary information, we don’t know what activities contributed to these values, or how these balances may have changed from the previous period. We only know what the company owes and owns at the end of the period.

Overlaying the balance sheet with the reported activities on the cash flow statement, we can start to get a more cohesive picture of what contributed to these account balances.

For instance, we can see the long-term debt value of $125,000 in the liabilities section of the balance sheet came from debt that was issued during the period, as displayed in the financing section of the cash flow statement.

Further, we can take a look at the purchase of $12,000 made for property, plant, and equipment (PPE) in the investing section of the cash flow statement.

The value of the PPE asset account on the balance sheet was $38,000, so we now know the company started the period with a balance of $26,000.

The additional details that you’re able to garner by assessing the two statements together offer a much clearer picture of how the financial position of the company improved or deteriorated over the period.

Final Thoughts on the Cash Flow Statement vs Balance Sheet Comparison

There is no need to compare whether a cash flow statement or balance sheet is more important.

They both reveal unique insights and information about a business’s finances and can be used to create informed future decisions and forecasts.

When you’re using a financial planning tool like Finmark, it’s easy to create real-time financial statements like a balance sheet or cash flow statement using current data.

You can compare current data vs historical performance, make reliable forecasts, and derive deep insights from your financials to make informed decisions.

See why hundreds of businesses use Finmark for better financial decision-making with your 30-day free trial today.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.