Cash Flow Statement vs. Income Statement: What’s The Difference?

Using the common three statement model for financial reporting, business leaders need to know the main differences between each of these statements to really know what’s going on with their finances.

Specifically, the cash flow statement and income statement represent the company’s financial position in two different ways.

But, you may be uncertain about what the actual differences between the two are, and how you can use them each to make data-driven decisions about your business.

Read through this article as we lay out the main differences between a cash flow statement vs income statement.

We’ll break down how the two are interconnected and why business leaders need to analyze both for a full view of the company’s finances.

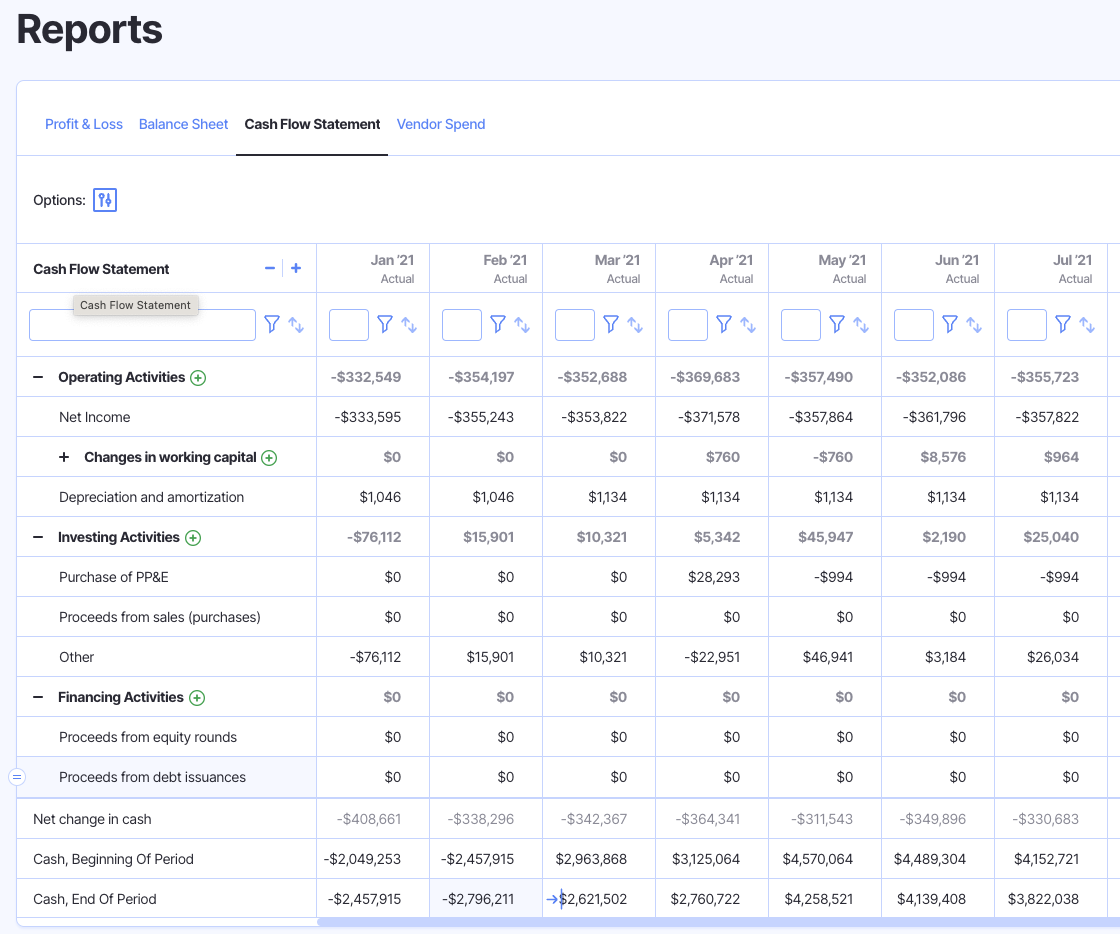

What Is a Cash Flow Statement?

The cash flow statement shows a business’s uses and sources of cash over a given time frame. The statement breaks down these sources and uses in three different categories:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

There are two different methods for calculating a cash flow statement–the indirect method and the direct method–though they both come out with the same results.

The indirect method tends to be the most popular method for ease of use and scalability. However, the choice over which method to use is a decision each company will make internally.

The calculations will look differently depending on the method utilized. But, the general idea of the cash flow statement is to show the actual cash inflows and outflows that a business experienced during the period.

Either method will result in the same total net cash flow figure that investors and business leaders are interested in.

They can then use this figure to perform a cash flow analysis to make important business decisions that will help them use their cash more efficiently.

With Finmark from BILL, you can easily create cash flow statements using your current financial data.

The tool allows you to make accurate cash flow projections to assist with future financial planning for the business so you can make data-informed decisions to optimize cash flows.

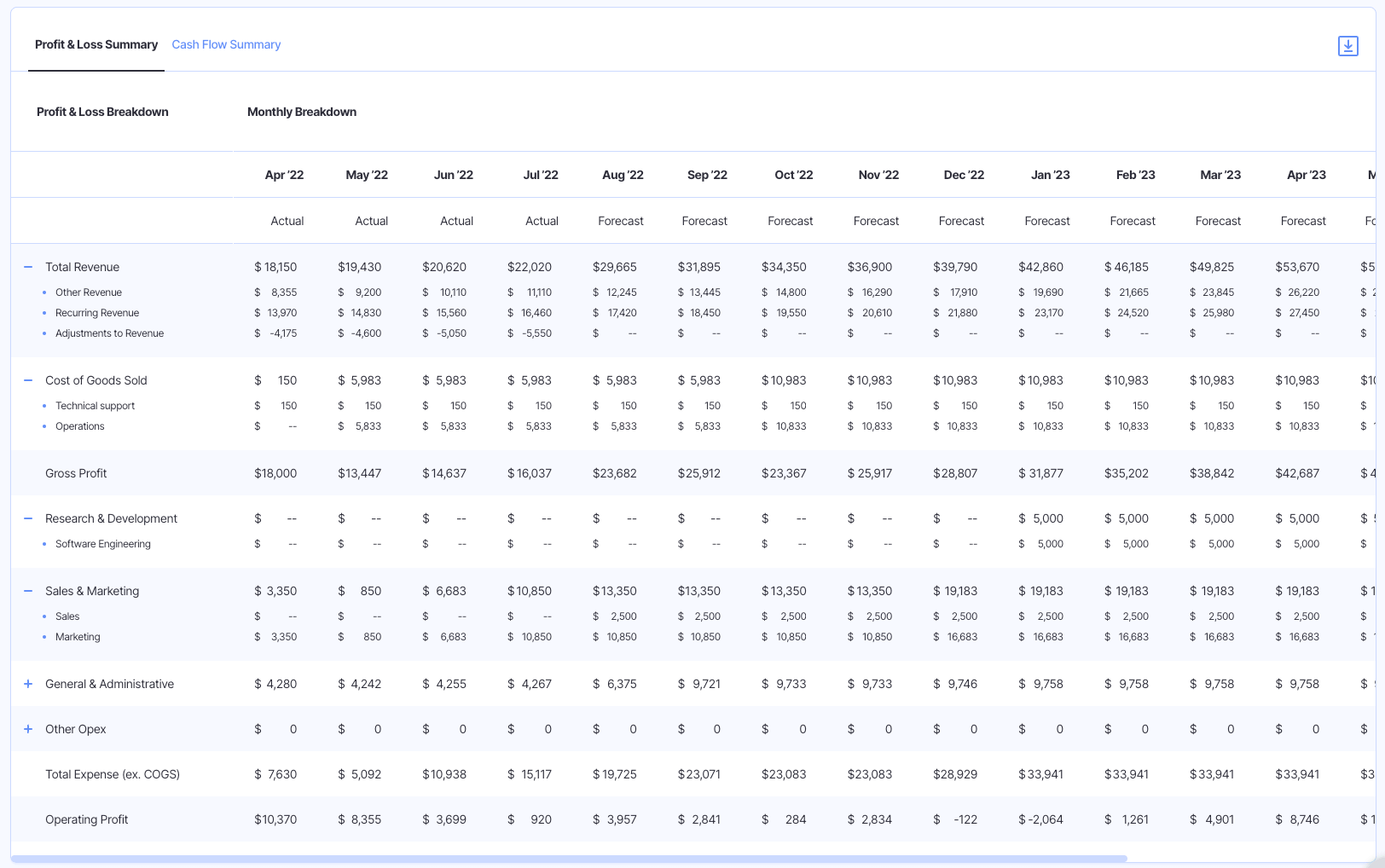

What Is an Income Statement?

The income statement, sometimes referred to as the P&L statement, is a summary of the profits or losses a business generated for a given period of time.

This statement shows the total revenue minus the total expenses, including non-cash items like depreciation expense in the calculation.

Companies will often prepare an income statement on a regular basis, like monthly, quarterly, or annually.

The income statement is what gives us headline figures like total sales, gross profit, net income, and others that are commonly referenced by business leaders, investors, and other stakeholders.

Thus, the income statement to gauge a company’s financial performance and assess their profitability.

Like with the cash flow statement, you can use Finmark to conveniently and accurately generate an income statement for your business with real-time financial data.

Easily look ahead at future projections for the income statement to see how your profitability may change with different variables taken into account.

Comparing Cash Flow Statement vs Income Statement

The two statements have distinct purposes that differ from one another and provide their own unique insights.

However, they are intertwined and highly correlated, so it’s important to know where the connection comes from.

The main link between the two statements is through the net income figure that is calculated on the income statement.

This figure becomes the first line of the net cash flow from operating activities section on the cash flow statement when using the indirect method.

Since the starting point for the cash flow statement depends on the net income figure (as well as findings from the balance sheet) this statement cannot be completed until the others have been done first.

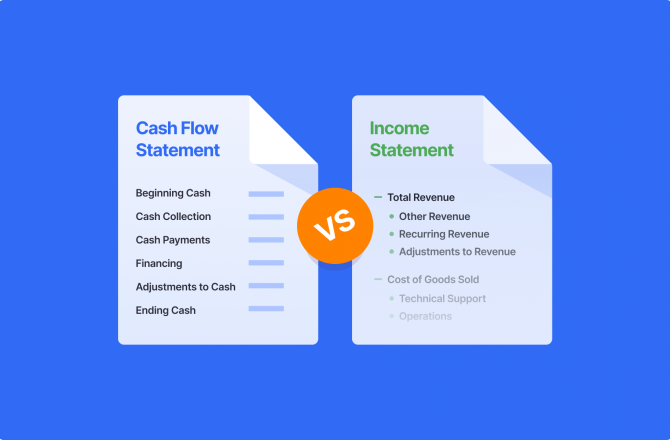

Here’s an illustration of the key components found in each of these statements so you can see the close relationship and where some of the overlap is.

|

|

Overall, the main difference you’ll find between the two statements is how they treat non-cash items.

Again, the cash flow statement is more focused on the actual cash inflows and outflows for a business over a given period of time.

On the other hand, the income statement formula is based on accrual accounting principles, including non-cash items like accrued revenue, depreciation expense, taxes payable, and others in the net income calculation.

This is why you’ll see the depreciation and amortization expense subtracted from revenues to get to the net income figure on the income statement.

But, since this is not an actual expense that led to a cash outflow, this amount is added back on the cash flow statement to provide a more accurate picture of the cash that left the business.

The direct tie between the two statements means a higher net income will drive a higher net cash flow, all things being equal.

Though this will result in a higher income tax liability, remember that this will be added back to the cash flow statement until it has actually been paid.

Why You Need Both Statements for Comprehensive Financial Analysis

There is no one statement that offers better financial insights than the other.

Both the cash flow statement and income statement provide a unique view into the finances of a business, and are necessary to the overall understanding of how the company is operating.

Insights Provided by the Income Statement

The income statement provides a measurement for the company’s financial performance and profitability.

This tends to be the most commonly looked at statement by investors and stakeholders, with the reported profit margins and net income levels being a way for them to easily compare the performance of different companies.

Monitoring this statement over time will help the business track changes in their profitability, determine where they could cut down on expenses to drive better margins, and other factors.

Insights Provided by the Cash Flow Statement

The cash flow statement offers a precise look at where the company is generating cash, and what the main uses of it are.

Many view it as an objective measure of how much cash a business actually has available to use and how efficiently they are using it.

An assessment of the cash flow statement will help a company determine if they have enough cash on hand to cover short-term liabilities, or if they will face solvency issues.

Putting It All Together

Assessing the two statements together is the best way for business leaders and investors to gain a comprehensive picture of a company’s financial heath.

Doing so can help them better manage working capital more and evaluate their investment opportunities more effectively.

Using the above example, we can see the clear differences between the two and the importance of analyzing both statements together.

In fact, in this example, the net cash flow figure of $223,700 is more than double the net income of $105,950.

Business leaders could make poor planning choices if they are making decisions based on the results from just one of these statements.

Assessing the net income figure alone, business leaders may start to worry about liquidity, look for ways to cut down on costs, forego certain investments, and even consider seeking out external financing sources.

But, overlaying net income results with the net cash flow that was generated for the period will show that they actually have more cash on hand than they may have feared.

Thus, they can still deploy cash to pursue investment opportunities and may not have the liquidity issues like they originally thought.

Wrapping up Our Comparison of Cash Flow Statement vs Income Statement

Business leaders need to know the key differences between a cash flow statement vs income statement to gain a clear assessment of their financial position.

But, analyzing them both together offers deeper insights that they can use for effective planning and forecasting.

When using Finmark, it’s easy to assess both of these statements using up-to-date data for an accurate view into your business’s financial health.

This direct view helps you make decisions and adjustments faster, making your operations more efficient in real-time.

Try Finmark for free for 30 days to see why hundreds of businesses trust us to help them make important financial decisions.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.