Cash Flow vs. EBITDA: What’s The Difference?

When it comes to keeping track of the financial health of your business, it pays to have a firm understanding of the various terms and accounting methods available.

This is particularly true if you find yourself comparing your organization to others, such as may be the case when sourcing investor funding.

Cash flow and EBITDA are two commonly used measures of financial performance. They’re also very often confused, with many using the two terms interchangeably.

EBITDA and cash flow are similar, yes, but they are definitely not the same thing.

In this guide, we’re going to explore the differences between the two, explaining when each is best used, and how to interpret the financial insights either measurement can provide.

Cash Flow vs. EBITDA: Primary Differences

Both cash flow and EBITDA look at a company’s financial performance.

Cash flow considers all revenue expenses entering and exiting the business (cash flowing in and out).

EBITDA is similar, but it doesn’t take into account interest, taxes, depreciation, or amortization (hence the name: Earnings Before Interest, Taxes, Depreciation, and Amortization).

While both can be considered measures of financial performance, and methods for comparing the performance of two or more companies, only cash flow is recognized by the GAAP (Generally Accepted Accounting Practices) as an official measure of financial performance.

Still, business leaders and investors alike find EBITDA to be a helpful metric for comparison, particularly between companies of different sizes or regions. That’s because accounting practices surrounding taxes and interest may differ significantly between regions, and this can distort comparisons on the basis of cash flow alone.

What is Cash Flow?

Cash flow is the movement (flow) of money (cash) into and out of your company.

Cash comes in when you make revenue, and out when you have to pay for expenses or purchase new equipment.

Cash flow is typically measured on a monthly basis, following a simple formula:

Net cash receipts – Net cash payments = Net cash flow

Master cash flow with our dedicated guide: How to Do Cash Flow Analysis: Step-By-Step Guide.

Where is Cash Flow Found On Financial Statements?

The cash flow metric is so important to the measurement of a company’s financial performance that it literally gets its own report, known as the cash flow statement.

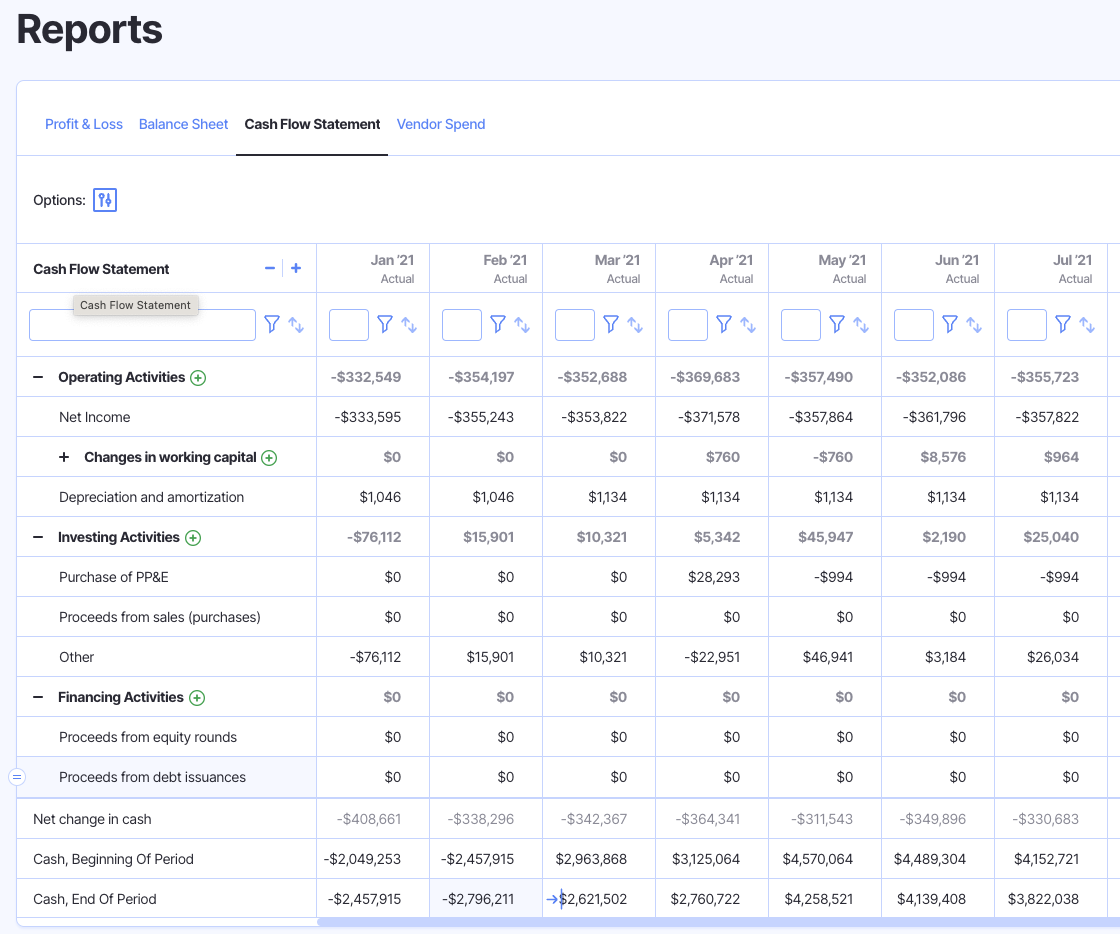

Cash flow statements look like this:

At the top, you’ll see your income for the period, sometimes broken down by revenue types, and followed by any depreciation and amortization accounted for.

Then you’ve got your outgoing cash line items, such as expenses and investment activities.

The last section shows the net change in cash (whether your cash flow was positive or negative for the period), and how this impacts your cash on hand.

What Does Cash Flow Tell You About Your Business?

Cash flow is a measure of how well your company is managing its cash resources, without the consideration of how non-cash items or accounting methods impact financial results.

First, you’ll be looking at whether cash flow was positive or negative for the period.

If over a given period your business received more cash than it spent, you have positive cash flow. The opposite is true of negative cash flow; if you spend more than you earn, then you’ll be cash flow negative.

While positive is generally better than negative, it’s more important to consider changes over time and long term trends.

For example, you might have one month of negative cash flow because of a late payment from a large customer. While this may reflect a need for stronger accounts receivable management, it doesn’t necessarily spell disaster from a finance and cash flow standpoint.

It’s important to note that this is not the same as profit, because events like receiving a grant, loan, or cash investment impact cash flow, but not profit.

For instance, let’s say that last month your business made $9,000 in revenue from customers, and spent $21,000 on operating expenses such as wages.

That’s a net loss of $12,000 for the month.

But, in the same month you received a $35,000 cash injection from a bank loan. This would mean that while you made a loss rather than a profit for the month, you were still cash flow positive to the tune of $23,000.

For this reason, it’s important to analyze your cash flow statement in conjunction with the balance sheet and P&L statement. Together, these three statements provide a holistic view over your company’s overall financial health.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Tax, Depreciation, and Amortization.

It’s similar to cash flow in that it’s a measurement of how a company is managing revenue and expenses, but absent of the kinds of accounting techniques and capital structure impacts that are present in a cash flow analysis.

This makes it easier to compare between companies with different capital structures (more on that soon).

Where is EBITDA Found On Financial Statements?

EBITDA is often found at the bottom of income statements (also known as profit and loss statements).

That said, EBITDA isn’t considered an official measure of financial health by GAAP, meaning it’s up to you whether you’d like to include it in your P&L or not.

What Does EBITDA Tell You About Your Business?

Much like cash flow, EBITDA tells you how well your company is managing its core business and cash flow, except that it doesn’t look at the impacts of financing and taxation.

Investors, banks, and business leaders like to use EBITDA to compare companies with different debt, capital, and financing models.

Consider, for example, two companies that both made $15,000 in net profit last month.

One is bootstrapped, and the other sought capital through a bank loan which it is repaying on a monthly basis at $3,000 a month.

This would mean that while both turned the same profit, their cash flow statements will look different (the business with the debt repayment obligation will show $3,000 less in positive cash flow).

Similarly, capital expenditures (investment in new machinery, for instance), would reduce a company’s cash flow, but wouldn’t be considered as part of an EBITDA analysis, as large capital expenditures are recorded as depreciation expenses (and EBITDA excludes depreciation).

Related: Cash Flow vs. Working Capital

Using Cash Flow and EBITDA in Practice

Both cash flow and EBITDA are important metrics to master if you’re looking to improve spending visibility and maximize control over your company’s financial performance.

Each has its place in a proper financial analysis.

Cash flow should be used to monitor aspects of business operations such as the effectiveness of your accounts receivable department and your ability to effectively manage expenses.

EBITDA, on the other hand, is ideal for comparing with other companies in your industry to help you understand performance without consideration of capital structure. This will be especially important when speaking with potential investors.

Both metrics can be tracked easily in Finmark from BILL, the financial planning and analysis platform for ambitious startups and SMBs.

Learn more about how our intuitive and powerful platform can elevate your financial performance here, or dive straight in yourself with a free 30-day trial.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.