What is Financial Reporting? (3 Reports Every Business Needs)

Financial reporting is not something you do just because you have to.

I mean, you do have to (depending on which country or state your company is based in), but there’s more to it than simply staying compliant.

Financial reporting is crucial for monitoring cash flow, assessing business growth against goals and projections, and making important financial decisions.

In this article, we’re going to explore the importance of financial reporting and discuss the four most crucial financial reports that you should be creating and analyzing at least on an annual basis.

What Is Financial Reporting?

Financial reporting is the process of pulling together financial details (income and expenses) from the previous period and communicating them in a formal manner.

This generally happens on an annual or quarterly basis, regularly both.

Financial reports are, in many cases, part of an organization’s obligation as a company to report earnings to the tax department.

This becomes even more crucial as your company grows. Publicly-listed companies are legally required to submit company statements such as these, and even have them audited by a third party.

But financial reports provide a lot of other benefits (especially for startups), giving you insights into your company’s financial performance and allowing objective comparison between financial periods.

What Are The Major Financial Reports?

There are really three major statements to prepare as part of your financial reporting:

- Balance sheet

- Profit & loss statement

- Cash flow statement

Balance Sheet

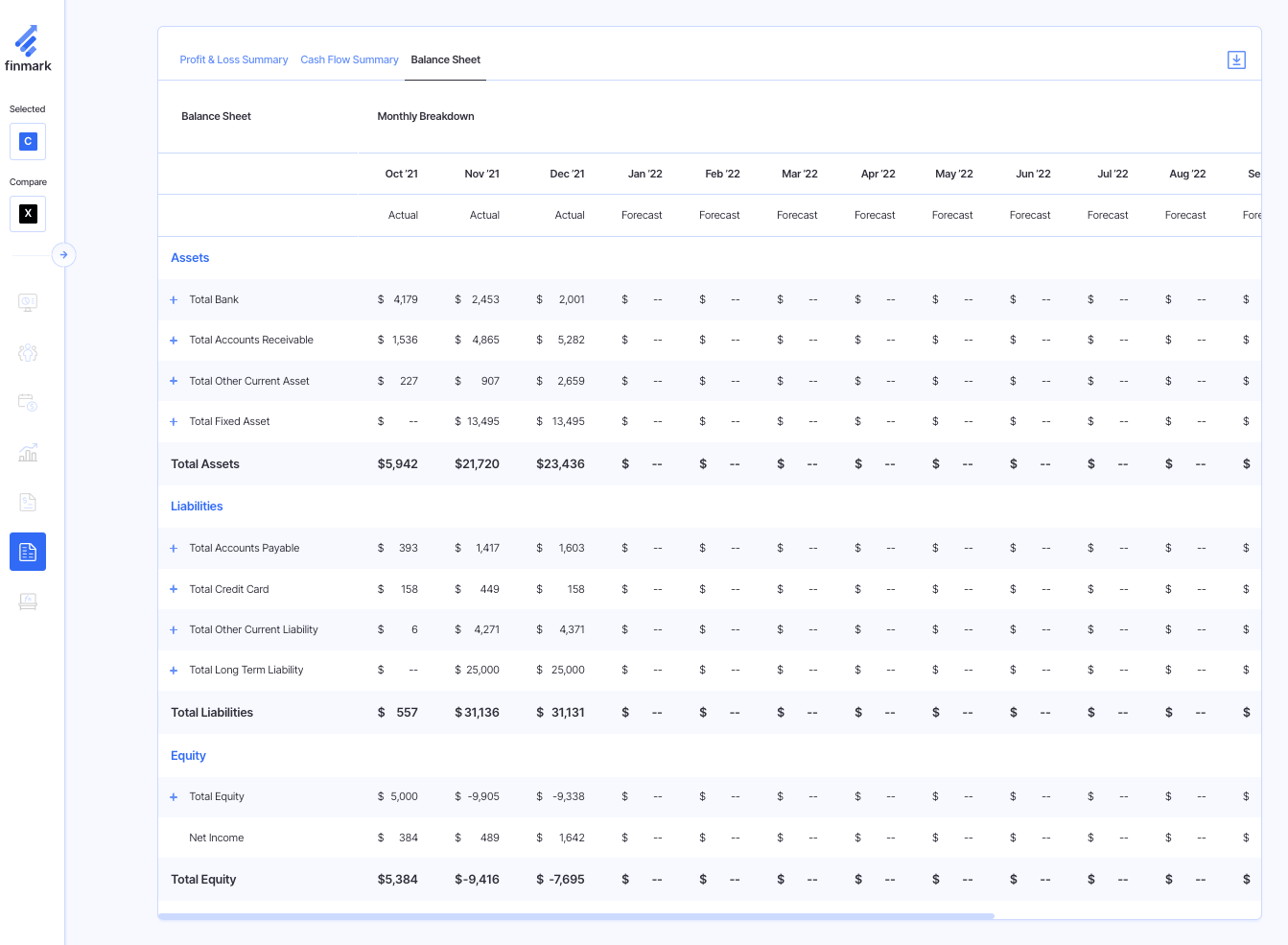

The balance sheet displays all of your company’s assets, liabilities, and shareholder equity.

The idea is that the document balances so that your assets equal your liabilities plus equity.

Take a look at the above balance sheet in Finmark, for instance. For each month, the company’s assets are equal to its liabilities and equity added together.

Balance sheets are intended to provide up-to-date (and real-time, if your financial reporting platform allows it) insights into debt coverage and asset liquidity.

Basically, it answers the question: can we pay all of our debts on hand right now? And if we needed to, what assets do we own to pay our debts, and how easy is this process (i.e., how liquid are our assets)?

The balance sheet breaks down to provide the following info:

- Liquid assets – Cash, certificates of deposit (CDs), short-term securities (like stock holdings), and treasury bills

- Current assets – Accounts receivable, inventory on hand, prepaid expenses, and fixed assets

- Current liabilities – Accounts payable, both short-term and long-term debt, payable wages, payable dividends, client prepayments, and upcoming tax expenses.

- Owner and shareholder equity – Retained income, capital gains and stocks, and receivable dividends.

Profit & Loss Statement

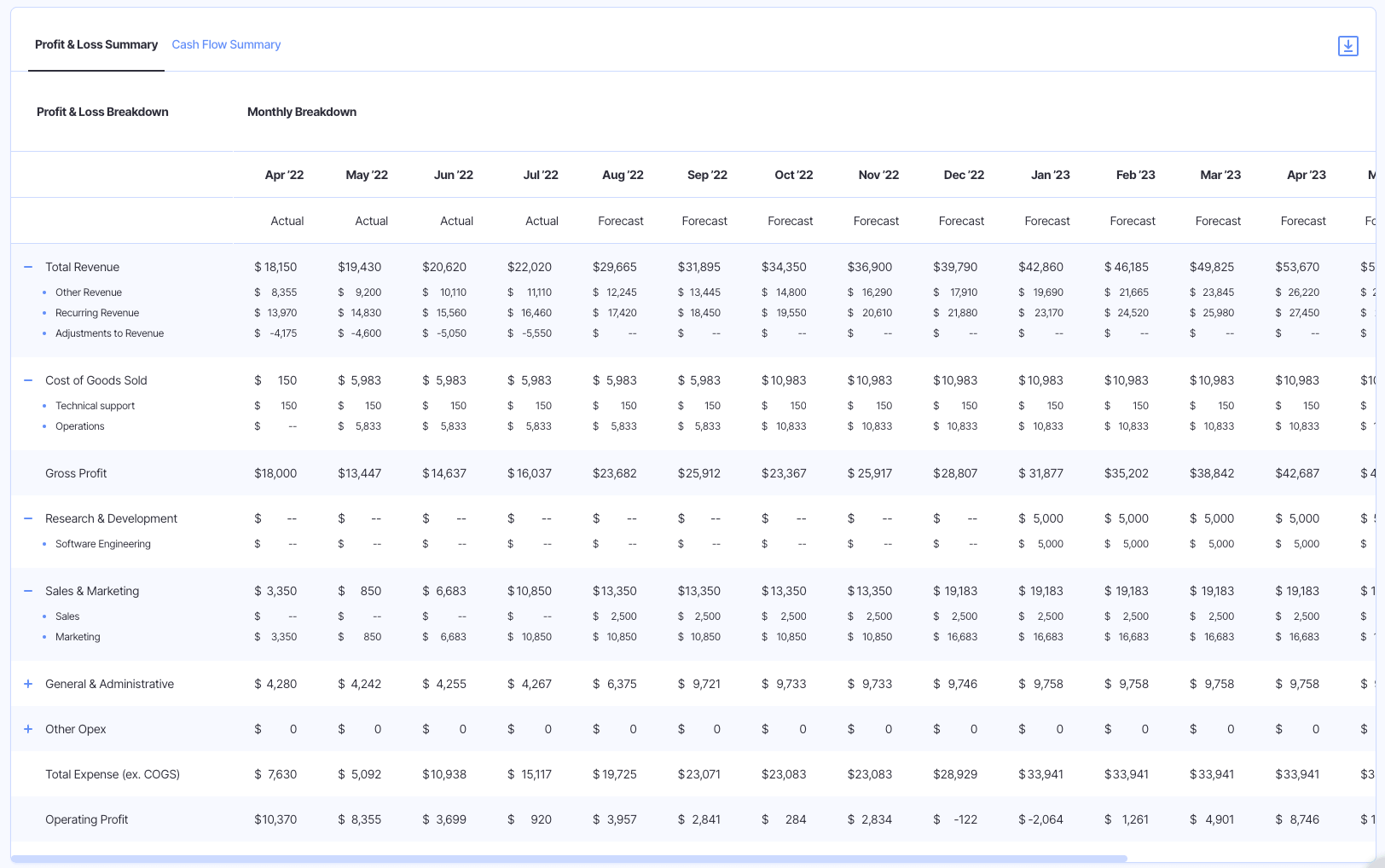

The profit & loss (P&L) statement, also known as the income statement, shows revenue sources and expense payments for the given financial period.

You’ll use the profit & loss statement to analyze:

- Top line revenue

- Net income

- Expenses

- Earnings per share (if your company is public)

- Net profit (or loss)

Each of these elements is broken down further into specific line items.

Notice in the above P&L Summary in Finmark, for example, how revenue is broken down into Recurring Revenue and Other Revenue, to reflect that organization’s various revenue streams.

Expenses are generally categorized by department, though the specific line items and level of detail you choose depends on your organizational and financial reporting needs.

Cash Flow Statement

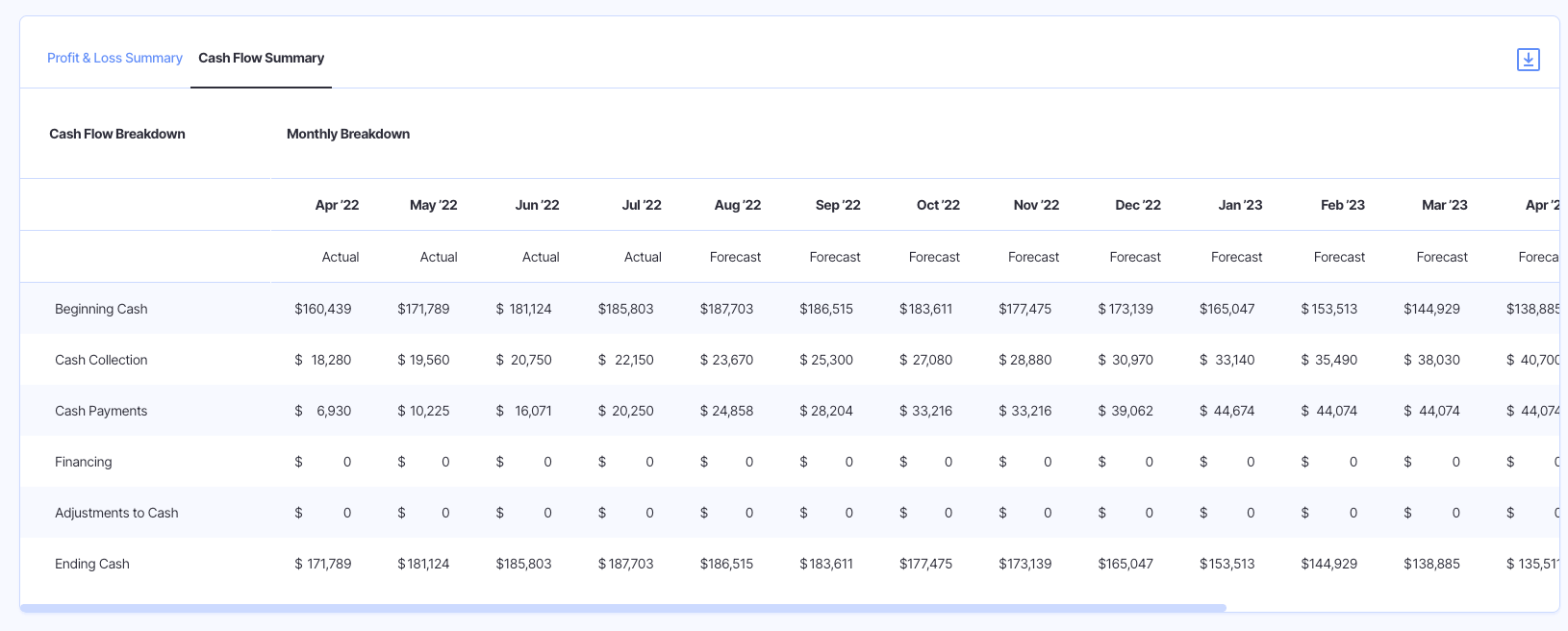

The cash flow statement is the last of the three horsemen of financial reporting.

Its function is pretty much in the name. The cash flow statement shows how much cash is flowing in and out of your business, and to and from where.

Cash flow statements are typically created monthly, and have four primary line items:

- Cash at the beginning of the month

- Cash collected

- Cash paid

- Cash at the end of the month (which is the sum of the previous three items)

Cash flow statements analyze your company’s financial health and ability to pay down debts. If your ending cash is decreasing each month, for instance, you’re burning through money faster than you’re making it.

This financial report also provides a jumping-off point for strategic financial decisions. If, for instance, you notice a trend of increasing cash on hand each month, this could present an opportunity for further investment in company expansion.

Statement of Changes in Equity / Statement of Retained Earnings

Bonus round!

I know, I said there were only three major financial statements, but this one’s pretty important too, so we’d be remiss not to cover it.

While your equity is likely to be displayed on the balance sheet, larger organizations with complex shareholder makeups often prefer to create a separate statement for this, known as the Statement of Changes in Equity (not super catchy, is it?).

This report does what it says on the box: details any changes in owner and shareholder equity during that financial period, including:

- Stock sales and purchases

- Purchased treasury stock

- Retained earnings post dividends and losses

Why Is Financial Reporting Important?

Accurate, up-to-date, timely financial reporting is critical for a number of reasons.

The reporting process delivers important insights into profitability, growth potential, and potential revenue and expense issues that can be resolved in the coming financial period.

Monitoring Income, Expenses, and Cashflow

Financial reports give you high-level insights into revenue for the year, but also allow you to dig deeper and see from which sources you’re generating the most income.

The same goes for expenses.

You’ll be able to see spend by department and for the company overall, but then narrow down to specific line items to understand where all that hard-earned cash is going.

This then leads the way for your FP&A (financial planning and analysis) team to provide data-led recommendations.

Supporting Financial Planning and Analysis

With your most important financial reports in hand, your FP&A team can take the ‘what’ and ask ‘why?’

That is, they can look at your performance for the previous period and analyze the factors that influenced revenue growth or spending increases, and provide recommendations for changes going forward.

With this information accurately prepared, FP&A leaders can provide strategic advice for improving your profitability.

Maintaining Financial Compliance

Okay, yes. There is a compliance element to financial reporting.

In many regions, it’s a requirement for registered companies to complete and lodge specific financial statements with their local tax departments.

Providing Information To Investors

Your investors don’t want to get a call every time you close a new contract.

They want a comprehensive update at the end of each financial period (quarterly, say), presented in the same format each time.

That’s actually one of the other benefits of preparing financial statements. Since they’re prepared the same way each period, it’s easy to compare your company’s performance over time.

Who Uses Financial Reporting?

Financial reports are used by a variety of stakeholders, not just the people who prepare them.

Finance Leaders

Financial leaders (such as CFOs and Financial Controllers) are typically the ones responsible for creating these reports.

Depending on the scale of the organization, however, the actual creation of financial reports may be designated to internal accountants, or even outsourced to an accounting firm.

Senior Leadership

Senior leaders such as CEOs and board members are one of the most important stakeholders and readers of financial statements.

They use them to assess performance against goals, and to make strategic changes to the direction of the business.

In smaller startups, it may even be the CEO who is creating the financial reports.

Investors and Stakeholders

Your investors have a strong financial interest in your company, so they’ll want to be kept up-to-date.

They are busy, though, and you’re probably not the only company they’re funding.

So, your investors will want to see financial reports on a regular basis (probably quarterly, but also an annual summary) to understand how their investment is panning out, and possibly to provide some advice or intervene where required.

Regulatory Institutions

Part of financial reporting is declaring your company’s earnings and expenses to the tax department and other regulatory institutions.

The agencies you report to depends on the region in which your business is registered.

For instance, publicly traded companies report certain financial reports to the Securities Exchange Commission (SEC) in the US.

Conclusion

Financial reporting is a non-negotiable for pretty much all companies, partly because of legal and tax requirements.

However, it also allows you to:

- Understand business performance

- Analyze profitability

- Spot potential financial issues before they become a big problem

But financial reporting shouldn’t be a burden, and it shouldn’t be an activity that takes up three weeks of every month.

Eliminate all that manual work by collecting all of your income and expense data in a financial reporting and modeling tool, which will allow you to quickly pull together your most critical financial statements as soon as you need them.

Yeah, we’re talking about Finmark. Learn how financial leaders use Finmark to boost productivity, make smart decisions, and improve profitability.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.