Fixed vs. Variable Costs: What’s The Difference?

Getting a startup off the ground and financially stable is no small feat.

The average new business spends around $30-40k on startup costs in the first year, and though you may have a strong idea of what your initial costs are going to be, chances are there will be a few surprises.

Having a good foundation of accounting principles and terms helps, but that doesn’t mean you’ve gotta go out and become a licensed CPA before founding your first company!

At the very least, you should have a good understanding of the difference between fixed costs and variable costs, how they impact your business, and what they mean for budgeting and financial forecasting.

Which, as you might have guessed, is exactly what we’re going to discuss here.

In this article, we’ll provide definitions for both fixed and variable costs, and describe some common examples of each. You’ll also learn how these two types of expenses impact your financial projections and reporting.

Fixed vs. Variable Costs: Overview

Let’s start by answering the most fundamental question:

What is the difference between fixed costs and variable costs?

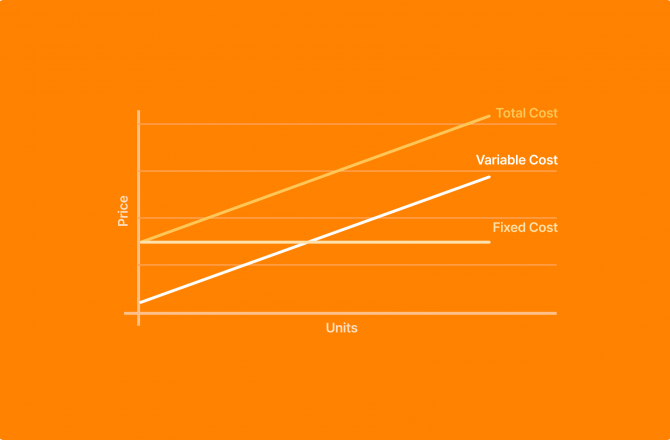

Fixed costs are simply that; fixed. These expenses stay the same each week, month, quarter, or year, regardless of how your business performs.

Rent, for example, is a fixed cost. Whether your company grows rapidly or doesn’t do quite so well, your landlord is still going to charge you the same amount.

Variable costs, on the other hand, fluctuate (they are variable). Most typically, variable costs increase and decrease with business performance (sales, more specifically).

For example, if you’re manufacturing a physical product, then the cost of raw materials will be a variable cost. If you sell more widgets, you’ll need to buy more widget components, and so the variable cost of raw materials increases.

Let’s dive into each a little deeper.

What Are Fixed Costs?

Fixed costs are a type of business expense that remains stable (the same) regardless of business performance.

Fixed costs do not increase or decrease based on sales or production, and you’ll need to pay for these expenses even if you don’t make any revenue one month.

The upside with fixed costs is that as you produce more goods or services, your relative cost of production decreases (an effect of economies of scale). That is, your fixed costs are the same to produce 100 units as they are to produce 200 units, but your revenue doubles when you sell 200 units.

The downside is that if your sales or production drops, you’ve still got an expense to pay. For example, if your sales drop through the floor for a quarter, your fixed costs don’t decrease to compensate.

The majority of fixed costs are indirect (they don’t specifically relate to the production of goods or services), though some can be direct.

Rent, for example, is an indirect fixed cost; it does not factor directly into production. Wages, however, are a direct fixed cost, as the expense goes directly into producing the goods or services your company sells.

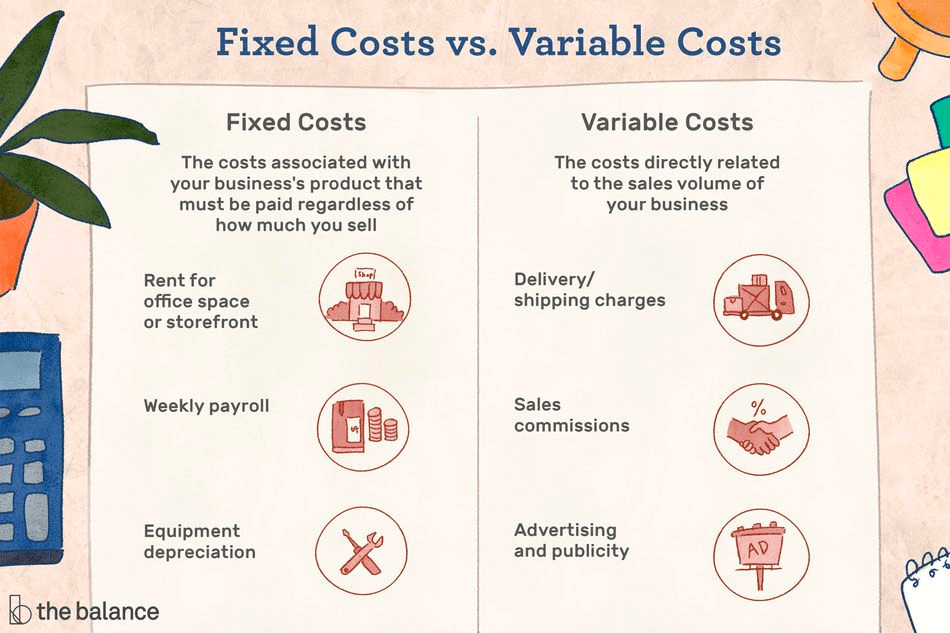

Common Examples of Fixed Costs

Startups have a number of fixed costs, especially those with physical locations (as opposed to fully remote companies).

Common examples of fixed costs include:

- Lease and rent payments

- Property tax

- Salaries and wages

- Insurance

- Interest payments

- Depreciation

- Amortization

- Some utilities

- Equipment rental

- Legal expenses

- Some marketing and advertising costs

What Are Variable Costs?

Variable costs are a type of business expense that fluctuates in relation to business production and sales.

When sales increase, variable costs increase, and vice versa.

Variable cost structures are helpful for companies in startup mode, as they don’t run the risk of over-committing to expenses that they might not be able to meet (if revenue is minimal or unstable).

Variable costs are generally direct costs in that they relate directly to the production of goods or services. Raw materials, for example, are a kind of variable cost that companies who produce a physical product will be familiar with.

Some variable costs can be indirect, however, such as utilities. If a factory produces more goods in one month (to meet additional demand), utilities expenses such as power will increase, and this is an indirect cost.

Common Examples of Variable Costs

Variable costs vary greatly depending on the kind of business you’re in, and the product or service you produce.

If you’re a software company, for example, then you won’t have a raw materials cost as you aren’t actually producing a physical product.

Common examples of variable costs include:

- Raw materials

- Utilities such as power and water

- Delivery costs

- Piece-rate labor

- Credit card transaction fees

- Billable staff wages

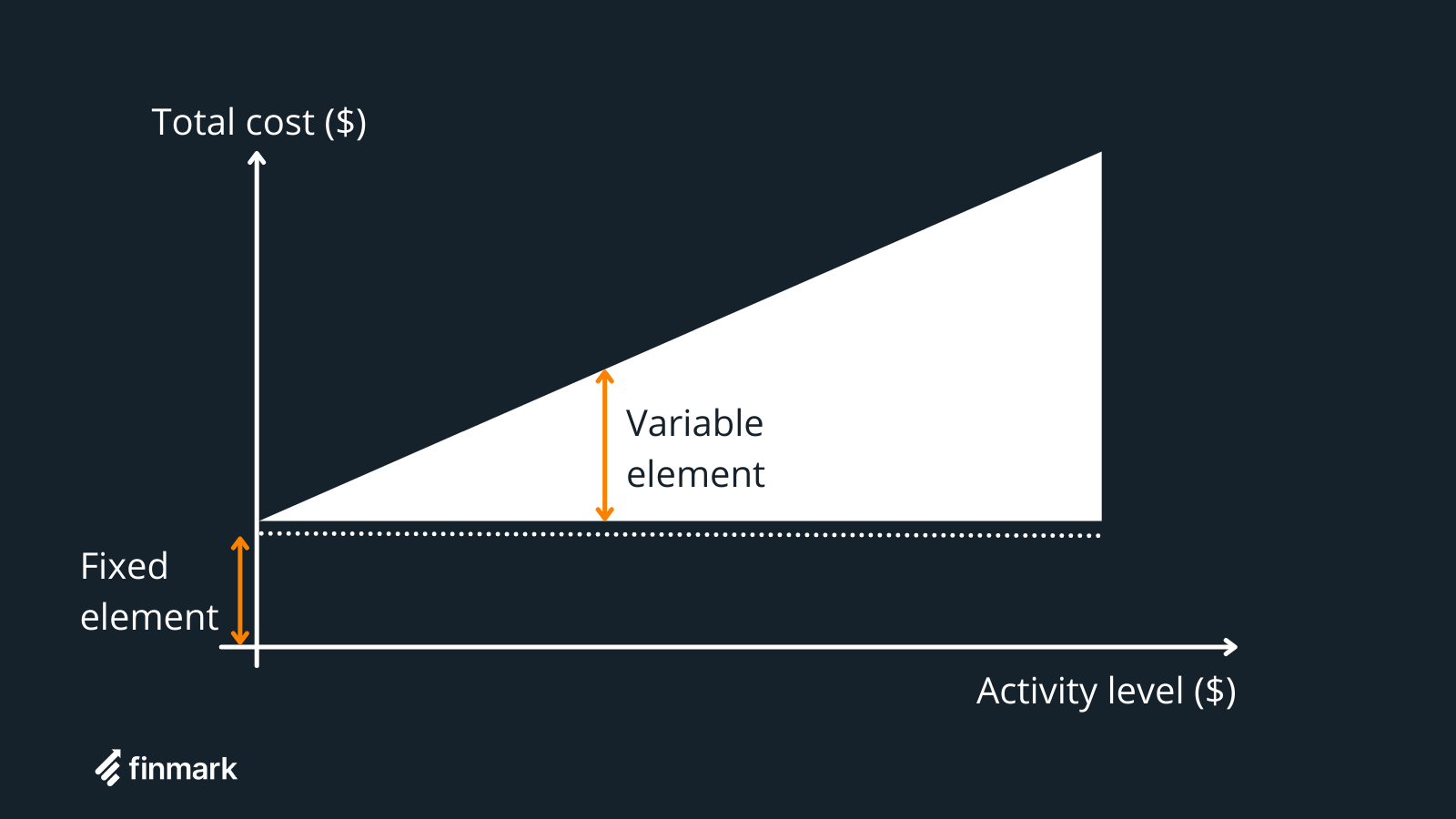

What About Semi-Variable Costs?

Semi-variable costs are a third expense category that incorporates a fixed element as well as a variable element.

They are also called semi-fixed costs or mixed costs.

Semi-variable costs tend to have a fixed component up to a certain production level, with a variable element kicking in as production surpasses that threshold.

For example, a factory may have a semi-variable power utility cost, where the business must pay a fixed cost of $2000 per month, regardless of production level. This $2000 cost buys them a certain amount of usage, above which they’ll be paying a variable rate.

This kind of structure exists in the digital world, also.

For example, cloud computing and storage companies (such as AWS) tend to charge a fixed rate for a certain amount of usage (such as cloud storage or API request), with a variable rate kicking in once you reach your threshold.

How Fixed and Variable Costs Impact Financial Projections and Reporting

In most cases, the distinction between fixed costs and variable costs is pretty straightforward.

So why does it all matter?

Don’t you just throw all of your expenses into your budgeting tool and let it do its magic?

Well, maybe. But there are a couple of important reasons that founders should have a strong understanding of how fixed and variable costs impact business operations.

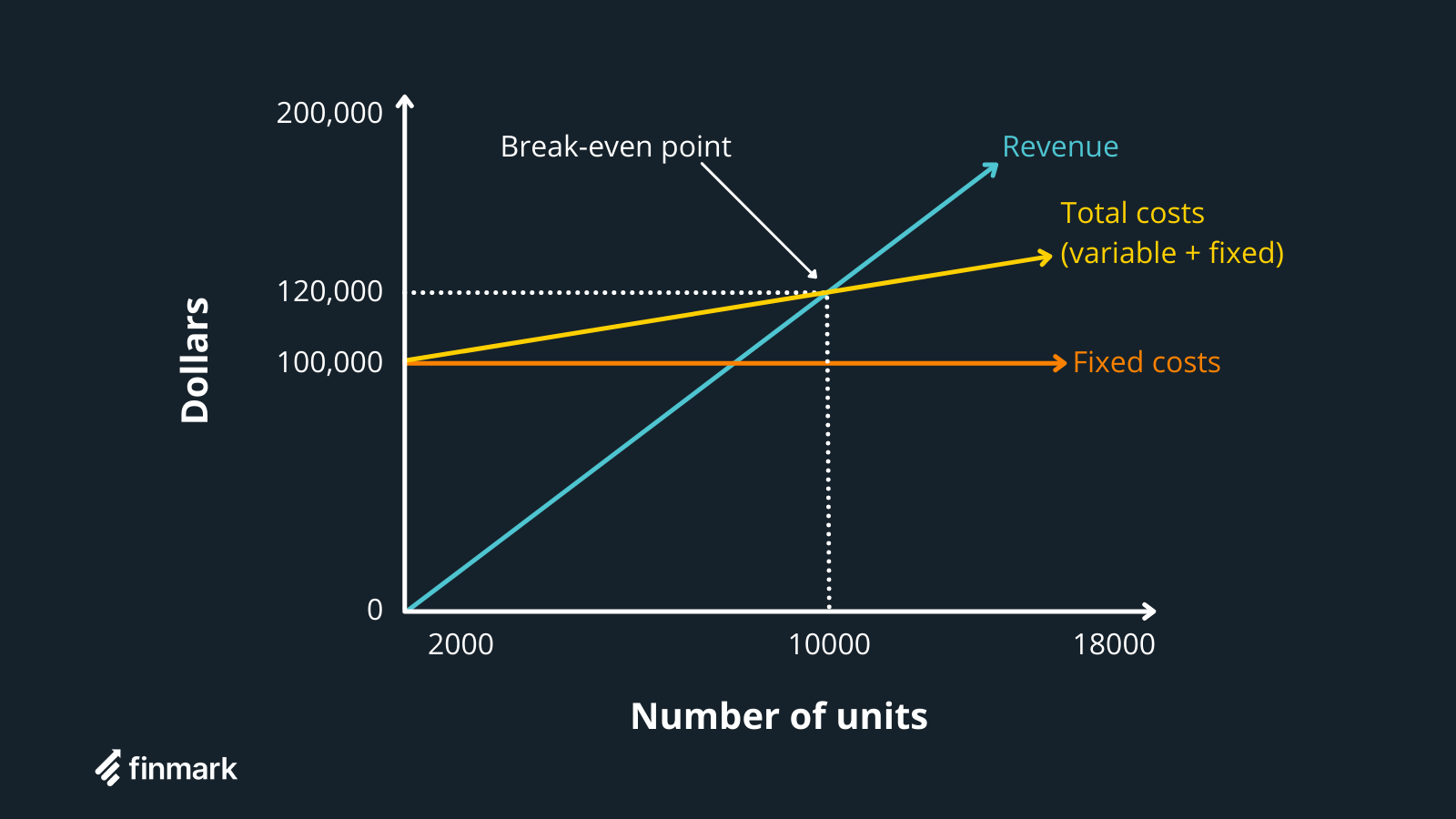

1. Calculating Your Break-Even Point

Understanding the fixed and variable costs your startup bears is crucial to calculating your break-even point.

Break-even point is the point where your total business costs and your revenue are equal. That is, it’s the turning point between making a profit and making a loss.

To perform a break-even analysis, use the following formula:

Break-even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

Let’s use the figures in the above graph to demonstrate.

Imagine you’re selling a product for $12 per unit. Your variable costs are $2 per unit, with fixed costs of $100,000.

Let’s calculate:

Break-even quantity = $100,000 / ($12 – $2)

Our break-even quantity here is 10,000 units. At a per unit sales price of $12, revenue at our break-even point will be $120,000.

Above that point, we’re making a profit, and below, we’re losing money.

2. Determining Pricing

Understanding which of your expenses are fixed and which are variable is important to setting pricing for your product.

Consider the previous example. We have variable costs of just $2 per unit. Looking at this, we might assume that a per-unit sales price of $6 would be suitable; we’re making 200% profit per unit, right?

Well, no. Because we haven’t considered the fixed expense of $100,000.

To turn a profit at $6 a unit, we’d need to sell 25,000 units instead of 10,000 at $12 each.

Being able to accurately calculate and predict your company’s fixed and variable expenses allows you to ensure the pricing point you’ve chosen is reasonable, profitable, and achievable.

3. Sourcing Funding

If you’re looking to raise funding for your startup, you’ll need a strong understanding of fixed and variable costs.

Investors will want to know about your revenue forecast, yes, but they’ll also need to feel confident that you understand the various expenses you’re going to face.

They’ll want to see whether your revenue model makes sense in the context of your expenses and that you’ve completed a break-even analysis.

4. Leveraging Economies of Scale

Lastly, understanding the difference between fixed and variable costs (and how each works) is important to be able to leverage economies of scale as you grow.

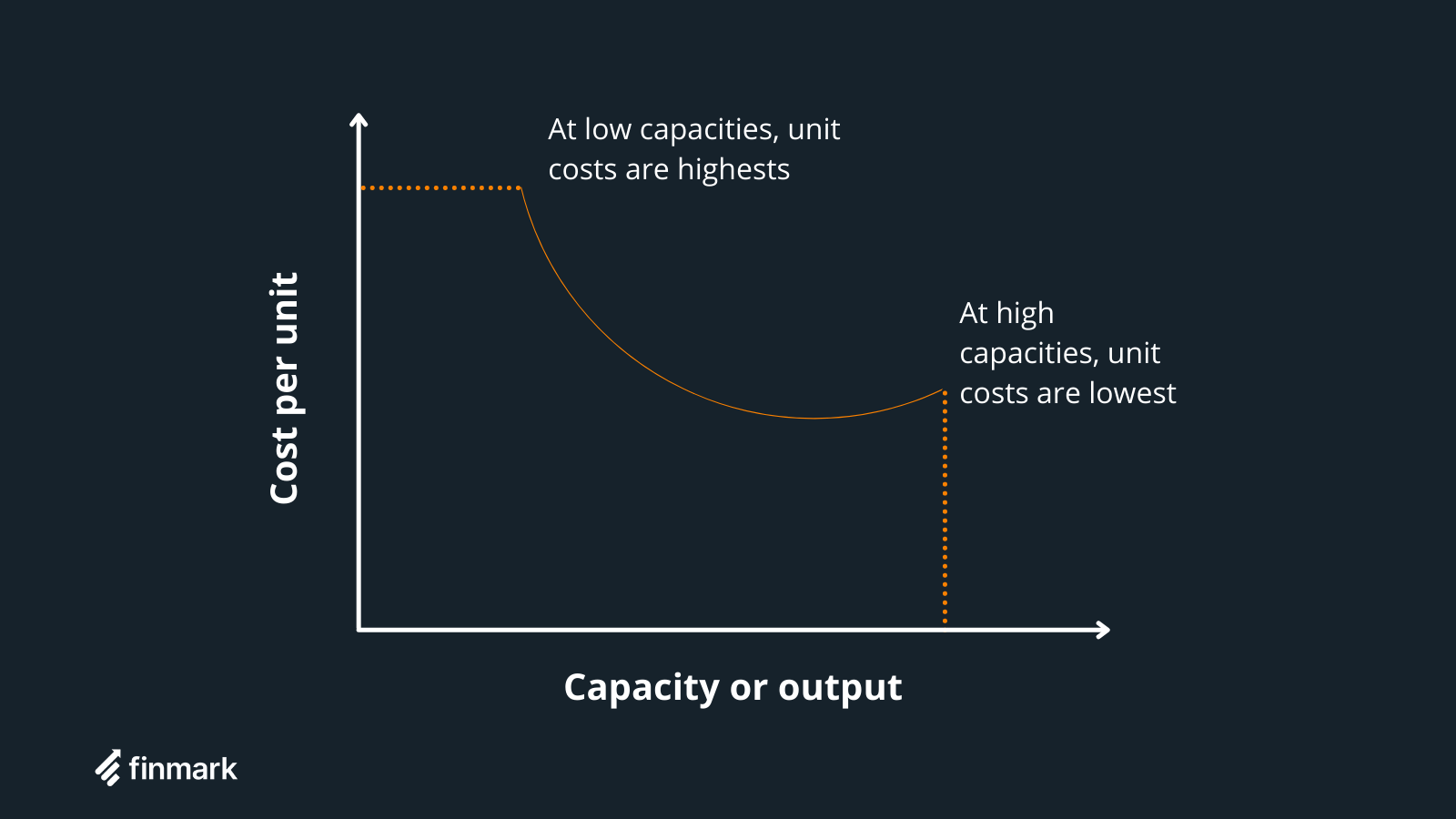

Economies of scale is a financial concept that describes how per-unit expenses tend to decrease as consumption increases.

One way this happens is through supplier discounting. For example, you may be able to purchase 10,000 units of a given component at a cheaper per-piece rate than you would 5,000 units.

Your per-unit cost also decreases as production increases when you have fixed expenses.

For example, let’s say you have total fixed costs of $50,000 per month.

If you produce 2,500 units in a month, your fixed cost per unit is $20. If you produce 5,000 units, however, your fixed cost per unit is just $10.

Your total fixed costs remain the same (because they’re fixed), but your product has doubled, meaning your per-unit cost has halved (so you’ll make more profit on each unit).

What to Do When You Miscalculate Variable Costs

Fixed costs are pretty easy to calculate correctly.

Often, you have some form of agreement or contract in place (like your lease), so you know exactly how much you’ll be spending each month.

Variable costs, on the other hand, can be a little more unpredictable. Sometimes even your best estimates won’t quite be correct, and you’ll need to do a bit of budget reallocation.

To mitigate this risk, it’s wise to invest in a powerful financial reporting platform that allows you to track and forecast key expenses.

(Oh hey, that’s us! Check out Finmark to see how we can help!)

If you do find that your variable costs end up being more (or less) than anticipated, this is known as a budget variance.

Check out our full guide to budget variances to learn how to manage unpredictable expenses.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.