Positive Cash Flow: How to Get In The Black

If there’s one area to put your focus on when it comes to business finances, it’s cash flow.

Keeping cash flow positive is mission-critical for every great finance leader, business owner, or founder.

Our guess is that it probably is for you as well.

So, we’ve built this guide to positive cash flow to help you get into the black, and stay there.

What Does Cash Flow Positive Mean?

Let’s start simple.

Cash flow is just the finance term for how money comes into and flows out of your business.

Cash comes in from sales, and it goes out when you have to pay expenses (like wages, utilities, rent, or loan repayments).

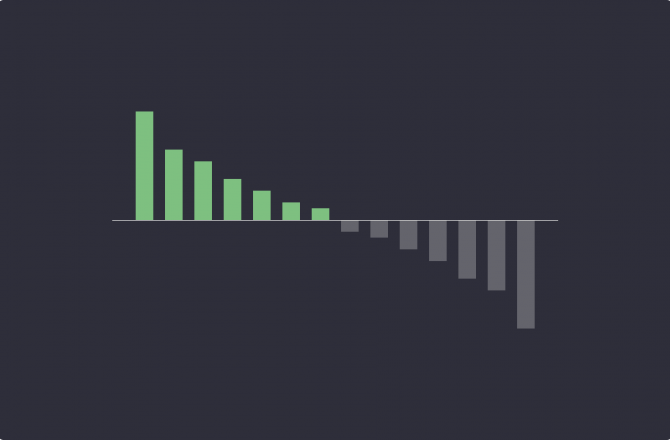

When the total amount of cash that comes in for a given period exceeds the amount that went out, your business is cash flow positive.

Negative Cash Flow vs. Positive Cash Flow

The term “positive cash flow” implies, as you’re probably thinking, the existence of a negative cash flow as well.

We’ve already covered this in detail in a separate article (read up on negative cash flow here), but the gist is that you’re cash flow negative if your outgoings for a given period exceed cash coming in, and that’s typically a bad thing.

There are a couple of exceptions, though.

A single negative month might just mean that you had some large unexpected expenses, or you had some client payments delayed.

Additionally, if you’re an early-stage, pre-revenue company, then negative cash flow is pretty much the expectation until you bring your product to market and start generating revenue.

Biggest Cash Flow Challenges

Keeping cash flow in a positive state is a fundamental financial goal. So, it’s critical to know what hurdles could be preventing you from meeting this objective.

Late-Paying Customers

Customers that drag the chain and don’t pay on time are always going to be problematic for cash flow.

You’ve still got your expenses to pay, and you don’t want to be that late payer (because you know exactly how annoying it is, but it can also impact supplier relationships and cause you to forego any early payment discounts).

So, you pay your bills on time, but you still haven’t gotten paid from your customers, meaning more cash went out than came in, and bam, you’re cash flow negative for the month.

Inaccurate Budgeting

Failing to forecast your outgoings accurately can quickly hurt your cash flow.

Say, for example, you forgot to budget for an upcoming wage increase. Suddenly, you’re paying more in wages each month, but not bringing in any additional revenue, pulling you out of positive cash flow.

Rapid Market Changes

Unexpected changes in your market can be a big cash flow killer, too.

For instance, when shipping costs went through the roof during the Covid pandemic, many companies suddenly had a much higher expense to contend with, some of whom probably spent more than a few months in negative cash flow.

Overstocking Inventory

For brick-and-mortar businesses, inventory management is an important practice to master.

Holding too much inventory at any one time can be problematic for cash flow. With slow-moving stock filling up the shelves, you’re unable to bring in more fast-selling products and drive more cash into the business.

If you get your stock levels wrong too often, this can have a flow-on effect on cash flow.

Best Practices For Maintaining Positive Cash Flow

There is clearly no shortage of factors that can turn a company’s cash flow negative.

But what can you do about it? Follow these five best practices to keep cash flow positive and drive business growth.

Work On Your Spend Management Practices

First, it’s time to take a good hard look at where your cash is going.

- Are there areas where you’re overspending?

- What expenses can be cut or reduced?

- Can any software licenses be consolidated or canceled?

- Who has the authority to purchase?

- How accurate are your budgets?

Start by establishing a status quo and look for easy targets that will get you quick wins.

Then, look at purchasing policies and procedures for controlling spending going forward.

For instance, you might put restrictions on departmental spending by implementing purchase approval workflows, distributing corporate purchasing cards, or putting a cap on the dollar amount business unit leaders can spend in a single transaction.

Build More Accurate Budgets With Real-Time Data

Most companies only build budgets on a monthly (or sometimes quarterly) basis.

But modern business moves much faster than this (expenses like fuel can increase dramatically in price overnight, for instance), meaning your organization needs to be much more reactive than that.

To maximize your agility, take advantage of real-time FP&A tools like Finmark from BILL.

With Finmark, you can connect with a variety of tools, from accounting to payroll and more.

Then, you can create data-backed budgets that update as your spending changes.

For instance, if your fuel expense exceeds the budget for the first two weeks of the month due to a price increase, you can adjust and extrapolate this data to the rest of the period.

Use Cash Flow Projections To Look Into The Future

Business financials need to not only be reactive, but be proactive as well.

That means you need to be able to look into the future and make projections about your cash flow.

For instance, you can use a platform like Finmark to build cash flow projections based on your current income and spending habits.

Then, you can perform scenario analysis, getting answers to questions like:

- What would cash flow look like if we grew 20%?

- How would we be sitting if expenses increased 10% without an increase in revenue?

- What would happen if we cut our investment in digital ads for a month?

Keep A Sufficient Cash Reserve

Keeping a cash reserve for unexpected bills is a solid best practice for all organizations.

While this isn’t going to change your cash flow per se, it ensures you’re safe in the event of a late paying customer or an unexpected large utility bill, and it means you don’t need to dip into an overdraft or credit card.

Just be sure to keep an eye on the amount you have in reserve, and systematically add to it as your company grows. That is, your cash reserve should be reflective of your outgoings, meaning as your expenses grow, so should your emergency account.

Look For Alternative Funding Options

Lastly, if cash flow is looking really bad, it might be worth considering other funding options for the short term.

Investors don’t typically fund companies for the purpose of plugging a cash flow gap (they’re generally more interested in investing in growth opportunities), but you may be able to secure some form of business loan.

Learn more about that in our article: Debt Financing 101.

Keep Cash Flow Positive With Finmark

Maintaining positive cash flow is one of the most basic, but most mission-critical practices that finance teams must master.

Of course, your biggest and most obvious lever for cash flow is upping revenue (get inside tips on building revenue here: How to Increase Revenue: 8 Strategies For Rapid Growth.

But for a more holistic approach to cash flow management, you need to be able to visualize and analyze spending and revenue in real-time.

That’s where Finmark comes in.

Finmark can help businesses track and forecast their cash flow, determine when/if you’re going to become cash flow positive, and analyze which revenue sources are helping/hurting cash flow.

Jump into a 30-day free trial here, and find out for yourself.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.