Cash Flow Management: A Guide for Small Businesses

If you’re a business owner, you’re probably aware that managing cash flow is not only the number one priority, but also one of the top challenges for early stage businesses.

You have to make sure you have enough cash coming in to pay operating expenses (wages, for example), to meet financial obligations such as loan repayments, and basically to keep afloat.

Things get a little scarier, though.

If you run out of cash: game over (in most cases).

So, cash flow management is pretty vital. But breathe, we’re going to help you out.

In this guide, we’re going to cover eight cash flow management strategies for your business, so you can avoid going to zero.

What Is Cash Flow Management

Let’s get the technical stuff out of the way. Cash flow management is a combination of tracking how money has run through your business and planning for how it will in the future.

Proper cash flow management means knowing what to do with your cash balance when you have positive cash flow and being prepared for a period of negative cash flow.

Planning ahead is a huge driver of maintaining healthy business finances.

When small businesses face cash flow shortages, they turn to banks and investors and either give up equity or lose profits to interest expenses. Scoring funding or a loan to kickstart your dream is great, but cash flow shortages will have you going back to the source more times then you’d like.

How Do Businesses Track Cash Flow

To stay on top of cash flow, you’ll need to get familiar with your accounting.

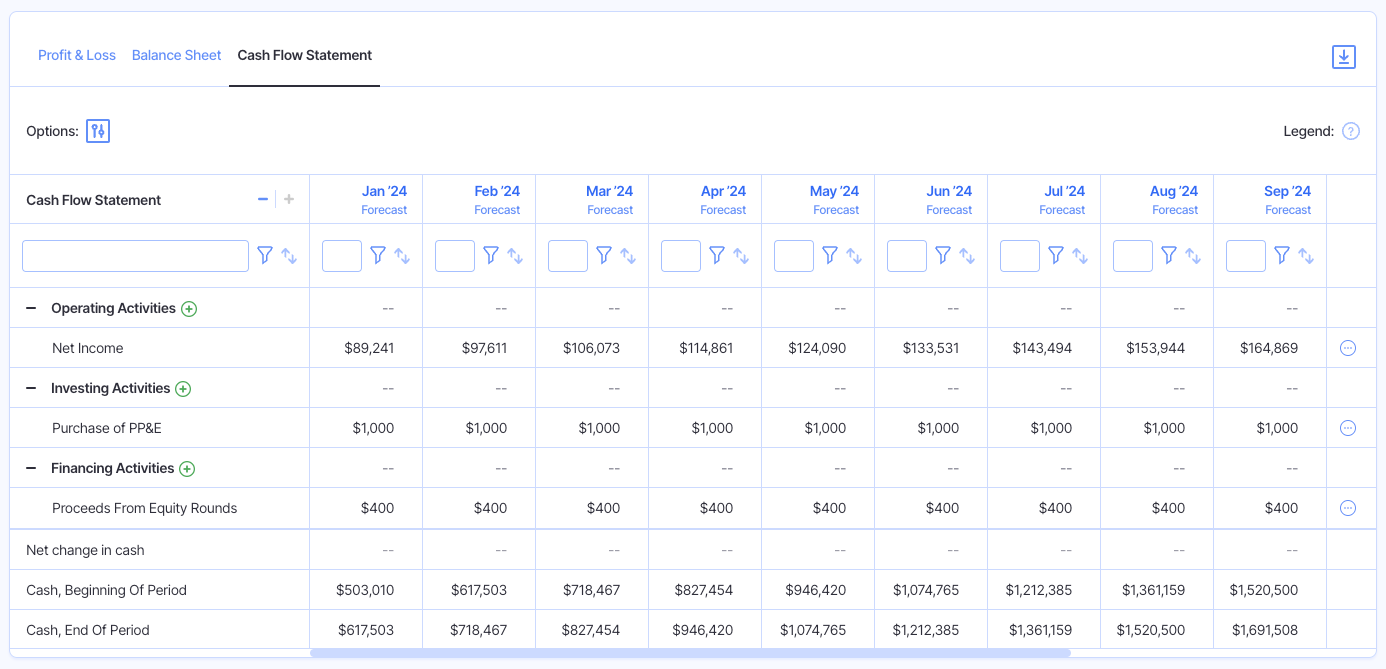

Cash flow statements are how most businesses track cash flow. They combine info from the two main financial statements (income statement and balance sheet) to give you a clear and concise picture of your cash inflow and cash outflow.

A cash flow statement is broken up into cash flow from operations, cash flow from investing, and cash flow from financing. This lets you see how cash is used and generated by different aspects of your business.

There are other reports used for cash flow analysis beyond trusty cash flow statements, but we have more on that later.

Why Cash Flow Management Is Important

The first point is kind of obvious:

If you don’t have enough cash, you can’t pay for things like advertising, equipment, and staff. Your cash outflow becomes unsustainable.

And if your cash flow issues get too bad (i.e., you run out of money altogether), then you may need to close up shop.

Kind of the same as real life, though, right? You need money to pay your bills, and if not, you could end up bankrupt.

The difference is that in real life you have a job with a steady paycheck (hopefully). But new businesses aren’t often making all that much money in the early stages.

In fact, many of them aren’t generating any revenue, let alone positive cash flow.

It’s not uncommon to spend the first couple of years just working on product rather than revenue growth.

And even if you do have paying clients, getting them to pay your accounts receivable consistently and on time can be a bit of a headache.

Even VC-backed companies need to be careful with managing cash flow, so they can keep as much runway as possible (more on that soon), and reach the next funding milestone.

In short: cash flow management is critical.

So, how do you avoid a cash flow crisis?

Take advantage of these eight strategies for cash flow management.

8 Strategies For Managing Cash Flow And Keeping Your Business Afloat

1. Dig Deep Into Reporting And Analysis

The bedrock of cash flow management is gaining a thorough understanding of where money is coming from (cash inflow), and where it’s going (cash outflow).

Simple, yes, but an area where many companies fall short.

There are two main financial reports you need to pay attention to:

- Cash flow projection

- Cash runway

In a cash flow projection, you’re estimating your future cash flow by adding up all of your expected revenue for the period (for example, the coming month), including your current account, and subtracting the expenses you’ve got coming up.

It’s a little more nuanced than that, but you can read about it in full in our comprehensive rundown: How to Create a Cash Flow Projection: Step-by-Step Guide.

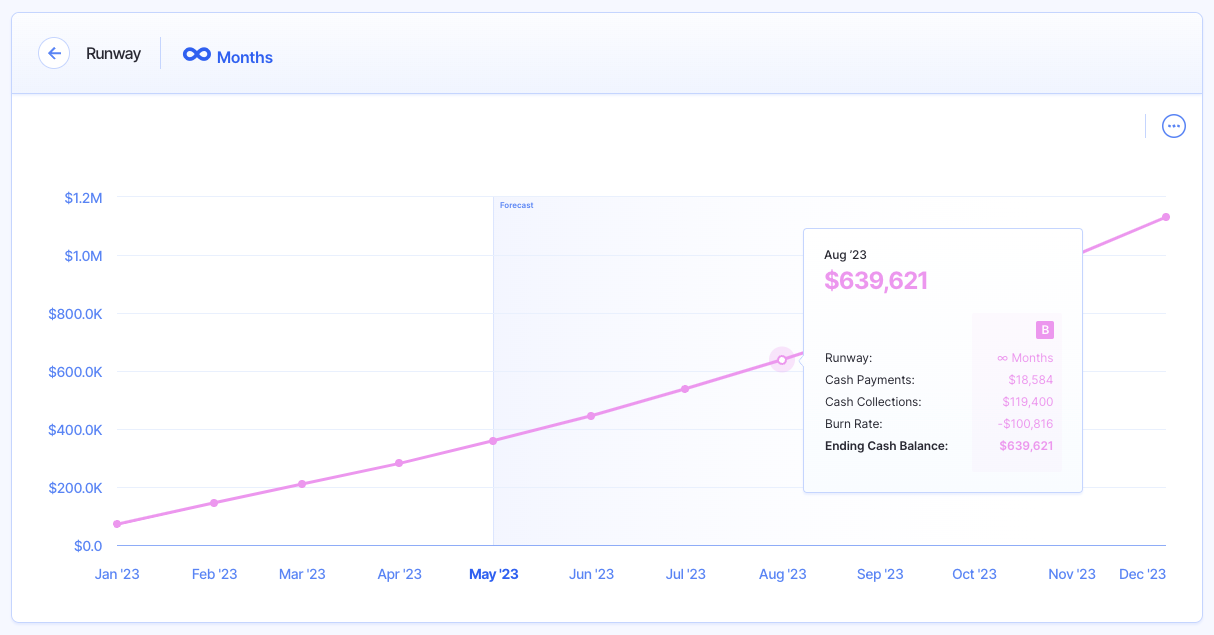

Cash runway is a calculation of how long you’ve got until your cash runs out.

This is especially useful for companies who are funded (or have equity contributed from founders) but are pre-revenue and therefore don’t have any money coming in yet.

Learn more about cash runway projections in our other comprehensive rundown: How Much Runway Should Your Business Have?

2. Find An Investor (Or A Loan)

Okay, so this isn’t a cash flow management strategy exactly, but getting funded certainly helps as it provides you with a strong cash reserve that might last for 18-24 months.

You’ll still need to monitor cash flow, but you’ll simply be more concerned with the money going out than what’s coming in.

Depending on your company’s age and stage, finding an equity partner might be a little difficult.

Don’t stress; you have an alternative: Debt financing.

Debt financing is basically getting a business loan, either from a bank, investor, or other financial institution.

The same benefit for cash flow exists: you’ve got a nice healthy bank account to play with. Just be mindful of accounting for future loan payments and avoiding any late payments that eat into your reserve.

But, of course, there are some pros and cons to each approach.

| Equity Financing | Debt Financing | |

| Ownership | You give some ownership | You retain complete ownership |

| Repayment | Capital doesn’t need to be paid back | Capital does need to be paid back, plus interest |

| Taxes | No tax benefits | Interest may be tax-deductible |

| Decision Making | You’ll need to consult with your investors | No consultation is required |

Check out our guide to find out if either option is a good move for your business: Equity vs. Debt Financing: Which Should You Choose?

3. Investigate Opportunities To Pre-Sell

This one’s a sneaky little tactic a lot of businesses don’t realize they can take advantage of.

You don’t actually have to have a product ready in order to sell it. No, we’re not talking about some sneaky vaporware scam; we’re talking about pre-selling.

Here’s how it works.

You’ve got a product in development, and it’s going to be another 12 months before it’s ready for the market.

Problem is, you need money now to pay your engineers to build the thing. Fun little catch-22, isn’t it?

So, you start building a list of your biggest potential customers: who can get the most value out of this product?

Then, you approach them with a special offer: “Hey, you need my thing, and when it hits the market, it’s going to cost X. Get in now, and I’ll give it to you for half price.”

Yes, you get a little less revenue, but you get it right now, boosting your cash reserves so you can keep building and actually get that thing to market.

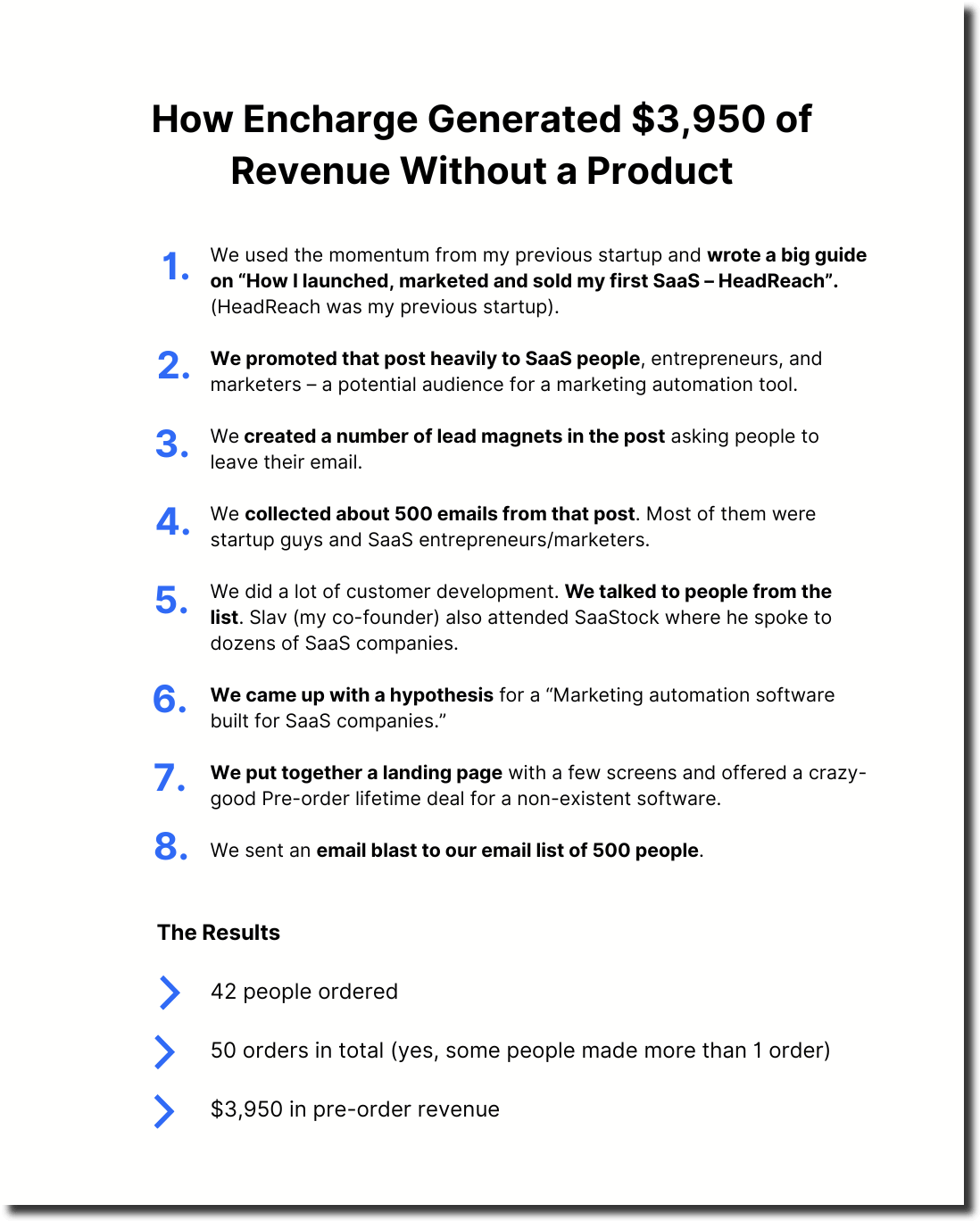

SaaS email marketing platform Encharge used pre-selling to generate initial revenue and validate their product idea before launching.

Here’s the exact strategy they used:

4. Negotiate Payment Terms, Options, And Methods

There is always an opportunity to open a discussion with your supplies about payment terms.

For example:

- Can you get payment discounts for paying early?

- Can you go from a 30-day invoice to a 60-day term and extend accounts payables?

- What happens if you pay via credit card, are there additional charges? Or can you get a discount because they get the funds instantly?

- Is it possible to make payments to vendors in installments?

- Are there quarterly or annual payment options? Will they reduce your costs?

All of these questions help you to identify opportunities to reduce your total expense amounts, and also to manage cash flow more efficiently.

For instance, if your overall cost is the same if you pay annually or monthly, then you might decide that you may as well just pay a little each month.

If, however, you get a discount for paying annually, then that might make sense for your overall operational costs.

5. Launch A Lifetime Deal (LTD) Promo

If you’re selling a SaaS product, a lifetime deal can be a great way to get some cash in the bank now to bulk up your runway.

A lifetime deal basically gives customers access to your platform for life (yeah, it’s just as it sounds). This is as opposed to them paying monthly or annually for your product.

Naturally, your total revenue across the period of a customer’s lifetime will drop (because you’ll have to give them a significant reason to purchase the lifetime deal), but the upside is that you get the cash in the bank right now, easing cash flow concerns.

Just how effective can LTD’s be?

Virtual event platform HeySummit launched using a LTD on Appsumo and generated over $140K of revenue in just two weeks.

6. Consider Not Going Freemium Immediately

SaaS companies love their freemium, don’t they?

If you’re unfamiliar, freemium is a pricing model where the most basic tier of your product is available for free, but users need to pay to upgrade to a more advanced plan.

But while freemium is a popular model for growth, customer acquisition, community-building, and lead generation, it can be a huge problem for profit margins and, as a result, cash flow.

Obviously, if customers are on the free plan, you’re not generating any revenue.

Sure, you say, but the point is to upgrade them to a paid plan. Yes, it is, but you’ll only be able to do this if:

- You’ve developed significant value and feature sets into the premium tiers

- You’ve gotten very good at converting users to paid plans

And, if you’re still in startup mode, there’s a fair chance that neither of those things is true yet (good things take time).

In that case, you’re actually losing money with each new user, because your customers aren’t paying you, but you still have to pay for server usage, support staff, etc. An instant recipe for cash flow issues.

Look, I’m not saying avoid freemium.

The freemium model can work great—if you execute it correctly. Namely, you need to account for pretty significant peaks and valleys in revenue as some freemium users who convert and churn.

As this article from Harvard Business Review points out:

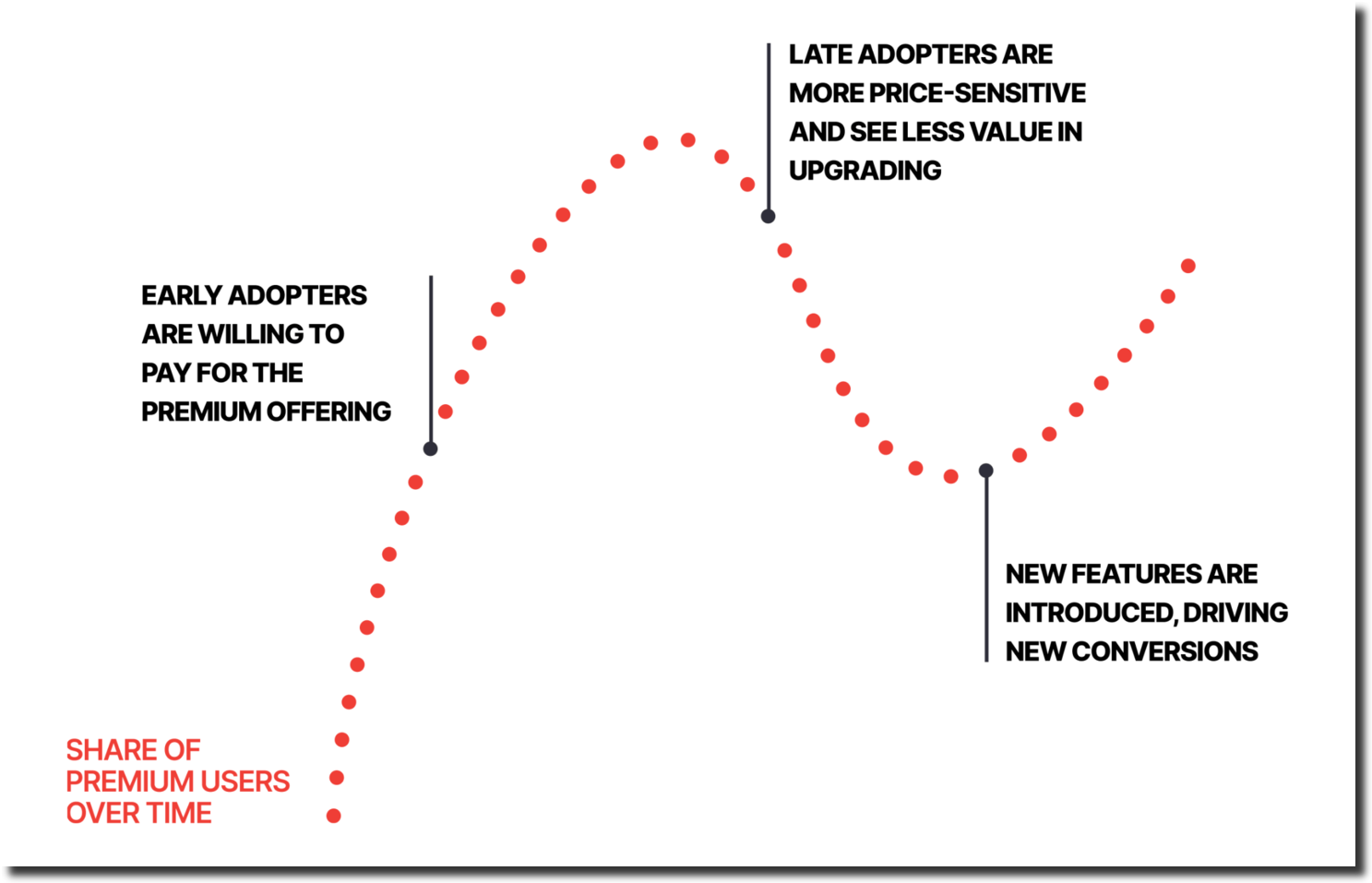

“Freemium companies typically see the share of paid subscriptions (and therefore cash flow) rise and fall and then rise again in a predictable way over time. Those that don’t account for this phenomenon risk failure.”

This graphic illustrates the shifts in revenue from converted freemium users.

7. Lease Equipment Instead Of Purchasing Outright

Buying your equipment upfront is going to be cheaper in the long run, yes.

But that’s only good if there is a long run. If your business doesn’t last, you won’t have a long enough period of time to get value from the equipment.

In this case, it might be smarter to lease your equipment (office furniture, computers, etc.) rather than buy it.

This way, you’re reducing your upfront cash investment, keeping more cash balances the bank for other ongoing expenses, and extending your cash runway with consistent and predictable operating expenses.

The moral is don’t commit to purchasing outright without comparing financing options to leasing. Committing to long-term assets without a long-term time period of use is poor cash flow management.

8. Implement Inventory Management Strategies

This one’s for those selling a physical product.

Take a page out of the books of supermarkets and large retail chains like Walmart and focus heavily on inventory management.

That means paying close attention (or rather, having an inventory management system pay close attention) to the rate at which certain stocked items or components are going out, and optimizing the amount of inventory you keep on hand.

If item A is moving twice as fast as item B, then you should dedicate twice as much shelf space for item A. Consider discounting item B to move any excess stock for extra cash.

This strategy reduces the need for huge storage locations, and helps manage cash flow more effectively because you’re not paying for inventory you don’t actually need to keep on hand.

Cash Flow Management Made Easy

Following these eight cash flow management strategies can be the difference between a flourishing business and struggling.

At the highest level, cash flow management is all about understanding the numbers, and the best way to do that is to invest in a system that offers real-time reporting, scenario planning, and cash flow projection.

Oh, hey, that’s Finmark from BILL (yeah, us).

Go ahead and stalk our features, or just jump straight in and start a free trial!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.