How to Create a Strategic Forecast For 2023

Financial forecasting is one of the most important aspects of a CFO’s role.

Accurate and insightful forecasts inform budget allocations, company investments, and spending decisions, and can even influence the possibility of future funding.

Unfortunately, many finance leaders create forecasts based on guesses and hunches rather than solid data, which ultimately leads to financial reports that, if we’re honest, don’t really mean a whole lot.

In this guide, we’re going to explore the very opposite: strategic forecasting.

It’s an approach to financial forecasting which combines historical performance with the expected changes in revenue and expenses from aspects like economic conditions, market trends, and strategic growth initiatives.

So, not guesses and hunches. Want to know how it’s done?

Keep reading.

What Is A Strategic Forecast?

This is one of those terms that kind of explains itself. I mean, a strategic forecast is a forecast that’s, well, strategic, right?

But what does that actually mean? First, let’s define what a ‘“forecast” is.

A forecast, or revenue forecast, is an estimate of what your company’s income will look like over a given period.

A revenue forecast for the next financial year, then, tells you what you can expect income to look like in the next 12 months.

You’ll notice a lot of hedge words in that definition, like “estimate” and “expect.” Indeed, the word “forecast” itself has an element of uncertainty to it.

That’s because, as finance leaders, we accept that nothing is written in stone. Any financial plans we make for the future are subject to change, whether by forces of our own or otherwise.

To counteract that uncertainty (at least to some degree), CFOs use strategic forecasts.

What Makes A Forecast Strategic?

A simple forecast looks at historical performance and maps that forward into the future: “Last year we made $4m in revenue, so next year we should also make $4m in revenue.”

A slightly smarter approach might look at growth trends, assessing that company revenue grows at a rate of 50% year-on-year and stating, “We made $4m in revenue last year, and we grow 50% each year, so this year we should make $6m.”

Strategic forecasting takes stock of these historical trends, but also brings in a number of other variables to make a more accurate estimate of revenue expectations:

- Revenue drivers (the levers you can pull to bring more income in) and how you plan to use them

- Employee headcount

- Economic conditions

- Market trends

- The upcoming release of new products or features

The analysis and incorporation of each of these important elements are what makes a financial forecast “strategic.”

What Variables Influence Strategic Forecasting?

Strategic forecasting takes stock of a number of different variables that could potentially influence your ability to generate revenue.

When designing your own forecast, draw from these variables to make your estimates as accurate as possible.

Historical Data

This is the variable that most of us look to first, and it’s certainly an important component of strategic forecasting.

Begin by analyzing the historical financial information you have on hand (which is easy to do with a tool like Finmark, from BILL).

Ask these questions:

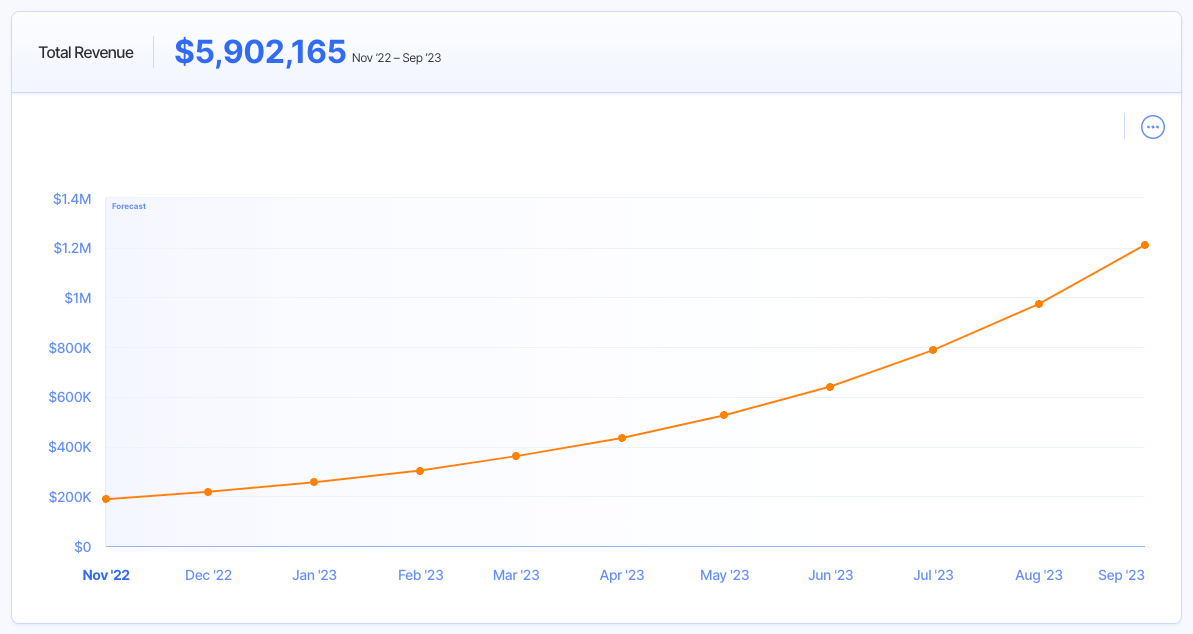

- What was our revenue last year, and the year prior?

- What was difference between those two years in terms of the actions we took?

- What does our revenue growth trajectory tell us?

This should give you a baseline forecast (“We did X last year, and our growth rate is Y%, so we should anticipate Z”).

Obviously, this isn’t a sufficient answer, but we’re just getting started.

Revenue Drivers

Next, dive deep into your revenue drivers.

Revenue drivers are the levers you can pull to influence revenue growth, and most of them fall into the sales or marketing categories.

Sales team training might be a revenue driver, as might advertising on LinkedIn. If you spend more money on that action and revenue increases, you’ve got a revenue driver.

Look at your drivers, and then dig into how you plan to pull those levers going forward.

Let’s say, for example, you know that LinkedIn advertising is a key revenue driver. You’re currently spending $500k on ads per year, and you know that for every additional $100k you invest, you generate $250k in revenue.

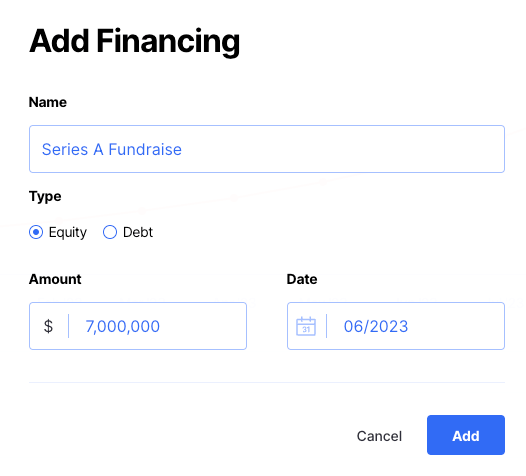

You’ve just received a nice new chunk of funding from one of your investors, and this year you plan to invest another $200k in LinkedIn ads, which means you anticipate adding $500k in revenue to the tally.

Add this to your forecast.

Employee Headcount

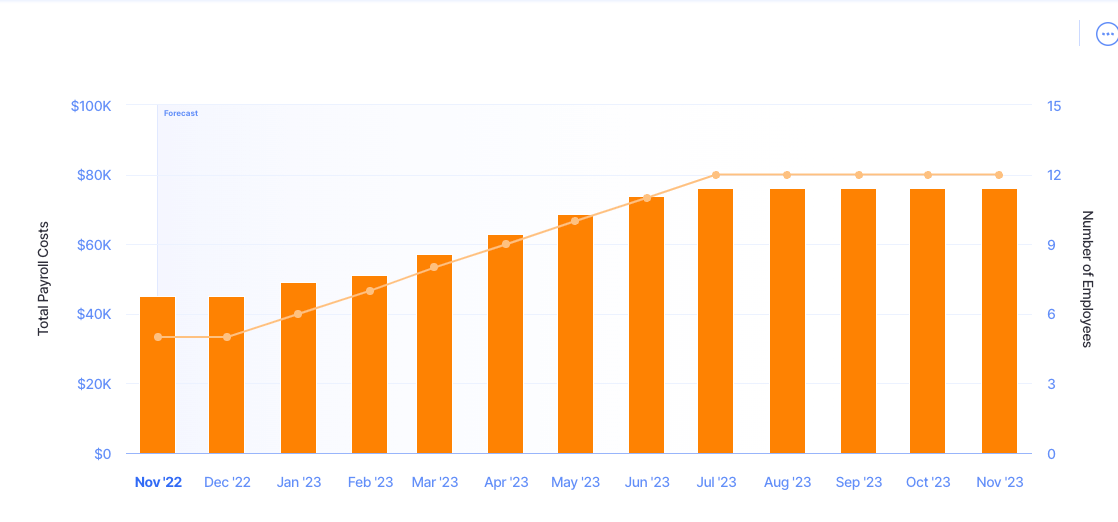

Depending on the role, employee headcount can have a major impact on revenue.

If you double your sales team headcount, for example, you should be able to bank on doubling sales volume, all things being equal.

Analyze your headcount growth goals as well as historical trends in this area (how many people you tend to hire this year), and then equate that to revenue.

What does it mean for income, for instance, if you add two new outbound sales reps?

Use your hiring plan here to inform the strategic forecasting process.

Economic Conditions

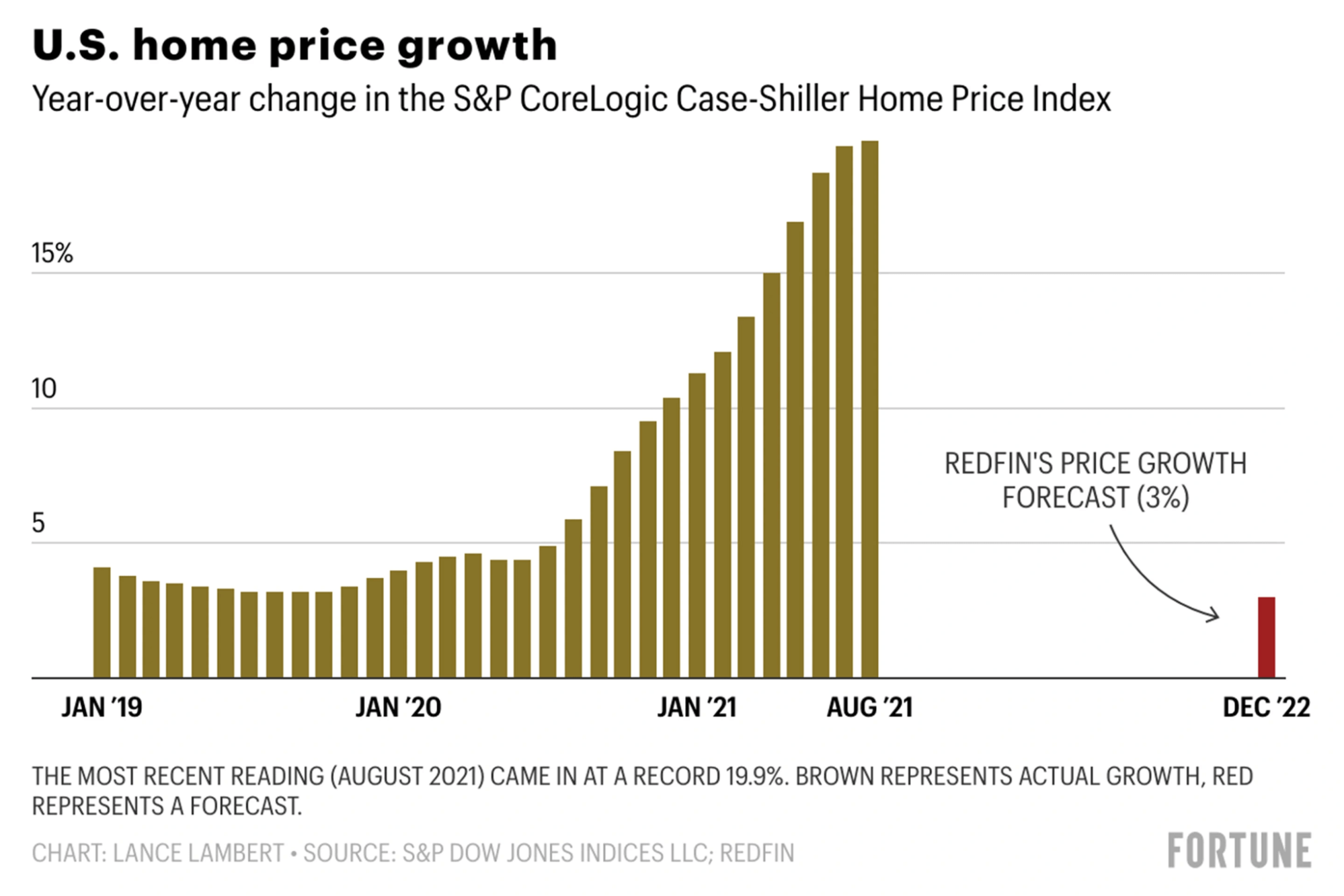

Predicting economic conditions can be challenging, and things can certainly develop quickly within the span of a year.

However, you should make considerations for the possibility of economic changes, and how they’ll impact your profitability and revenue-driving capabilities.

Consider the real estate startup that experienced a massive revenue boost during the pandemic. During that time, they likely had very optimistic forecasts. But now that things have cooled down, many of those companies have much less optimistic forecasts.

Analyze how the current economic state of your country and industry might be impacting your ability to drive revenue, and account for any expected developments.

Market Trends

Separate from the wider economic conditions that you exist in are trends and developments in your market.

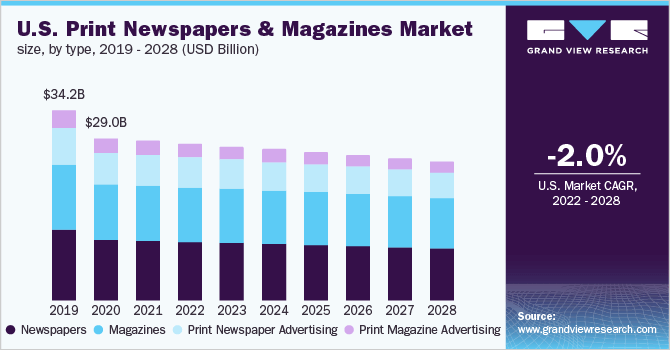

Let’s say you’re in print media. It’s a market that, for many years, has been trending downwards, so it will be important to understand this trend when creating a forecast for the next financial period.

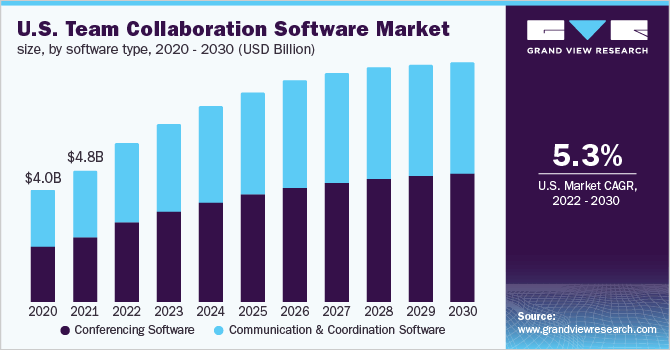

On the other side of the equation, companies that offer software for remote teams (such as asynchronous communication software) are profiting off the rise in worldwide remote work.

Take stock of any trends in your market, and analyze how they might continue (or not) over the next financial year. Apply these predictions to your revenue forecast.

New Product or Feature Releases

Lastly, consider how your product development pipeline might have an impact on earnings.

Look at your historical data for an indication here: do you see a boost in sales when you release new product updates or features?

Then, ask: how should you account for that in your future forecast?

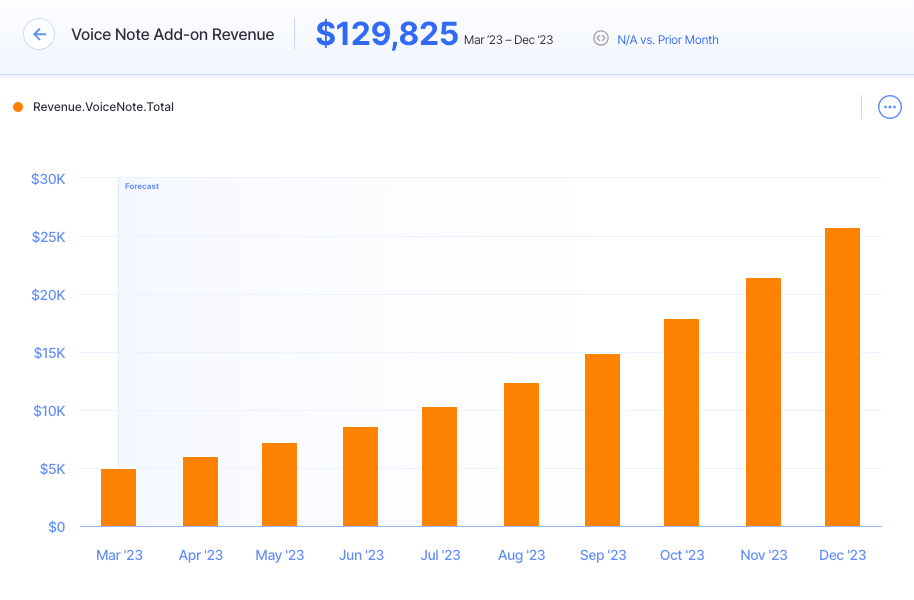

Let’s say you are one of those asynchronous communication platforms, and you’re currently text-based. In quarter two, you’re planning on dropping a voice note feature.

How might this impact profitability? How many of your existing customer subscriptions do you expect to upgrade to include this feature? How many new customers might this attract?

Add these estimates to your strategic forecast as well.

How to Create a Strategic Forecast

Ready to build your first strategic forecast?

In the following sections, we’ll look at a very high-level approach to strategic forecasting.

If you’re interested in digging into the nitty gritty, tactical elements of this process, check out our guide: Revenue Forecasting: 4 Step Guide.

1. Bring In Historical Data

Start by pulling together any relevant data on your previous financial performance.

For those of you using a financial reporting and forecasting platform, this should be as easy as heading to the analytics suite and accessing the reports you need to see.

If you haven’t quite got your systems set up yet, you might need to spend a bit of time digging through various spreadsheets and financial statements. Invest the time upfront to get accurate data, in any case.

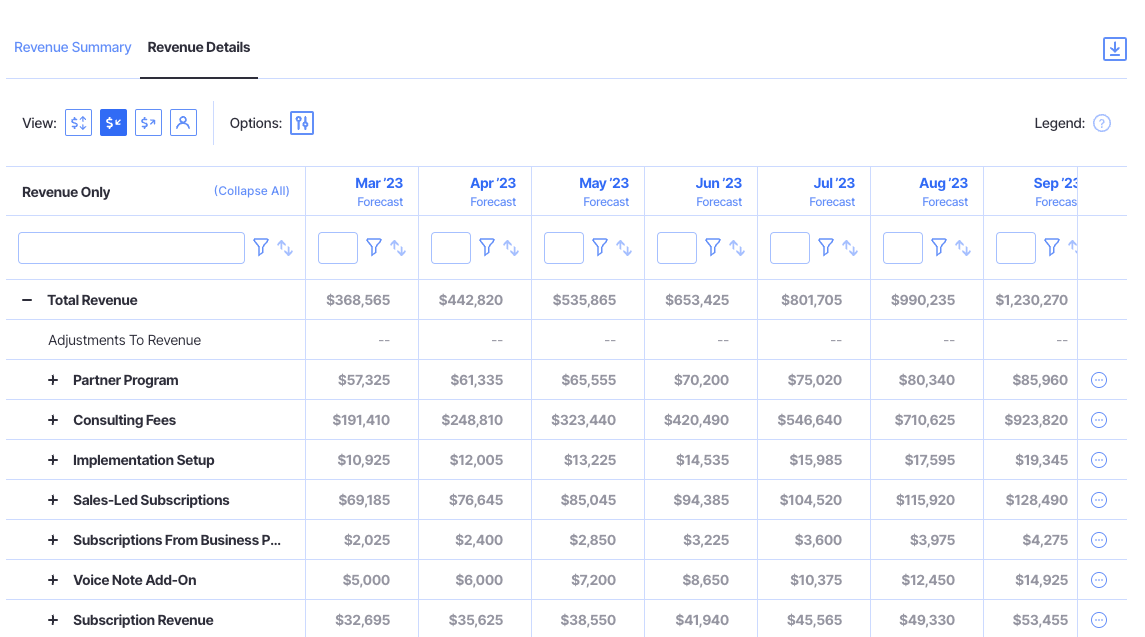

Make sure you can review revenue data at multiple levels:

- Total revenue

- Revenue from each stream

- Revenue for existing vs. new customers

- Recurring vs. one-off revenue

Hint: This is easy to do in Finmark!

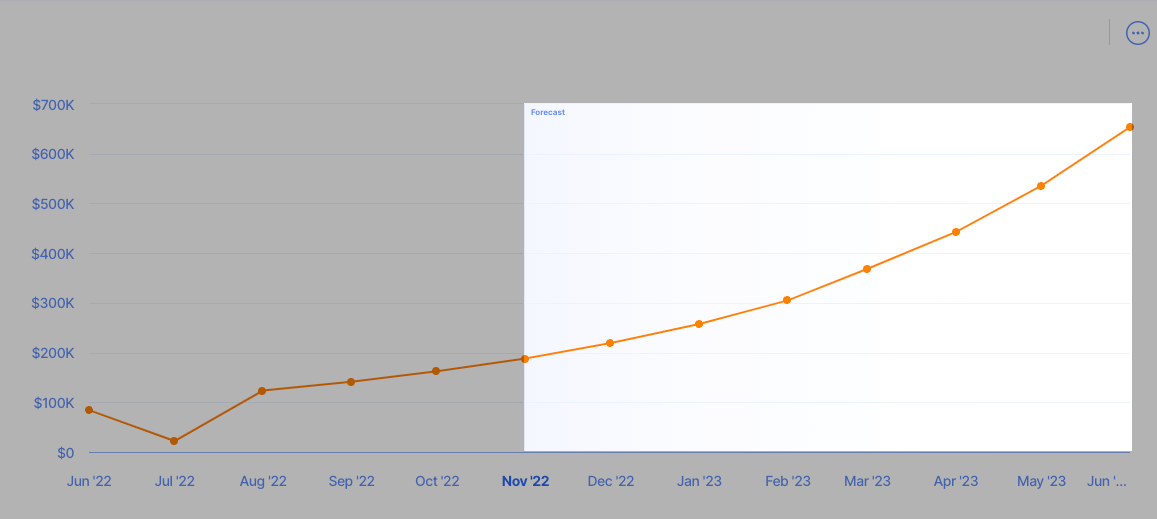

2. Add Growth Trajectory

With this data in hand, you should have a firm revenue number for last year’s earnings.

Of course, you don’t want to just meet last year’s performance, right?

Dig into your growth trajectory data to understand what you can expect revenue to look like this coming year if you do nothing else different.

Say, for example, that in each quarter of last year, your revenue grew by 10%. Apply that growth trajectory to your forecast.

3. Apply Strategic Variables

Here’s where you pull in what you’ve just learned.

Consider the different variables we discussed above:

- Your revenue drivers (and how you intend to influence them)

- Employee headcount

- Economic conditions

- Market trends

- Any new product or feature releases in the pipeline for the financial period

Analyze how these initiatives might impact revenue, and add those estimates to your forecast.

For example, you might have identified that one of your key revenue drivers is headcount in the customer success team, as you have a top-level business goal of growing revenue from existing customers.

Plug in the expected revenue increases (or decreases, as market trends and economic conditions may have a less-than-desirable impact) from these variables and adjust your forecast as required.

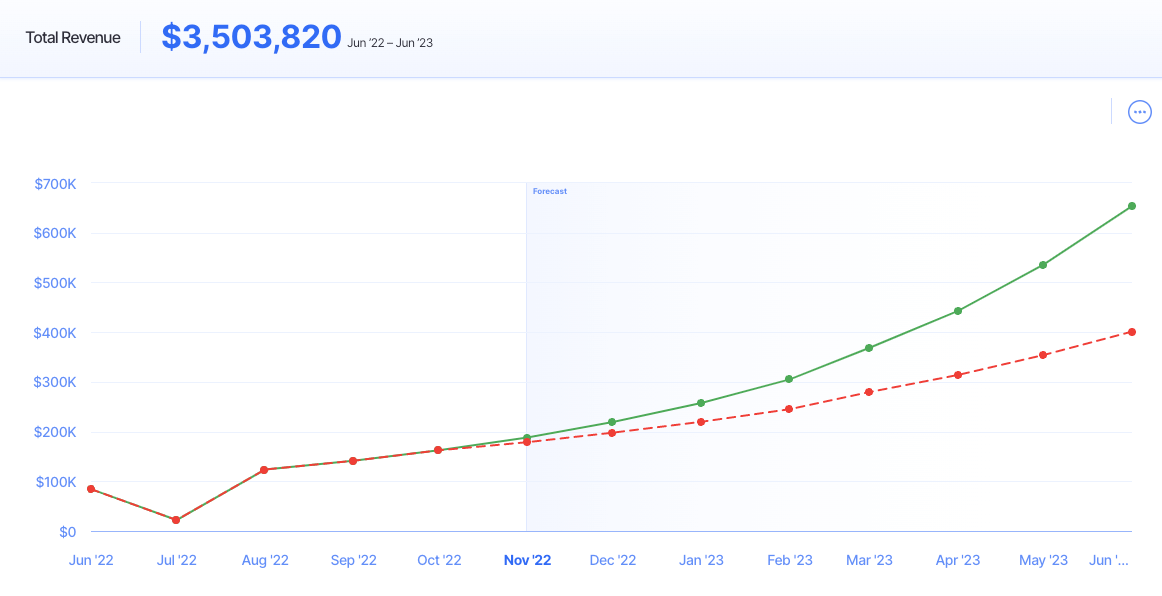

4. Create Upside/Downside Scenarios

Lastly, prepare for uncertainty by analyzing multiple financial scenarios and creating upside and downside plans.

Basically, what you’re going to do here is make your primary forecast and then say, “What happens if we are up 10% from our expectation, what can we do with the additional revenue?” and “What if we’re down 10% because we overestimated? How do we need to adjust spending.”

The full process of scenario analysis is a little outside the scope of today’s lesson, but you can upskill yourself here: How to Do Scenario Analysis: Step-By-Step Guide.

Sprinkle Some Strategy on Your Forecast

Strategic forecasting is one of the most important skills every great CFO needs to master.

That said, effective forecasts don’t appear in a vacuum. The best financial leaders take advantage of powerful financial modeling software to pull out key insights and automate and optimize various aspects of the forecasting process.

Ready to learn more about how these tools can bolster your expertise and make CFO-life easier? Check out our guide here: What Are The Best Financial Modeling Tools?

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.