Cash Flow Forecasting: How to Accurately Plan Ahead

Have you ever wished you could see into your business’s financial future? There’s one key too you need to know to help stay ahead of the curve: cash flow forecasting.

By dedicating a small amount of time every week, month, quarter, or year, you’ll identify periods where money might be tight or growing and plan accordingly.

Getting started with cash flow forecasting is intimidating. But with our guide, you’ll have all the tools you need to get started and begin planning for your future.

What is Cash Flow Forecasting?

Cash flow forecasting is a way of projecting how much money will enter and leave your business over a chosen period of time. It’s used by businesses of all sizes to predict whether they’ll have enough money to cover expenses, payments, or meet future financial goals.

A cash flow forecast is often based on past data. But there will be some other factors where you’ll need to use your intuition to fill in the gaps.

The Benefits of Cash Flow Forecasting

Forecasting your cash flow helps make the future a little bit more predictable. Whether it’s making budgeting decisions or getting a clearer picture of how much cash you’ll have available down the line, a cash flow forecast takes out some of the guesswork.

Most importantly, cash flow forecasting lets you adjust your plans to ensure your business’s financial health.

For example, let’s say you need to place an order to restock your inventory.

You’ll pay for the order now and receive the stock in three months. You could use cash flow forecasting to predict whether your cash flow will sustain you for three months before the new stock arrives.

How to Forecast Cash Flow

Performing a cash flow forecast is as complicated or basic as you want it to be.

Based on your needs, you might take a simplified approach for a general understanding of how your business will perform. Or you might want to take an in depth approach for a more precise picture.

In general, these are the eight steps to perform a cash flow forecast.

1. Choose a Forecasting Method

There are two different methods for forecasting cash flow:

- Direct method: The simpler of the methods, the direct method only looks at cash transactions. You can think of cash transactions as when money actually changes hands. Examples of what you would include as cash transactions are sales revenue and operating expenses.

- Indirect method: The indirect method adds in additional adjustments or non-cash transactions. This includes changes to an accounts receivable or payables balance, inventory, and depreciation.

So which method is best for you?

For most small businesses that use the cash basis of accounting, the direct method meets your needs.

But if you spend more time looking at your balance sheet, the non-cash adjustments included in the indirect method are valuable.

If you’re new to cash flow forecasting, start with the direct method to get some reps and learn what information is most valuable to you. Then consider moving to the indirect method once you’re confident in your forecasting practices.

2. Choose a Forecasting tool

Cash flow forecasting can be done with a basic template for either Excel or Google Sheets.

There are also financial planning tools like Finmark from BILL that automatically turn financial data into forecasts which saves you a lot of time.

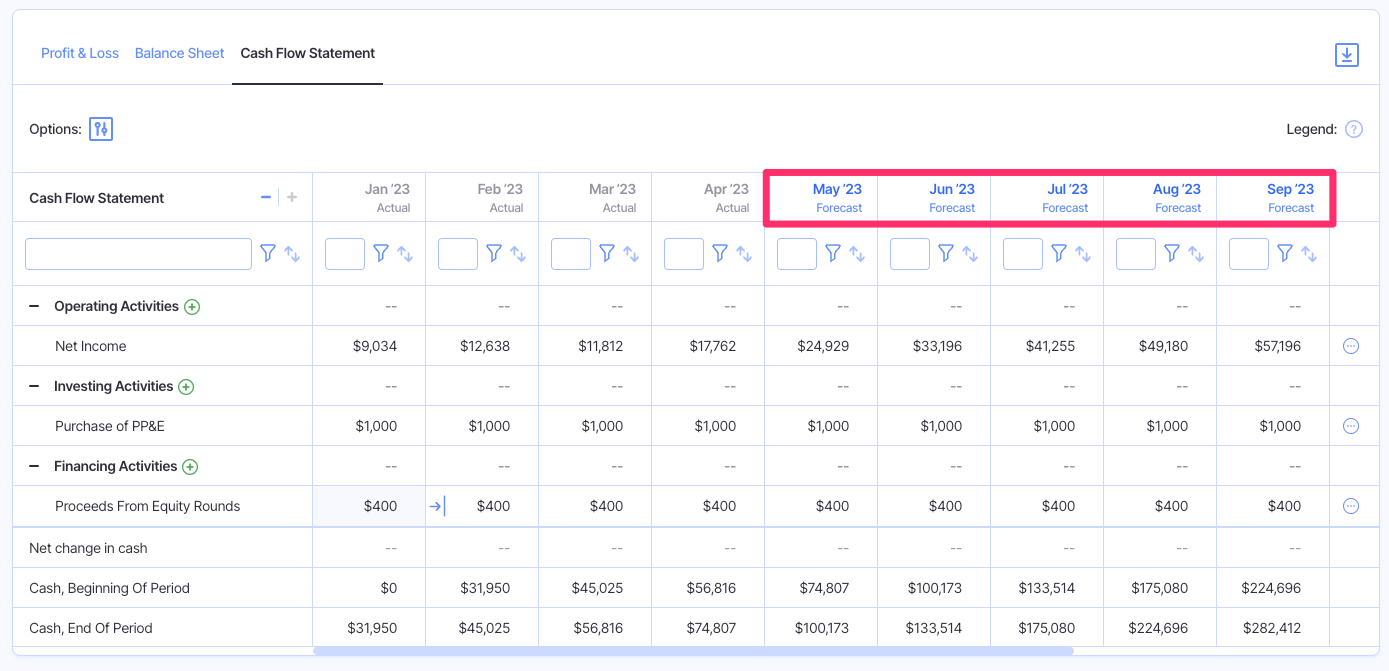

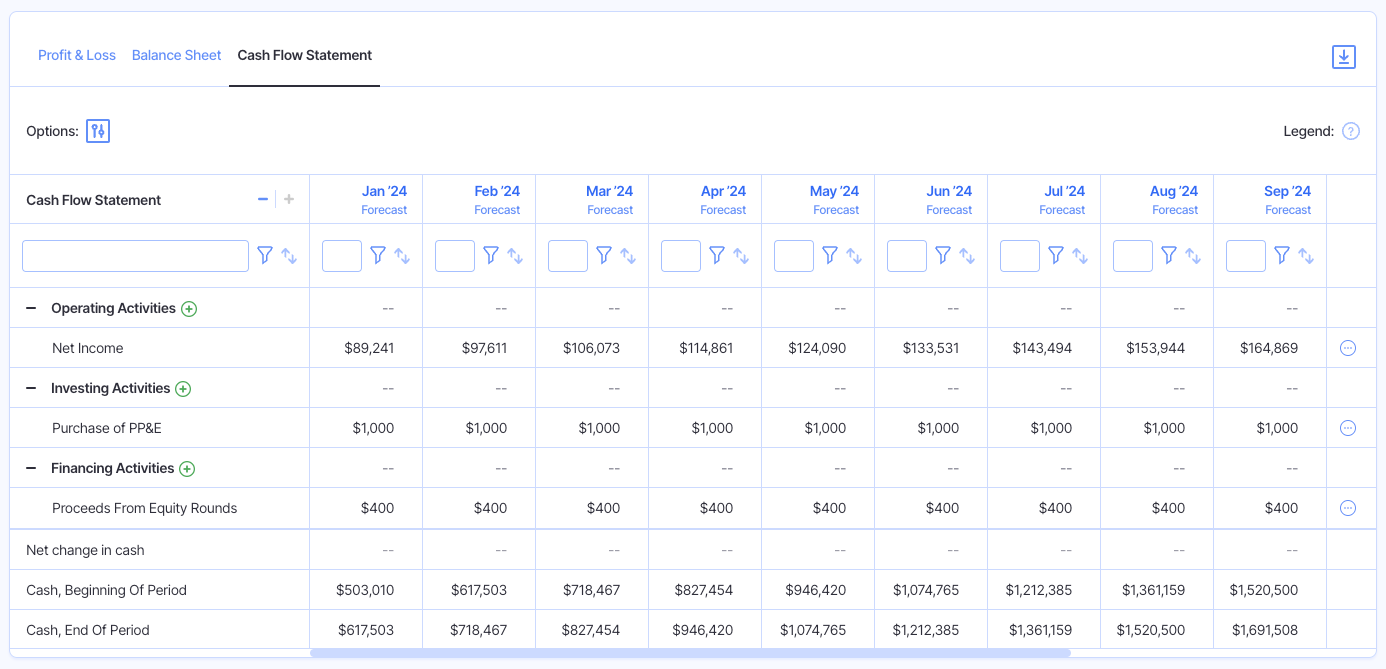

3. Choose the Period You’re Forecasting For

You can ultimately choose any timeframe for a cash flow forecast. It can be as short-term as predicting the next month or as long-term as the next year. But remember that the longer the time period, the more you need to assume about the future.

You can always add extra time onto a cash flow forecast. For example, if you forecast the next quarter and want to see the quarter after, it’s easy enough to add it on with a bit of extra work.

4. Look at Past Data

Cash flow forecasts are predictions, but are rooted in data. Start by reviewing your financial statements from the past year to find trends in your revenue and expenses for the period you’re looking at.

You’ll want to have a firm understanding of your recurring expenses that are a guarantee like rent, utilities, and software subscriptions. Then look at variable costs by month like payroll, marketing, and office supplies to estimate how they’ll shape out for the period you’re forecasting.

5. Forecast Sales and Revenue

Start by looking at the money you expect to earn based on past data. Make any adjustments to reflect what you might be doing differently.

For example, what if you are planning a massive inventory clear out sale next month? You’ll need to estimate the additional revenue this will add.

A good approach to estimate additional revenue from a sale or promotion is to take your desired revenue goal and multiply it by a percentage of how likely you think it is you’ll hit it. If you’re hoping to add $10,000 in sales and you’re 80% sure you’ll hit it, forecast for $8,000. This is called expected value.

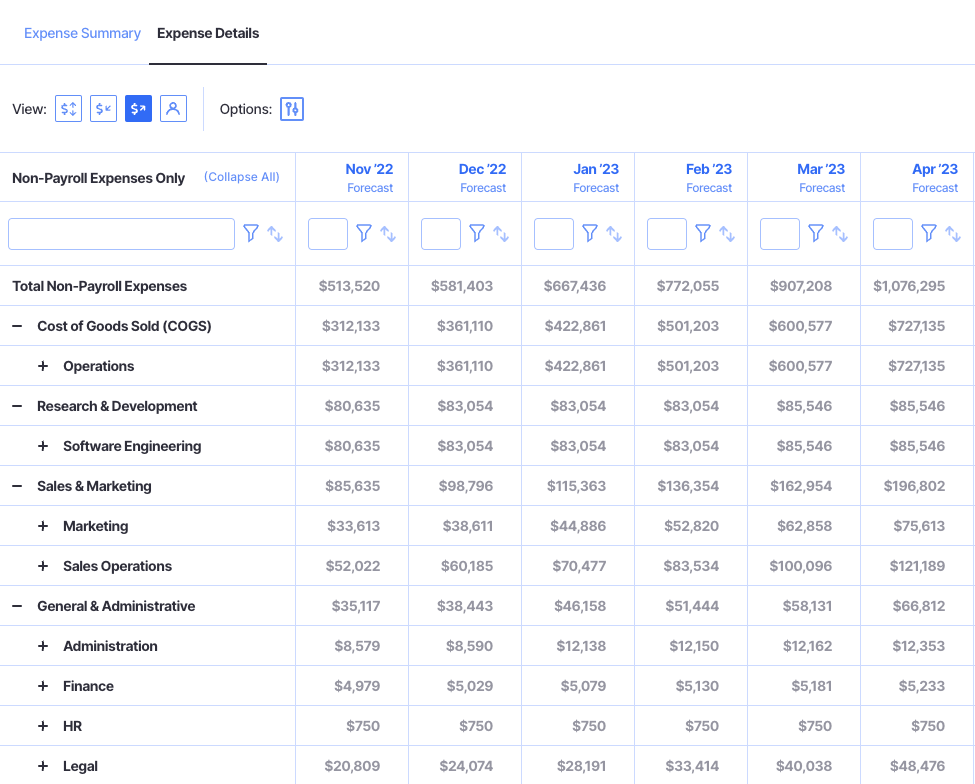

6. Estimate Expenses

Just as you did with sales, start by taking your recurring expenses and expected costs based on past trends. Then add in any expenses that will be new. Some variable expenses that are helpful to review are marketing costs and payroll expenses—costs that change as your business grows.

7. Add Additional Cash Inflows and Outflows

This is where things can get a bit tricky.

If you choose to use the direct method, you could skip this step. But for the indirect method, this is where you add any non-cash adjustments.

For this step, look at your balance sheet. You’ll need to make adjustments for things like:

- Depreciation of an asset

- The increase or decrease in accounts receivable or payables

- Paying down debt like a credit card, loan, or line of credit

- The increase or decrease in inventory

How much extra information you include depends on how exact of a forecast you want for your business.

If you only care about the bottom line, you don’t need to spend a lot of time on this step. But if you want the clearest picture of your business, spend the extra time to take into consideration all cash flow activity.

8. Review and Adjust

Now that you have a cash flow forecast, it’s time to dig into the results.

But first, take a moment to look at how your work adds up and review your assumptions you made to ensure everything is accurate.

Once you’ve got a completed cash flow forecast, here are three possible outcomes:

- Negative cash flow: More money is leaving your business than entering. It’s time to look at expenses you can save on, look for short term ways to grow revenue, or try to delay payments when possible.

- Neutral cash flow: An equal amount of money is leaving and entering your business. This will keep your operations stable, but you’re at risk of cash flow going negative if your expenses increase or revenue dips.

- Positive cash flow: More money is entering your business than leaving. Start thinking about ways to put this extra cash to work. There’s room for a big purchase to improve operations, extra marketing spend, or maybe just stashing it away as a rainy day fund.

How to Analyze Your Cash Flow Forecast

Now that you have a cash flow forecast, what do you do with it? Analyze.

To get the most amount of value from a forecast, try these different approaches.

Simulate Different Scenarios

A great value from cash flow forecasts is simulating scenarios or how a change affects your business. You can answer questions like:

- How does an increase in our cost of goods sold affect our cash flow?

- What happens if our sales are higher or lower than expected?

- How does a loan affect our monthly cash flow?

- How will an additional employee affect our forecast?

By running a situation through a cash flow forecast you get a clearer picture of its impact and can make a decision with confidence.

Identify Shortages or Surpluses

One of the biggest challenges for small businesses is adapting to a cash shortage. Performing a cash flow forecast helps you see when a shortage might occur so you can make adjustments to prevent it from ever becoming a problem.

You might also see a cash surplus in your forecast. This lets you know when you can plan on making a new purchase or increase your spend without breaking the bank.

Plan for Seasonal Trends

If your business has periods of increased or decreased activity, a cash flow forecast helps you plan for it. You can either determine how much you’ll need to save to weather a down period or how much extra cash on hand you’ll have from a peak of activity.

Looking into these seasonal trends also helps you decide how to adjust your spending.

For example, if you know more sales means you’ll need more employees, you can see how much extra room you have in the budget for payroll. Or for a down period, how much payroll you need to cut to stay cash positive.

Create Timelines for Financial Goals

Do you have a big purchase on the horizon? Or maybe a revenue number you’re wanting to hit? A cash flow forecast helps predict when you’ll get there.

This is especially helpful for businesses that are looking for investment or to take out a loan.

You can map out the impact of that additional capital and showcase your business’s increased value. Or alternatively, you might see that the impact wasn’t what you expected, saving you from taking on unhelpful debt.

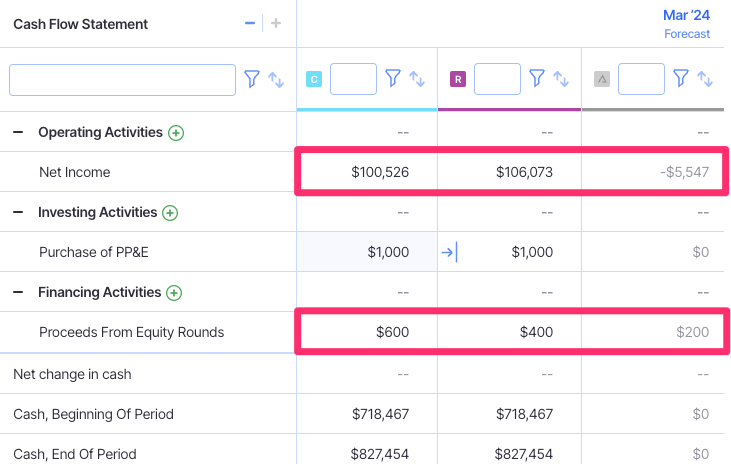

Compare Actual Results to the Forecast

Cash flow forecasts are one part science and one part art. The science is all the historical data you use and the art is the predictions you make.

At the end of a period, you might look at your cash flow forecast and see your estimation was off. This doesn’t mean you made a bad forecast! In fact, digging into the why is a very valuable practice.

Understanding why a cash flow forecast was off the mark helps you learn about your business—and improve future forecasts.

Maybe you identify a seasonality you didn’t expect or you recognize an uptick in expenses you didn’t see coming. Once you find those trends, you can include them in future forecasts or adapt your strategy to better prepare for them.

Regardless of the outcome of a cash flow forecast, it’s an invaluable tool for getting an in-depth understanding of how your business operates. This knowledge helps you make better decisions and keep your business cash positive.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.