Reforecasting: When & How to Reforecast Your Budget

Reforecasting was once seen as something businesses only needed to do when major changes happened (you know, like that thing that happened a couple of years back).

Today, more and more finance teams are starting to make reforecasting a regular part of their processes.

As circumstances change, updating your forecast to reflect the impact of those changes is just good business practice.

I mean, why wouldn’t you want your budget to be as accurate as possible throughout the entirety of the year?

And thanks to tools like Finmark from BILL, a lot of the “heavy lifting” involved can be automated, or at least done a whole lot faster, taking the pain out of regular reforecasting.

This article will be your 101 on reforecasting.

What Is Reforecasting?

Reforecasting is pretty straightforward. It simply means “forecasting again.”

It’s when you need to re-create and adjust your budgets due to some unforeseen circumstance occurring, or when you’re otherwise veering off the original track.

Though most consider the need for reforecasting in the context of a negative event (like a huge supply chain shortage), reforecasting can also be a valuable practice in light of positive variance.

For example, let’s say your revenue for the last quarter was 20% higher than anticipated, and you forecast this increase to remain constant. To maximize growth, you’ll want to strategize on how you can best invest this additional cash flow.

Therefore, you’ll need to reforecast.

Why Should Businesses Reforecast?

The primary reason behind reforecasting is to ensure your budgets are accurate and make sense in light of your company’s current financial position.

Consider this.

You built your annual budget at the beginning of the fiscal year, and you’re now six months in. Revenue is about 20% short of expectation, and your shipping expense has increased dramatically due to international transportation issues.

Is your budget for the next six months still accurate?

The answer is no.

You know that your shipping expense is going to be more than budgeted and that your income is unlikely to grow any faster than it already has been (all things being equal).

If you continue as planned, you’re going to run into a cash flow issue. But if you reforecast, you can reallocate spending, adjust for the increased expense, and potentially pivot your revenue strategy to right the ship.

This is why a reforecasting practice can be so beneficial for businesses.

How To Know When You Need To Reforecast

There is still a pervasive belief that reforecasting only needs to happen when a major event takes place that significantly impacts profitability.

Classic examples include:

- A costly lawsuit

- Missing out on expected funding from an investment

- A huge supply chain issue

- Changes to compliance regulations

- Economic and market changes

- The loss of an essential business partner

While it’s true that such events do beg for a reforecast, these aren’t the only reason for forecasting.

The best way to think about it is this:

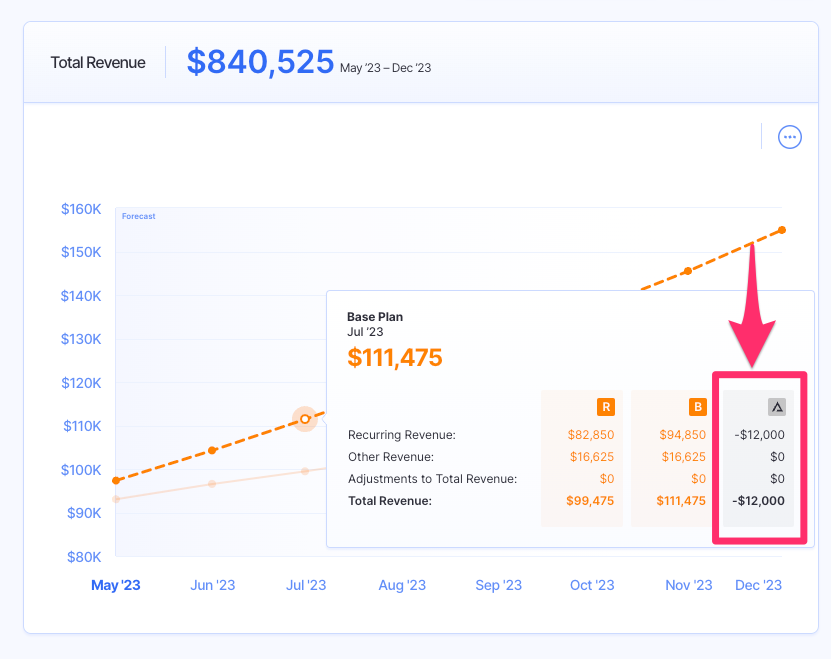

Whenever you notice significant changes or variances in your budgeted numbers, you probably need to make some adjustments. Here’s an example of a large revenue variance that might be cause for a reforecast.

Look for significant variances in your budgeted figures

If you are regularly looking at your budget versus your actuals and notice a significant deviation in revenue or spending, it may be time to review your initial forecasts.

Of course, you don’t want to be start adjusting your budget for every little unexpected spike in expenses or revenue.

So, the best way forward is to decide on a variance threshold, above which you engage in reforecasting.

For example, you might decide that if a particular revenue or expense line item comes in at 10% above or below budget for more than two months in a row, you’ll reforecast.

From there, having a repeatable reforecasting process is going to help make this critical process quick and seamless.

Reforecasting A Budget In 7 Steps

Reforecasting is all about updating the assumptions you had when you originally built your budget and using the data you now have on hand to improve the accuracy of that budget.

Follow these repeatable steps each time you need to reforecast. The first four are all about pulling the relevant data together; the final three are where you create the actual budget forecast.

1. Review Your Variances

The first step is to do a budget variance analysis.

This is where you look at your actuals vs. your budgeted figures and determine where the difference is.

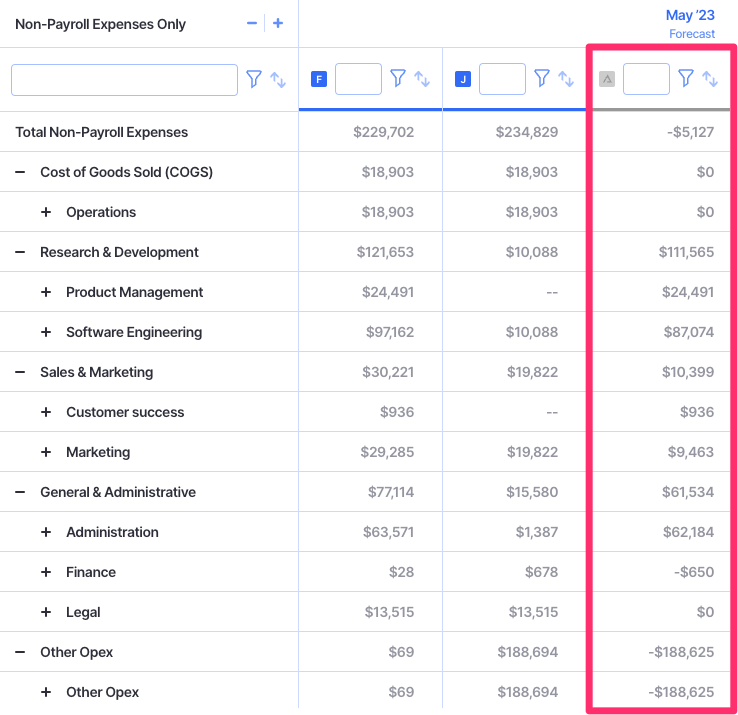

Comparing budgeted figures with actual performance. Notice the variance in the highlighted column.

Maybe your marketing campaigns overperformed, leaving you with excess revenue that can be added to the budget.

Or, if they underperformed for an extended period of time, you may have overestimated your cash flow and need to make adjustments.

You probably already have a good idea of where to look because this variance is what’s driven you to reforecast in the first place.

But, rather than only incorporating the variance knowledge you already have, run a full variance analysis to ensure all your financial data is up to date.

Learn how here: Budget vs Actuals (How to Compare & Analyze).

2. Consider Continuing Trends

Next, you’ll need to do a bit of future-gazing to determine which of the trends you’ve identified will actually continue into the future.

Let’s take the example of a dramatic increase in shipping costs.

Over the last quarter, your shipping expense was 35% more than anticipated due to international supply chain issues.

You’re clearly going to need to reforecast, as this is a major divergence from your budget.

But you might not need to increase your shipping budget by 35% for the remainder of the financial year if you can establish that costs are already deflating back to normal.

Use your analysis of market trends and predictions to determine by how much your budget really needs to be adjusted.

3. Reassess Revenue Drivers

Take this opportunity to reassess how your revenue drivers are performing.

Your revenue drivers are the key inputs that contribute toward revenue growth (learn more about how to determine what yours are here).

Examples of revenue drivers

In a scenario where your revenue is sitting above or below budget, it may be the case that you over or underweighted a given revenue driver.

Understanding how these inputs are currently impacting revenue growth is crucial to developing a more accurate budget.

Similarly, if you’re reforecasting due to an expense increase, you may be able to adjust your investment in particular drivers to speed up revenue growth and offset the additional expenditure.

4. Revisit Cash Flow Projections

It’s always a good idea to create a new cash flow projection in anticipation of a budget reforecast.

This will give you an up-to-date reflection of what income should look like for the remainder of the year, allowing you to allocate investment accordingly.

Learn how to create one here: How to Create a Cash Flow Projection: Step-by-Step Guide.

5. Adjust Revenue Streams In Your Budget

With the data you’ve gathered from your assessment of revenue drivers and cash flow projection, adjust your expected revenue for each stream in your budget.

6. Modify Expenditure

Now that you’ve got the income side of your budget reforecast in order, it’s time to look at spending.

If you’re reforecasting due to an unexpected increase (or decrease, yay) in expenditure, use your variance analysis and consideration of trend continuation to update the budget for this line item.

Then, adjust budgets based on the changes you’ve made to the revenue aspect of your forecast.

For example, if you’ve forecasted a 10% increase in revenue from your original budget, you may want to allocate this additional cash to an investment in further growth like social media ads or content.

7. Build Upside/Downside Scenarios

Scenario analysis is always a good practice when budgeting, and it’s just as relevant when reforecasting.

By building upside and downside scenarios, you can anticipate what might happen if revenue or expenses are higher or lower than expected (i.e., the situation you’re in right now) and build a contingency plan in advance.

This will help speed up the reforecasting process in the future.

This is especially critical when you’re unsure about the continuation of specific trends. For example, if it’s unclear whether that increase in shipping costs is going to continue for the remainder of the financial period.

In this case, you can build two scenarios: one where the price returns to normal, and another where the increase persists.

Learn more about building upside and downside scenarios in our guide: How to Do Scenario Analysis: Step-By-Step Guide.

Reforecast Faster With Finmark

Reforecasting is an important financial practice, but it is one that can get a bit time-consuming, especially if you’re doing it on a monthly basis to maintain budget accuracy throughout the year.

Finance teams should spend less time creating financial statements and more time analyzing them and creating strategic plans for future growth.

Finmark is a financial modeling and planning platform that automatically syncs your actuals so you can compare your budget vs actuals easier and spot variances.

Then you can look at trends in the variance and use that information for your reforecasting process.

Discover just how easy it is to reforecast in Finmark with a 30-day free trial.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.