12 Ways to Extend Your Startup Runway (With Examples)

Before a plane can take off, it needs enough runway to pick up speed until it eventually soars into the air.

Startups are similar. In order for your business to be able to “fly”, you need enough runway to gain traction and build momentum. When your startup runway is too short, you’ll miss your opportunity to “take off”.

Whether your growth has stalled, or you only have a couple of months of runway left, don’t worry. You can still extend your startup’s runway and take off to success.

Here’s how.

12 Ways to Extend Your Startup Runway

In order to extend your cash runway, you need to get more money in the bank or reduce the amount that goes out. Simple, right?

Not quite. If it were that easy, there wouldn’t be an entire website dedicated to startups that have failed.

Not to worry though. I’ll break down 12 strategies (with examples) to extend your startup runway so you have more time to build and grow your business, without the constant fear of running out of money.

Bear in mind, every tactic we cover might not be the best fit for your startup. Our goal is to give you options, so you can pick the strategies that make the most sense for your business.

Learn more: How Much Runway Should Your Startup Have?

1. Increase Your Prices

One of the most straightforward ways to add revenue and extend your runway is to raise your prices.

Here’s a quick example. Let’s say we’re a SaaS startup with three pricing plans:

- Basic: $50/month

- Premium: $100/month

- Enterprise: $250/month

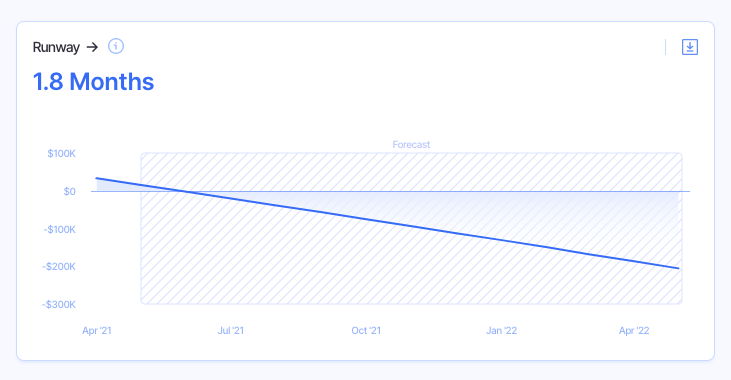

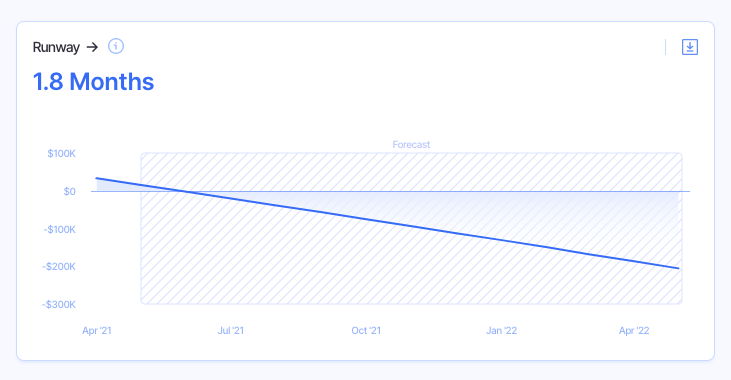

With our current churn rate and monthly customer growth, our runway is less than two months.

Now let’s see what happens if we increase the pricing across all plans by 20%.

With that change, we’ve effectively doubled our runway.

A lot of founders are terrified of raising their prices, and it’s understandable. Telling people to pay you more money isn’t the most comfortable conversation to have.

But here’s the thing. When your runway is dangerously short, having those uncomfortable conversations might be a necessity. However, it doesn’t have to be as unpleasant as you might think.

If you’re still getting new customers each month, then you can start by just increasing the prices for new customers. That’ll stop you from having those awkward “why is my price going up?” conversations.

There’s a caveat with this approach though. In most cases, the impact of increasing your prices for new customers is proportional to the number of new customers you get each month. In other words, if you’re not getting a lot of new customers, don’t expect this to magically double your runway.

If you really want to move the needle and extend your runway, you might need to consider the uncomfortable alternative—increasing prices for existing customers.

The key to increasing pricing for existing customers is to be honest and transparent. Nobody wants to pay more money for essentially the same product/service. So your best bet is to explain why you’re raising your prices and the benefit your customers will get from it.

Here’s an example of an email you can send:

“Hi [customer name],

First off, I want to thank you for being a [your company] customer. Our #1 goal is always to provide you with the best product and service possible. In order to keep delivering on that promise, we’re going to make some upcoming changes.

After reviewing our financials and crunching some numbers, we realize that we need to increase our prices. Trust me, this isn’t a decision we made lightly. However, the reality is that our business isn’t sustainable at our current prices (which are among the lowest in the industry).

Starting [date], your pricing will increase from [current price] to [new price]. Again, this change will allow us to not only continue bringing you the product and services you love, but to also keep improving on what we’ve built by adding new features, speeding up our customer service response, and more.

I can’t thank you enough for sticking with us, and we have some very exciting things coming up. If you have any questions about the changes, you can reply directly to this email and we’ll be happy to help you.”

If you want some more examples of email templates, here are a couple of resources:

- How to Let Customers Know About a Price Increase

- Price Increase Email Templates

- How to Email Customers About a Price Change

As with most of the tips we’re going to give you, make sure you forecast the impact increasing your pricing will have on your runway like I did in the example above (I used Finmark to do it by the way).

Do not, I repeat, do not just increase your prices without modeling it out first!

If you don’t increase your price by the right amount, you could end up needing to increase them a second time.

And if you increase your price too much, you could do more harm than good (fewer customers signing up and existing customers churning). Use your financial model to help you find the sweet spot, and forecast what your revenue will look like in different scenarios.

One last note. If your startup’s runway is short because people simply don’t like your product (i.e. you have high churn and low new MRR), raising your prices isn’t going to help. If people don’t think your product has enough value at $100, they’re not going to change their mind when you increase your prices to $120.

If you’re in that boat, consider some of the other tactics on the list.

2. Get Higher Paying Customers

If you use a tiered pricing model, another way to extend your runway is to focus on acquiring higher-paying customers.

Sticking with the previous example, let’s say you have three price plans:

- Basic: $50/month

- Premium: $100/month

- Enterprise: $250/month

Every enterprise account generates 5X more revenue than a Basic account, and premium accounts are 2X a basic account. Focusing on getting more premium and enterprise customers will have a much bigger impact on your runway than basic accounts.

How exactly do you go about doing that?

Start by finding out what your higher-paying customers need and want. Are there certain features you can add that’ll make them more likely to sign up? Do you need to use a certain marketing channel to attract more of them?

For example, at Finmark we service companies of all sizes. But larger companies tend to have more complex needs for their financial models than newer startups.

In order to get an idea of what those complex needs are, we talk to larger companies (customers, leads, and businesses we’d like to work with) to find out what they want to see in a financial modeling tool.

You can do the exact same thing with your own startup. Identify who your target audience is for higher-paying customers, then ask them what they need/want, and prioritize those changes.

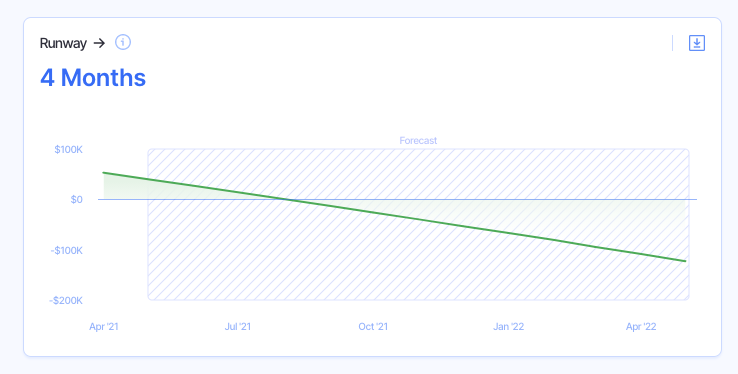

Then, model what your runway will look like if you’re able to get more high-paying customers. With our example, let’s say we start to focus on getting more premium and enterprise customers through an outbound email campaign.

We can create a revenue stream in Finmark specifically for this campaign (read this article on Revenue Drivers for a step-by-step guide to do this). Let’s compare what our runway looks like with and without this push for higher-paying customers.

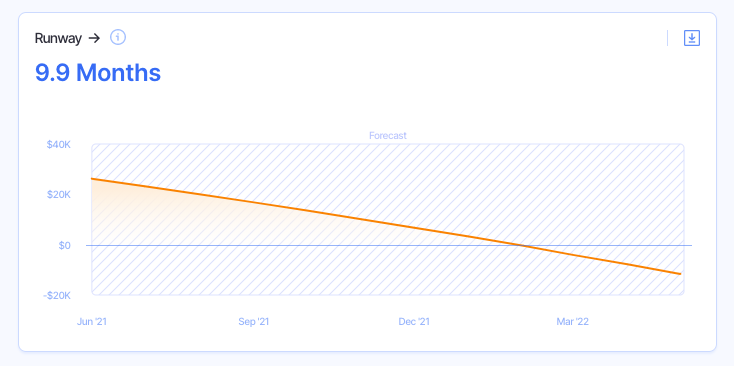

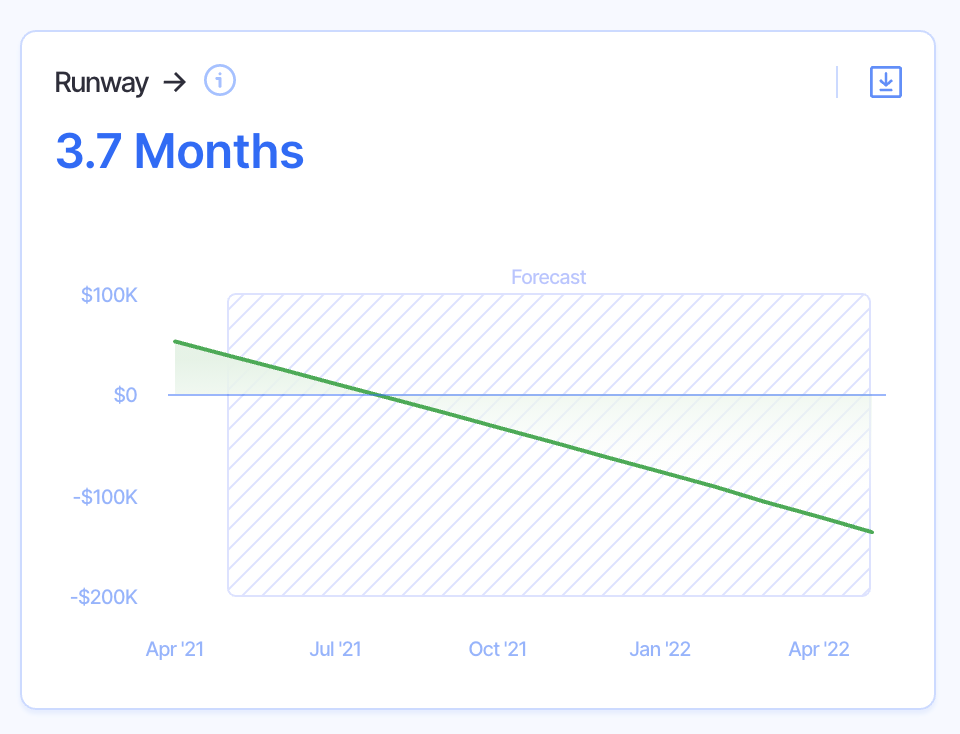

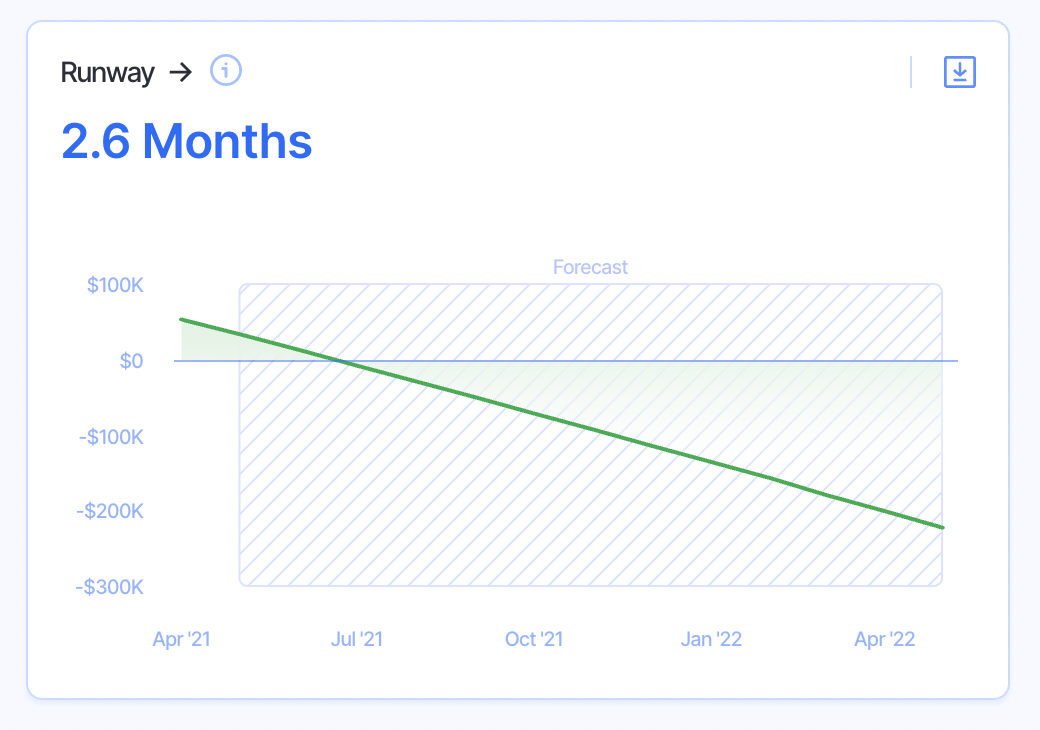

Here’s the original.

And the extended runway after our email campaign push.

This is a simplified example, but the principle is the same. If you can get more high-paying customers, you’ll have a bigger impact on your runway than only getting smaller customers.

3. Experiment With Your Pricing Model

I’m going to tell you a quick story about Mixpanel.

Mixpanel is a product analytics tool that allows software and app companies to monitor the actions users take in their products. Each action is called an “event”. An event could be when a user signs up, clicks a specific button, or any other action a user might take in an app.

When Mixpanel launched, their pricing was based on how many events their customers used. So if we were a music streaming service, for instance, we might have events for user sign-ups, when a user plays a song, when they skip a song, etc. Every time a user takes one of those actions, it counts as an “event” that we have to pay for.

That sounds perfectly fine on the surface. But what happens when we get a surge of events one month? For instance, a major artist releases a new album, which results in us having more events than normal. But the next month, the number of events goes back down to normal.

It creates unpredictability for Mixpanel and their customers:

- Customer: It’s nearly impossible for them to predict how many events they’ll have in a month.

- Mixpanel: Their revenue (and subsequently runway) became less predictable since their customers were paying based on events.

In order to solve the problem, Mixpanel switched from charging based on events to Monthly Tracked Users. Their customers’ pricing became based on how many users interact with their app/software, instead of events, which is much more predictable.

You can read more about Mixpanel’s experience here, but the point of all of that is sometimes your pricing model can be the problem with your runway.

In Mixpanel’s case, if you don’t know how much revenue you’re going to generate month-to-month, it makes it difficult to plan how much you can spend and what your growth will look like.

Just because you started with one pricing model doesn’t mean you’re obligated to stick to it forever. If your pricing model doesn’t make financial sense anymore, don’t be afraid to change it.

4. Create Additional Revenue Streams

We’ve all heard it before—don’t put all your eggs in one basket.

However, most startups don’t follow that advice when it comes to their revenue streams, particularly in the beginning. You have your flagship product and that’s pretty much it.

If sales slow down for your flagship product, your runway starts to shorten until you eventually flatline.

TeliportMe was on that path during the pandemic, but here’s what they did to avoid catastrophe.

TeliportMe is a software company that lets you create and host 360° virtual tours.

Prior to the pandemic, they were a typical slow-growth startup that was also profitable. But their main source of revenue was from travelers who used their app to record and capture their journeys.

As you can imagine, the pandemic wiped away a large chunk of their revenue. At one point, they went from doing $40K a month in revenue to $4K.

A 90% drop in monthly revenue is a quick way to shorten your runway. So they pivoted.

While the tourism industry slowed down, the real estate industry started to pick up. But since people couldn’t see properties in person, there was a rise in virtual tours. As a result, TeliportMe launched a tweaked version of their product specifically for real estate companies.

They launched on Appsumo and got around 500 new users over a three-month period.

You don’t necessarily have to create a completely new product either. You can create new streams through add-ons like additional users or extra services like a white-glove setup.

The more revenue streams you have, the more protection you have if revenue from one of them slows down.

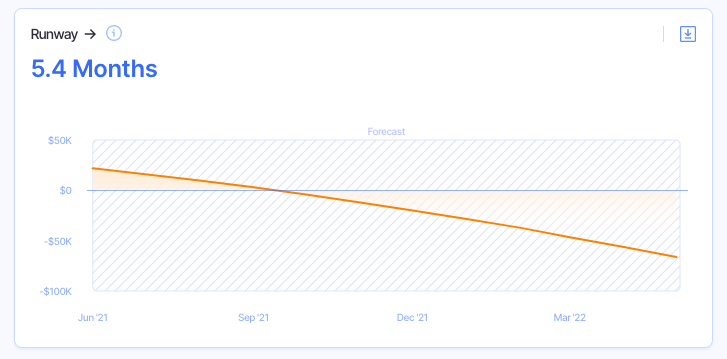

Going back to our fictional SaaS company, let’s say we decide to create an add-on product—advanced reporting for an additional $150/month. If we model out what happens if we’re able to sell that add-on to just a portion of our existing customers, we see that it takes our startup runway from 1.8 months to over 9 months!

5. Analyze and Reduce Churn

Those first few examples focused on generating revenue. But there’s another way to optimize your revenue and extend your runway. Revenue retention.

If you’re a subscription-based business, retaining revenue is equally as important as generating new MRR. Having a revolving door of customers coming in and out of your business is difficult to sustain, and it makes growth nearly impossible.

We’ll start with the revenue retention metric at the top of most startups’ list… churn.

There are two major types of churn:

- Customer churn: The percentage of customers you lose monthly

- Revenue churn: The percentage of revenue you lose monthly

Since we’re talking about runway, we’re going to focus on revenue churn. Revenue churn takes into account all the revenue you lost from existing customers over a period of time.

That includes the revenue you lose from:

- Cancellations: A customer cancels their account, so they’re not paying you anything at all.

- Contraction: Customers who downgrade their account or remove certain features. They’re still paying you, but not as much as they used to.

Your goal is to retain as many customers and as much revenue as possible. In our article about revenue churn, we give you four simple ways to do exactly that.

I highly suggest reading that article, but here’s a very quick review of the tactics it covers:

- Invest in customer success: The better equipped your customer support team is to resolve issues, the more likely you are to retain customers.

- Attract the right customers: If your customers are churning quickly, it’s a sign you’re not targeting the right people and they’re not the right fit for your product.

- Offer alternatives to cancellation: While account downgrades aren’t ideal, it can be better than completely losing customers. Consider offering customers an alternative to churning completely.

- Increase expansion MRR: Expansion MRR is additional revenue from existing customers (the opposite of MRR churn). If your expansion MRR is greater than your contraction revenue, it can help even things out.

Be sure to read the full revenue churn article for more details and examples of how to implement all four of these tactics.

Now, let’s see an example of the impact reducing churn can have on your startup’s runway.

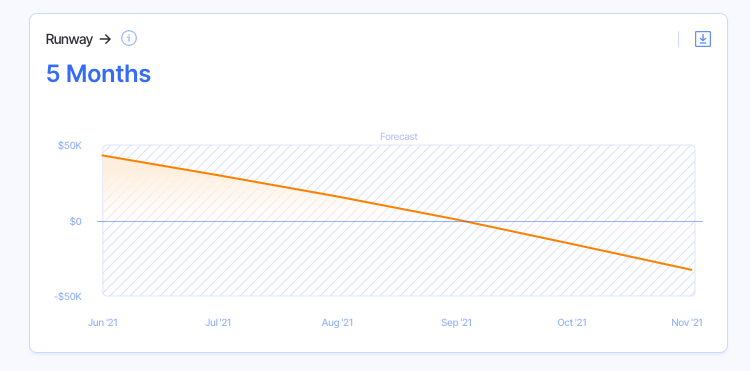

Assume a startup has a moderate monthly churn rate of 8%. Not terrible, but there’s definitely room for improvement. With their current burn rate and revenue, they have five months of runway.

What happens if they’re able to slice their churn rate in half? They add almost a month and a half of runway.

If you have high monthly churn (like over 10%) then improving your customer retention needs to become one of your top priorities if you want to extend your runway and stay in business.

6. Optimize Your Customer Acquisition Cost (CAC)

One of my favorite shows to watch is Shark Tank. It’s a show where entrepreneurs get to pitch investors (the “sharks”) to get an investment for their business.

One of the sharks on the show is Kevin O’Leary (a.k.a. Mr. Wonderful). Whenever an entrepreneur with a subscription model comes in to pitch, Mr. Wonderful almost always asks about their customer acquisition cost (CAC).

Your CAC is how much money it costs you to acquire one new customer. If the entrepreneur doesn’t have any idea what their CAC is, or if it’s too high, Mr. Wonderful never invests.

The reason why it’s a red flag for him is he knows that CAC is one of the biggest challenges startups have. If you’re paying too much to acquire customers, you can’t sustain your business because you’ll never make your money back (see: CAC payback period).

So how much is “too much” to spend on customer acquisition?

It depends on a few factors. But one of the main dependencies is your average customer lifetime value (LTV). LTV is how much money a customer will pay you over the course of their subscription before they cancel their account.

In order to create a sustainable subscription-based business, your LTV should be higher than your CAC. That’s known as your LTV:CAC ratio.

According to sites like Profitwell and Chargify, the optimal LTV:CAC ratio is 3:1. Meaning, you should get at least 3X as much revenue from a customer as you spent to acquire them before they churn.

That’s just a general rule of thumb. So if your ratio isn’t quite 3:1, don’t freak out. Your goal should be to optimize the ratio as much as possible and at least have an LTV that’s greater than your CAC, even if it’s only by a little bit.

When your CAC is greater than your LTV, you’re essentially losing money on each customer you acquire, which will shorten your runway.

7. Get Rid of Non-Essential Expenses

Like we’ve seen, increasing and retaining your revenue can have a big impact on your runway. However, it takes time to implement a lot of those strategies and you likely won’t see the payoff for a while.

That’s why when most companies want to extend their runway, they start with their expenses. In a lot of cases, decreasing your monthly burn rate will have a more immediate impact on your runway than trying to increase your revenue.

This is the exact scenario we were in at one startup I used to work for. Our financial forecast was far from sunny, and we needed to make some big changes to lower our burn rate.

So every department was tasked with taking a look at their expenses to see if anything could be cut.

It’s difficult to suggest specific expenses you should cut since what might be essential to one business might not be essential to another. But to give you an idea, some of the expenses we ended up getting rid of were:

- Catered dinner

- Travel

- Unnecessary software

Those three categories alone helped a lot. (I’ll tell you about the biggest change we made a little later.)

When you’re trying to decide what’s non-essential, think of the expenses that won’t drastically alter the way your startup operates. In our case, catered dinners and travel were nice-to-haves but not business-critical.

And for the unnecessary software, we just did an audit of the tools we were paying for across all departments. We noticed there was some redundancy (multiple tools that did almost the same thing), some tools weren’t even being used, and some we just didn’t really need.

If you’re on the fence about which expenses to cut, model it out.

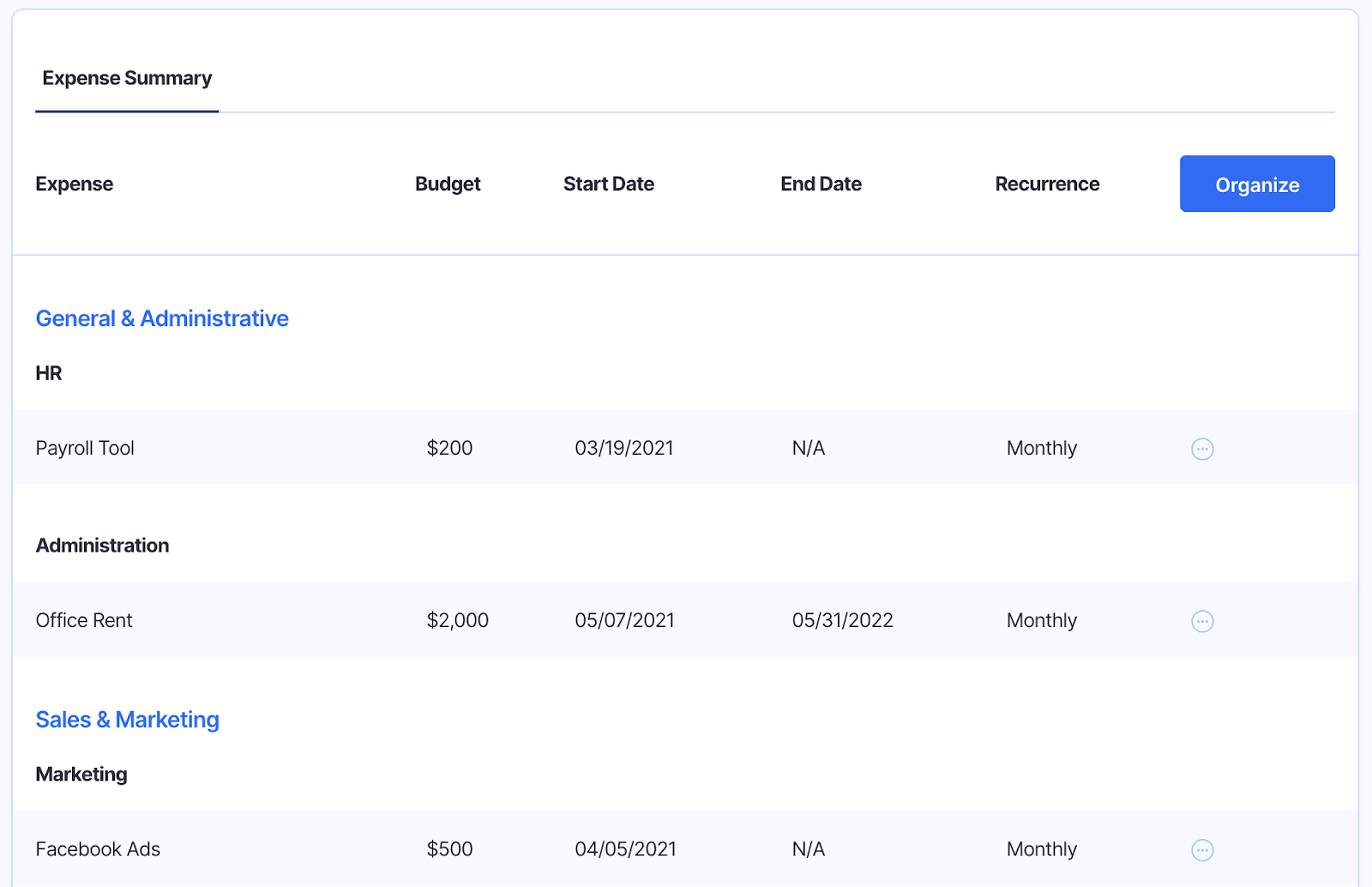

Here’s a quick example of how to do it. Start by taking a look at all of your expenses.

Then, create a new financial scenario where you remove expenses you think aren’t essential. You’ll be able to see how much each change impacts your runway.

It’s a good idea to audit your expenses even if you have plenty of runway. You never know how much “hidden money” you’ll find.

Startup tip: Look for 'hidden money' in your expenses. You never know what you might find. Click To Tweet8. Reduce How Much You Spend on Necessary Expenses

Once you’ve eliminated your unnecessary expenses, the next step is to see if you can reduce the amount you spend on your necessities.

For instance, there might be tools you absolutely need in order to operate and for your team to do their jobs. But are there lower-cost alternatives? Can you downgrade your account? Can you get a discount?

Get creative and think of different ways to save money on your necessities. At another company I worked for, we used to do product swaps with other companies to build our tech stack.

We’d give them a free account for our tool and they’d do the same in return. In some cases, we saved hundreds of dollars on monthly software subscriptions, which really adds up when you’re swapping with multiple companies.

Here’s a tip though. Before you reduce or completely eliminate an expense, talk to your team first. Be upfront about your company’s current financial situation and let them know you need to cut some expenses to extend your runway.

Ask them about the specific expenses you’re thinking of cutting so they have some input. You might find out that expenses you thought they cared about aren’t really that important to them. Or an expense you thought wasn’t essential could be necessary for them.

9. Fundraise

I purposefully put fundraising lower on the list. Fundraising can be a great way to extend your runway and give you peace of mind knowing you have some money in the bank.

However, if all of the things above are broken (your CAC is too high, your burn rate is out of control, and your revenue growth stalled) then fundraising might just delay the inevitable.

Also, asking investors for more money when things aren’t working out is difficult and gives you less leverage, which means worse terms for you.

However, if your startup is gaining traction, but you just need some more runway to build and grow, fundraising can be a good option. And if you have a strong financial model to show investors the growth potential of your startup and your plan to get there, it’ll sweeten the deal.

Asking investors for more money when things aren’t working out gives you less leverage, which means worse terms for you. Click To Tweet10. Consider Alternative Financing Options

VCs and angel investors aren’t the only ways to get funding for your startup. There are tons of alternatives, some of which don’t even include giving up equity:

- Crowdfunding: You can run campaigns on sites like Kickstarter, Indiegogo, Fundable, and others. Instead of giving away equity, you give rewards based on how much people contribute.

- Revenue-based financing: An investor gives you a loan that you repay by giving a percentage of your gross revenue (royalties) to the investor until you repay the agreed upon amount.

- Debt: A good ol’ fashion loan. You’ll have to pay interest, but you’ll retain equity. You can get these from banks, credit unions, private lenders, or even consider an SBA loan.

- Grants: Depending on your business, you may qualify for grants. The upside is you don’t have to pay it back. The drawback is you might not qualify and it can also be a long process.

There are more options than ever for startup funding. You just need to find the right fit for your business.

11. Slow Down on Hiring

Payroll is typically the biggest expense for startups. If you’re trying to extend your runway, consider pressing pause on adding new employees until you’re in a better financial position.

You don’t want to hire new employees only to have to let them go after a few months because you couldn’t actually afford them in the first place.

This is why building a financial model is so important. You can create a hiring plan to figure out how many people you can afford to hire and the impact it’ll have on your runway long term.

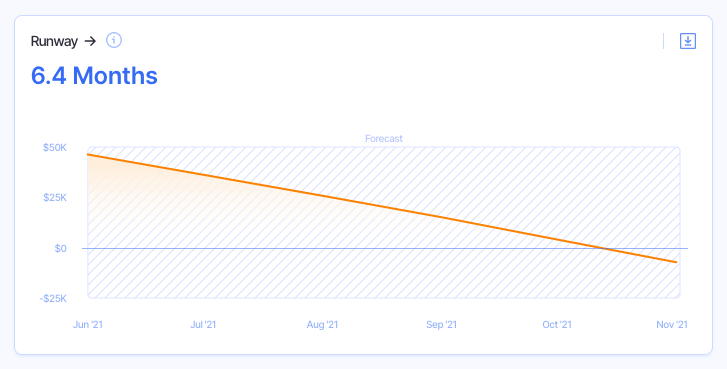

For example, let’s say our current forecast shows a runway of just over three months.

We think adding a growth marketer can help accelerate our growth by boosting acquisition. We can add the proposed new hire into our model to see how it’ll change our runway (i.e. can we afford to hire them).

Here’s a look at what happens when we add the hire at a salary of $80K.

We’ll lose about a month of runway. We have to weigh the cost vs. benefits of hiring this employee. We could also adjust their salary or consider hiring them as a freelancer to start.

You can (and should) model all of these hiring scenarios out to see what makes the most sense for your startup.

12. Reduce Benefits or Salaries

In most cases, this is the last resort for startups trying to extend their runway. Reducing benefits, asking employees to take a pay cut, or the worst scenario—layoffs.

Since payroll is such a big expense for startups, reducing your headcount can significantly extend your runway.

Remember that one company I worked for that had to cut costs? Even after cutting some smaller expenses, it wasn’t enough. Ultimately, they ended up having to lay some people off.

The decision allowed the company to stay afloat and eventually bounce back. But it wasn’t a pleasant experience, particularly for the people who were let go.

That’s why hiring wisely and building new hires into your financial model is so important. Hiring too fast or spending too much on payroll is an easy way to put your startup in a financial bind—just ask Groupon.

Back in the early 2010’s, Groupon began hiring new employees faster than UPS during the holiday season. Unfortunately, their business didn’t grow as quickly as they were hiring people, which caused them to lay off 1,100 employees in 2015.

While the move cost them $35M in the short term (mostly from employee severance and compensation benefits), it gave them more runway to restructure and keep operations going.

This is a textbook example of the importance of not only having a solid financial model, but also creating multiple scenarios because you never quite know what the future has in store.

How Long is Your Startup Runway?

The time to think about increasing your startup runway isn’t when you only have three months of runway left. You should regularly review your burn rate, revenue, and all the pieces of your finances so you’re never caught off guard.

I hate to sound like a broken record, but using a financial modeling tool like Finmark not only saves you time, but it can also prevent you from making huge financial mistakes with your startup. Give it a test drive with a free 30 day trial here.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.