Revenue Planning: Step-by-Step Guide

One of the most exciting parts of growing a business is watching the revenue pour in.

Less thrilling is watching that money leave your account. But the statement “you’ve gotta spend money to make money” is truer in startup-land than anywhere else.

However, choosing where to speed that revenue can be a little tricky.

Should you invest in a sales team? Contract a marketing agency? Or upgrade the offices to improve company culture and hopefully influence employee retention.

All good things, right?

The process of making this decision is called revenue planning. It moves you beyond flipping a coin between two choices and uses real-world data and financial modeling to understand the impact of investing in one initiative over another.

In this article, you’ll discover seven steps to planning revenue allocation and using all that hard-earned cash to keep growing your enterprise.

What Is Revenue Planning?

Revenue planning is creating a plan for how to use the revenue your company generates.

You’re earning the cash; now you have to decide where to spend it.

But revenue planning is more than just deciding whether to withdraw funds or hire more staff; it’s about forecasting which revenue investments will bear the most fruit.

For example, will your company grow more by investing in your tech stack or bringing on three additional developers?

Revenue planning is done alongside your revenue forecast.

First, you analyze aspects such as current revenue, growth trends, new product, sales and marketing initiatives, and market conditions.

This process gives you a forecast for how much revenue you can expect to receive under various conditions (it’s generally best to model multiple scenarios to be prepared for the reality of business).

Once you’ve forecasted how much revenue your company will generate over the next 6, 12, or 18 months (or whatever period you’re looking at), you need to plan how to use that revenue to grow the company.

That’s revenue planning.

Why Revenue Planning is Important

The importance of revenue planning cannot be understated.

Startups don’t grow in a vacuum.

They grow because they:

- Continue to develop a better product

- Invest in marketing activities that increase brand awareness

- Employ a sales team to drive revenue directly

Those are just a few reasons startups succeed, by the way.

All of these initiatives require funding. Development, marketing, and sales all cost money. You need to hire employees, yes, but also invest in software, equipment, and office space.

But even fast-growing companies only have so much capital available to spend.

Often, it’s a case of deciding to invest in one initiative over another or perhaps splitting your revenue between several investments.

Without a revenue planning process, you’re basically guessing.

You can make a fair assertion that investing in marketing will grow revenue, but you don’t know by how much.

What if your marketing ROI is 1.5x, meaning you earn $1.50 in return for every dollar you spend? Is that sufficient? And how does that compare to the ROI of investing in sales?

Data-driven revenue planning (like the kind you’re about to learn about) gives you these insights so you can make informed financial decisions, not guestimates.

How To do Revenue Planning

So, you’ve got a handle on why revenue planning and allocation are essential. How do you actually do this thing?

Here, we’ll outline seven steps to follow in your revenue planning process.

1. Get Back To Basics: Review Your Organizational Goals

How you invest your revenue should depend heavily on your company’s goals (you’ve set goals, right?)

Yes, everyone’s goal is to grow, but what does that mean?

Do you want to:

- Grow revenue?

- Grow your customer base?

- Grow your market share?

- Grow brand awareness?

- Grow your product offering?

All of these desires are connected (a larger market share generally means more revenue), but first, you need to understand which is your priority.

Let’s say, for instance, your goal right now is to increase your user count, and that takes priority over growing revenue. You’re not focused on growing revenue from each account or increasing LTV right now, just on new customer acquisition.

In this case, investing in an initiative that attracts new customers, regardless of size or potential revenue, makes more sense.

If your goal is to grow revenue, you might be better off investing in a customer success team to upsell and cross-sell existing customers.

You could also invest in product development to enhance your product. That way, you can charge more for your offering.

So, review your company goals and use these to inform the investment initiatives you choose.

2. Analyze Performance To Determine Your Revenue Drivers

Assuming, of course, that at least one of your company goals is to grow revenue, then it’s going to be crucial to understand what drives new revenue for your company, that is, your revenue drivers.

Most revenue drivers will be either marketing-led or sales-led, for instance:

- Social media advertising

- Content marketing

- Outbound sales

- PPC advertising

- Customer success and account management

If social media ads are driving most of your revenue right now, say, then it’s going to make sense to invest more in this channel if growing revenue is an objective.

3. Build A Clear Timeline For Revenue Investment

The timeline for investment is important, as some initiatives take more time than others.

For example, say you need to increase new customer acquisition by 50% in the next two quarters because you have an upcoming funding round. SEO may not be the best initiative to invest in since it can take a few months to reap the benefits.

Instead, you might invest in ad campaigns or something else with a more immediate ROI.

You’ll also need to consider timelines for hiring purposes. In the above example, ad-based marketing might be wise, but your timelines will drive the decision to hire in-house vs. contracting a marketing agency.

4. Look Forward To Predict and Mitigate Risk

Growing a company is never without risk. Markets change, employees leave, and operating costs rise with minimal notice.

When assessing how to invest your revenue, it’s important to understand how things such as these might change and how they’ll impact your business operations (and expected return on investment).

For instance, you may determine that expanding your sales team is the best use of your revenue.

But what would happen if two of your four developers suddenly left? Dropping product development capacity by half could significantly impact your revenue goals (perhaps you have a new feature in progress).

If this were to happen, you’d need to reallocate spending to solve this resource shortage.

Considering potential risks helps you to be prepared for such situations and to have a contingency plan in place before they happen.

5. Use Financial Modeling To Assess Revenue Allocation Options

Okay, now we’re getting into the nitty gritty.

Determining where and when to spend your revenue should be grounded in financial forecasting and modeling.

Yes, sorry, you’re going to have to do a bit of math here. But don’t stress, because Finmark has your back 😉

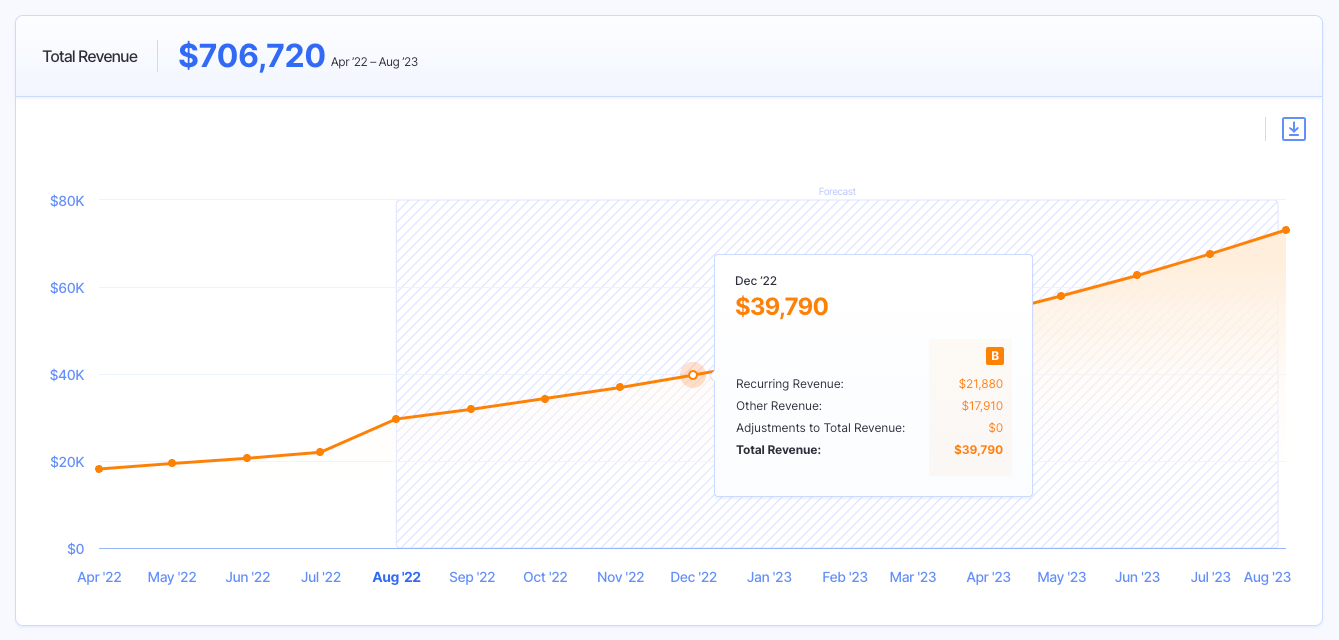

Using Finmark’s financial modeling, you can calculate forecasted revenue for various situations.

For example, what might revenue look like if you hired two new Sales Development Reps? What about three?

And what if you invested some money in a product-led marketing approach where prospects guide themselves through a purchasing and onboarding process?

Use financial modeling to create forecasts like these and run with the option that looks most appealing on paper.

6. Plan For Multiple Revenue Scenarios

Even the best-laid plans go awry.

No matter how well-grounded in research your revenue plan is, you should be prepared for things to change.

Scenario planning helps you mitigate this risk.

Let’s say, for instance, that you’ve forecasted $3m in revenue for the coming year. Using this data, you’ve designed a revenue plan for investing that in new staff across several departments.

But what happens if you only generate $2m?

Perhaps you can’t afford all of those desired hires; which will you prioritize?

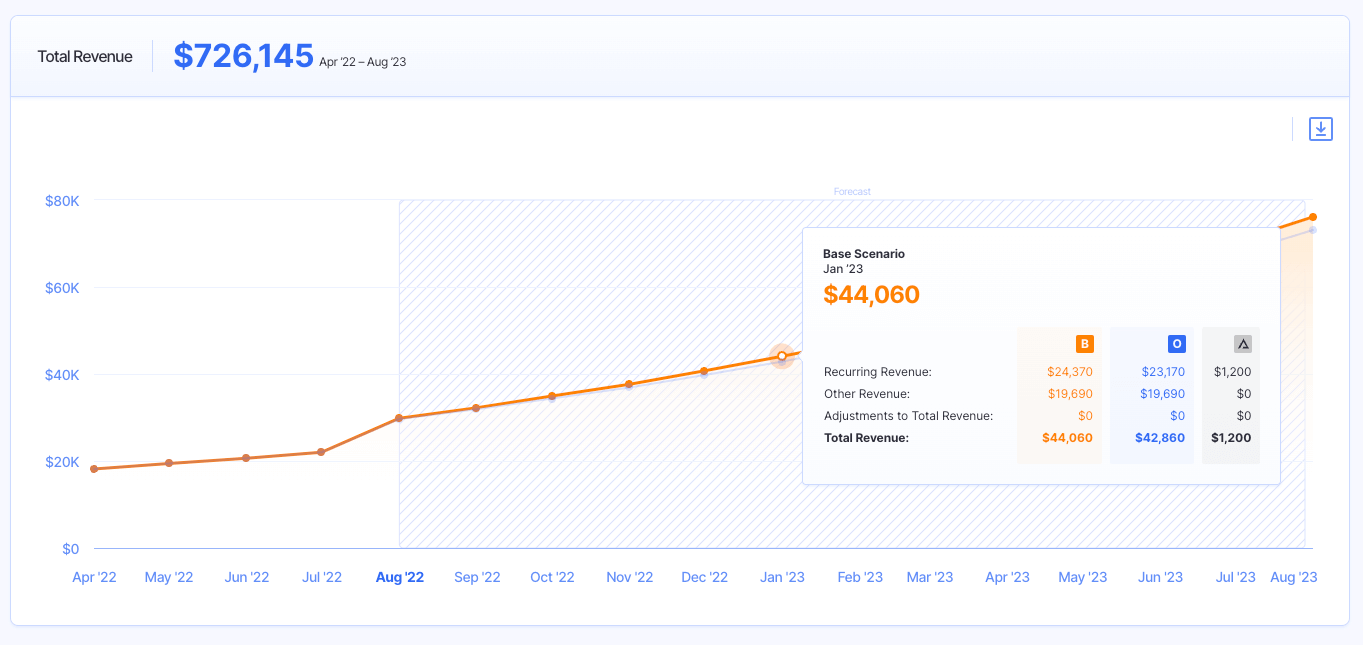

Use financial planning tools to model various scenarios and potential budget variances, and build multiple backup plans in case things don’t go as expected (which should probably be expected!).

Hint: You can do this in Finmark!

Here’s an example of two scenarios being compared side-by-side. Scenario B assumes slightly higher revenue than Scenario O.

You can see the delta between the two scenarios and how each impacts the forecast directly on your dashboard.

7. Design A Method For Tracking Spending and Revenue Progress

Now you’ve built a revenue plan for spending all the cash. But don’t rest on your laurels here; revenue planning is not a set and forget process.

You need to prepare for changes and monitor both incoming revenue and outgoing expenses so you can pivot where required.

So, set yourself up with a financial analysis platform to monitor key metrics like CAC, revenue, runway, and burn rate in real-time and make sure things are tracking as expected.

What’s Your Revenue Plan?

Generating revenue is nice, but unless you plan what to do with it, you’re selling yourself (and your company) short.

Planning ahead puts your company in the best position for long-term success and can navigate any changes.

The best way to create and manage a revenue plan is with a tool like Finmark. Finmark makes it easy to build revenue forecasts, model different scenarios, and make changes to your plan in

real-time.

If you’re ready to try it, sign up for a free trial or book a demo with our team to see it yourself!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.