5 Financial Modeling Skills Every Founder Should Master

A lot of founders shy away from financial modeling because they’re intimidated. You might think that you need to have professional accounting skills or be an Excel master.

Ten years ago, that might’ve been the case.

Thankfully, things have changed. Thanks to a slew of new financial modeling tools available (like Finmark), every founder can learn to build their own model even if you don’t have an MBA or finance background.

So, what do you need to know in order to build a model? We’ve broken down five essential financial modeling skills that will help you build a reliable and accurate model with confidence.

1. Analysis

Whenever you’re working with data, analysis skills come in handy. And financial modeling involves a lot of data.

At its core, analysis involves three specific skills:

- Collecting information/data

- Interpreting the data

- Making decisions based on your findings

Here’s how each of those skills applies to financial modeling.

Collect Data & Information

First, you need data to analyze.

Luckily, with financial modeling, the primary data points you need are a given—revenue, expenses, and employees/payroll.

However, within those buckets, you have specific metrics and variables that will differ depending on your business.

For example, an e-commerce brand’s revenue might be directly tied to their Facebook Ad campaigns. As a result, the data points they need to include in their model could involve ad clicks, cart abandonment rate, and other parts of their funnel that directly impact their revenue projections.

People with analytical thinking skills have the ability to recognize:

- Which data points they need

- Whether or not they have all the necessary data

- How that data should be put together

With financial modeling, that means knowing which metrics you need to include, whether or not you’re tracking all the necessary metrics, and how all those metrics should be put together so it’s easy to understand.

Interpret The Data

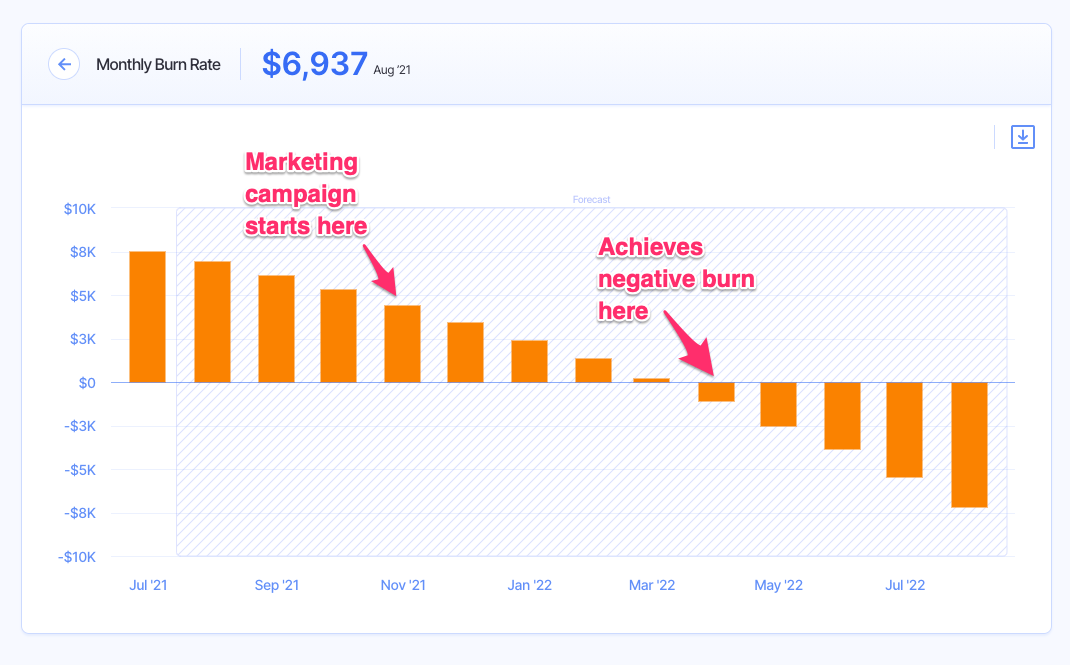

Once you have your data, the next step is to put it all together and interpret what it means. For instance, when you see this graph, what does it mean to you?

Hint: It’s showing when the “turning point” of this company’s burn rate will be.

Interpreting data also means you have the skills to recognize whether a report, statement, or trend is good or bad. Do you have the ability to look at your profit and loss statement and know whether it’s good or bad?

I’d argue that the most important part of data interpretation, though, is understanding the “why” behind your data. It’s pretty simple to look at a graph and see whether it’s trending in the right direction. But unless you can understand why it’s trending up or down, your analysis won’t be complete.

For instance, using the chart from above, it’s one thing to know that this company is forecasting its monthly revenue to be greater than expenses starting April. But if you can do some analysis to understand why that’s happening, you can use that information to plan your next steps.

Make Decisions

After you’ve collected and interpreted the data, you should be able to draw conclusions and make decisions based on what you’ve found.

We’ve mentioned it before, but financial models aren’t meant to be static documents that you create once and never touch again. Your model is a tool that helps you make data-informed decisions about how to grow your business.

Using analytical skills, you can look at what your model is forecasting and determine what steps you should take in order to:

- Capitalize on opportunities and continue what’s working if the data shows a positive trend.

- Course correct if the data shows a negative trend.

Referring back to the burn rate example from earlier, let’s say the company analyzed their data and determined monthly revenue will exceed expenses starting April because they’ve built a marketing campaign into their model that they expect to drive a ton of new customers in Q4.

Based on that conclusion, they might decide to start the marketing campaign earlier to achieve a negative net burn rate sooner. That could mean changing some of their priorities and timelines, which is why doing this level of analysis with your financial model is so important.

If you’re not naturally an analytical thinker, don’t worry. Just like most skills, it’s something you can improve over time. Here’s an article with tips to get the analytical part of your brain working so you can sharpen your financial modeling skills.

2. Foresight

At its core, a financial model is built on assumptions you make about your business. The more accurate those assumptions are, the more accurate your model will be.

This is why foresight is a wildly useful financial modeling skill. Foresight is your ability to predict what the future of your business looks like and what you’ll need in order to reach your goals.

Let’s make this even more practical.

Say you set a goal to reach $83K in monthly recurring revenue (MRR) by the end of next year. That’s not going to happen auto-magically, and it’s going to require resources in order to get there.

Foresight is your ability to predict what steps you need to take in order to reach $83K MRR and the likelihood of succeeding, so that you can build it into your financial model.

Will you need to hire new employees? Do you need to maintain a certain lead conversion rate on your marketing campaigns? How high can your churn rate get before it impacts your revenue growth? What new features do you need to release in order to attract new customers?

Great financial modelers account for all these variables and have the foresight to model different scenarios so they can map out all their possibilities.

Some people naturally have foresight because they’re forward-thinking. But like any other skill, it’s something you can improve. Here are some tips:

- Practice critical thinking: With foresight, you need to be able to look at the positive and negative scenarios that could happen with your business. Critical thinking forces you to look at situations objectively, which really comes in handy. Here are some tips to improve critical thinking.

- Study historical data: They say past performance is not a guarantee of future success. However, historical trends can give you insights into what’s going to happen in the future.

- Know your business: Aside from past performance, you should know the ins and outs of your business. For instance, which marketing channels lead to greater conversions? What type of features do your customers gravitate towards? What are the biggest indicators of churn? These are all data points that can improve your foresight.

- Ask “what if”: Scenario analysis is a key part of financial modeling. It’s centered around the concept that there’s no straight path to success. By constantly asking yourself “what if X happens”, you’ll be able to map out various scenarios for your business and be prepared for whatever happens.

3. Basic Accounting

You don’t need to be a CPA to build a financial model. However, you should have an understanding of basic accounting principles. For instance, you should know the difference between cash and accrual accounting, how to read the three major financial statements, what revenue recognition is, and other common accounting terms.

Even if you’re a founder who doesn’t plan on building your model yourself, it’s important to understand the fundamentals of accounting so that you understand the financial state of your company and can talk about it with investors, advisors and your team.

If you’re completely new to the world of business accounting and finances, you can start with some of the books on this list. There are also plenty of articles online for free. With a little Googling, you can learn most of the accounting skills you need for financial modeling.

Also, if you use a tool like Finmark to build your model, we have tooltips and educational resources to guide you through the entire process. That’s one of the many advantages of using a dedicated financial modeling tool instead of templates.

Again, you don’t need to be an accounting expert, but you should learn the basics.

4. Attention to Detail

There’s no such thing as a “perfect” financial model. However, if your model is filled with mistakes it can do more harm than good. Even seemingly small typos can have big consequences—just as our founder.

For example, say your actual monthly churn rate is 13%. But you accidentally enter 3% into your model instead. That’ll lead to overestimating your runway, which means you’re making decisions based on incorrect data.

Mistakes like this are easier to make in a spreadsheet, but even if you’re using a tool like Finmark, you still need to pay attention to the details you’re entering.

Being detail-oriented doesn’t just mean you’re careful with how you enter your data. It also means that you have the ability to spot when something’s off in your model.

If your revenue forecast doesn’t look quite right, or your actuals are nowhere near your budget, you need to be able to recognize it as early as possible and fix the issue.

Being detail-oriented is a vital financial modeling skill that can mean the difference between an accurate model or one that leads your business down the wrong path. Some ways you can improve this are:

- Play Sudoku: I know, it sounds silly. But I know from personal experience that playing Sudoku helps you get better at spotting tiny details that can drastically change your outcome.

- Proofread: It’s easy to rush through things like data entry and just assume you did everything correctly. However, if you get into the habit of double-checking your work, it’ll eventually become second nature and you’ll find yourself spotting issues without even thinking about it.

- Collaborate: Nobody’s perfect and we all make mistakes. Collaborating is a good way to ensure that you’ve dotted all your i’s and crossed the t’s because other people might be able to spot mistakes you’ve made and vice versa. You can learn from any mistakes they point out so you can avoid making the same mistake next time.

- Go distraction-free: Distractions disrupt focus. When it comes to financial modeling, in particular, make sure you’re working on your model somewhere you won’t be distracted and can fully concentrate on the task at hand. If you’re trying to respond to emails or work on something else while you’re building your model, you’re setting yourself up to make mistakes.

5. Presentation

One of the most overlooked financial modeling skills is the ability to present your model and financial plan to others.

Whether you’re pitching new investors, meeting with advisors, or going over the numbers with your team, presentation matters.

Your financial model tells the story of your business. It shows what your company has done, how it’s doing today, and what you’re predicting it will do in the future.

The better you’re able to walk people through that journey, the more likely you’ll be to secure an investment (with favorable terms), assure your existing investors, and motivate your team.

Here are some tips for improving your financial modeling presentation skills:

- Know your numbers: The people you’re presenting to are going to have questions about your data (especially investors). If you’re stumbling over yourself or sound lost, it’s not very reassuring to people who are potentially giving you hundreds of thousands of dollars. Study your numbers and know them like the back of your hand.

- Create your story: The best presenters are usually great storytellers. Stories are easy to follow and captivating. When you’re presenting your financial model, decide what picture you want to paint. For instance, if your Q1 numbers weren’t great, be prepared to explain what happened and the steps you’re taking to fix it.

- Practice: Being a good presenter takes practice. The more reps you put in, the more comfortable you’ll be when it’s time to present. Rehearse your presentation beforehand if you have to. Just try not to sound too scripted. Over time, presenting your model will feel like having a normal conversation.

Sharpen Your Financial Modeling Skills

Financial modeling is nothing to be afraid of. Every founder can do it.

You likely already have most of the skills you need. It’s just a matter of practicing and applying them to your financial model.

One of the best ways to make financial modeling easier is to use a dedicated tool rather than spreadsheets. Building financial models in spreadsheets requires an additional set of skills, particularly with formulas and calculations.

With Finmark, you don’t need to memorize a huge list of Excel formulas, you just need to know your business and your numbers. If you can do that, you have the skills you need to build a financial model that accurately reflects your business.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.