How to Build a Budget Forecast From Scratch

You probably have some big goals for growing your startup and how much revenue you want to generate this year.

But how much time have you spent thinking about the cost of reaching those goals?

If you want to generate $10K, $100K, or $1M in new revenue, how much money will you need to spend to make it happen?

That’s where a budget forecast comes in handy.

Creating a budget forecast gives you a strategic way to think about your expenses, and how they relate to revenue.

In this guide, we’ll go over everything you need to know about budget forecasting including why you need one and a simple three-step process to build one from scratch.

What is a Budget Forecast?

A budget forecast models how much money your business plans to spend over a specific time period (typically quarterly or annually), and the expected outcomes.

To be clear, a budget forecast is not just a list of how much money you spend on your current expenses. It’s forward-looking.

In other words, it’s a forecast of your future expenses based on historical data, revenue goals, and assumptions about the future.

Why You Should Forecast Your Budget

If you already have a pretty good idea of how much your business spends and what your expenses are, do you really need to go through the process of creating a budget forecast?

The short answer is, yes.

As I mentioned, a budget forecast isn’t just for documenting how much you’re spending. When done correctly, it can help you plan for growth and make smarter decisions about where to best allocate your budget to reach your goals.

Aside from that, here are a few other reasons you should have a budget forecast:

You Need it to Raise Money

If you plan to fundraise, investors will expect to see a forecast of how you plan to spend the money you’re asking for.

With a budget forecast, investors can see exactly how much you plan to spend each month, where the money is going, what the expected outcomes are, and how long it will last. This brings me to my next point.

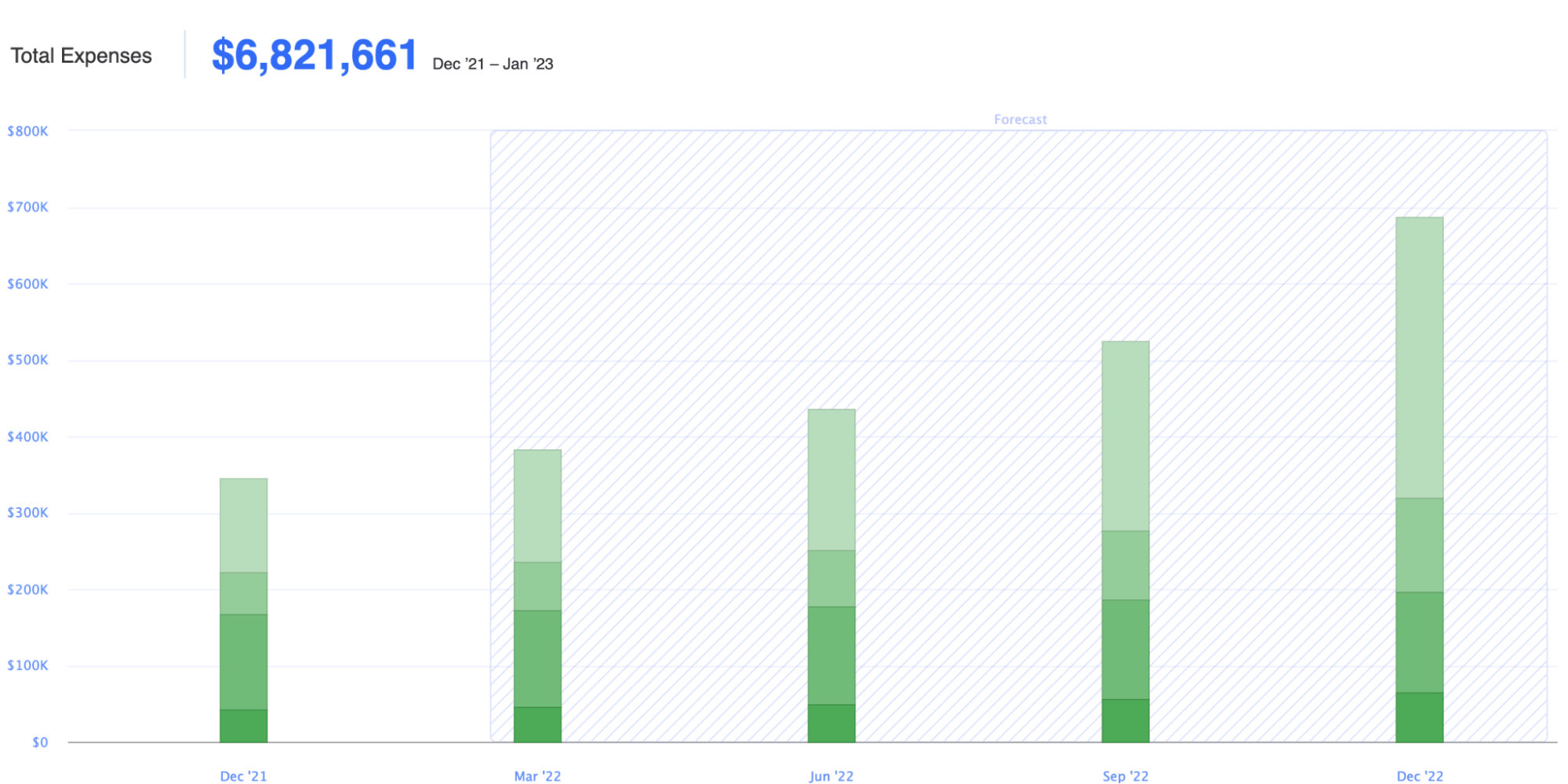

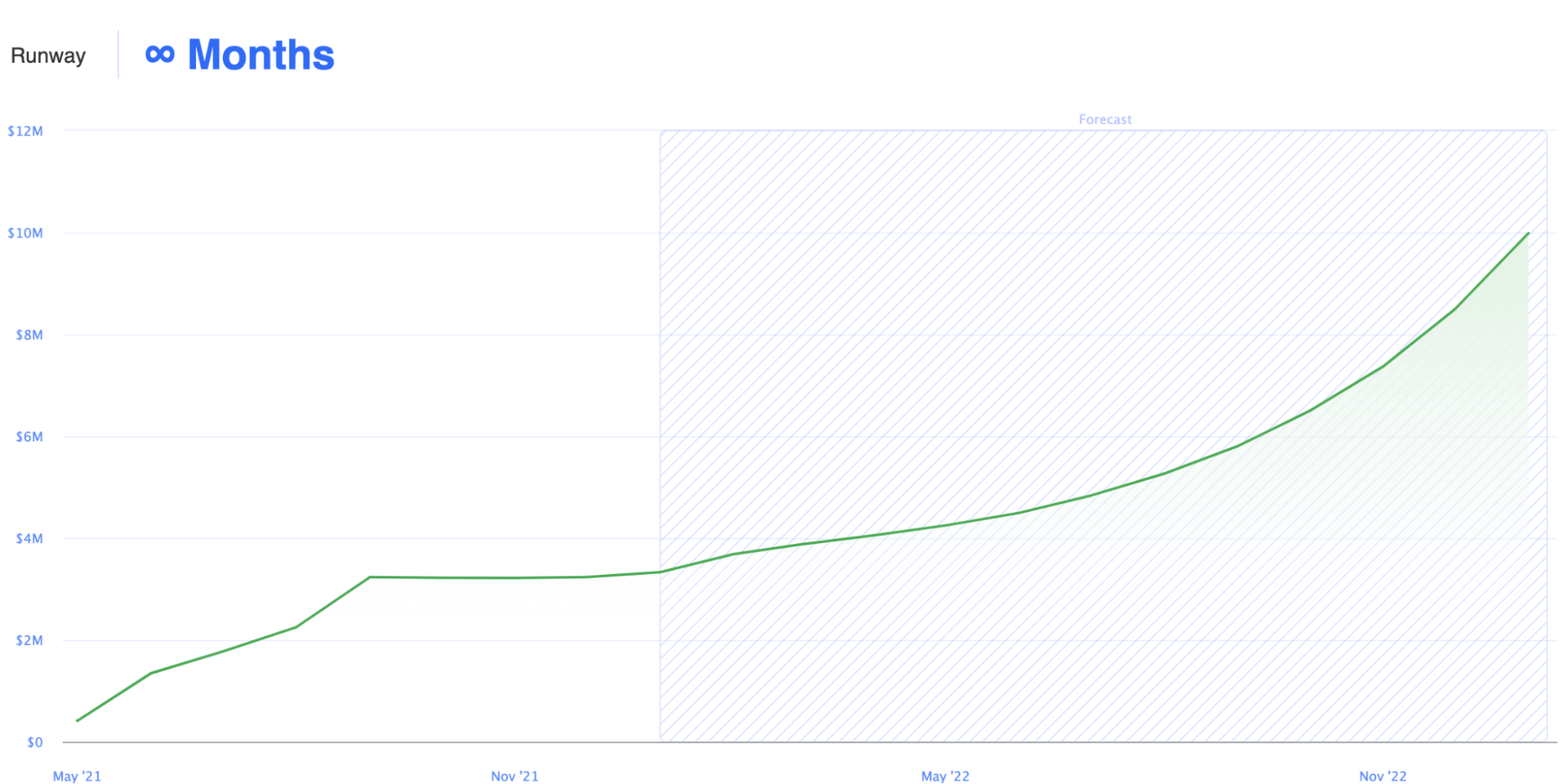

Forecast a More Accurate Runway

This is important for both you and your investors. A budget forecast is a critical step in calculating your runway.

When you forecast how much money you plan to spend over the next 12 months, you’ll have a much more accurate picture of how much runway you have.

For example, if your budget forecast accounts for a gradual increase in your advertising budget over the next 12 months, that will directly impact your runway.

You’ll Be More Deliberate With Your Budget

The reality is that a lot of startups aren’t strategic about their budget. They view it as a necessity for accounting and just track how much money they spend each month.

If that’s how you’ve been approaching your budget, it’s time to switch things up.

The more you think about your budget in relation to revenue and growth, the easier it’ll be to make decisions about how to allocate your budget.

When you’re creating and forecasting your budget, think about what each expense means for your business and what impact it’ll have.

That doesn’t mean you should overanalyze every printer cartridge, snack, and box of paperclips you buy. But for larger expenditures like consultants and events, your budget forecast is the perfect opportunity to think about how much you should spend and whether or not you need to budget for it.

Your budget forecast makes you consider things like “if we spend this much for X instead of Y, we’ll be able to do Z.” That level of analysis can completely shift your growth trajectory and more importantly, save you from running out of money.

How to Create a Budget Forecast

Now that we’ve covered the “what” and “why”, let’s dive into the “how”.

Here’s how to create a budget forecast in four steps:

Step 0: Choose The Right Tool

Before you can start building your budget forecast, you need a tool to build it with. Whatever tool you choose, some of the minimum requirements you should look for are:

- Compare your actuals against the budget

- Forecast revenue and expenses

- Ability to model multiple scenarios

- Track employee expenses

- Forecast fixed and variable expenses

- Build a complete financial model

That last point is very important. Your budget forecast is part of your financial model. If you’re just inputting all your expenses into a spreadsheet and dragging the numbers across 12 months, that’s not a forecast.

You need a tool that’s going to take into account your revenue forecast, fundraising goals, and overall financial projections in order to create an accurate budget forecast.

My recommendation is Finmark. Not just because it’s our tool, but because it makes the entire process much easier. It checks off everything I laid out above and more.

Whether you choose to use Finmark or not, you can still use the same framework I’m about to lay out with any tool. But if you’re interested in following along, I highly recommend using Finmark. You can try it for free here.

Step 1. Set Your Expectations

This first step is one that way too many startups tend to overlook when they’re forecasting their budget, but we highly recommend it.

Start by setting expectations for your budget.

Remember what I said about tying your budget forecast to your revenue? This is why it’s important.

Whether you plan to spend $5K, $10K, or $100K, you should have some expectation of what you plan to get in return. You don’t have to go line item by line item. Instead, think of your budget as a whole.

For instance, “if we spend $100K this year, we expect to generate $300K in new revenue.”

The purpose of this exercise is to shift your mindset about expenses and budgeting. Instead of thinking of expenses being something you document, think about how the money you spend will help you grow the business. That way, you’re not just thinking about “how much can/should we spend”, but rather, “how much do we need to spend to reach our goals”.

Depending on your goals, this approach will put your business in a much better financial position with a healthier balance sheet, and a more data-driven path to growth.

Step 2. Organize Your Expenses

Once you’ve set your expectations, it’s time to get into the nitty-gritty of building your budget forecast. That starts with laying out all your current expenses.

If you’re using an accounting tool like Quickbooks or Wave, this step should be fairly straightforward. You can export the data into the tool you’re using for your budget forecast.

Finmark has integrations for a few different accounting platforms, including Quickbooks, Wave, Xero, and Zoho.

For your forecast, make sure all your expenses are organized and classified correctly. Some of the most important things to check are:

- Department

- Fixed vs. Variable expenses

- One Time vs. Recurring expenses

Department

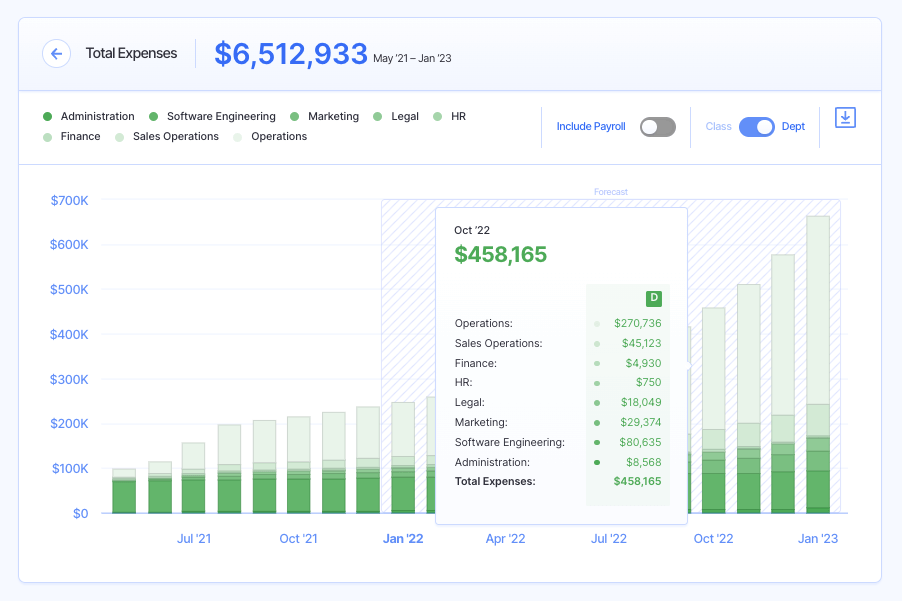

Being able to see your budget forecast by department is helpful for understanding how much needs to be allocated for each department and the projections of how much they’ll spend over time.

Chances are you’re already doing this, but use this as a reminder to go in and make sure everything is correct.

Fixed vs. Variable Expenses

This is one of the things that can make budget forecasting a little tricky.

Fixed expenses like rent and some utilities are fairly simple to forecast since they’ll be the same month to month.

However, variable expenses like cost of goods sold (COGS) or software with usage-based pricing might be a little more difficult to accurately forecast.

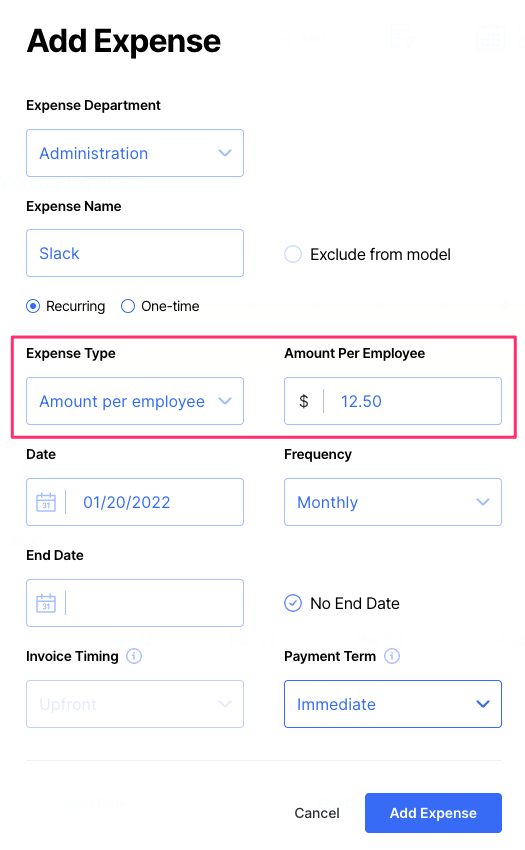

Start by defining which expenses can vary over time. For instance, if your company has a paid Slack membership, your monthly expense varies depending on how many employees you have.

In Finmark, we can include this in our budget forecast by adding the expense as a “per employee” expense type.

Now that we’ve set the expense and parameters, whenever we hire a new employee or someone leaves, the budget forecast will update to reflect the change for our Slack expense.

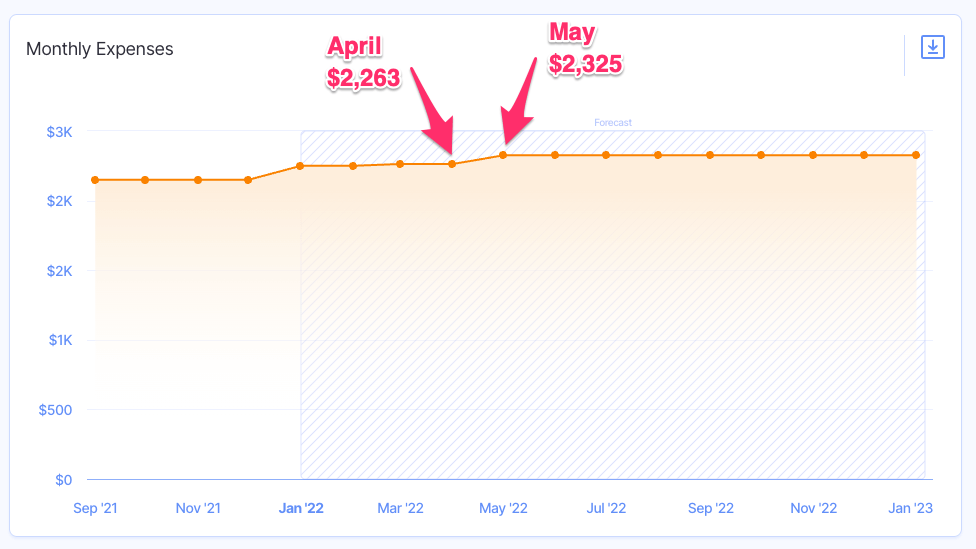

Let’s take this a step further. If you plan to hire new employees this year, you can add the roles you plan to hire into your model and the additional cost of Slack will also reflect in our forecast.

For instance, say you plan to hire five new roles in May. You can see how those new employees will affect your budget forecast.

When you combine employee-related expenses with your hiring plan, your budget forecast becomes much more accurate.

Other examples of variable expenses that might impact your budget forecast are your payroll software, web hosting, or any other expenses that may change over time.

One Time vs. Recurring Expenses

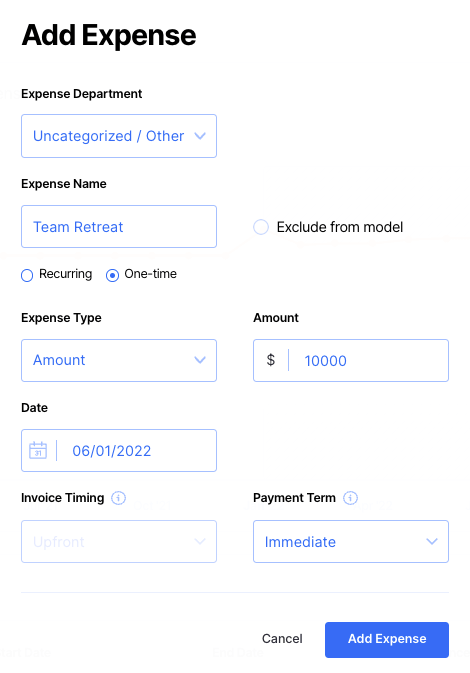

Another thing to consider is one-time vs. recurring expenses. Again, most recurring expenses are pretty simple to account for in your budget forecast. But don’t forget about any one-time expenses that you might incur throughout the year.

For instance, if you do an annual event for your team, you should build that expense into your budget forecast.

Step 3. Set Your Assumptions

Every forecast is based on assumptions, and your budget forecast is no different. Two of the main things you want to make assumptions about are:

- What does your revenue forecast look like? Changes in your revenue can have a big impact on your budget. If you outperform your goals and grow faster than expected, you may want to consider increasing your budget. On the flip side, if you underperform, your budget might shrink.

- Will your expenses change throughout the year? Software companies change their pricing. Consultants change their rates. Your COGS can fluctuate. Leave some room in your budget forecast to account for any potential changes.

A word of caution: Any assumptions that you make should be based on data and logic.

For instance, if you’re trying to forecast your Facebook Ad budget for the year, your projections should be based on past performance or expert advice, not just what you “hope” to achieve.

If you’ve run Facebook Ads in the past and generated a 5:1 return on ad spend, that’ll help you forecast how much revenue you can expect to generate on your next campaign. You know that if you spend $1,000 in Facebook Ads, you can expect to generate roughly $5,000 in revenue from it.

Using that information, you can adjust your budget forecast accordingly throughout the year.

You also need to account for anomalies in your historical data.

If you typically generate $10K in new MRR each month, but one month you generated $30K because your software got mentioned by a big influencer, that $30K month is an outlier.

Don’t base your budget forecast on the assumption that you’ll be able to generate $30K in new MRR on a regular basis. Otherwise, you’ll not only be severely disappointed, but you’ll end up over-spending since your budget was based on unrealistic expectations.

Lastly, you need to ask yourself “what if”.

What if your Facebook Ad campaign doesn’t give you a return at all? What if you start generating more new MRR. What if your churn rate starts to increase or decrease?

All of these scenarios will impact your budget, and you need to be prepared for it.

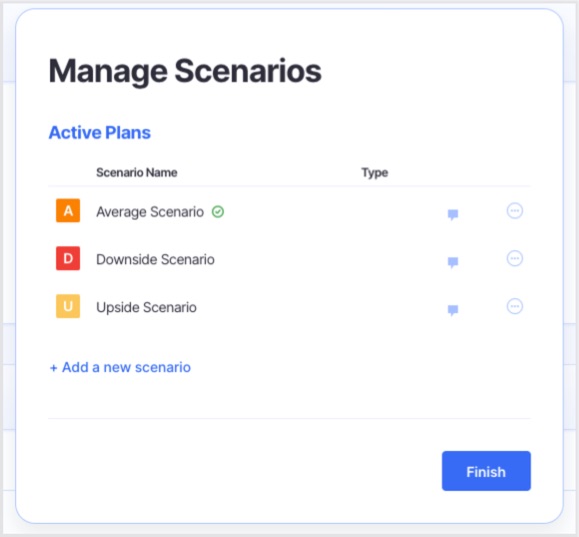

The best solution is to create multiple scenarios. We always suggest having three scenarios for your forecast:

- Base scenario: This outlines your forecast if everything goes as planned. You meet your revenue expectations and don’t go over or under budget.

- Upside scenario: This outlines your budget forecast if you overperform. For instance, maybe some departments are under budget which means you can allocate budget elsewhere. Or you may beat your revenue projections, which also gives you more money in your budget.

- Downside scenario: Think of this as your conservative forecast. It’s your plan if you don’t generate as much revenue as you planned, and gives you a contingency plan for your budget.

You can easily create these scenarios in Finmark. Start with your base scenario, and then simply duplicate it and change your assumptions around revenue or expenses for your upside and downside scenarios.

Modeling different scenarios for your budget forecast keeps you prepared for the ups and downs of building a startup. Check out this guide for more tips on modeling and analyzing multiple scenarios

Step 4: Keep Your Budget Forecast Up to Date

Every month that passes, you have new data to base your assumptions on. Depending on your budget model, you should have the flexibility to update your budget and forecast based on the new information.

If you’re over budget for 3-4 months in a row, it’s a sign that you should take a look at your forecast to understand what went wrong.

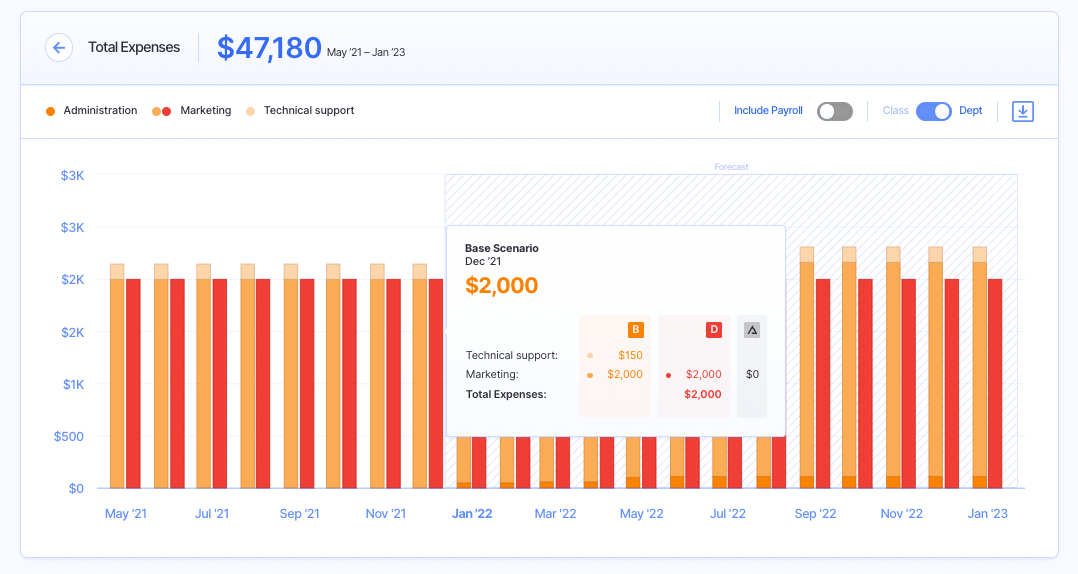

With Finmark, you can compare your actuals against your budget to see exactly where the discrepancies are.

Your budget forecast isn’t something you can “set and forget”. Monthly or quarterly, you should check your forecast against your actuals and see how things stack up. Identify the cause of any discrepancies and make adjustments. And if necessary, reforecast.

Ready to Build Your Budget Forecast?

A budget forecast is an important part of your financial plan. It gives you the opportunity to plan your expenses in advance, and think strategically about the cost of growth.

Thanks to tools like Finmark, building your budget forecast is easier than ever before. If you don’t have a budget forecast yet, or you’re tired of building them in complicated spreadsheets, give Finmark a try with a free 30-day trial!

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.