How to Build a Budgeting Process From Scratch

It’s time to craft a new budget for the upcoming quarter.

You sit down and think to yourself: okay, where to start?

You waste a bit of time figuring out a rough process, and then dive into the numbers. Next quarter you do it all over again, but take a slightly different approach, not remembering quite how you did it last time.

The quarter after that, you build your budget a third way.

Spot the problem?

If you’re designing your budget using a different method each time, your financials are going to lack consistency, and you’re going to waste a bunch of time that could be better spent elsewhere.

In short, you need an effective and repeatable budgeting process that you can use every time you need to create or update your budget.

In this article, we’re going to discuss building that budgeting process in seven simple steps.

A Quick Disclaimer!

Before we dive in, a quick disclaimer.

Not every company’s budgeting process is going to look alike, and the following seven steps are not the be-all and end-all of budgeting processes.

Use them as a guideline, and take note of what works (and what doesn’t) for your specific organization. Then, as you learn more about how a budgeting process flows best for you, make appropriate changes.

Just make sure you have the process (adjusted or otherwise) noted down somewhere for easy reference each time you need to create a new budget.

Creating a Budgeting Process In 7 Steps

Here’s how to create a repeatable budgeting process from start to finish:

1. Review The Previous Financial Period

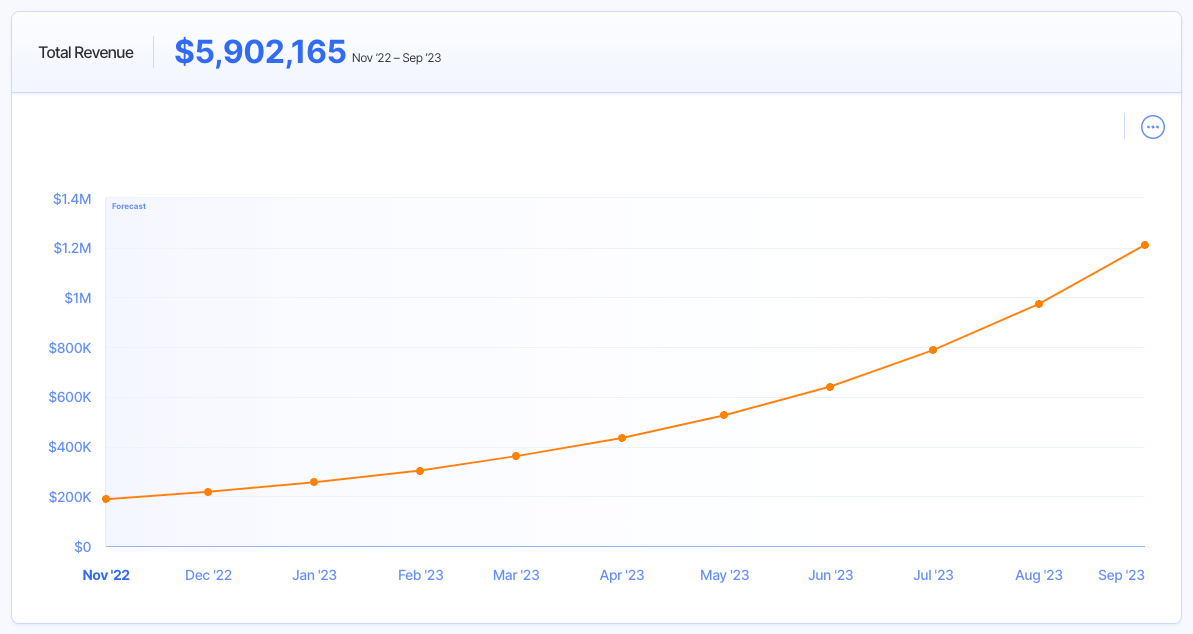

Begin by looking back at the last financial period, be that the last year, quarter, or month (depending on how far out you’re budgeting for).

Look specifically for trends in:

- Revenue growth

- Expenses by department or category

- Spending habits

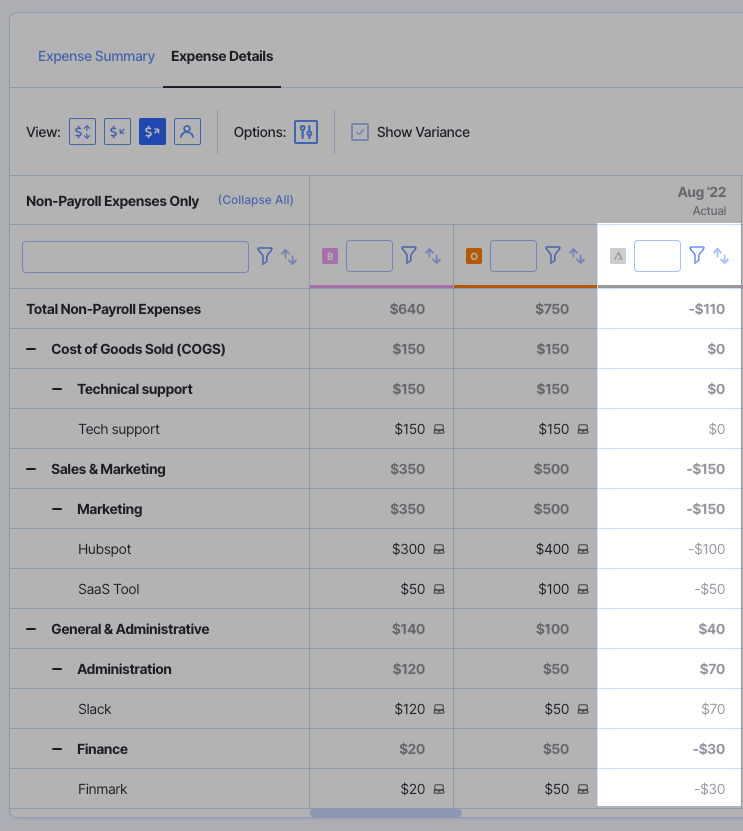

Pay special attention to how your actual income and expenditure stacked up against the last budget you created.

How far off were you? In what areas was your budget under or over? And, most importantly, why? Ask for some assistance from your financial planning and analysis team for this last part.

Consider how this information might inform the budgeting process.

For instance, you might note that sales commission expenditure seems to be increasing at a rate of 5% per month. It would be unsuitable, then, to simply take the last period’s expense and replicate it in your new budget. You’ll need to account for this growth as well.

2. Assess Existing Revenue Streams

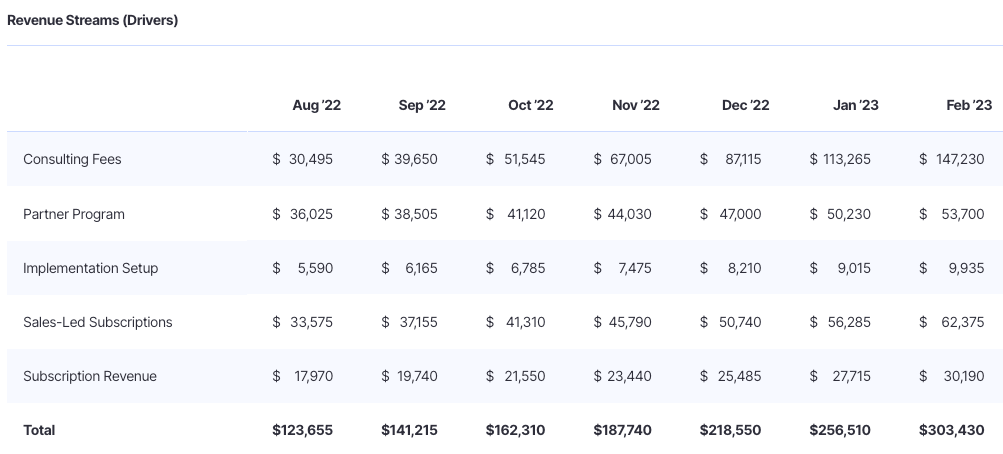

Next, examine the sources of revenue you have in play right now.

Ask:

- How is each revenue stream performing?

- What trends or changes can we see?

- Is growth consistent, or are certain streams unreliable?

Use this data to forecast your expected revenue for the next financial period.

Let’s say you have three revenue streams right now:

- Subscription revenue

- One-off fees (such as implementation charges)

- Consulting fees

You’re moving upmarket and focusing more on enterprise clients, and as such, your one-off fees are growing quickly, and your consulting service is becoming less important.

Actualize this initiative in the numbers (look at how revenue streams are growing or shrinking) and bring this information through to the new budget you’re creating.

3. Outline Any Fixed Costs

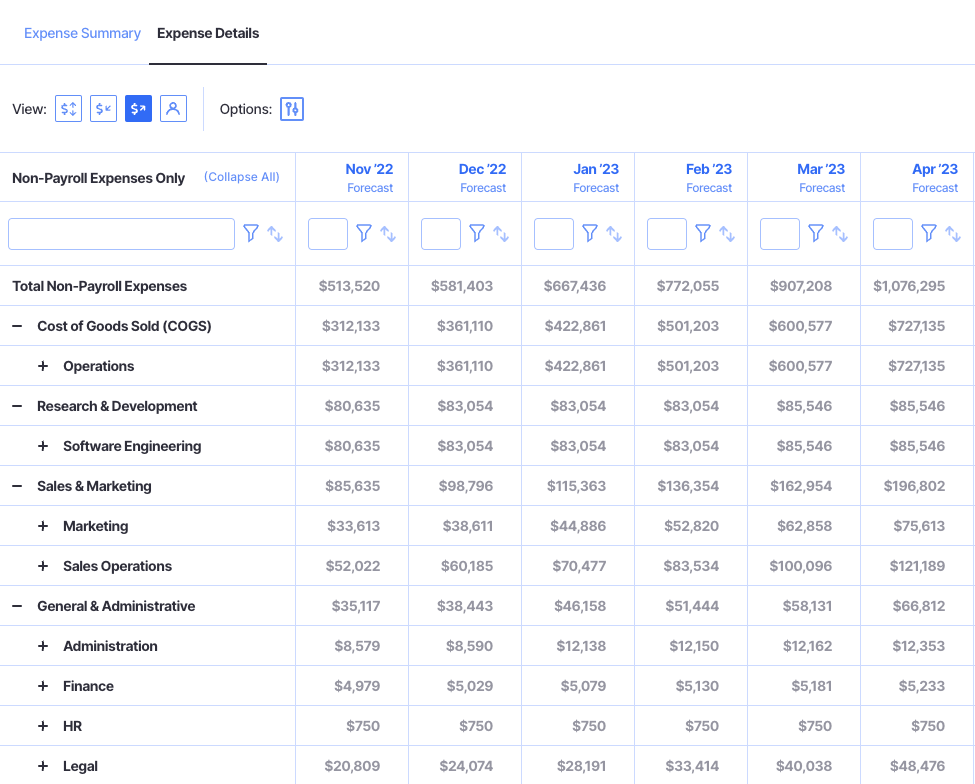

Now you’ll move onto the expenses aspect of budgeting.

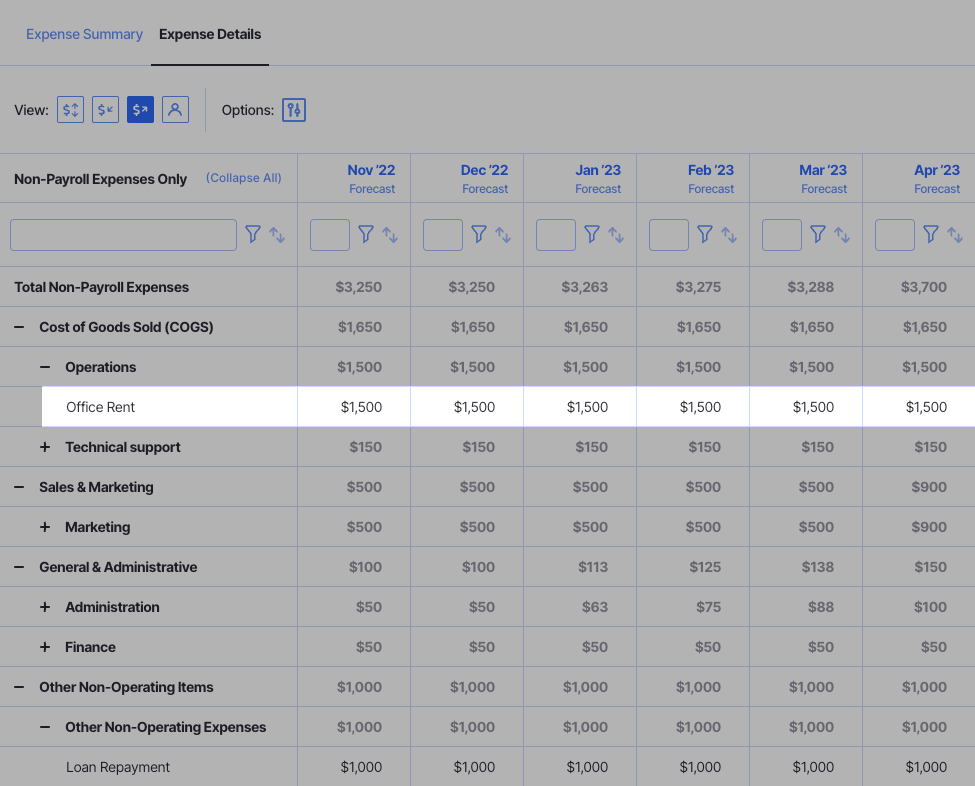

Start by looking at fixed costs, as these are the easiest to calculate. Fixed costs are those expenses that don’t fluctuate based on production. That is, it doesn’t matter how busy you are, you still have to pay that same amount.

Fixed expenses include things like:

- Rent

- Software (with fixed pricing)

- Loan repayments

- Most salaries and wages

In a lot of cases, you can simply pull through the data from your last financial period. However, be careful to consider any changes you expect to see in the next period as well.

For instance, perhaps you’re moving to a new office, so your rent costs will increase. Or maybe you’re adding 20 new employees, in which case you’ll need to account for their salaries as well.

4. Calculate Your Variable Costs

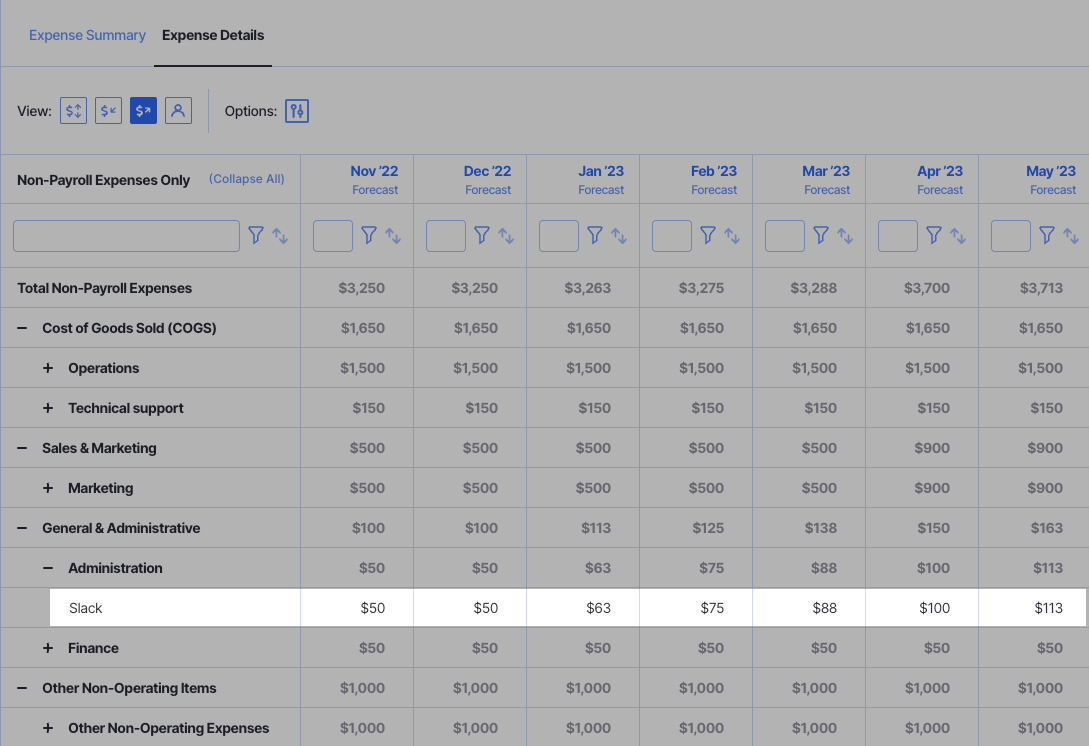

Variable costs are those expenses that do fluctuate with production.

Common examples include:

- Contractors who are paid on an as-needed basis

- Electricity costs in a goods production factory

- API requests

- Software that charges per user or usage (email marketing, Slack)

Calculating variable costs is a little trickier, as it involves forecasting what your performance is going to look like.

To create a realistic estimate, start by reviewing the variable costs from your previous financial period. Then, look at your current growth trajectory, and apply this knowledge to the upcoming budget.

For example, you might look at customer database growth rates, and apply this to your transactional email expense to forecast an increase in that variable cost.

5. Consider Growth Initiatives In Play

A good budget considers not only what’s happening now, but what’s expected to occur in the upcoming period.

Growth trajectories are helpful for understanding how previous performance might impact the upcoming financial period, but you should also weave in expected changes related to the growth initiatives you have in play.

Let’s say you’re building the budget for the next financial year. In the first quarter, you have plans to double the sales team headcount.

You’ll not only need to factor in this additional expense, but also consider how that growth initiative might impact revenue. You might forecast a 50% revenue increase starting from quarter three, for instance.

Make these estimates conservatively so as not to overcommit yourself, but make sure to consider and integrate them nonetheless.

6. Create A Forecast For Additional Investment

Refer to your strategic plan for financial growth here to understand how company spending might change in the upcoming financial period.

For example, if you operate a retail chain and you expect to open 15 new locations in the next quarter, you’ll need to budget for this investment as well.

Check out our Capital Planning Guide to learn more about how to plan for big picture plans.

Smaller investments are important to take note of too. For instance, consider how new marketing campaigns might require additional capital, and factor this into your new budget.

7. Allocate Budget According To Your Strategic Goals

Every department is going to need an individual budget so that department leaders know what they have to play with, and how they can best invest in the resources they need to meet their individual goals.

But simply spreading the available budget evenly across departments is a move that is, at the very least, not particularly strategic.

Review your company’s strategic revenue goals and allocate spending in light of that plan.

If growing brand awareness is a key objective for the upcoming period, for example, you might allocate additional budget to the marketing department to fund this investment.

4 Best Practices For Designing A Budgeting Process

Beyond the actual steps in your process, let’s look at four tips that, if you put them into action, will improve your budgeting process and allow you to create more realistic estimates.

1. Build A Review Process

Part of effective budgeting is reviewing actual numbers against expectations, and adjusting budgets as appropriate.

If you’re creating an annual budget, say, then you should include a quarterly progress review.

In this quarterly review, compare actual figures with budgeted numbers. Analyze variance to inform changes.

For example, if revenue has grown at a faster rate than anticipated (and it’s reasonable to assume that this will continue), then you might be able to allocate more spending to growth initiatives, which would need to be reflected in an updated budget.

2. Communicate Budgeting Decisions In Tangible Terms

Often, finance leaders create complex budgets that make sense to them, but not to those who are actually responsible for spending decisions and for driving progress toward company goals.

One of the most important skills of a great CFO is the ability to communicate to their team what budgets mean in tangible terms.

For instance, if you have a revenue goal of $15m, what does that mean for the sales team? How many new customers do they have to close, and what does the average customer value need to be?

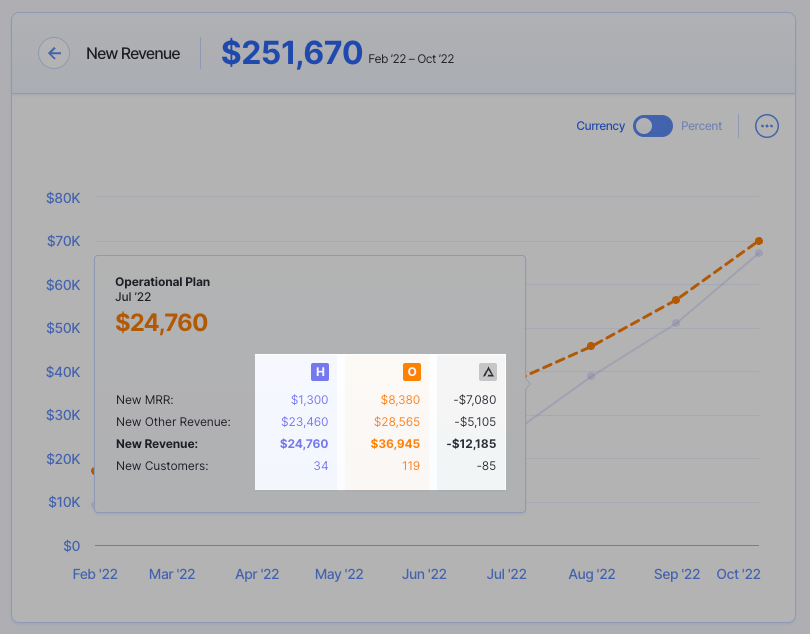

3. Create Upside and Downside Scenarios

No matter how strong your budgeting process is, you can never predict revenue and expenses with 100% certainty.

Customer demands change, new policies come into place, and markets shift as new entrants come onto the scene.

While you can’t be prepared for everything, you can prepare multiple scenarios and have alternative budgets up your sleeve should things not go according to plan.

Create a downside scenario where you don’t quite achieve your revenue goals (say you’re 10% below). What does this mean for spending? Where should you make cuts first?

Similarly, create an upside scenario where you’re more profitable than expected for the financial period. How can you effectively reinvest this additional cash?

4. Weigh A Top-Down vs. Bottom-Up Approach

A top-down approach to budgeting involves starting with the big figures like incoming revenue, and using expected profits to drive spending decisions.

A bottom-up approach, on the other hand, asks department leaders to forecast their expected expenses and make requests for additional investments, and then ladders this data up into revenue goals.

Both have their benefits.

The top-down budget is a little more conservative, as you look at what you have before you look at what you’ll spend. However, bottom-up budgeting is more realistic from a spending requirement standpoint, as it gives an opportunity for department leaders to request exactly what they need from a budget.

Consider integrating the two budgeting styles to get the best of both worlds.

Ready to Setup Your Budgeting Process?

Designing a repeatable and scalable budgeting process is key to driving efficiency and improving consistency across every budget you create.

The best budgeting processes start with a deep dive into historical financial data, allowing finance leaders to create realistic budgets grounded in fact.

To take advantage of these insights and to improve the budgeting, variance analysis, and scenario forecasting processes, you’ll need a powerful financial modeling platform.

Sign up for a free trial to see how Finmark, from BILL can help you accomplish all of this and more

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.