14 Financial Planning Tips for Startups

If you fail to plan, you plan to fail.

That old adage really rings true when it comes to financial planning for startups.

One of the biggest mistakes you can make as a founder is trying to “wing it” with your finances. Taking the time to create a financial plan will:

- Make you think more strategically about growth

- Help you prepare for all the ups and downs of running a startup

- Make it easier to fundraise

- Give you more confidence about the day-to-day decisions you make

Trust us, the value you’ll get from financial planning is well worth the time you put into it. But it’s only as valuable as you make it.

In this guide we’re going to show you how to take your startup’s financial plan from being a boring static document and turn it into your new favorite growth tool.

What is Financial Planning?

A financial plan is like a financial game plan for your startup. It outlines your company’s current financial state, your goals for the future, the actions you’ll take to reach those goals, and how much it’s going to cost.

Financial planning is the process of putting your “game plan” together and documenting it. Using data, you make assumptions about revenue, expenses, and other financial parts of your business to forecast the financial trajectory of your business.

A lot of startups document their plan in a spreadsheet, but we prefer software 😉. We’ll dive into why and how in a little bit.

Why is Financial Planning Important for Startups?

It costs money to grow a business, and most people don’t have unlimited resources. If you don’t plan for how you’re going to grow and how much it’s going to cost, you can easily waste your two most precious resources—time and money.

On top of that, if you plan on pitching investors, they’re going to expect to see a financial plan. They need to know that once they give you hundreds of thousands or millions of dollars to grow your startup, you have a plan for exactly how you’re going to use the money.

Essentially, financial planning forces you to think strategically about how to best use your resources and what your expected results are. Throughout the process, you’ll have to answer questions like:

- How much revenue will we generate?

- What will our churn rate look like?

- How many months of runway will we have?

- How much do we have to spend on sales and marketing?

- How many people can we afford to hire?

By answering these types of questions with data and numbers and turning it into a financial plan, you’ll have a clearer picture of what growth looks like, how much it’ll cost, and how to measure success.

If you want to build your financial plan quicker, (and with more accuracy), I highly recommend giving Finmark a try. It’s much easier than using a spreadsheet, especially for founders.

14 Financial Planning Tips for Startups

Now that you know what financial planning is and why startups need to do it, let’s take a look at some tips to make sure you’re creating the best financial plan possible.

1. Choose The Right Financial Planning Tool

If you’re like most startups, your financial plan probably starts in a spreadsheet. While spreadsheets can be an ok solution for building your financial plan, there are better options out there—like ours.

When it comes to choosing the right financial planning software for startups, here are our tips:

- Scalable: Is it going to be easy to manage your financial plan as you grow? Or will it require you to change the entire framework of your financial plan as you scale?

- Easy-to-use: Many financial planning solutions aren’t made for non-finance people. They’re unnecessarily complicated and require an intermediate level of financial knowledge to understand. Look for something that’s simple enough for non-finance people to use, but powerful enough for your future CFO or FP&A team to work with.

- Collaborative: You should be able to easily (and securely) collaborate with your team, investors, accountants, or other stakeholders on your financial plan.

- Customizable: The tool should allow you to customize your models to reflect your business type and industry.

- Integrations: Does it integrate with your accounting, payroll, and CRM tools?

If you’re looking for something that checks all these boxes, I think you’re going to like Finmark. Plus you can try it free for 30 days!

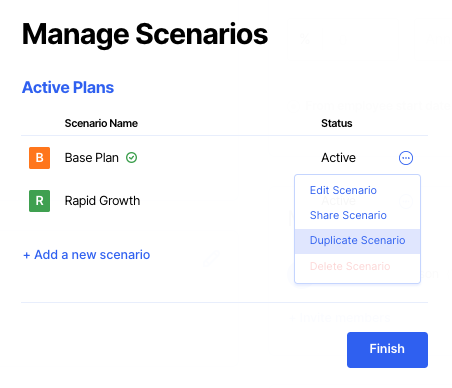

2. Plan For Multiple Scenarios

In an ideal world, your revenue would always trend upward, unexpected expenses would never pop up, and everything would just fall into place.

But as any founder will tell you, that’s rarely the case.

The thing is, nobody hopes for the worst-case scenario for their business. But if you plan for it in advance, you’ll be better prepared to maneuver through it if it happens.

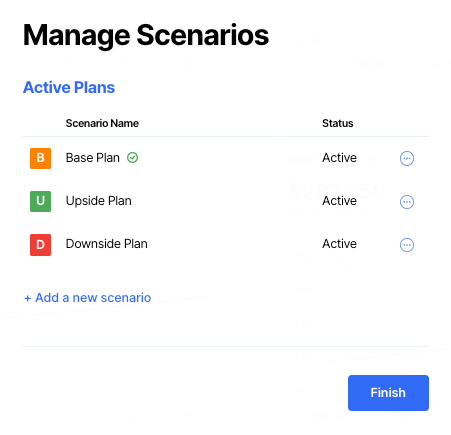

That’s why we recommend creating downside, upside, and baseline scenarios when you’re doing your financial planning. Each scenario has different assumptions for how your business will grow, so you’re more prepared for whatever happens.

Your baseline plan has the expectation that your business will grow at a steady rate. Your assumptions while building this plan might include:

- Your cash flow won’t drastically change

- You won’t go on a hiring spree,

- Your burn rate will stay relatively consistent

- Your revenue growth will be steady

A baseline financial plan is important because it gives you a benchmark. Since it’s primarily based on how your company has performed historically, it’ll be a good indicator of whether or not you’re trending up or down.

Your upside plan is your best case scenario, where your expectation is to outpace your baseline. Some assumptions you might make are:

- You’ll get new customers at a faster rate each month

- Your average revenue per account (ARPA) will increase

- Your expenses will stay relatively flat while revenue grows

- You’ll decrease your churn rate

Be careful with your upside plan though. If you’re going to make these types of assumptions, they need to be tied to actions.

For instance, you need to have a plan for how you’re going to get more customers, how you’re going to decrease churn, where new revenue will come from, etc.

Just changing your churn rate from 10% to 4% in your financial plan without a strategy for how you’re going to get there isn’t “planning”, it’s guessing.

Your downside plan is going to be the least enjoyable to create, but you’ll thank yourself for doing it. This is the plan with built-in expectations that you’ll see a decline from your baseline plan. It could include assumptions like:

- Your churn rate will stay flat, or increase

- Your ARPA will decrease

- Your burn rate will outpace your revenue growth

- Your gross margin will decrease

- Higher customer acquisition cost (CAC)

- Longer CAC payback

The advice I gave you for your upside plan also applies to your downside plan. Your assumptions need to be tied to an event or action of some kind.

For example, maybe you plan on trying some new customer acquisition channels and you’re unsure of how they’ll perform so you estimate a higher CAC or lower conversions.

Or maybe your revenue growth has been on a slow decline for a few months, so you plan for what happens if that trend continues or speeds up.

What you don’t want to do is make assumptions like “our revenue will decrease 10%” without having any data or reasoning to justify why that would happen.

Essentially, your downside financial plan should have a little bit of skepticism, not pessimism. The difference is skepticism means having some doubt, while pessimism is assuming the worst will happen.

Learn more about how to do scenario analysis here.

3. Ask “What if”

Sometimes founders and finance leaders tend to look at financial planning as a means to an end. You enter in a few numbers to get a final “report” on where your financial will be in the future.

This usually happens because you’re financial planning for a specific event—fundraising, investor meetings, preparing for the new year, etc.

Instead, I want to challenge you to take a new perspective when you’re building your startup’s financial plan. Use it as an opportunity to ask “what if” questions and see how it’ll impact your financial projections.

Remember what I said about tying your assumptions to actions? This is when you can brainstorm on what those actions are.

For example, you might ask:

- What if we try sponsored newsletters?

- What if we hire a new customer support rep?

- What if we increase our pricing by 10%?

- What if we double the amount we spend on Google ads?

- What if we create a new add-on product or service?

Since you’re financial planning, try to make your “what if” questions quantifiable, and ideally something with a monetary value attached to it. That way, you can build it into your financial plan and see how it affects your projections.

4. Don’t Assume Your Expenses Will Stay Flat

A common mistake founders make with financial planning is assuming expenses will stay flat over time. If your company is growing, more than likely, so will your expenses.

There’s a big misconception that higher expenses are a bad thing. Yes, rising expenses can be bad—if you’re spending money on unnecessary things. But think about some of the most common expenses that come with growth:

- Employees (63% of SMBsthat predict they’ll grow revenue plan to hire new employees in 2021)

- Space (if you have a physical office)

- Sales and marketing

- COGS

- Software (new tools, plan upgrades)

- Hosting

Generally, these expenses will all grow as your company gets bigger.

One of the most common examples is with customer support. The more customers you get, the more questions, bugs, and support tickets you’ll have.

So at some point, you’ll need to bring on new support people to handle the volume. Otherwise you risk losing customers (and revenue) because 58% of consumers will switch companies because of poor customer service.

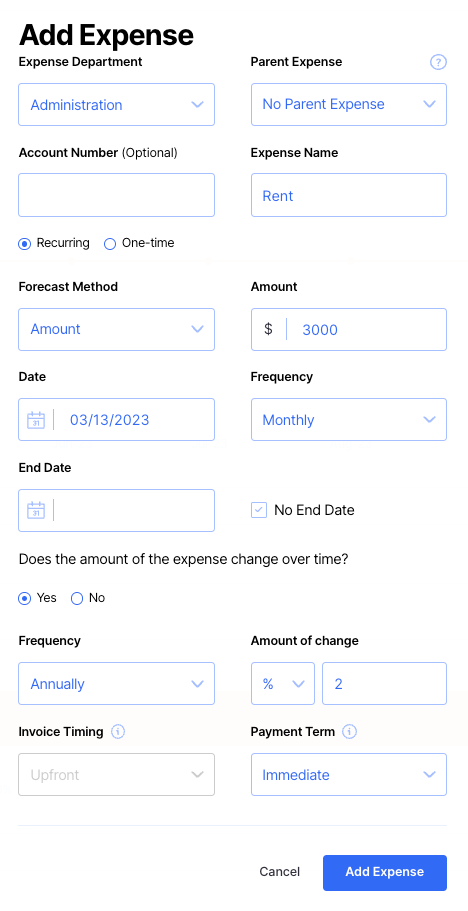

If you’re using Finmark, you can account for these types of changes when you add expenses into your financial plan. Here’s how.

Let’s take rent for example. If your rent is currently $3,000 per month, but you expect that amount to increase 2% annually from rent increases, you can build that into your financial plan with Finmark.

Including these expense increases in your financial plan make your data more accurate, and therefore reliable. Underestimating your expenses can lead you to think you’ll have more cash available than what you’ll actually have.

5. Be Flexible

Financial plans shouldn’t be static. Create your plan with the understanding that things may change.

We’ve already mentioned the importance of making multiple scenarios to prepare for what “might” happen. But when things do pop up, you should adjust your financial plan accordingly.

For instance, if your original financial plan assumed 30% of your sales would come from product line A, but after three months you realize it’s actually closer to 50%, you need to adjust the plan.

Not only will you need to adjust your revenue, but you may also consider making changes like allocating more budget to market this product line since it’s overperforming.

Taking a “rolling” approach to your financial plan allows you to create a more accurate forecast since it’s based on the most up-to-date information available.

A good place to start is to get into the habit of reviewing your actuals each month and then make any necessary adjustments to the assumptions in your original financial plan.

6. Understand Your Cash Flow

We touched on the importance of burn rate, but let’s talk more about cash flow.

Cash flow is how money flows in and out of your business. If you don’t understand how to manage cash flow, it can literally bankrupt your business.

Cash flow is a common issue for businesses that sell physical goods. They often have to plan for months in advance to manage inventory and sales. Here’s an example.

Say you buy widgets wholesale and sell them on your website at a markup. You order your inventory in advance, but you’re not 100% sure of how much you’ll be able to sell. You place an order for your inventory (cash leaves your business), but it may be a couple of months before it arrives.

In the meantime, you still have expenses like payroll, warehouse space, and others that need to be paid.

If you don’t plan your cash flow correctly, you could end up in a position where you don’t have enough cash to pay expenses because you’re waiting for new inventory to arrive.

Always keep an eye on your cash flow and know:

- When cash is coming into your business

- Where it’s coming from

- What expenses need to be paid and when

Cash flow management is an art and a science. But if you get it right, you’ll put your business in a much better financial space.

7. Plan For Where Revenue Will Come From

I touched on this in tip #1, but let’s dive a little deeper.

Revenue is one of the most important metrics you’re going to include in your financial plan so you want to make sure the numbers are as accurate as possible. That starts by being realistic about where your revenue is going to come from.

In most cases, revenue doesn’t just grow automatically. There’s a catalyst to increase it. It could be salespeople, Facebook ads, content, events, or some other action that’s bringing in leads who will ultimately convert into customers. These are all called revenue drivers, because they literally “drive” your revenue.

You don’t necessarily need to completely map out your revenue strategy during financial planning, but you should be able to account for where any planned revenue growth is going to come from.

Here’s an example of how you can do it.

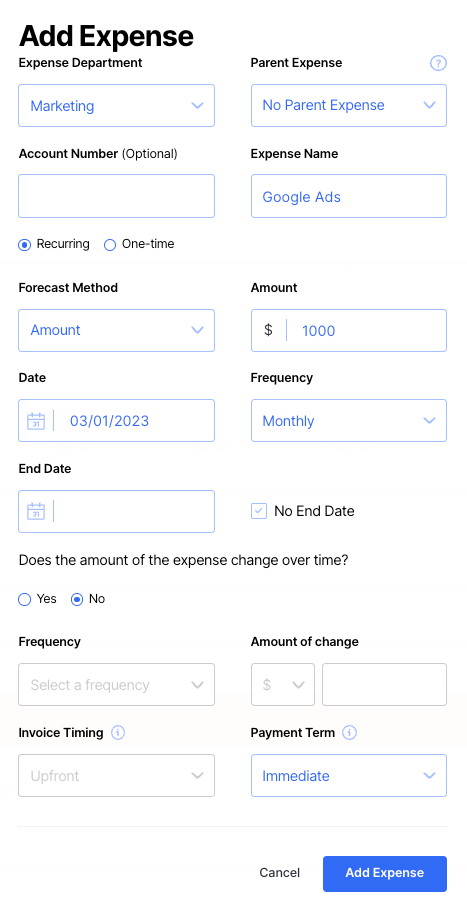

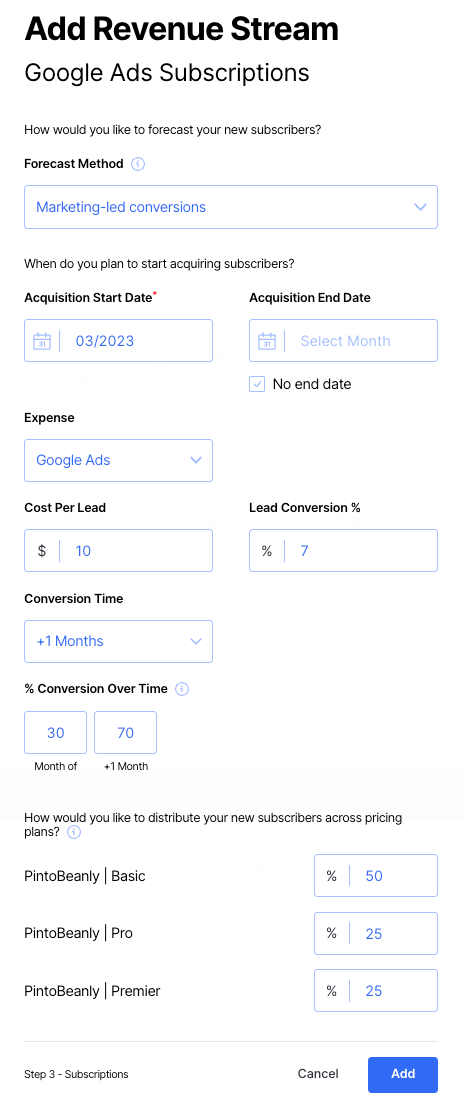

Let’s say we’re a SaaS company and one of our revenue drivers is Google Ads. We run Google Ads to get leads that will convert into customers. So we need to account for the revenue we’re going to get from our ads in our financial plan.

First, we’ll create Google Ads as an expense, and specify how much we plan to spend on the ads. We’ll plan for $1,000 per month.

Now that we know how much we plan to spend, we need to plan for how much revenue we expect to get from that $1,000. So we’ll head into the revenue section of our financial plan and add our Google Ads as a new stream of revenue.

You’ll have to fill in some data points based on your assumptions like your lead conversion rate and cost per lead. I recommend reading this article for some tips on how to make accurate assumptions for those numbers.

Once we add this in, it’ll show in our revenue projections and financial plan.

You can repeat this process for all of your different revenue drivers, including your other marketing channels and your sales team. It’s fun to play around with the numbers and test your assumptions to see what impact they have on your financial plan.

Again, financial planning makes you go beyond just setting arbitrary goals. It makes you think about how you want to achieve your goals, plan what actions you need to take, and how much it’s going to cost.

8. Consider All Employee Costs

Here’s an often overlooked expense you should account for in your financial plan, particularly for newer founders that plan on hiring for the first time—additional employee costs.

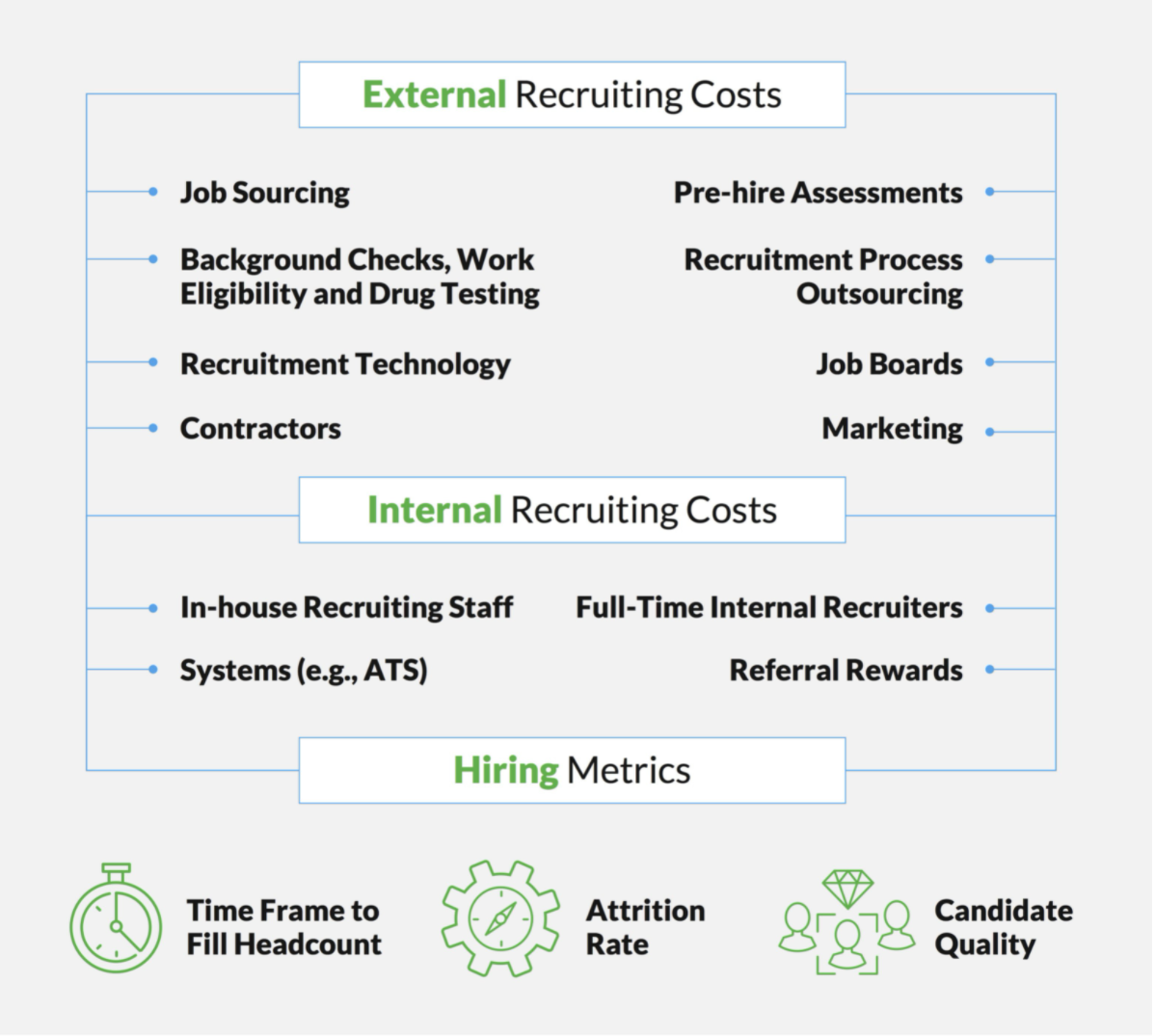

Hiring (and retaining) employees includes more than just salaries. Recruiting, onboarding, new equipment, benefits, and taxes are all additional costs that come along with hiring new employees.

According to Glassdoor, the average U.S. company spends about $4,000 just to recruit a new employee. If you hire just 5-10 new employees over the course of a year, that’s an additional $20-$40K you need to account for in your financial plan. And the larger your company, the more employees you’ll typically hire per year.

Here’s a look at some of those “hidden” expenses of recruiting that Glassdoor highlighted.

In Finmark, we make it easy to account for these expenses. You can manually add expenses like background checks and job board listings directly into your plan whenever you hire new employees.

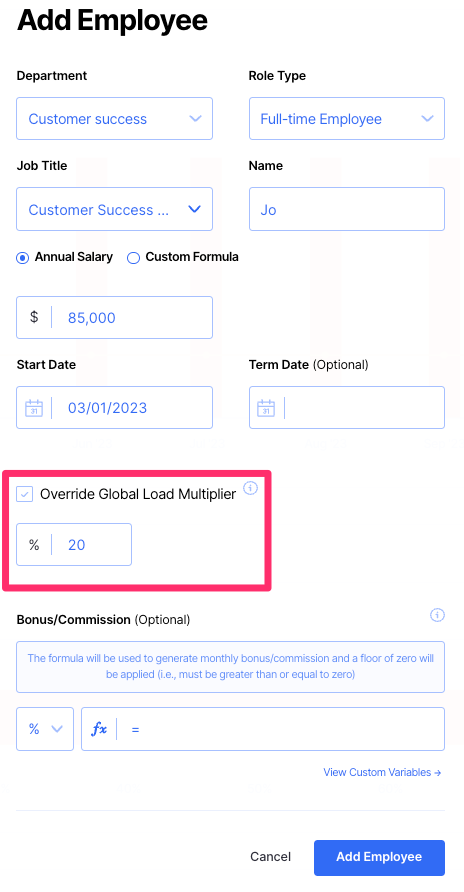

And for things like benefits and taxes, we have a “Load Multiplier” feature that allows you to add on a specific percentage on top of salaries for taxes and benefits. You can add this across all your employees, or do it on an individual basis.

So if we have an employee with an annual salary of $85K, we can add an additional 20% to account for their taxes and benefits.

In Finmark, we make it easy to account for these expenses. You can manually add expenses like background checks and job board listings directly into your plan whenever you hire new employees.

And for things like benefits and taxes, we have a “Load Multiplier” feature that allows you to add on a specific percentage on top of salaries for taxes and benefits. You can add this across all your employees, or do it on an individual basis.

So if we have an employee with an annual salary of $85K, we can add an additional 20% to account for their taxes and benefits.

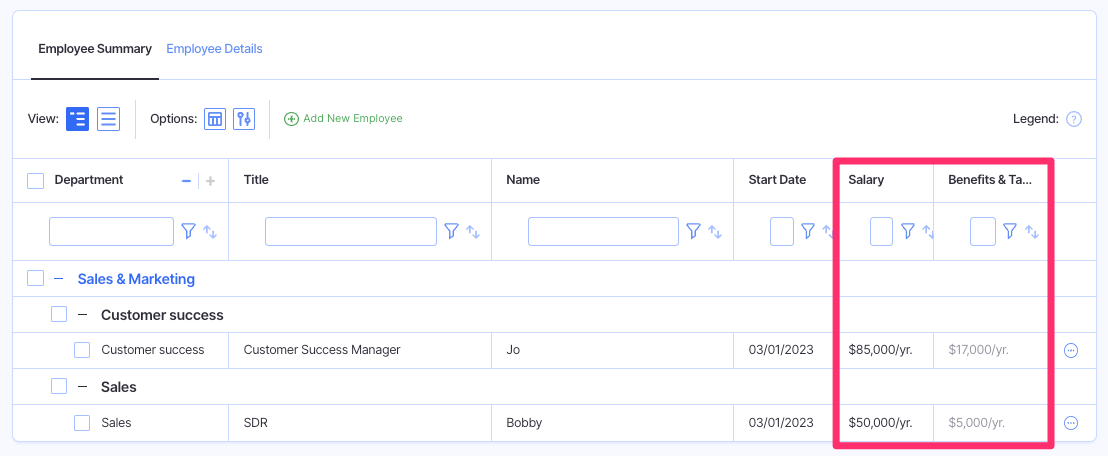

Then you can see the total breakdown of salary vs benefits and taxes for all your employees.

The more employees you have, the more important it is to account for these extra expenses.

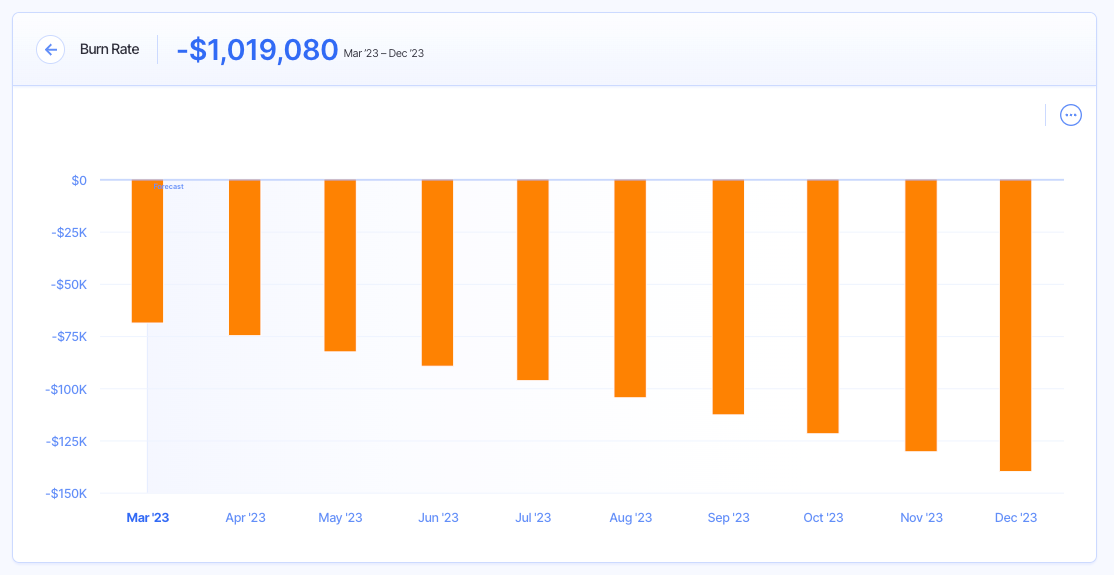

9. Watch Your Burn Rate

In the early days of a startup, you’re likely burning through a lot of cash. Even if you’re well funded, it’s easy for expenses to quickly spiral out of control.

That’s why it’s crucial to not only monitor your burn rate, but optimize it if it gets too high.

Pay attention to where your cash is going each month, how it impacts your revenue, and spot opportunities for improvement.

A good rule of thumb is to plan for cash before you get it. For instance, if you plan to raise a $1M seed round, you should build a financial model that details how you plan to spend that money and build a financial model for it.

With a financial model, you can forecast what your burn rate looks like over time and estimate when and if you’ll run out of cash. That’ll also be an indicator of when you’ll need to seek additional funding to continue growing.

Bear in mind, that advice is primarily for new startups who are either pre-revenue or unprofitable.

However, if you’re already generating revenue or are profitable, you still need to keep an eye on your burn rate. While negative burn rate is a good sign, it could mean you’re not maximizing your revenue potential.

In those scenarios, it’s good to have a cash reserve for a rainy day, but also think of ways you can use excess cash to fuel your growth.

10. Keep Your Data Clean

Your financial plan is only as good as the data you’re feeding into it.

As basic as it may sound, proper bookkeeping and following best practices for accounting can go a long way towards building a strong financial foundation for your business.

In practice, that means:

- Properly categorizing expenses

- Using the correct accounts

- Completing financial reports on time

It’s a simple tip, but it can make a big difference in your business—positive or negative.

11. Scrutinize Your Budget

This is an extension of the burn rate tip.

Unless you have limitless funds, you should review and analyze your budget on a regular budget.

Are there any expenses that can be reduced or eliminated?

Did you have any unexpected spikes in certain expenses?

Do you consistently have budget variances?

Sometimes businesses wait until problems arise to scrutinize their budgets at this level. But the reality is if you catch the red flags early, you have plenty of time to course correct.

You probably won’t be able to do a detailed review of each expense line item, but having a high-level view of trends in your expenses is very helpful.

Finmark can be extremely helpful for analyzing expenses in your financial plan.

Our software gives you a detailed view of your expenses, organized by department. This makes it really easy to see any big jumps or drops month-over-month.

Review this data monthly to avoid being caught off-guard.

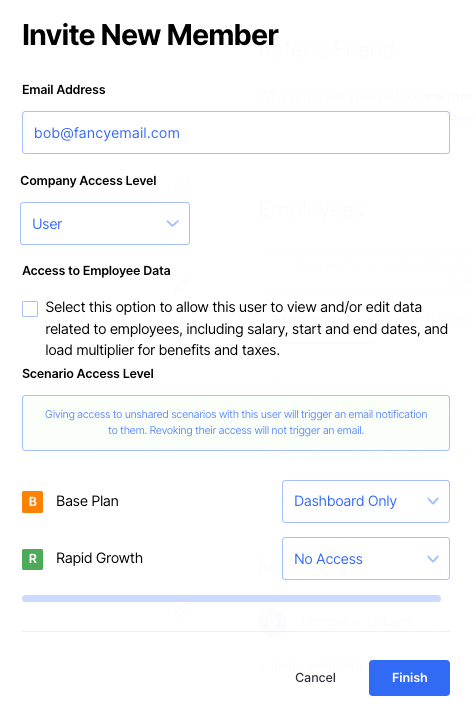

12. Share Your Financial Plans

Ask yourself these two questions:

- Is your financial planning process collaborative?

- Who has access to your financial plan?

If you’re a founder and you’re the only person working on your startup’s financial plan, that’s a problem. And if you’re the only person who ever looks at your financial plan, that’s an even bigger problem.

Financial planning for startups isn’t something that should be done in isolation. If you have co-founders, they should be involved. If you have a team, they should be involved.

I’m not saying that everyone needs to be able to edit your plan, but you should at least ask questions and get insights from stakeholders when you’re putting your plan together—particularly as your startup grows.

Finmark is helpful here too. You can easily share your plan with other people and grant them specific levels of access.

Here’s an example of why collaboration is so important for financial planning.

Let’s say you’re building your financial plan, and want to project how much revenue you’ll drive next quarter. You need to know what actions marketing and sales plan to take and what their projections are.

Everything from what marketing campaigns you’ll be running, the expected number of leads they’ll generate, sales rep performance, and other info that’ll help you project how well you’ll perform.

Unless you’re leading marketing and sales, you’ll need to get that insight from your team. Your sales and marketing leaders will be able to give you some additional context around performance as well.

For instance, marketing might let you know that they’re going to be trying some new advertising channels so new leads might be a little less predictable.

Or your sales leader might’ve brought on a new SDR that was able to ramp up quicker than expected, so they’re going to be able to convert more leads.

This level of detail is only possible when you collaborate and get input from your team while you’re financial planning.

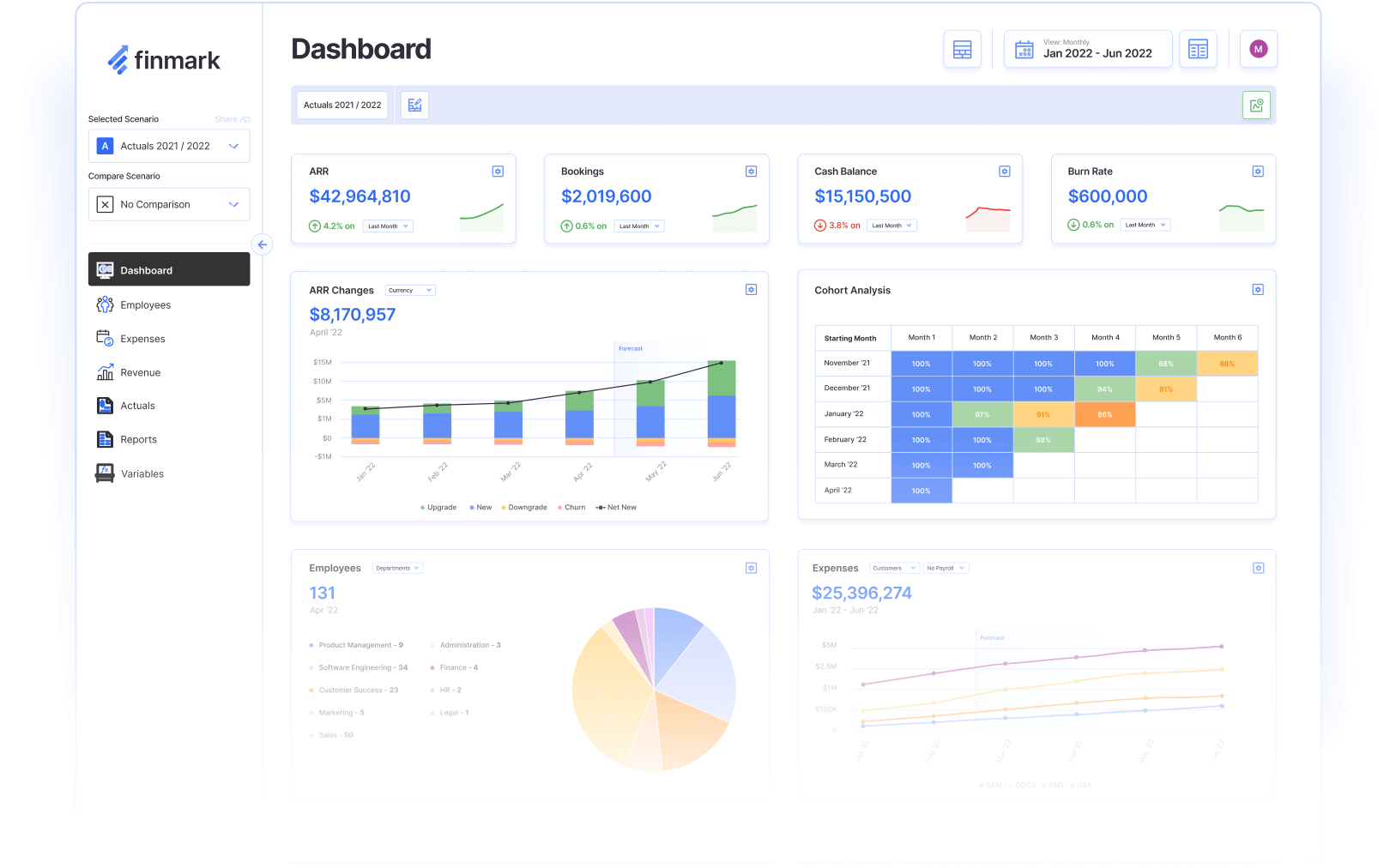

The other part of collaboration is sharing and presenting your financial plan. This is actually something we do at Finmark.

About once a month, the founders will review the current financial state of things with the entire company. We go over runway, revenue, customer growth and other parts of the financial plan.

That level of transparency helps everyone get on the same page and sets expectations.

All too often, founders wait until there’s a problem to get transparent about the financial plan. For instance, when they need to cut expenses or reduce headcount. In most cases, the founders know these changes are coming for months, but the rest of the team doesn’t know until it’s too late.

When you routinely review your financial plan with your team, it lets everyone know where things stand and gives them the opportunity to be proactive and course correct if things are trending downward. And when things are going well, it gives everyone a morale boost and motivation to keep growing.

I’ll be honest, it makes it A LOT easier to share your financial plans when you build it in a tool like Finmark rather than a spreadsheet. I’ve seen both, and from an employee’s perspective, looking at the data in charts and graphs is much more engaging and enjoyable than a bunch of cells.

When you’re using spreadsheets for your financial plan, you’ll generally have to take that data and create some sort of slide deck to present because spreadsheets aren’t the best tools for presenting data.

The process of building a deck is time-consuming and you can’t show the level of detail in the same way as you can in a tool like Finmark.

During our financial presentations, we dive into things like average revenue per account, which customer plan levels we projected to get for the month vs. what we actually got, and other details that require filtering data and switching between scenarios.

All of that is nearly impossible to do (smoothly) in a spreadsheet, but it just takes a few clicks in Finmark.

Long story short, collaborate! You’ll have a more accurate financial plan and your team will feel much more involved in the company.

13. Consider Working With an Outsourced CFO

Founders are often busy running the company. Sometimes you’re the COO, marketer, a salesperson, and wear 10 other hats. With all that on your plate, doing in-depth financial analysis probably isn’t at the top of your to-do list.

While early-stage startups hire accounting firms to handle the day-to-day finances (payroll, bookkeeping, etc.), there’s often not anyone overseeing strategic finance.

There’s no CFO or FP&A person tasked with looking at the long term financial strategy of the company and spotting opportunities for growth. That generally doesn’t happen until the company has matured significantly.

But even in the early stages, there are a lot of insights you can learn from analyzing your financial data. Yet so many young startups miss out on it because it never crosses their mind.

However, that has been changing. Outsourced CFO firms are becoming more prevalent, and even accounting firms are starting to offer client advisory services to provide strategic insights for startups.

If you’re in a position where a full-time finance person doesn’t make sense, but you still want to optimize your finances, consider working with an outsourced CFO. Tweet us if you want some recommendations!

14. Regularly Review Your Financial Plan

Your financial plan isn’t something you should create and leave sitting untouched until a major event like fundraising.

Here’s one way to think about your financial plan. I’m going to throw a football analogy at you, but stick with me!

In football, teams create game plans for each opponent they face. The game plan outlines all the different plays they can use, guidance for what to do in various situations (i.e. when to kick a field goal), strengths and weaknesses of their opponents, and other strategies to increase their chances of winning.

The coach reviews their game plan throughout the entire game so they can make adjustments based on how things are going. For example, if the team has a big lead by the third quarter, they might decide to run the ball more even though the original plan was to throw.

You should take the same approach with your financial plan. As we mentioned earlier, growing a startup doesn’t always go as planned. Your financial plan is your playbook that you should refer back to and adjust based on the situation.

Whenever something happens in your business and you think “we didn’t plan for this”, take a look at your financial plan and see what adjustments you need to make in order to deal with the current situation.

The perfect example of this was the pandemic. Nobody had a global economic freeze in their playbook. As a result, a lot of startups saw revenue plummet, certain expenses like rent became obsolete, growth stalled or declined, and nothing went as planned.

If you just left your financial plan alone and tried to make changes on the fly, you’d basically be playing a guessing game. Instead, you should adjust your “game plan” by reviewing and updating your financial plan.

That could mean lowering your projected revenue, cutting and reducing certain expenses, adjusting your hiring plan, or any other changes you need to account for the drastic shift in your business.

You can do this quickly in Finmark by just duplicating your original plan, and making changes to the updated version. That way you still have the original plan and can compare it to the new one when you need to.

Outside of those extreme cases, it’s good to get into the habit of reviewing and analyzing your financial plan at least monthly.

So many things can change from week to week that require some extra financial planning. For instance, what if your marketing strategy isn’t panning out quite like you planned, so your projected leads and revenue are off. You can adjust your financial plan accordingly.

The bottom line is that plans can (and should) be changed. Financial planning is an active and ongoing process.

Ready to Start Financial Planning For Your Startup?

We covered a lot in this guide. But our goal isn’t just to give you information—we want to make sure you take action.

Start by signing up for a free trial of Finmark.

Whether you’re starting from scratch or transitioning from a spreadsheet, using a dedicated tool will save you hours of time and make financial planning for your startup easier than ever.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.