10 FP&A Best Practices to Follow

Building a high-performing financial planning and analysis (FP&A) business unit is about much more than preparing financial statements and reporting on fiscal success.

It’s about analyzing data to understand the “why” behind financial changes (positive or negative), building forecasting and scenario planning processes, and identifying opportunities to mitigate risk and uncertainty.

Hiring professionals with well-developed FP&A skills is a great start. Still, the most critical is developing a set of best practices that your team can follow, ensuring consistency and accuracy across the board.

This article will explore 10 of the most important FP&A best practices to follow and apply in your organization.

1. Forecast Multiple Scenarios Based on Historical Data

Growing businesses must be prepared for several financial scenarios.

Yes, you want to run the numbers on your budget and goals and then make adjustments based on your actuals.

But you also need to be prepared for those unlikely situations:

- What if revenue growth is much slower than expected?

- What happens if you can’t scale your sales team as quickly as predicted?

- What if a new government is voted in next year, and your company taxes increase?

Scenario planning and analysis is a crucial FP&A practice for understanding how your business will perform in these situations.

The best practice when performing scenario analyses is to map out three possibilities:

- Base scenario: What happens to your company if there are no significant changes (you stay on the same growth trajectory).

- Upside scenario: What happens to your company if you do better than expected.

- Downside scenario: What happens to your company if you do worse than expected.

2. Measure the Financial Influence of Strategic Changes

One of FP&A’s core responsibilities is understanding, analyzing, and communicating the financial impact of strategic business changes.

For example, let’s say your company has decided to invest several thousand dollars in a new lead generation program.

You’ve contracted this marketing activity to an external firm, and they’re expected to grow your brand presence and capture new leads for your sales team to nurture and close.

FP&A must analyze the change in sales performance after this undertaking and distinguish between performance increases that came from internal changes and those that relate directly to the investment in lead generation.

3. Identify Factors That Drive Business Success

FP&A professionals are responsible for solving financial problems, but they also need to be skilled at uncovering the ‘why’ behind any positive financial change.

You need to look at the factors that drive business success (largely revenue growth).

To determine whether established business drivers are valid for use in practice, assess them on three dimensions:

- Logical: Is there a coherent relationship between the identified driver and the measured outcome?

- Actionable: Is there an internal ability to manipulate that driver?

- Relevant: Is the correlation between the driver and the outcome strong?

For example, let’s say your firm defines “innovation” as a key business driver.

First, is there a logical connection between innovation and business growth?

You’d need to ask questions like, “What percentage of new sales include products we’ve developed in the last three years?”

Second, does your company have the ability to manipulate that driver? That is, how easy is it for you to continue innovating?

For instance, if innovating your product depends on third parties, it’s not something you can directly control.

Thirdly, how strong is the connection between innovation and revenue growth?

Look into historical movements in revenue growth; do they correlate with new product releases?

4. Translate Strategy into Action

The best FP&A teams take the high-level strategies provided by senior leadership and translate them into actionable plans that can be easily communicated to everyone and accurately measured.

For example, a simple strategy might look something like:

“To continuously identify areas to cut expenses, so we can pass these savings onto our customers and remain the lowest-cost supplier on the market.”

It’s the leadership team’s job to determine which strategy to pursue; it’s the job of the financial planning and analysis team to translate that into action.

That is:

- Detailing where you can find opportunities to cut costs

- Setting boundaries (how far is too far?)

- Determining appropriate financial targets (e.g., cut operational costs by 10%) and timelines

- Defining measurement criteria

- Translating and communicating these initiatives to unit leaders

5. Build a Process for Rolling Forecasts

Forecasts project current performance forward into the future.

Business leaders use them to understand whether they’re on track to meet budget and organizational goals and steer the ship back on track if things aren’t going well.

As such, forecasts need to be provided relatively regularly.

A new forecast once a quarter isn’t going to allow the leadership team to stay agile and make quick decisions regarding revenue drivers.

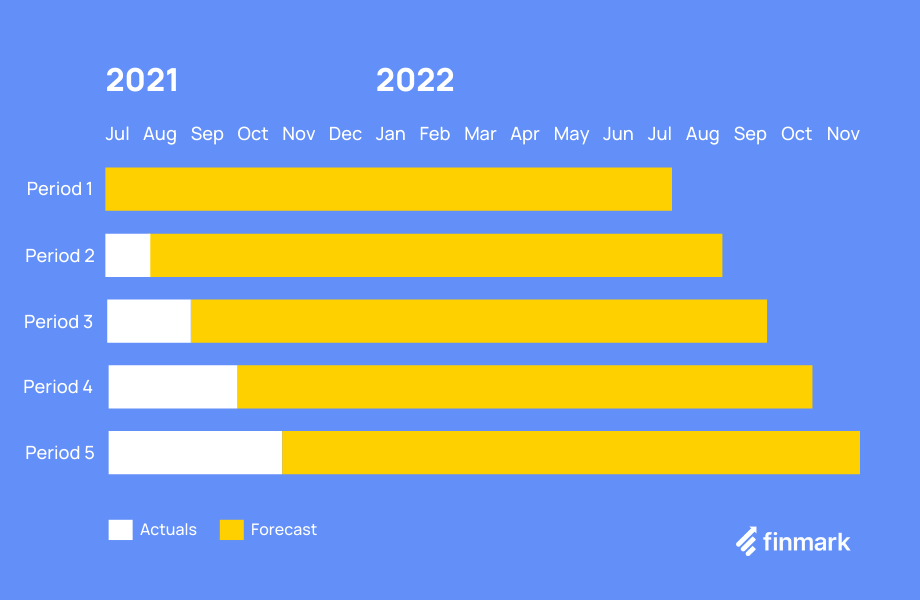

Monthly forecasts should be the minimum, and the best practice is to set up a rolling forecast.

Rolling forecasts are prepared each month and look forward 12-24 months, regardless of when the forecast is created.

For example, a forecast created in July 2021 will project until July 2022. But a quarter later (October 2021), you are forecasting to October 2022.

Rolling forecasts are a beneficial best practice for FP&A professionals because they:

- Use real-time data to project business performance

- Can be used as a growth measurement tool (is forecasted revenue increasing over time?)

- Provide helpful insights for scenario planning

6. Ensure Targets Ladder up into Financial and Operational Goals

Skilled FP&A professionals understand how to break down high-level financial and operational goals into measurable targets that each department (and individuals within them) are solely responsible for.

For instance, a high-level organizational goal at your company is to increase EBITDA (earnings before interest, taxes, depreciation, and amortization).

You’ll need to understand what business changes, developments, and initiatives will help deliver that, define targets and measurements, and work with operational leaders to achieve them.

Those targets might break down departmentally, for example:

- Sales: Increase average account size by 5%

- Marketing: Drive 20% more new leads each month

- Operations: Increase productivity by 10%, and reduce costs by 5%

7. Use Scenario Modeling to Understand and Mitigate Risk

Risk detection, analysis, and mitigation are huge parts of the FP&A practice.

The best financial leaders model various scenarios, calculate the likelihood of given events occurring and implement initiatives to protect against those potential events.

For instance, let’s say you’re a large apparel manufacturer and e-commerce retailer.

Rising oil costs can have a significant impact on your operation, influencing cost factors such as:

- Manufacturing machine operation

- Costs of carrying higher levels of inventory to protect against rising shipping costs

- Delivery costs to your customers

FP&A advisors will need to look ahead for potential changes in the market, model possible scenarios, and suggest contingency plans to put in place should such events occur.

8. Develop a Process for Measuring Development

Setting targets is one thing, but building (and then putting into practice) a process for measuring progress towards those targets is just as critical.

For each of the targets you’ve defined (through the best practices we’ve discussed in points four and six), define:

- What KPIs (key performance indicators) inform progress toward that target?

- Who is responsible for each of those KPIs?

- How will we know when we’ve achieved a given goal?

- How often are we measuring progress?

- Who is in charge of reporting?

- What processes do we have in place if and when we identify that we aren’t on track to meet targets?

- Who has the authority to make organizational changes based on these new insights?

9. Analyze Budget Variance to Uncover Root Causes

Budgets are not projections; they’re goals.

When your company sets a budget, it aligns figures like expected revenue and outgoings with larger organizational growth goals.

But goals aren’t always met (and sometimes, they’re far exceeded), meaning our actual figures don’t align with our budgets.

That’s where budget variance analysis comes into play.

The best FP&A professionals, however, don’t just look at the numbers and say, “Oh, revenue last quarter was 10% below budget”, and leave it at that.

They look deeper to uncover the root causes behind budget variance.

If you discover a budget variance, investigate:

- What are the drivers that influence this figure (remember step three)?

- How have we affected those drivers in the last quarter (or the financial period you’re measuring)?

- Are there external factors (economic, market, legal) that have played a part?

10. Build a Tech Stack That Supports FP&A Processes

Financial planning and analysis is, at its heart, about digging deep into financial data, understanding root causes, and providing recommendations for moving forward.

The best way to do this is with a financial planning tool; one that makes it easy to:

- Compare budgets with actuals

- Build forecasts

- Plan for fundraising

- Visualize key financial metrics

These platforms support FP&A professionals so they can focus on the analysis aspect without spending hours every week manipulating spreadsheets and archaic data management systems.

Hint: We make a pretty amazing tool for this!

Conclusion

Well-developed and documented FP&A best practices deliver stronger reporting, improved risk mitigation, and a better understanding of the key drivers behind revenue growth.

But every FP&A professional needs their right-hand man — a powerful financial modeling and forecasting platform that makes it effortless to build accurate reports, analyze data, and share findings.

Check out Finmark, the strategic finance platform for fast-growing companies, and book a demo with our team today to find out how we can help you deliver on the FP&A best practices we’ve just discussed.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.